Bitcoin seems to be quietly gathering power beneath the floor. After a wholesome pullback that shook out weak arms, the market is displaying indicators of renewed momentum. Key technical alerts counsel this correction could have been a setup for the following main rally, probably paving the best way for a brand new all-time excessive.

Wholesome Correction Inside A Dominant Uptrend

EtherNasyonaL, in a current publish, highlighted that Bitcoin continues to take care of its upward trajectory regardless of current market fluctuations. The analyst described the newest motion as a wholesome correction throughout the broader bullish development, emphasizing that such retracements are pure in a sustained rally.

Following a rejection from the provision zone, Bitcoin discovered sturdy help at a key demand space, the place patrons rapidly stepped in to defend the value. This rebound underscores the underlying power of market members and reaffirms that bullish sentiment stays dominant.

EtherNasyonaL famous that short-term volatility, for merchants not concerned in leveraged positions, usually seems as noise within the greater image. BTC’s macro development continues to be constructive, and the continuing correction could merely function gasoline for the following leg greater. General, Bitcoin’s construction stays stable, with its development intact and momentum nonetheless alive.

Bullish Spring Formation Factors To Potential Breakout Setup

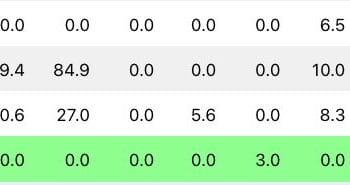

Crypto analyst Christopher Inks, in an X publish, famous that Bitcoin’s newest value motion has refined its buying and selling vary, providing a clearer market construction. He urged that the asset could have simply fashioned a heavy spring or bullish Swing Failure Sample (SFP), a setup that usually precedes sturdy upward motion.

If this bullish setup holds, the analyst expects a validation part, the place Bitcoin may kind the next low on decrease quantity, a traditional signal of profitable testing. Such a transfer would verify the spring’s power and probably set off momentum towards a brand new all-time excessive (ATH). This part is essential in figuring out whether or not the following main rally is about to start.

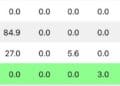

Inks additionally pointed to Open Curiosity (OI) as a key affirmation instrument. A decline in open curiosity as value consolidates would counsel quick overlaying and validate the bullish check. However, rising OI on decrease closes would indicate continued distribution, signaling that the market might have extra time earlier than reversing decisively.

From an Elliott Wave Concept (EWT) perspective, Inks recognized a three-wave construction from the swing low whereas printing a brand new swing excessive that matches a flat correction sample. Since flat corrections usually happen earlier than the continuation of a bigger uptrend, this evaluation aligns with the Wyckoff interpretation, suggesting Bitcoin’s construction stays sturdy and poised for an additional upward leg.