In the present day, Coinbase Derivatives has introduced the launch of US Perpetual-Fashion Futures on July 21. These new futures contracts are designed to supply US merchants a home, regulated different to the favored perpetual futures broadly used on offshore platforms.

“We’re excited to announce the upcoming launch of US Perpetual-Fashion Futures on Coinbase Derivatives Change, designed to reflect the performance of world perpetual futures whereas adhering to US regulatory requirements. Internationally, perpetual futures have change into the dominant crypto derivatives product, representing upwards of 90% of complete crypto buying and selling exercise in some reviews,” acknowledged the corporate.

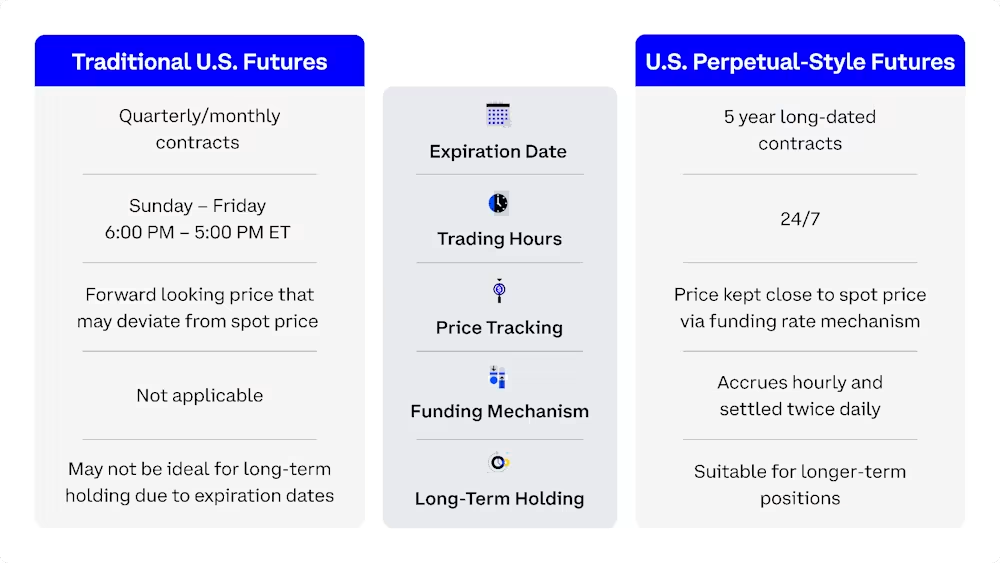

The preliminary launch will embrace nano Bitcoin Perpetual-Fashion Futures (0.01 BTC) and nano Ether Perpetual-Fashion Futures (0.10 ETH) contracts. These contracts can have five-year expirations, commerce 24/7, and embrace a funding price mechanism designed to maintain futures costs carefully aligned with spot market costs. Funding will accrue hourly and be settled twice each day throughout designated money adjustment intervals.

Presently, many US primarily based merchants entry perpetual futures via offshore platforms, which can contain regulatory, custody, and counterparty dangers. The brand new contracts purpose to get rid of these dangers by providing a home and compliant different.

Coinbase states that these merchandise are meant to offer regulated publicity to the Bitcoin and crypto market with flexibility in place sizing and capital effectivity. Extra particulars on buying and selling entry via accomplice platforms are anticipated to be shared forward of the launch.

“We’re extremely proud to deliver perpetual-style futures to the US – a transformative milestone that may characterize the start of a brand new period in US market entry, effectivity, and innovation,” the corporate acknowledged.

On June 20, Coinbase obtained the European Union’s Markets in Crypto-Belongings Regulation (MiCA) license from Luxembourg’s monetary regulator, enabling it to function throughout all 27 EU member states below a unified framework. The license permits Coinbase to serve roughly 450 million Europeans below a single regulatory framework, changing separate licenses beforehand held in Germany, France, Eire, Italy, The Netherlands, and Spain.

“This milestone marks a big step and permits us to function below a unified, regulated crypto atmosphere in one of many largest financial areas on the earth, whereas solidifying Coinbase’s place as a world chief in regulatory compliance and innovation,” acknowledged Daniel Seifert.