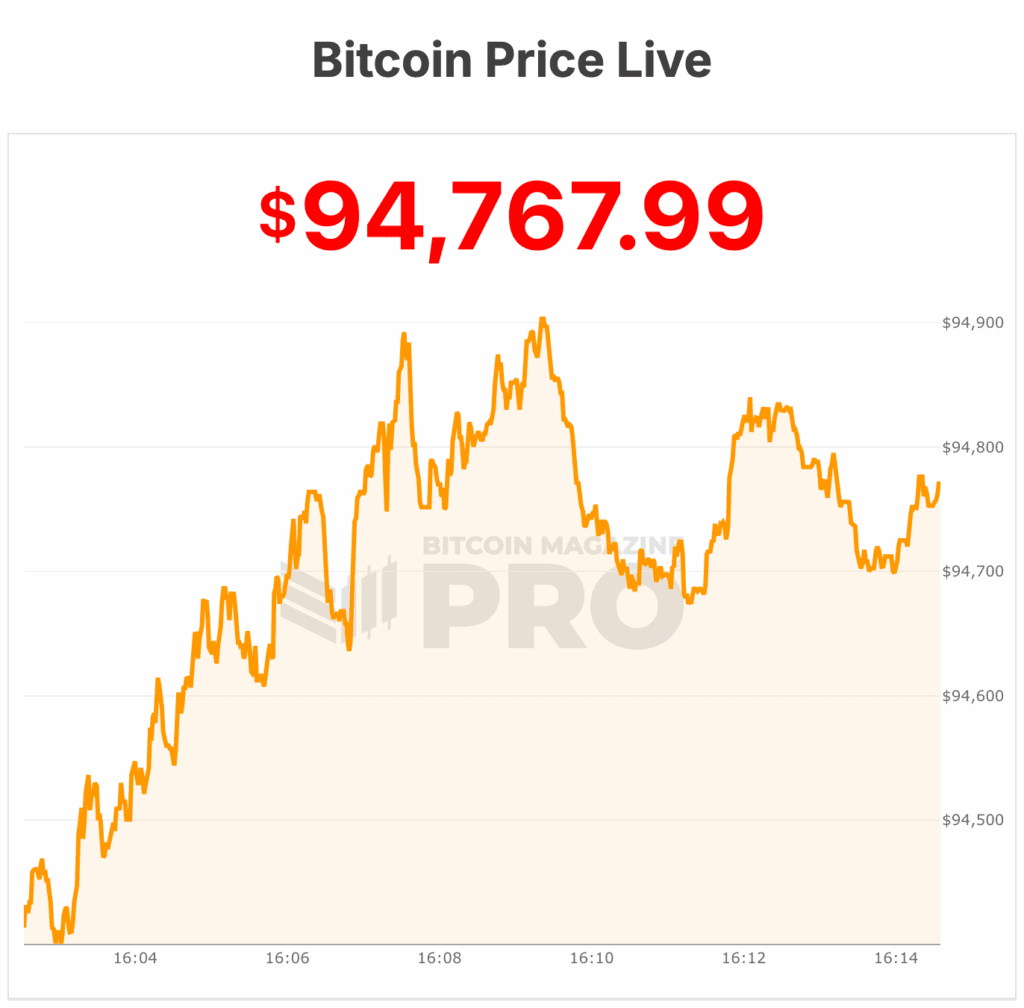

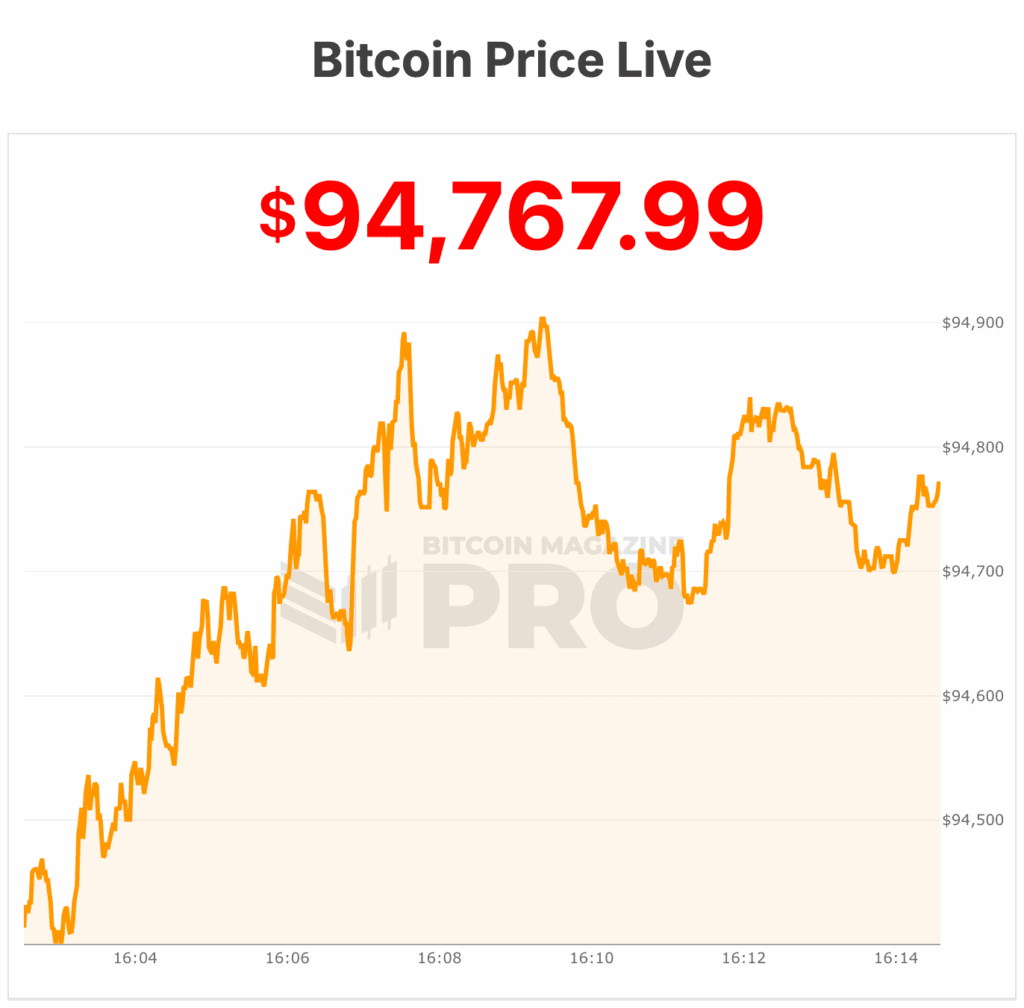

Bitcoin worth slid to contemporary six-month lows on Friday, breaking decisively under the psychological $100,000 mark and intensifying a sell-off that has worn out almost 1 / 4 of its worth in simply over a month.

By noon, the bitcoin worth was buying and selling between $94,000 and $97,000, its weakest degree since early Could and a steep fall from October’s $126,296 all-time excessive, in accordance with Bitcoin Journal Professional information.

On the time of writing, the bitcoin worth is at $94,850 but it surely bounced off of ranges at $94,000.

The drop caps off a chaotic week throughout world markets, the place threat property, from tech giants to crypto shares, have tumbled amid collapsing expectations for a Federal Reserve charge reduce in December.

Simply two weeks in the past, merchants had been pricing in a near-certain 97% likelihood of easing. In the present day, that chance has plunged to roughly 50%, triggering deleveraging throughout equities and digital property alike.

Why is the Bitcoin worth dropping?

The macro pressures are solely a part of the story. The Bitcoin worth is dealing with inner market dynamics which have amplified the decline. In response to new information from CryptoQuant, long-term holders have offered an estimated 815,000 BTC previously 30 days— the biggest such exodus since early 2024.

Spot demand has weakened on the worst potential second, and U.S.-listed spot Bitcoin ETFs have recorded a whole bunch of tens of millions in day by day outflows, draining liquidity whereas fueling draw back momentum.

The turmoil extends past crypto. Threat-sensitive equities—together with Nvidia, Tesla, Palantir, Coinbase, and Bitcoin miners—had been hammered on this week’s classes as buyers fled speculative property.

Rising considerations over an AI bubble, mixed with uncertainty surrounding delayed U.S. financial information following the 43-day authorities shutdown, have pushed the VIX to its highest studying since mid-October.

Institutional shopping for has fallen under the day by day provide issued by miners, including regular promote stress at a time when liquidity is thinning.

Bitcoin worth is teetering at difficult ranges

Bitcoin worth is now hovering close to its intently watched 365-day shifting common across the $100,000, a degree analysts say may decide whether or not the present pullback turns right into a sharper correction, in accordance with Bitcoin Journal Professional.

Researchers at Bitfinex famous to Bitcoin Journal that the drawdown from October’s peak is monitoring intently with typical mid-cycle retracements, matching the roughly 22% pullbacks seen all through the 2023–2025 bull market.

Regardless of the slide under a bitcoin worth of $100,000, they estimate that about 72% of all circulating bitcoin stays in revenue — a sign that long-term holders are nonetheless sitting on features at the same time as sentiment weakens.

Different analysts see indicators that the market could also be nearing a ground. JPMorgan estimates bitcoin’s present manufacturing value — pushed larger by rising community issue — sits round $94,000, a degree that has traditionally acted as a powerful draw back anchor.

With the worth now approaching that threshold, the financial institution argues that bitcoin’s price-to-cost ratio is again close to historic lows and maintains a bullish 6–12 month outlook focusing on roughly $170,000.

Nonetheless, the forces shaping this correction are far bigger than retail merchants. Whales, establishments, and leveraged market constructions now dictate most main strikes. Single transfers from wallets holding 1000’s of BTC can shift sentiment throughout exchanges.

However bitcoin’s current wave of whale promoting isn’t an indication of panic however typical late-cycle conduct, in accordance to Glassnode.

Glassnode says long-term holders are steadily realizing income, with month-to-month spending rising from 12,000 BTC per day in July to about 26,000 — per regular bull-market distribution somewhat than an “OG whale exodus.”

The broader backdrop isn’t serving to. The U.S. authorities has reopened after a document 43-day shutdown, the longest in American historical past, following President Trump’s late-Wednesday approval of a brief funding measure.

Beneath the invoice, federal businesses are funded solely via Jan. 30, that means uncertainty will proceed to hold over markets at the same time as operations slowly resume.

At press time, bitcoin worth is buying and selling at $95,670, hovering close to production-cost ranges and testing key technical help.

Bitcoin worth slid to contemporary six-month lows on Friday, breaking decisively under the psychological $100,000 mark and intensifying a sell-off that has worn out almost 1 / 4 of its worth in simply over a month.

By noon, the bitcoin worth was buying and selling between $94,000 and $97,000, its weakest degree since early Could and a steep fall from October’s $126,296 all-time excessive, in accordance with Bitcoin Journal Professional information.

On the time of writing, the bitcoin worth is at $94,850 but it surely bounced off of ranges at $94,000.

The drop caps off a chaotic week throughout world markets, the place threat property, from tech giants to crypto shares, have tumbled amid collapsing expectations for a Federal Reserve charge reduce in December.

Simply two weeks in the past, merchants had been pricing in a near-certain 97% likelihood of easing. In the present day, that chance has plunged to roughly 50%, triggering deleveraging throughout equities and digital property alike.

Why is the Bitcoin worth dropping?

The macro pressures are solely a part of the story. The Bitcoin worth is dealing with inner market dynamics which have amplified the decline. In response to new information from CryptoQuant, long-term holders have offered an estimated 815,000 BTC previously 30 days— the biggest such exodus since early 2024.

Spot demand has weakened on the worst potential second, and U.S.-listed spot Bitcoin ETFs have recorded a whole bunch of tens of millions in day by day outflows, draining liquidity whereas fueling draw back momentum.

The turmoil extends past crypto. Threat-sensitive equities—together with Nvidia, Tesla, Palantir, Coinbase, and Bitcoin miners—had been hammered on this week’s classes as buyers fled speculative property.

Rising considerations over an AI bubble, mixed with uncertainty surrounding delayed U.S. financial information following the 43-day authorities shutdown, have pushed the VIX to its highest studying since mid-October.

Institutional shopping for has fallen under the day by day provide issued by miners, including regular promote stress at a time when liquidity is thinning.

Bitcoin worth is teetering at difficult ranges

Bitcoin worth is now hovering close to its intently watched 365-day shifting common across the $100,000, a degree analysts say may decide whether or not the present pullback turns right into a sharper correction, in accordance with Bitcoin Journal Professional.

Researchers at Bitfinex famous to Bitcoin Journal that the drawdown from October’s peak is monitoring intently with typical mid-cycle retracements, matching the roughly 22% pullbacks seen all through the 2023–2025 bull market.

Regardless of the slide under a bitcoin worth of $100,000, they estimate that about 72% of all circulating bitcoin stays in revenue — a sign that long-term holders are nonetheless sitting on features at the same time as sentiment weakens.

Different analysts see indicators that the market could also be nearing a ground. JPMorgan estimates bitcoin’s present manufacturing value — pushed larger by rising community issue — sits round $94,000, a degree that has traditionally acted as a powerful draw back anchor.

With the worth now approaching that threshold, the financial institution argues that bitcoin’s price-to-cost ratio is again close to historic lows and maintains a bullish 6–12 month outlook focusing on roughly $170,000.

Nonetheless, the forces shaping this correction are far bigger than retail merchants. Whales, establishments, and leveraged market constructions now dictate most main strikes. Single transfers from wallets holding 1000’s of BTC can shift sentiment throughout exchanges.

However bitcoin’s current wave of whale promoting isn’t an indication of panic however typical late-cycle conduct, in accordance to Glassnode.

Glassnode says long-term holders are steadily realizing income, with month-to-month spending rising from 12,000 BTC per day in July to about 26,000 — per regular bull-market distribution somewhat than an “OG whale exodus.”

The broader backdrop isn’t serving to. The U.S. authorities has reopened after a document 43-day shutdown, the longest in American historical past, following President Trump’s late-Wednesday approval of a brief funding measure.

Beneath the invoice, federal businesses are funded solely via Jan. 30, that means uncertainty will proceed to hold over markets at the same time as operations slowly resume.

At press time, bitcoin worth is buying and selling at $95,670, hovering close to production-cost ranges and testing key technical help.