A protracted-dormant Bitcoin stash moved into an trade this week, renewing worries about previous cash re-entering the market and the impact that would have on costs.

Associated Studying

Mt. Gox Origins And Staggering Returns

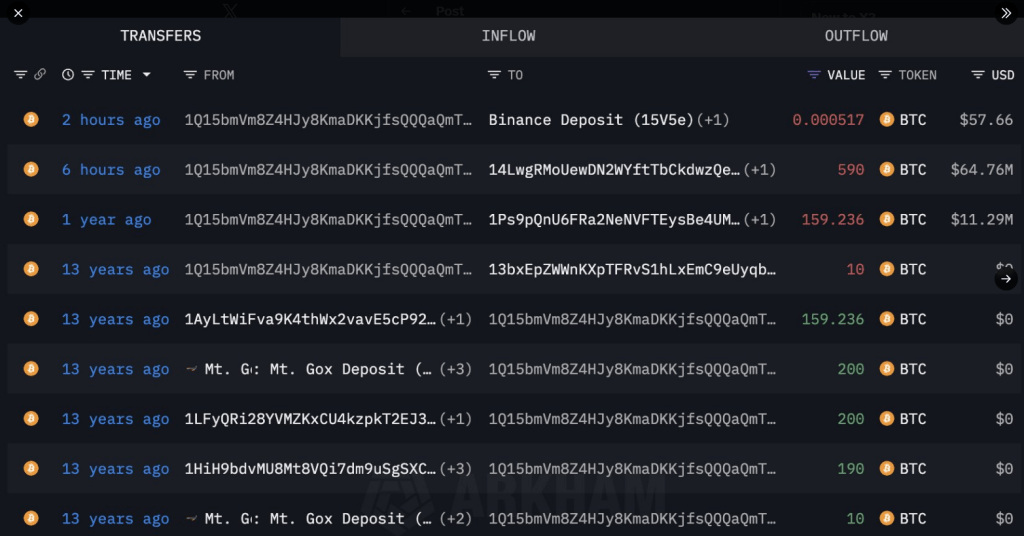

In accordance with blockchain tracker Lookonchain, a cluster of addresses tied to cash pulled from Mt. Gox greater than 13 years in the past despatched 300 BTC to Binance in a single transaction.

These cash have been reportedly purchased at about $11 every, that means the unique outlay was roughly $8,151. The switch is now value about $33.47 million, a mark-up of roughly 410,624%. Stories have disclosed that about 590 BTC nonetheless stay in the identical group of addresses.

The market crash simply awoke a sleeping Bitcoin OG, who deposited 300 #BTC($33.47M) to #Binance 2 hours in the past.

He initially withdrew 749 $BTC($8,151 on the time) from #MtGox 13 years in the past, when $BTC was simply $11.

He moved 159 $BTC to a brand new pockets a 12 months in the past however didn’t promote —… pic.twitter.com/tSxgO0Mw5E

— Lookonchain (@lookonchain) October 12, 2025

Pockets Exercise And What Modified

Final 12 months, the identical proprietor moved 159 BTC into a brand new pockets after which left it untouched. This latest transfer is totally different as a result of the cash arrived in an trade sizzling pockets, the place they are often bought shortly.

Merchants and market watchers famous the distinction: one motion stored cash on the chain, the opposite put them inside attain of an order guide. Whether or not the proprietor chooses to promote some or the entire 300 BTC just isn’t identified, however the presence of these funds on Binance makes speedy promoting attainable.

Market Strikes And Flows

Bitcoin’s worth recovered to about $115,000 on Monday, after dipping to $102,000 on Friday. That drop triggered billions in liquidations and left merchants on edge.

Based mostly on figures, ETFs recorded $2.7 billion in inflows over the past week, and institutional demand confirmed resilience regardless of the volatility. Nonetheless, the market’s calm is fragile; a big promote order from an previous holder might change short-term provide dynamics shortly.

The transfer was flagged by on-chain analysts after which amplified throughout social platforms. Change inflows from wallets tied to early-era miners or Mt. Gox addresses have a tendency to attract consideration as a result of they sign provide that was beforehand dormant coming again into circulation. On this case, the numbers are giant sufficient to get merchants’ consideration.

Attainable Eventualities And Dangers

If a few of the 300 BTC is bought, worth stress might improve, significantly throughout skinny buying and selling home windows. Alternatively, the switch might be a part of property consolidation or a choice to maneuver funds to chilly storage, by which case promoting might not comply with.

Associated Studying

Market members will watch pockets conduct intently: speedy withdrawals to a number of trade addresses, for instance, would doubtless be interpreted as a promoting signal.

Featured picture from Gemini, chart from TradingView