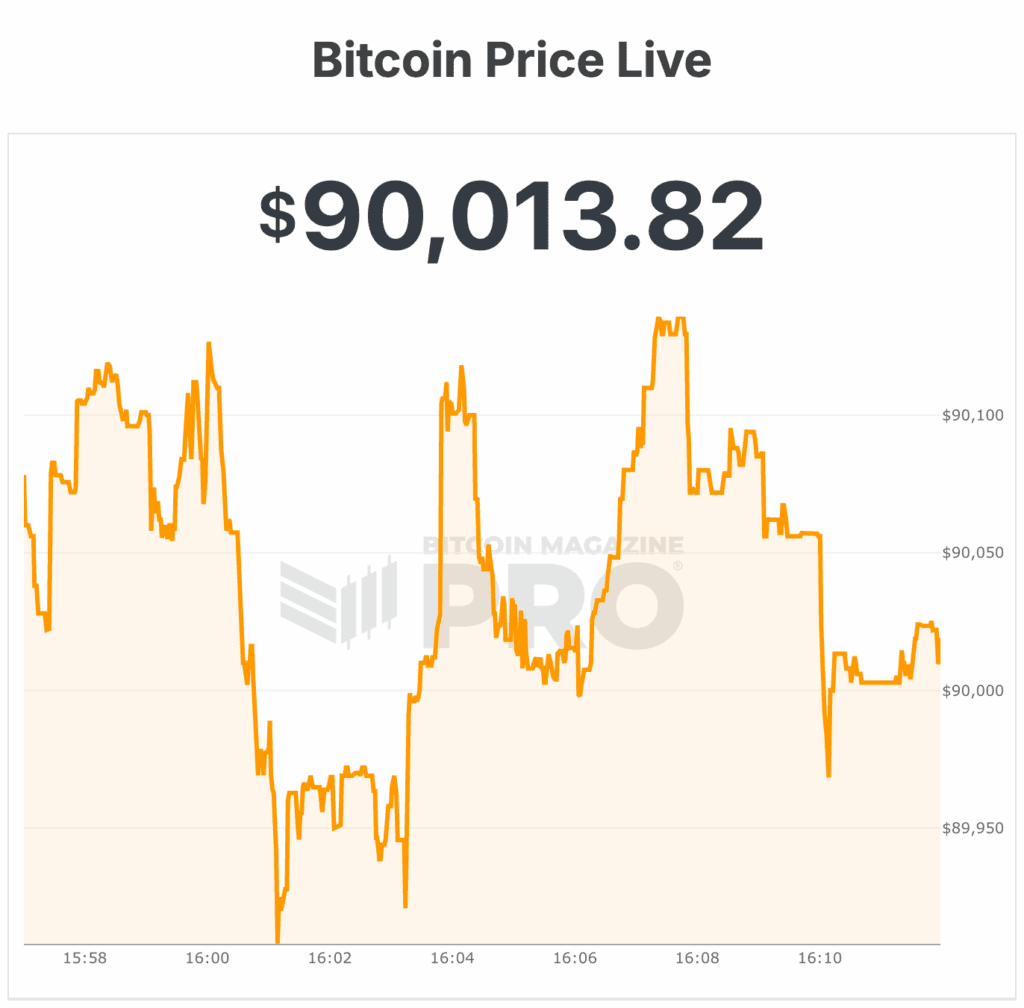

The bitcoin value skilled a number of intraday spikes on Wednesday, swinging by a number of thousand {dollars} as merchants reacted to shifting geopolitical headlines and recent feedback from U.S. President Donald Trump.

The world’s largest cryptocurrency began the day close to $88,000 earlier than surging above $90,000 in early buying and selling. The rally proved short-lived, nonetheless, with bitcoin sliding again into the higher $87,000 vary after markets opened and dipped. Costs then roared larger as soon as once more, rebounding towards $90,000 after Trump introduced a delay to deliberate commerce tariffs.

Bitcoin value was final buying and selling round $90,000 on the time of writing, having briefly reclaimed the extent for the second time in the identical session.

Trump feedback spark bitcoin value rally

The newest transfer adopted feedback from Trump on the World Financial Discussion board in Davos, Switzerland, and a subsequent publish on his Fact Social platform.

Trump mentioned he would delay tariffs that had been scheduled to take impact on February 1 after what he described as a “very productive assembly” with NATO Secretary Common Mark Rutte.

Within the publish, Trump outlined a preliminary framework for a broader settlement involving Greenland and the Arctic area, calling the potential deal “an ideal one for the US of America, and all NATO nations.” He added that, primarily based on the discussions, the deliberate tariffs wouldn’t transfer ahead.

Markets responded positively to the information. U.S. equities bounced sharply, with the S&P 500, Nasdaq and Dow Jones Industrial Common all rising roughly 1.5% on the day.

Danger belongings throughout the board adopted go well with, lifting the bitcoin value and different main cryptocurrencies again towards latest highs.

Throughout his Davos remarks, Trump additionally reiterated his assist for digital belongings, saying he hopes to signal complete crypto market construction laws “very quickly.”

“Now, Congress is working very exhausting on crypto market construction laws — Bitcoin, all of them — which I hope to signal very quickly, unlocking new pathways for Individuals to succeed in monetary freedom,” Trump mentioned.

Bitcoin value evaluation as macro dangers linger

Regardless of the aid rally, macroeconomic considerations stay within the background. Analysts have pointed to renewed stress in Japan’s bond market as a possible headwind for international threat belongings.

Japan’s 10-year authorities bond yield has climbed to round 2.29%, a degree not seen since 1999. QCP Capital highlighted in a observe that Japan’s authorities debt exceeds 240% of GDP, with debt servicing prices projected to eat roughly 1 / 4 of fiscal spending by 2026.

Based on Bitcoin Journal evaluation, the bitcoin value held its bullish construction above $90,000 final week, rallying to $98,000 and shutting round $93,600, protecting a mildly bullish bias.

Bulls will need the bitcoin value to reclaim $94,000 and retest $98,000 this week, with a sustained break doubtlessly reaching $103,500 and the $106,000–$109,000 resistance zone.

Key assist is at $91,400, with a loss probably resulting in a deeper pullback towards $87,000 or $84,000.

Whereas momentum has improved, the $103,500–$109,000 space is anticipated to be sturdy resistance, the place rejection might determine whether or not the rally continues or drops towards sub-$80,000 ranges.

Wednesday’s dramatic value motion proved pricey for leveraged crypto merchants. Based on CoinGlass information, greater than $1 billion in crypto positions had been liquidated over the previous 24 hours as costs whipsawed larger and decrease after which larger.

Lengthy positions bore the brunt of the harm, accounting for about $672 million in liquidations, whereas brief positions made up about $335 million.

Bitcoin led the losses with roughly $426 million in liquidations, adopted by Ethereum at round $366 million.

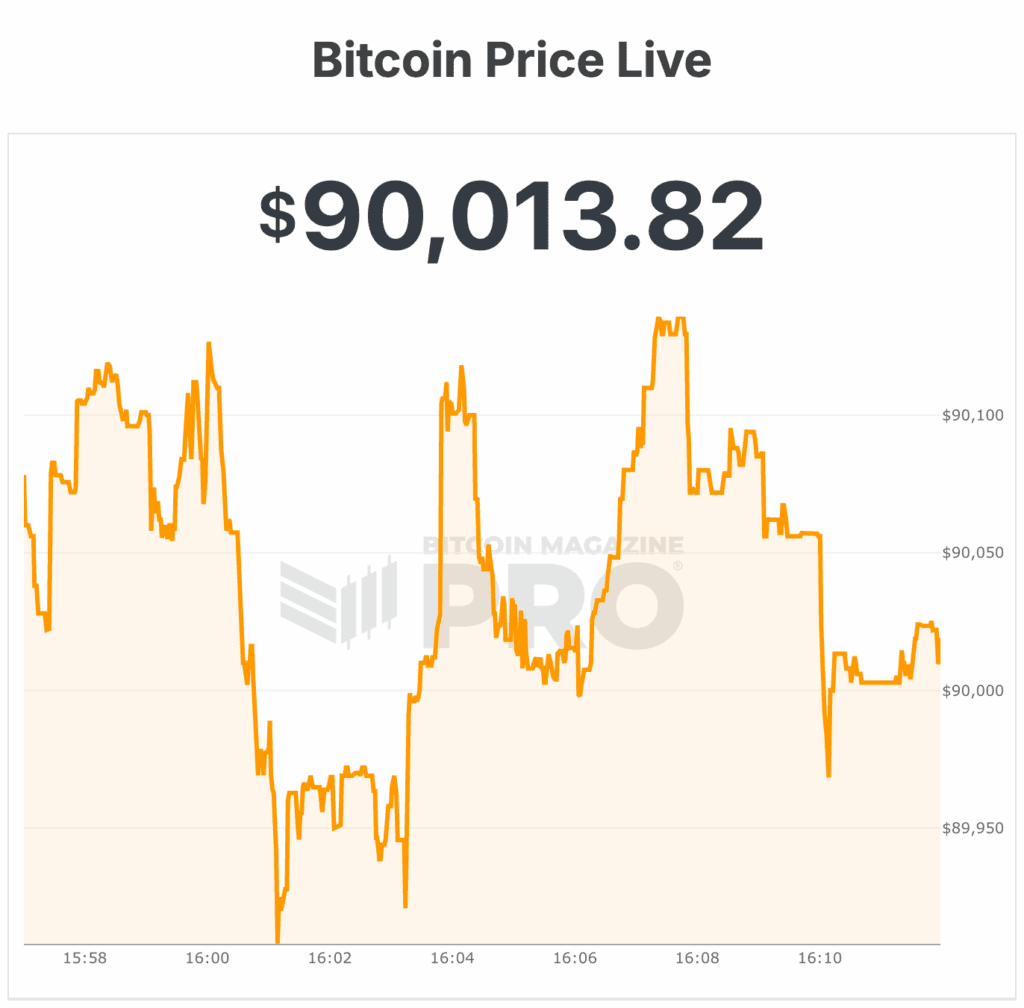

At the moment, the bitcoin value is buying and selling at $90,019 with a 24-hour quantity of $67 B, holding regular over the previous day. Its market cap stands at $1.798 T, slightly below its 7-day excessive of $90,296 and above the 7-day low of $87,304.

The bitcoin value skilled a number of intraday spikes on Wednesday, swinging by a number of thousand {dollars} as merchants reacted to shifting geopolitical headlines and recent feedback from U.S. President Donald Trump.

The world’s largest cryptocurrency began the day close to $88,000 earlier than surging above $90,000 in early buying and selling. The rally proved short-lived, nonetheless, with bitcoin sliding again into the higher $87,000 vary after markets opened and dipped. Costs then roared larger as soon as once more, rebounding towards $90,000 after Trump introduced a delay to deliberate commerce tariffs.

Bitcoin value was final buying and selling round $90,000 on the time of writing, having briefly reclaimed the extent for the second time in the identical session.

Trump feedback spark bitcoin value rally

The newest transfer adopted feedback from Trump on the World Financial Discussion board in Davos, Switzerland, and a subsequent publish on his Fact Social platform.

Trump mentioned he would delay tariffs that had been scheduled to take impact on February 1 after what he described as a “very productive assembly” with NATO Secretary Common Mark Rutte.

Within the publish, Trump outlined a preliminary framework for a broader settlement involving Greenland and the Arctic area, calling the potential deal “an ideal one for the US of America, and all NATO nations.” He added that, primarily based on the discussions, the deliberate tariffs wouldn’t transfer ahead.

Markets responded positively to the information. U.S. equities bounced sharply, with the S&P 500, Nasdaq and Dow Jones Industrial Common all rising roughly 1.5% on the day.

Danger belongings throughout the board adopted go well with, lifting the bitcoin value and different main cryptocurrencies again towards latest highs.

Throughout his Davos remarks, Trump additionally reiterated his assist for digital belongings, saying he hopes to signal complete crypto market construction laws “very quickly.”

“Now, Congress is working very exhausting on crypto market construction laws — Bitcoin, all of them — which I hope to signal very quickly, unlocking new pathways for Individuals to succeed in monetary freedom,” Trump mentioned.

Bitcoin value evaluation as macro dangers linger

Regardless of the aid rally, macroeconomic considerations stay within the background. Analysts have pointed to renewed stress in Japan’s bond market as a possible headwind for international threat belongings.

Japan’s 10-year authorities bond yield has climbed to round 2.29%, a degree not seen since 1999. QCP Capital highlighted in a observe that Japan’s authorities debt exceeds 240% of GDP, with debt servicing prices projected to eat roughly 1 / 4 of fiscal spending by 2026.

Based on Bitcoin Journal evaluation, the bitcoin value held its bullish construction above $90,000 final week, rallying to $98,000 and shutting round $93,600, protecting a mildly bullish bias.

Bulls will need the bitcoin value to reclaim $94,000 and retest $98,000 this week, with a sustained break doubtlessly reaching $103,500 and the $106,000–$109,000 resistance zone.

Key assist is at $91,400, with a loss probably resulting in a deeper pullback towards $87,000 or $84,000.

Whereas momentum has improved, the $103,500–$109,000 space is anticipated to be sturdy resistance, the place rejection might determine whether or not the rally continues or drops towards sub-$80,000 ranges.

Wednesday’s dramatic value motion proved pricey for leveraged crypto merchants. Based on CoinGlass information, greater than $1 billion in crypto positions had been liquidated over the previous 24 hours as costs whipsawed larger and decrease after which larger.

Lengthy positions bore the brunt of the harm, accounting for about $672 million in liquidations, whereas brief positions made up about $335 million.

Bitcoin led the losses with roughly $426 million in liquidations, adopted by Ethereum at round $366 million.

At the moment, the bitcoin value is buying and selling at $90,019 with a 24-hour quantity of $67 B, holding regular over the previous day. Its market cap stands at $1.798 T, slightly below its 7-day excessive of $90,296 and above the 7-day low of $87,304.