Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value rose over 1% previously 24 hours to commerce at $115,025 as of three:49 a.m. EST, as over half a billion {dollars} returned to identify BTC exchange-traded funds (ETFs) amid rising rate of interest lower optimism.

Spot Bitcoin ETFs within the US recorded a complete each day web influx of $552.7 million, in response to Coinglass, as institutional buyers flip to BTC in a renewed wave of confidence.

BlackRock’s IBIT led what’s the fourth day of consecutive constructive flows with $36.2 million, adopted by $134.7 million into Constancy’s FBTC.

In the meantime, buyers at the moment are watching the Federal Open Market Committee Assembly (FOMC) on Sept. 16, with rising optimism of an rate of interest lower.

𝗝𝗨𝗦𝗧 𝗜𝗡: US CPI is available in at 2.9%, as anticipated.

Charge cuts are confirmed! pic.twitter.com/iiEVtDi5AK

— Lark Davis (@TheCryptoLark) September 11, 2025

CME’s FedWatch software reveals a 92.7% odds of a 25 foundation level fee lower, whereas probabilities of a half-point fee lower hovers round 7.3%.

The optimism comes because the US Client Worth Index (CPI) knowledge landed on the right track, rising 2.9% year-on-year in August, whereas core CPI superior 0.4% from July.

With the cooler US inflation knowledge, BTC briefly touched a 19-day excessive of $116,300 earlier than retracing to the present value, exhibiting that sellers stay energetic at this key resistance.

Bitcoin Worth Poised For Wave 5 Rally

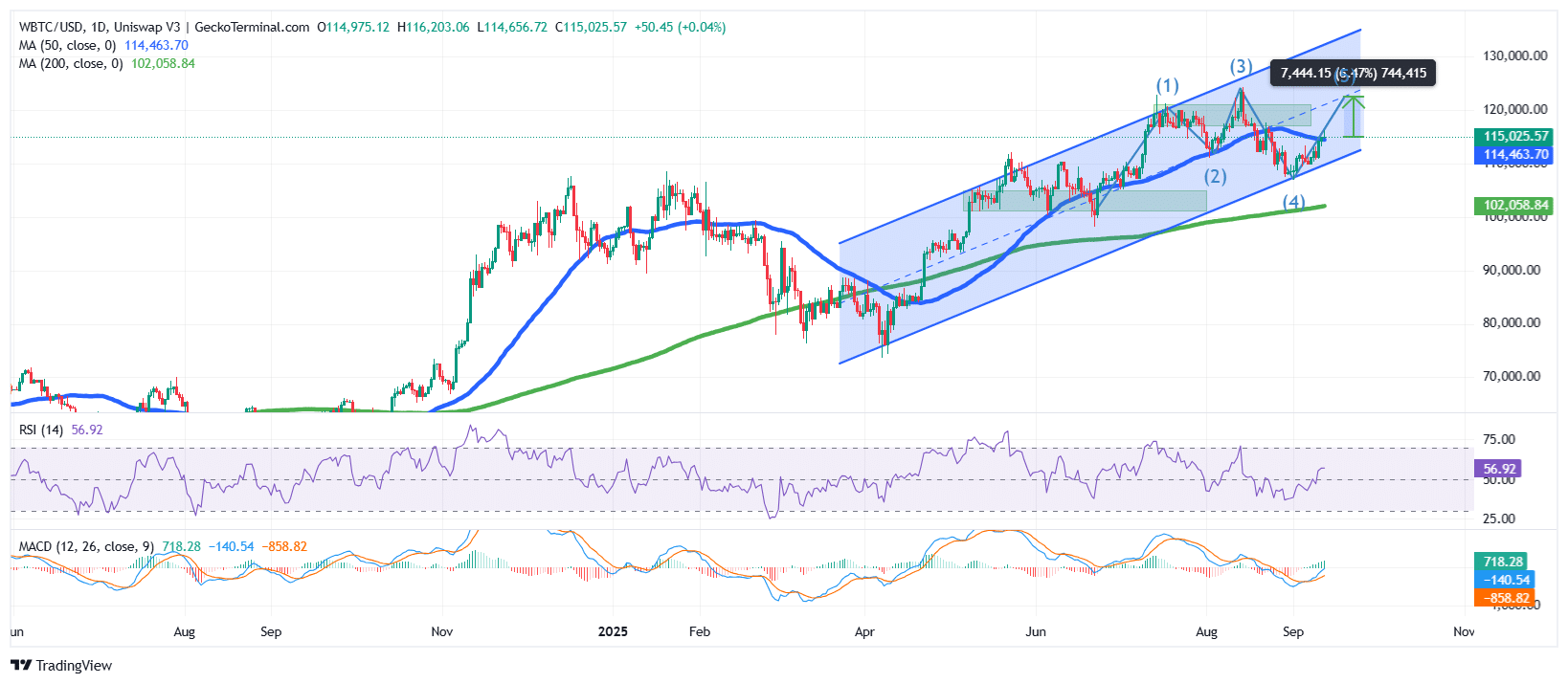

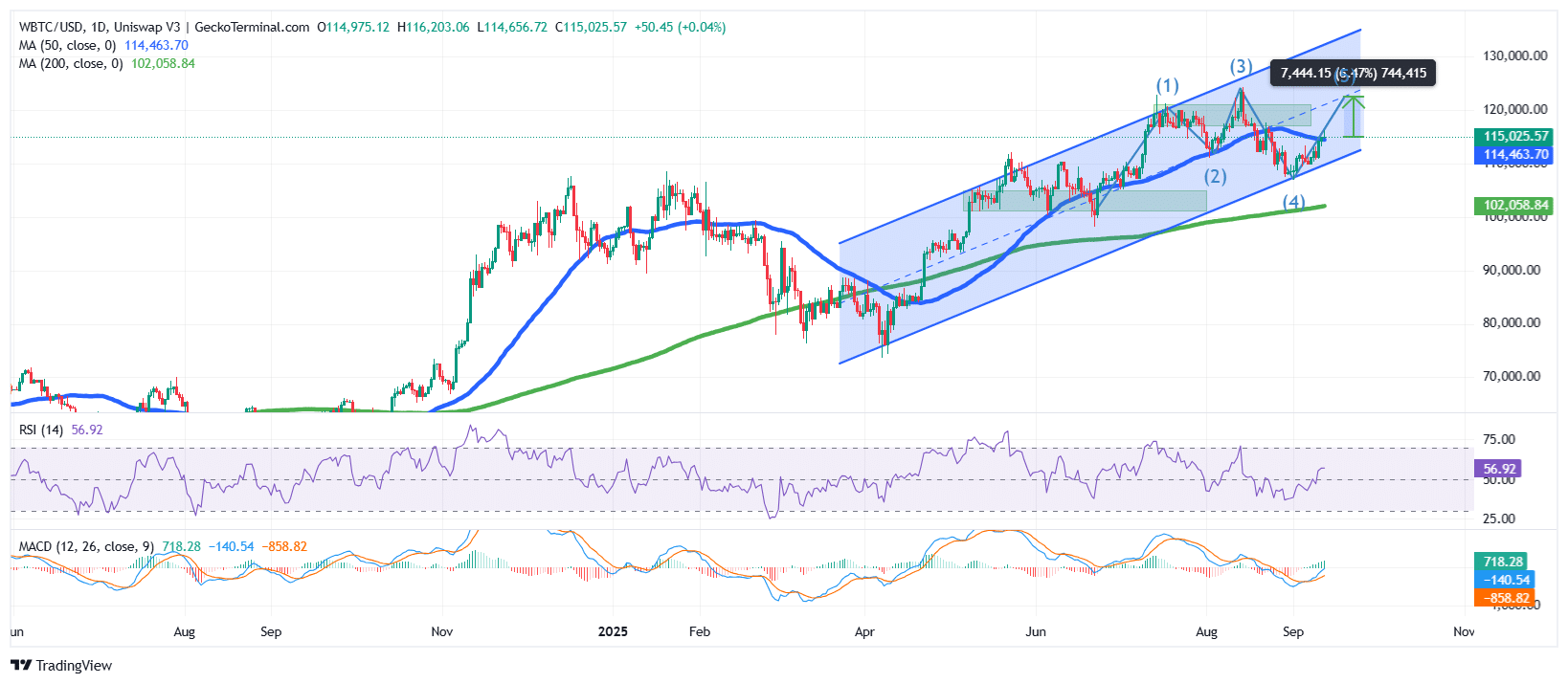

The BTC/USD evaluation on the each day timeframe reveals a robust bullish construction inside a well-defined rising channel sample.

The BTC value is transferring greater after bouncing off the decrease boundary of the channel, which coincided with the 200-day Easy Shifting Common (SMA).

The market additionally seems to be following an Elliott Wave sequence, with waves (1), (2), (3), and (4) already accomplished, and wave (5) probably in progress. This implies that the market could also be getting into its remaining impulsive leg to the upside, which usually completes the cycle earlier than a deeper correction.

Bitcoin’s value has additionally reclaimed the 50-day SMA as help, a bullish signal that confirms short-term power throughout the bigger uptrend.

WBTC/USD chart evaluation (Supply: TradingView)

Momentum Indicators Align For Continued Upside

The Relative Power Index (RSI) is at the moment at 56.92, which sits in impartial territory however leans barely bullish. This means that momentum is favoring patrons, however the market isn’t but overbought, which can give the worth house to soar even greater.

Furthermore, the Shifting Common Convergence Divergence (MACD) additionally reveals indicators of strengthening momentum.

The histogram has flipped again into constructive territory, whereas the blue MACD line is crossing above the orange sign line, which is a bullish crossover.

Based mostly on the channel construction, Elliott Wave projection, and bullish indicator alignment, the worth of Bitcoin is probably going within the early phases of wave (5), which ought to goal the higher boundary of the channel.

The transfer locations the subsequent potential resistance zone within the $124,000 vary. If bullish momentum accelerates, BTC might even soar towards $130,000.

On the draw back, the $114,000–115,000 area now serves as rapid help, supported by the 50-day SMA. If this stage holds, the bullish situation stays intact.

A breakdown under the $110,000 zone would weaken the construction and probably retest the 200-day SMA close to $102,000.

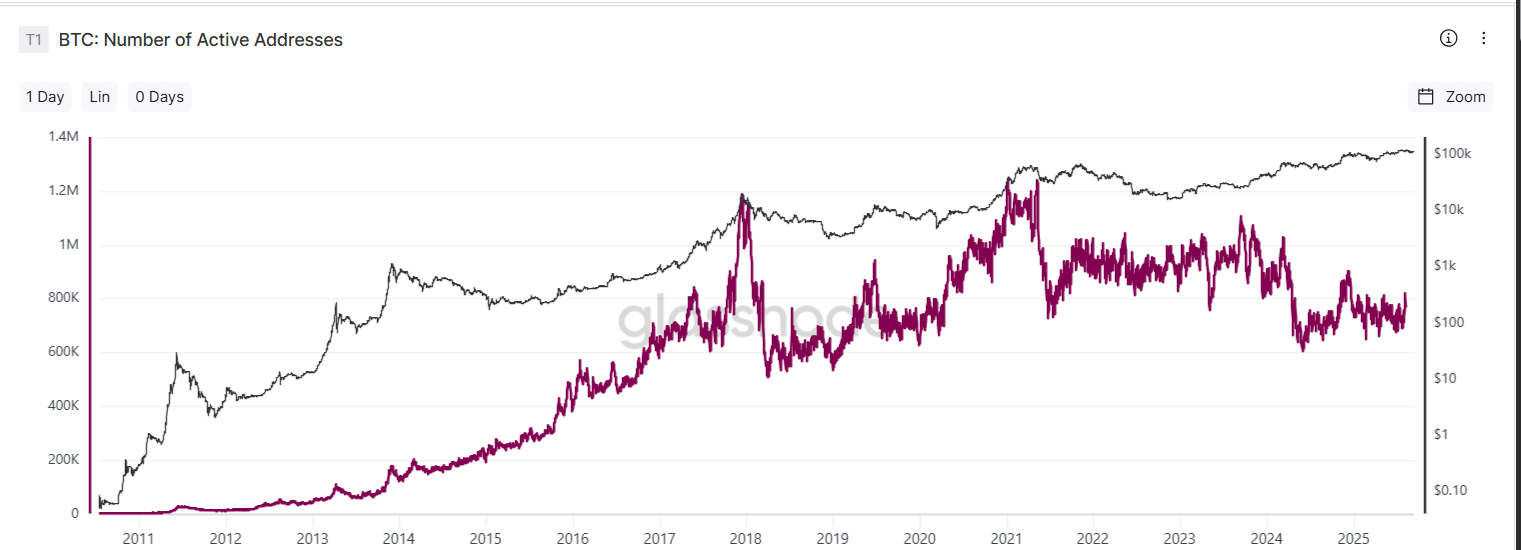

With all components pointing to a surge in 2025, knowledge from Glassnode reveals that the variety of buyers including BTC to their hoard continues to develop.

In the meantime, X person Ted Pillows believes that if BTC reclaims the $117,000 stage, it’ll be heading in direction of a brand new ATH.

$BTC has totally reclaimed the $113,500 stage.

$117,200 is the subsequent essential stage for Bitcoin and it additionally has a CME hole.

If BTC totally reclaims this stage, the doorways in direction of the brand new ATH will open.

In case of a rejection, BTC might revisit month-to-month lows. pic.twitter.com/DSFgDFNsEg

— Ted (@TedPillows) September 12, 2025

Moreover, $4.3 billion of Bitcoin month-to-month choices expire right now, favoring neutral-to-bullish bets.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection