Key Highlights

- For the very first time within the month, the Coinbase Bitcoin Premium index has indicated a optimistic charge

- This development comes as BTC soared above $92,000 on Friday

- Coinbase Bitcoin Premium index exhibits rising confidence amongst institutional buyers within the cryptocurrency after current turmoil

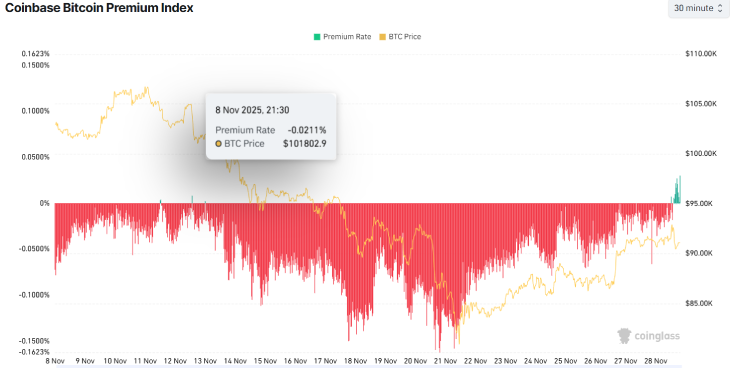

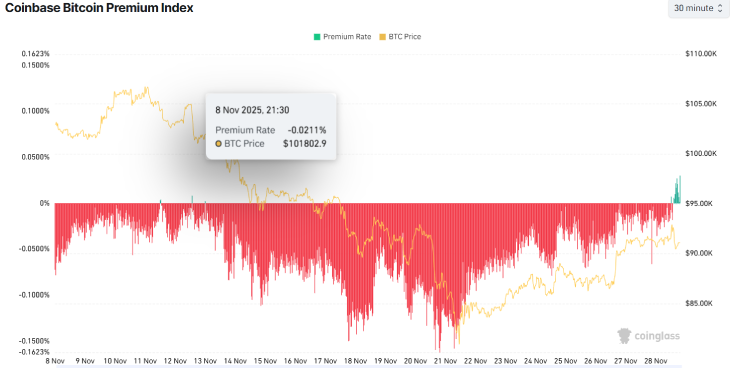

On November 28, Coinbase Bitcoin Premium witnessed a serious development, wherein it reversed a month-long damaging premium charge. The most recent premium charge revolves round 0.03% on the chart.

(Supply: Coinglass)

That is the primary time within the month that Coinbase Bitcoin Premium exhibits a optimistic premium charge. This development provides a ray of hope that institutional buyers are getting their confidence again in BTC after the turmoil within the cryptocurrency market.

What’s the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium is an index that measures the value hole for BTC between the U.S.-based Coinbase alternate and the main world exchanges (USDT markets like Binance).

When the index is optimistic, it exhibits robust shopping for strain from U.S. institutional buyers and is taken into account a bullish indicator for the cryptocurrency market. On the flip facet, a damaging charge is taken into account as decrease demand from the buyers.

This inexperienced spike occurred after BTC soared above $92,000 on Friday, sparking euphoria within the crypto group about its potential bullish momentum. On the time of writing, the cryptocurrency is buying and selling at round $91,217 with a market capitalization of 1.82% trillion, in line with CoinMarketCap.

Nonetheless, the cryptocurrency remains to be struggling to interrupt the essential resistance stage at $93,000. If it occurs, it may assist Bitcoin to witness an additional rally.

This index has efficiently managed to foretell main occasions within the cryptocurrency’s historical past, together with the bull run of 2021, the place it signaled robust institutional accumulation from firms like Tesla, MicroStrategy, and so on. Equally, it additionally tracked the 2022 and 2023 downfall with heavy promoting strain.

Within the newest report, JPMorgan talked about that BTC is now reacting to macroeconomic tendencies, and its worth momentum is not only restricted to the Bitcoin halving occasion. The banking large mentioned in its assertion, “Crypto is transferring away from resembling a enterprise capital fashion ecosystem to a typical tradable macro asset class supported by institutional liquidity slightly than retail hypothesis.”

“Cryptocurrency costs are actually extra influenced by broader financial tendencies slightly than crypto’s predictable four-year halving cycle, the method the place the speed of recent provide of Bitcoin is lower in half and adopted by a bull market rally,” JPMorgan states within the report.

Bitcoin’s Institutional Funding Grows All through 2025

After U.S. President Donald Trump took the Presidential oath for his second time period, the cryptocurrency market has witnessed a historic bull run, serving to main cryptocurrencies to realize new all-time highs by establishing a brand new cycle.

For instance, the bull run in cryptocurrency has skyrocketed its worth to new all-time highs after hovering above $126,000. One of many main elements behind this rally was a rising institutional funding through completely different streams.

After receiving clear regulatory steering from the Trump administration, institutional funding has grown impressively. This confidence was additionally seen in Bitcoin ETFs influx. The end result was record-breaking monetary inflows, with the full property in crypto ETFs hovering above $122 billion, in line with Coinglass.

Spot BTC ETFs have gotten the largest funding product for institutional buyers to spend money on cryptocurrency. These funds have attracted over 617.44K Bitcoins in whole internet influx since their launch final 12 months. This surge even allowed BTC ETFs to outperform conventional gold ETFs.

Main ETF issuers like BlackRock, Constancy, and ARK Make investments led this cost, with BlackRock’s iShares Bitcoin Belief accumulating an enormous $28 billion in internet investments. Company America additionally joined the motion as public firms now maintain over 1 million Bitcoin, 4.87% of the full 21 million BTC provide. Technique alone holds over 649,870 BTC in its treasury.

Key Highlights

- For the very first time within the month, the Coinbase Bitcoin Premium index has indicated a optimistic charge

- This development comes as BTC soared above $92,000 on Friday

- Coinbase Bitcoin Premium index exhibits rising confidence amongst institutional buyers within the cryptocurrency after current turmoil

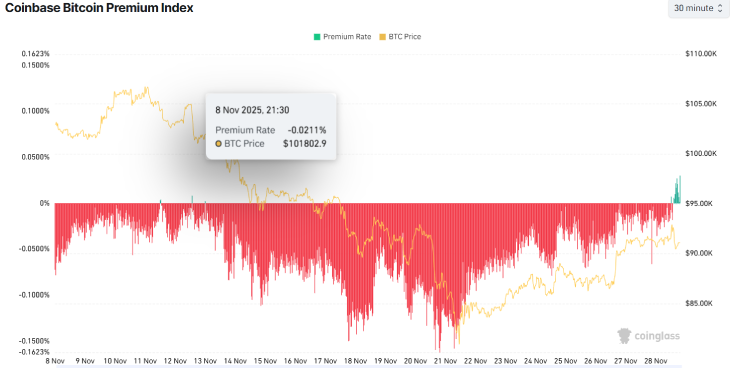

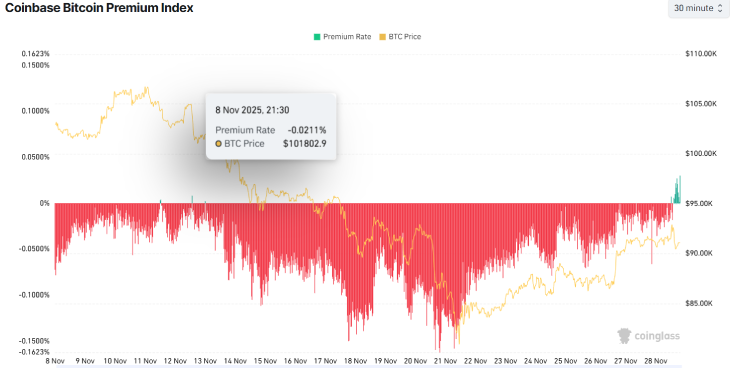

On November 28, Coinbase Bitcoin Premium witnessed a serious development, wherein it reversed a month-long damaging premium charge. The most recent premium charge revolves round 0.03% on the chart.

(Supply: Coinglass)

That is the primary time within the month that Coinbase Bitcoin Premium exhibits a optimistic premium charge. This development provides a ray of hope that institutional buyers are getting their confidence again in BTC after the turmoil within the cryptocurrency market.

What’s the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium is an index that measures the value hole for BTC between the U.S.-based Coinbase alternate and the main world exchanges (USDT markets like Binance).

When the index is optimistic, it exhibits robust shopping for strain from U.S. institutional buyers and is taken into account a bullish indicator for the cryptocurrency market. On the flip facet, a damaging charge is taken into account as decrease demand from the buyers.

This inexperienced spike occurred after BTC soared above $92,000 on Friday, sparking euphoria within the crypto group about its potential bullish momentum. On the time of writing, the cryptocurrency is buying and selling at round $91,217 with a market capitalization of 1.82% trillion, in line with CoinMarketCap.

Nonetheless, the cryptocurrency remains to be struggling to interrupt the essential resistance stage at $93,000. If it occurs, it may assist Bitcoin to witness an additional rally.

This index has efficiently managed to foretell main occasions within the cryptocurrency’s historical past, together with the bull run of 2021, the place it signaled robust institutional accumulation from firms like Tesla, MicroStrategy, and so on. Equally, it additionally tracked the 2022 and 2023 downfall with heavy promoting strain.

Within the newest report, JPMorgan talked about that BTC is now reacting to macroeconomic tendencies, and its worth momentum is not only restricted to the Bitcoin halving occasion. The banking large mentioned in its assertion, “Crypto is transferring away from resembling a enterprise capital fashion ecosystem to a typical tradable macro asset class supported by institutional liquidity slightly than retail hypothesis.”

“Cryptocurrency costs are actually extra influenced by broader financial tendencies slightly than crypto’s predictable four-year halving cycle, the method the place the speed of recent provide of Bitcoin is lower in half and adopted by a bull market rally,” JPMorgan states within the report.

Bitcoin’s Institutional Funding Grows All through 2025

After U.S. President Donald Trump took the Presidential oath for his second time period, the cryptocurrency market has witnessed a historic bull run, serving to main cryptocurrencies to realize new all-time highs by establishing a brand new cycle.

For instance, the bull run in cryptocurrency has skyrocketed its worth to new all-time highs after hovering above $126,000. One of many main elements behind this rally was a rising institutional funding through completely different streams.

After receiving clear regulatory steering from the Trump administration, institutional funding has grown impressively. This confidence was additionally seen in Bitcoin ETFs influx. The end result was record-breaking monetary inflows, with the full property in crypto ETFs hovering above $122 billion, in line with Coinglass.

Spot BTC ETFs have gotten the largest funding product for institutional buyers to spend money on cryptocurrency. These funds have attracted over 617.44K Bitcoins in whole internet influx since their launch final 12 months. This surge even allowed BTC ETFs to outperform conventional gold ETFs.

Main ETF issuers like BlackRock, Constancy, and ARK Make investments led this cost, with BlackRock’s iShares Bitcoin Belief accumulating an enormous $28 billion in internet investments. Company America additionally joined the motion as public firms now maintain over 1 million Bitcoin, 4.87% of the full 21 million BTC provide. Technique alone holds over 649,870 BTC in its treasury.