Be part of Our Telegram channel to remain updated on breaking information protection

The BNB Value has surged 2% within the final 24 hours, buying and selling at $907, as optimism returns to the crypto market following bullish feedback from Binance founder Changpeng “CZ” Zhao, who lately mentioned {that a} new crypto “tremendous cycle” may very well be on the way in which.

His assertion adopted the U.S. Securities and Alternate Fee’s (SEC) removing of crypto from its 2026 danger precedence record, a transfer seen as constructive for all the market. This has boosted confidence amongst buyers and helped push costs greater.

CZ additionally identified that whereas many retail merchants have been promoting throughout latest market dips, giant monetary establishments are doing the alternative. For instance, Wells Fargo revealed it had purchased round $383 million price of Bitcoin ETF shares. This exhibits that huge banks nonetheless consider within the long-term worth of crypto property.

I may very well be unsuitable, however Tremendous Cycle incoming. https://t.co/6TLldEMmGA

— CZ 🔶 BNB (@cz_binance) January 10, 2026

Different main establishments are additionally rising their publicity. Morgan Stanley lately filed for a Bitcoin ETF after seeing robust demand from its rich shoppers. Final 12 months, the financial institution eliminated restrictions on crypto investments, permitting all its wealth shoppers to spend money on digital property like Bitcoin.

There may be additionally rising discuss governments adopting crypto. Ark Make investments CEO Cathie Wooden has urged that the U.S. might begin shopping for Bitcoin for its strategic reserves. If that occurs, it might considerably improve demand throughout the market.

In the meantime, funding agency VanEck launched very bullish Bitcoin worth predictions. In its base case, the agency expects Bitcoin to achieve $2.9 million by 2050. In a extra excessive situation, the place Bitcoin turns into a serious international reserve asset like gold, the value might rise as excessive as $53.4 million. Even in a bearish case, VanEck believes Bitcoin might nonetheless attain $130,000.

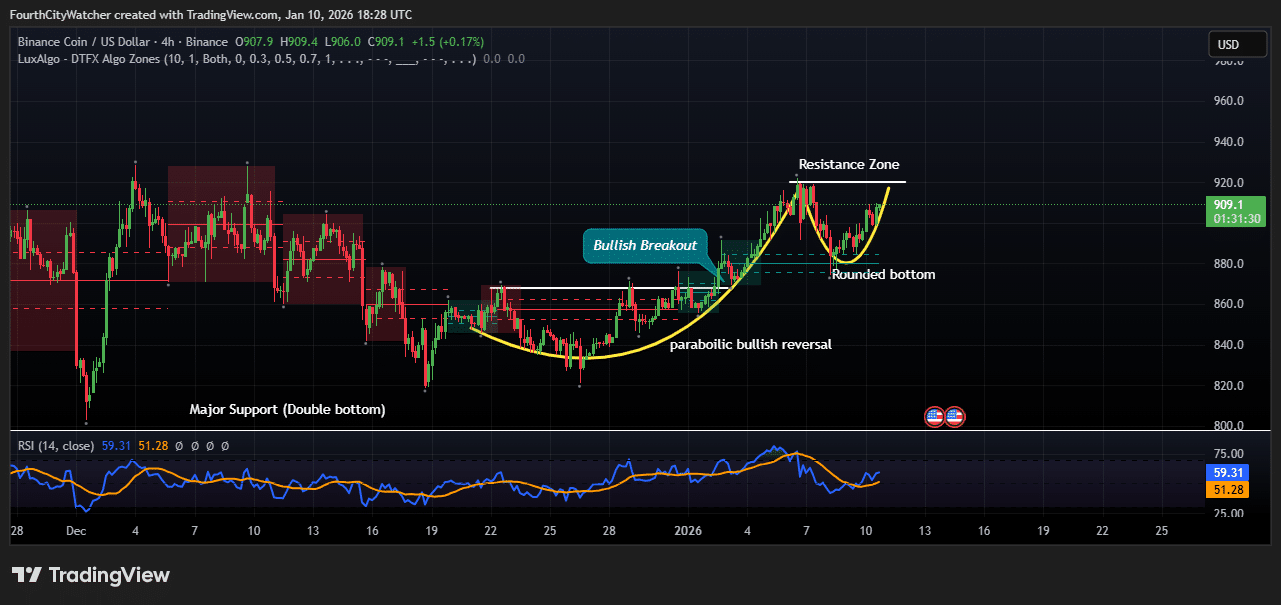

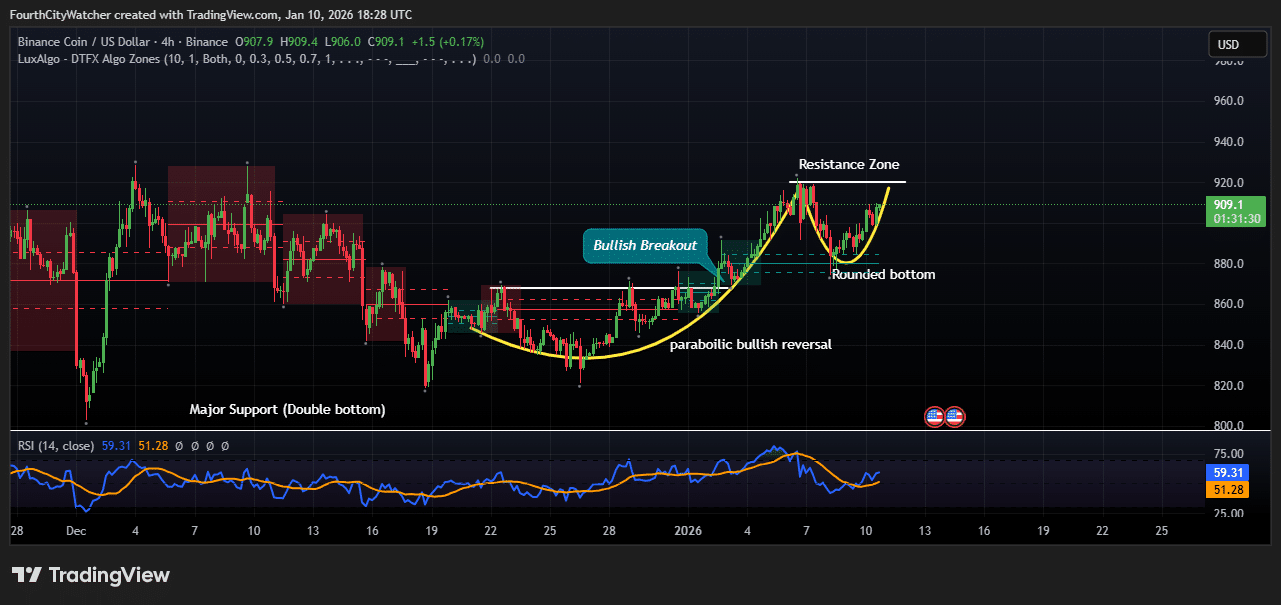

BNB Value Close to Key Resistance After Robust Bullish Restoration

BNB is at the moment buying and selling round $910 after exhibiting a powerful restoration from the $820–$830 assist zone. This space acted as a serious ground the place consumers stepped in and stopped additional worth declines. The double-bottom construction and rounded base formation on this area signaled that promoting stress was weakening and {that a} pattern reversal was beginning to kind, shifting from bearish to bullish, with consumers slowly regaining management of worth motion.

After constructing this strong base, BNB broke above its earlier consolidation vary in a transparent bullish breakout, confirming that demand was rising and that merchants had been extra assured in greater costs. The worth additionally began forming greater lows, which is a wholesome signal of an uptrend. The curved bullish construction on the chart exhibits that purchasing momentum has been regular quite than aggressive, indicating a extra sustainable restoration as a substitute of a short-term pump.

BNBUSD Chart Evaluation. Supply: Tradingview

BNB is now approaching a key resistance zone round $920–$930, the place sellers beforehand entered the market. This stage is necessary as a result of worth has already proven hesitation right here, with small pullbacks and slower motion.

The RSI indicator is at the moment round 60, which implies the market is bullish however not overbought. This means there’s nonetheless room for additional upside earlier than the value turns into overstretched. The latest RSI bounce additionally helps the concept shopping for momentum is returning after a brief pause.

If consumers handle to push BNB above this resistance with robust quantity, the subsequent upside goal may very well be round $950–$970. A profitable breakout would affirm that the bullish pattern remains to be robust and that greater ranges could also be examined quickly.

Nonetheless, if BNB fails to interrupt above the $920–$930 resistance zone, a short-term pullback is feasible. The worth might retrace towards $890 and even $870, that are necessary assist ranges the place consumers might step in once more.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection