The bitcoin worth was buying and selling close to the $90,000 mark on Friday as crypto markets steadied following a delay from the U.S. Supreme Court docket on a intently watched ruling tied to President Donald Trump’s tariff coverage, quickly easing near-term macro uncertainty.

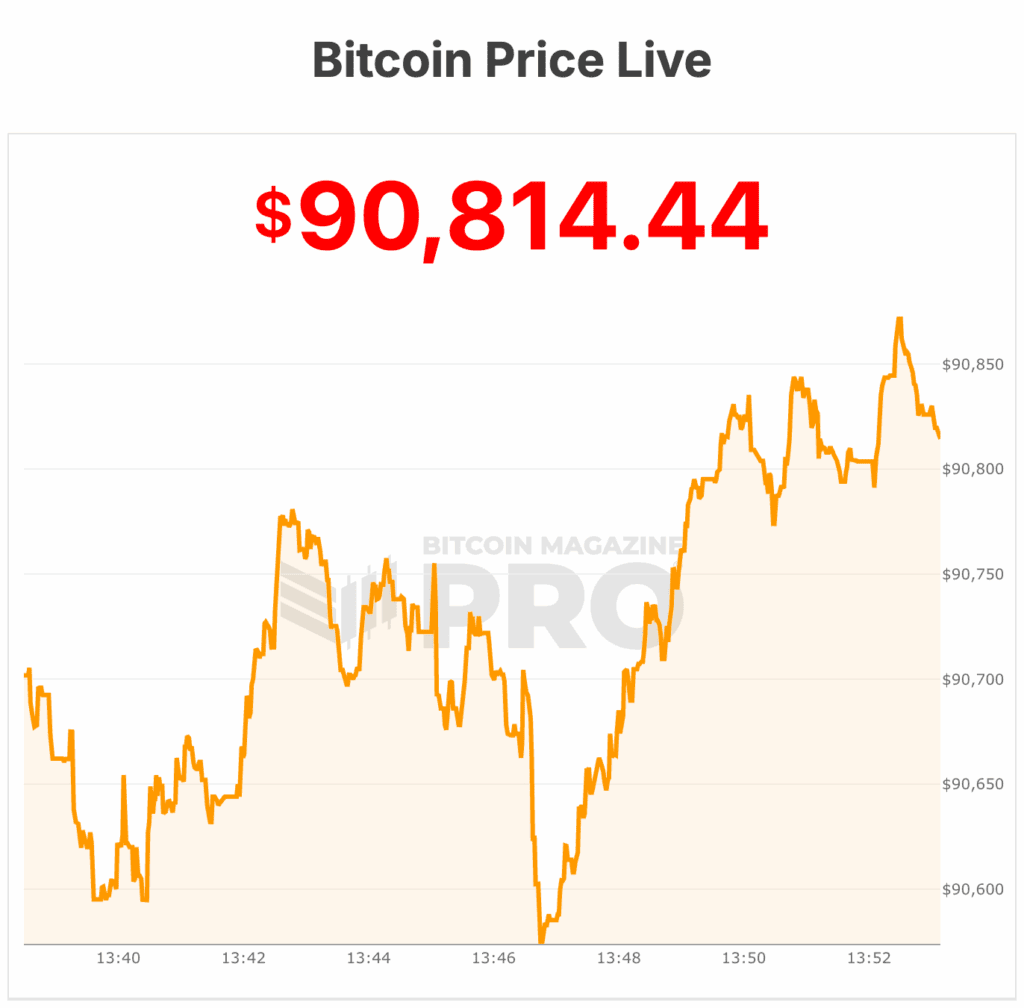

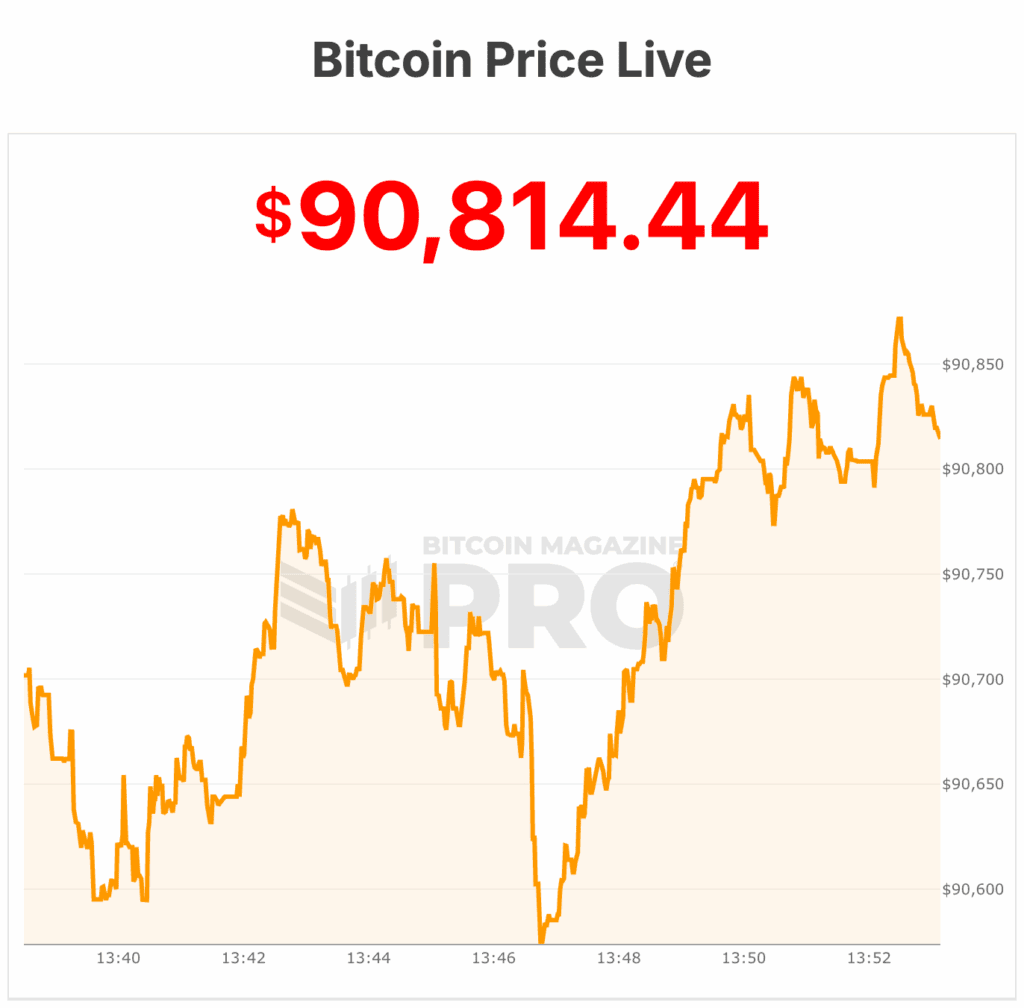

The value of bitcoin stood at $90,443 on the time of writing, down about 1% over the previous 24 hours, in keeping with market information. Each day buying and selling quantity totaled roughly $45 billion, whereas bitcoin’s complete market capitalization slipped to roughly $1.80 trillion, additionally down 1% on the day.

Regardless of the modest pullback, the bitcoin worth stays tightly rangebound close to latest highs. The asset is presently about 2% under its seven-day excessive of $91,839 and roughly 1% above its seven-day low of $89,671, per Bitcoin Journal Professional information.

Bitcoin’s circulating provide now stands at 19,973,659 BTC, inching nearer to its fastened cap of 21 million cash — a structural characteristic that continues to underpin long-term bullish narratives.

Tariff uncertainty weighs, then lifts the bitcoin worth

Crypto costs initially wavered this week as merchants positioned forward of a possible Supreme Court docket resolution on the legality of Trump-era international tariffs, extensively considered as a serious macro catalyst.

Nevertheless, markets moved greater on Friday after the court docket delayed its ruling till subsequent week, lowering quick draw back danger throughout equities, bonds, and digital property.

The bitcoin worth hovered round $90,000 close to the U.S. fairness market open as buyers reassessed danger publicity.

Analysts mentioned the delay eased considerations about abrupt fiscal disruptions, together with the likelihood that the U.S. Treasury might be compelled to refund extra than $130 billion to importers if the tariffs had been struck down.

Bitcoin has more and more traded as a macro-sensitive asset, reacting to shifts in coverage expectations, liquidity circumstances, and geopolitical uncertainty.

Consequently, main authorized or political developments proceed to affect short-term worth motion, at the same time as long-term adoption traits stay intact.

Bitcoin worth in consolidation following early-year rally

The present worth displays a cooling interval after the bitcoin worth surged within the opening days of the yr, briefly pushing towards new short-term highs.

That early-January rally reignited bullish sentiment but in addition triggered profit-taking as momentum light close to resistance.

Technically, merchants are watching the $90,000–$91,000 zone as a key assist space. A sustained break decrease may expose draw back towards the high-$80,000 vary, whereas a transfer again above $92,000 would doubtless reopen the trail towards greater resistance ranges.

For now, bitcoin stays locked in consolidation, with volatility compressed and merchants awaiting a clearer catalyst.

Will the US purchase Bitcoin?

Cathie Wooden of ARK Make investments mentioned in a podcast just lately that politics may drive the U.S. to actively purchase bitcoin in 2026. Wooden argues that crypto has grow to be a sturdy political challenge for President Trump, probably shaping coverage forward of the midterm elections.

Whereas the U.S. presently holds a bitcoin reserve made up of seized property, Trump has pledged to not promote any of the bitcoin, and the unique aim was to accumulate a million BTC.

Wooden urged in her dialog that the administration might transfer from holding solely confiscated bitcoin to buying BTC outright for a nationwide strategic reserve.

Crypto has additionally emerged as a extra organized political constituency, supporting Trump and interesting with the White Home by means of occasions and donations. On the coverage facet, govt orders have established the reserve and stockpile, with suggestions for Treasury-led enlargement.

Wooden sees authorities purchases as a possible market inflection level, reinforcing bitcoin’s shortage as practically 20 million of its 21 million cap have already been mined. If the US would begin shopping for bitcoin, its secure to imagine that the bitcoin worth would react positively.

On the time of writing, the bitcoin worth is $90,814.

The bitcoin worth was buying and selling close to the $90,000 mark on Friday as crypto markets steadied following a delay from the U.S. Supreme Court docket on a intently watched ruling tied to President Donald Trump’s tariff coverage, quickly easing near-term macro uncertainty.

The value of bitcoin stood at $90,443 on the time of writing, down about 1% over the previous 24 hours, in keeping with market information. Each day buying and selling quantity totaled roughly $45 billion, whereas bitcoin’s complete market capitalization slipped to roughly $1.80 trillion, additionally down 1% on the day.

Regardless of the modest pullback, the bitcoin worth stays tightly rangebound close to latest highs. The asset is presently about 2% under its seven-day excessive of $91,839 and roughly 1% above its seven-day low of $89,671, per Bitcoin Journal Professional information.

Bitcoin’s circulating provide now stands at 19,973,659 BTC, inching nearer to its fastened cap of 21 million cash — a structural characteristic that continues to underpin long-term bullish narratives.

Tariff uncertainty weighs, then lifts the bitcoin worth

Crypto costs initially wavered this week as merchants positioned forward of a possible Supreme Court docket resolution on the legality of Trump-era international tariffs, extensively considered as a serious macro catalyst.

Nevertheless, markets moved greater on Friday after the court docket delayed its ruling till subsequent week, lowering quick draw back danger throughout equities, bonds, and digital property.

The bitcoin worth hovered round $90,000 close to the U.S. fairness market open as buyers reassessed danger publicity.

Analysts mentioned the delay eased considerations about abrupt fiscal disruptions, together with the likelihood that the U.S. Treasury might be compelled to refund extra than $130 billion to importers if the tariffs had been struck down.

Bitcoin has more and more traded as a macro-sensitive asset, reacting to shifts in coverage expectations, liquidity circumstances, and geopolitical uncertainty.

Consequently, main authorized or political developments proceed to affect short-term worth motion, at the same time as long-term adoption traits stay intact.

Bitcoin worth in consolidation following early-year rally

The present worth displays a cooling interval after the bitcoin worth surged within the opening days of the yr, briefly pushing towards new short-term highs.

That early-January rally reignited bullish sentiment but in addition triggered profit-taking as momentum light close to resistance.

Technically, merchants are watching the $90,000–$91,000 zone as a key assist space. A sustained break decrease may expose draw back towards the high-$80,000 vary, whereas a transfer again above $92,000 would doubtless reopen the trail towards greater resistance ranges.

For now, bitcoin stays locked in consolidation, with volatility compressed and merchants awaiting a clearer catalyst.

Will the US purchase Bitcoin?

Cathie Wooden of ARK Make investments mentioned in a podcast just lately that politics may drive the U.S. to actively purchase bitcoin in 2026. Wooden argues that crypto has grow to be a sturdy political challenge for President Trump, probably shaping coverage forward of the midterm elections.

Whereas the U.S. presently holds a bitcoin reserve made up of seized property, Trump has pledged to not promote any of the bitcoin, and the unique aim was to accumulate a million BTC.

Wooden urged in her dialog that the administration might transfer from holding solely confiscated bitcoin to buying BTC outright for a nationwide strategic reserve.

Crypto has additionally emerged as a extra organized political constituency, supporting Trump and interesting with the White Home by means of occasions and donations. On the coverage facet, govt orders have established the reserve and stockpile, with suggestions for Treasury-led enlargement.

Wooden sees authorities purchases as a possible market inflection level, reinforcing bitcoin’s shortage as practically 20 million of its 21 million cap have already been mined. If the US would begin shopping for bitcoin, its secure to imagine that the bitcoin worth would react positively.

On the time of writing, the bitcoin worth is $90,814.