Brevan Howard, one of many world’s largest hedge funds with about $20 billion underneath administration, has considerably expanded its place in BlackRock’s spot Bitcoin ETF, IBIT.

Contemporary regulatory filings reveal the agency now holds roughly $2.32 billion value of IBIT shares — a stake that will put it forward of Goldman Sachs because the fund’s prime shareholder.

Earlier this yr, Goldman reported $1.4 billion in IBIT holdings, however the newest numbers recommend Brevan Howard has overtaken the Wall Avenue financial institution.

The transfer provides to a rising listing of high-profile establishments gaining Bitcoin publicity by means of ETFs, together with Harvard’s endowment fund, which just lately disclosed a $116 million IBIT place.

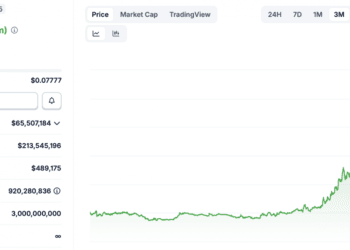

The shopping for spree comes as BlackRock’s Bitcoin ETF surpasses $90 billion in property underneath administration, making it one of many largest funds within the U.S. only a yr after launch. Throughout all U.S.-listed Bitcoin ETFs, mixed property now stand at $153.43 billion — about 6.54% of Bitcoin’s complete market worth.

Institutional enthusiasm for Bitcoin ETFs is a part of a broader pattern of conventional finance aligning extra intently with digital property.

With regulated merchandise now providing direct publicity to Bitcoin, hedge funds, pension funds, and college endowments are more and more snug allocating substantial capital to the sector.

For a lot of, IBIT’s speedy progress has turn into a bellwether for Bitcoin’s institutional adoption.

Even with latest value volatility, demand stays resilient. On August 14 alone, Bitcoin ETFs attracted over $523 million in internet inflows, with BlackRock and Grayscale driving many of the exercise. This stage of shopping for throughout a market pullback highlights the conviction amongst large-scale traders, lots of whom view short-term dips as alternatives to strengthen their positions.

The data supplied on this article is for informational functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. Coindoo.com doesn’t endorse or suggest any particular funding technique or cryptocurrency. All the time conduct your personal analysis and seek the advice of with a licensed monetary advisor earlier than making any funding choices.