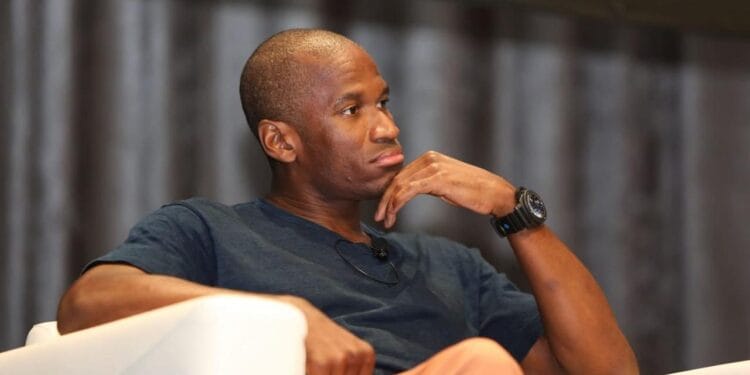

Arthur Hayes, co-founder of BitMEX, has cashed out greater than $13 million in crypto holdings because the market reels from a pointy downturn.

Blockchain monitoring knowledge exhibits Hayes unloaded roughly 2,373 ETH ($8.32 million), 7.76 million ENA tokens ($4.62 million), and practically 39 billion PEPE tokens (round $415,000) in a transfer that stunned many given his previous bullish outlook on altcoins.

The sell-off got here as Bitcoin slipped to $112,731 inside 24 hours, coinciding with what CryptoQuant’s Julio Moreno describes because the third main profit-taking wave of the present bull cycle—a sample that always precedes market corrections. Including to the stress, spot Bitcoin ETFs recorded $812 million in outflows on Friday, their second-largest one-day loss ever, whereas Ethereum ETFs additionally noticed substantial withdrawals.

“]

Hayes has beforehand warned merchants to brace for volatility, significantly in mild of upcoming U.S. tariffs on over 60 nations, set to take impact August 7. The White Home’s commerce measures, paired with Federal Reserve issues over potential inflation, have amplified bearish sentiment.

Whereas the timing of Hayes’s liquidation raised questions, it could be extra of a calculated danger adjustment than a shift to a long-term bearish stance. In current months, he has maintained that Ethereum may ultimately climb to $10,000, and simply weeks in the past he invested $1.5 million in Ethena (ENA) at decrease costs. His newest transfer could also be an effort to lock in income and protect capital for re-entry when market circumstances stabilize—constant along with his historical past of shopping for into weak spot and exiting throughout turbulence.