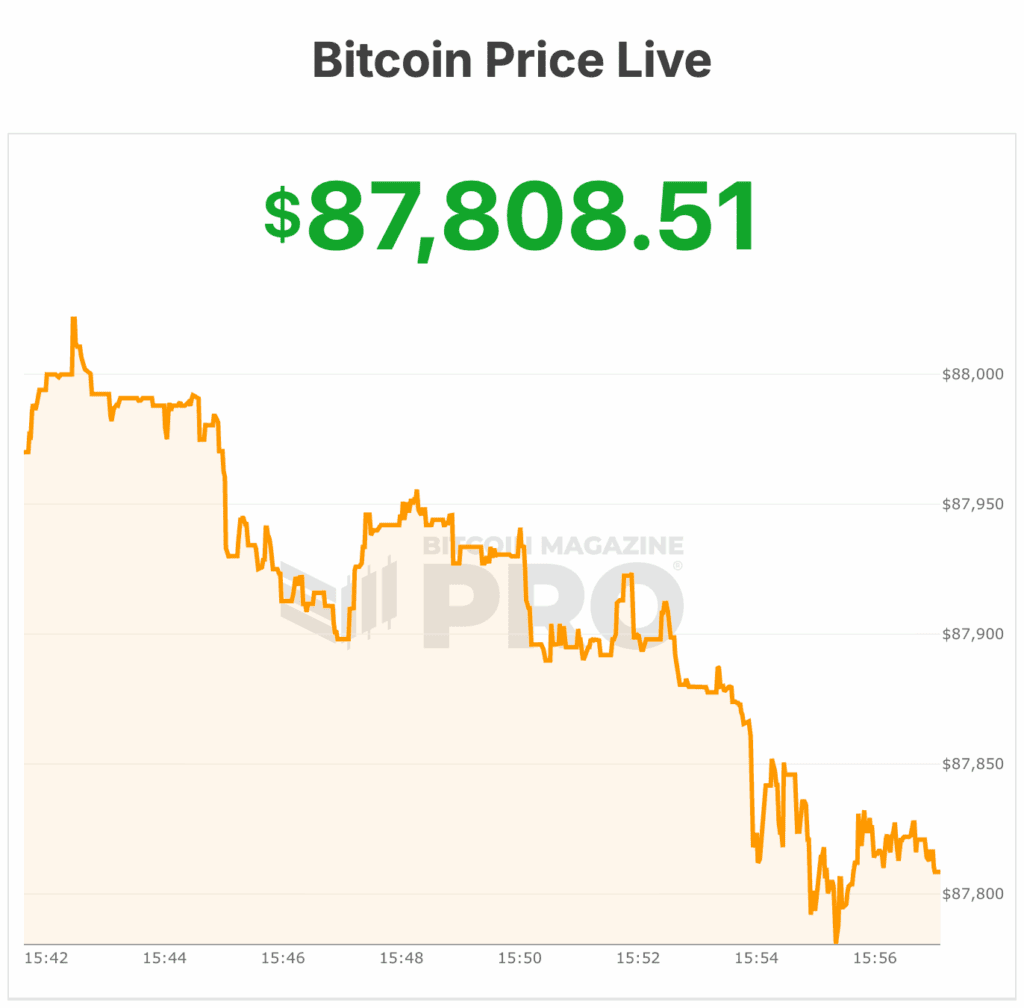

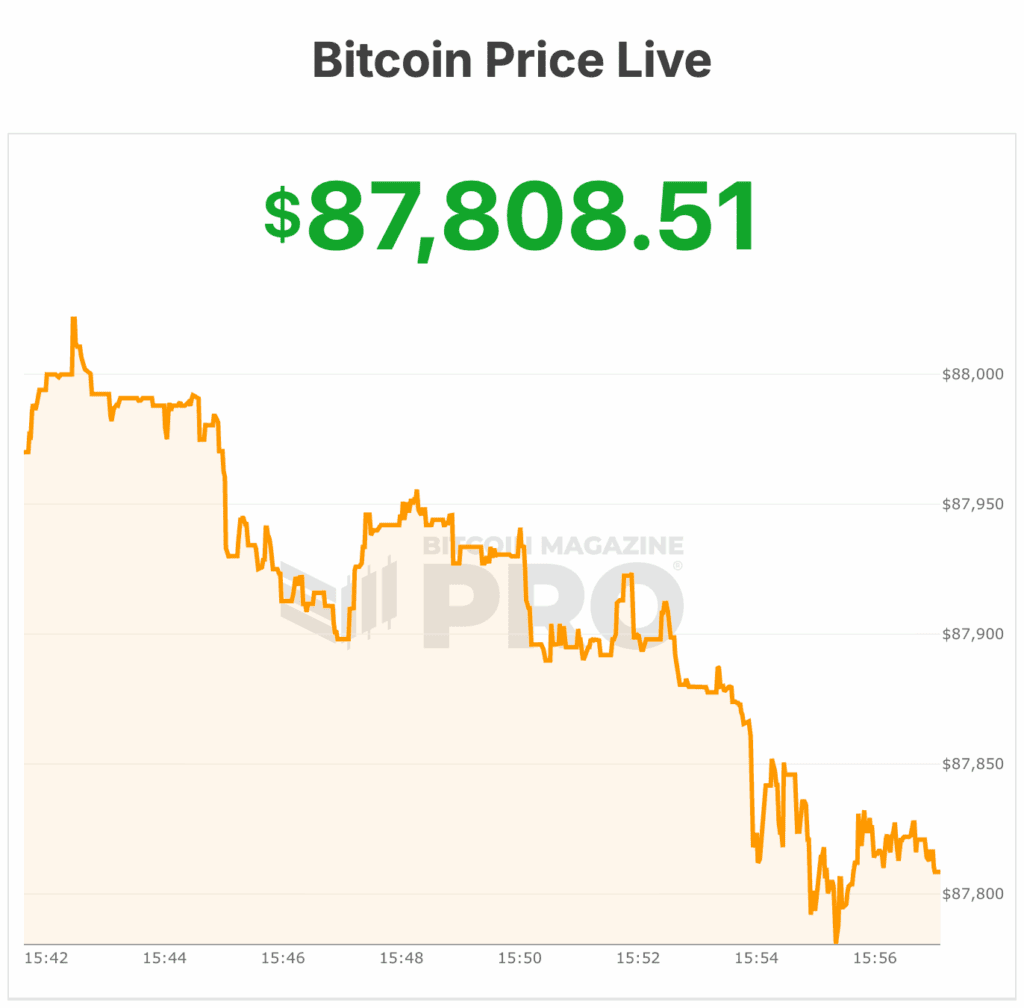

The bitcoin worth hovered under $90,000 close to $80,000 at the moment as merchants made one other late push to get better year-end losses throughout skinny vacation buying and selling, however the market once more lacked the conviction wanted for a sustained breakout.

The bitcoin worth stood at $88,063 on the time of writing, up about 1% over the previous 24 hours, in keeping with market information. Buying and selling quantity totaled roughly $40 billion, reflecting muted participation as December attracts to a detailed.

Bitcoin is now about 1% under its seven-day excessive of $89,201 and roughly 1% above its seven-day low of $86,855.

The world’s largest cryptocurrency has a circulating provide of 19,969,296 BTC, with a tough cap of 21 million cash. Bitcoin’s whole market capitalization is roughly $1.76 trillion, up 1% from a day earlier.

Bitcoin pushed towards the $90,000 degree yesterday for a second straight session earlier than the rally stalled as soon as once more. Value motion stays confined to a broad vary between roughly $85,000 and $95,000, a construction that has outlined the market since a sharp October sell-off.

That drawdown adopted Bitcoin’s all-time excessive in early October, when costs had been up practically 30% on the 12 months.

Since then, sentiment has shifted. The bitcoin worth is now down about 5% from final December, placing it on monitor for its first annual loss in three years.

“I’d proceed to count on exaggerated strikes on gentle circulate by way of New 12 months’s,” Jasper De Maere, desk strategist at Wintermute, stated in a notice to Bloomberg.. He cautioned merchants towards relying too closely on short-term alerts till liquidity returns to regular ranges.

The latest worth stagnation contrasts with the broader restoration in conventional threat property. Bitcoin started the 12 months with a robust rally fueled by optimism round crypto-friendly insurance policies underneath the second Trump administration.

That enthusiasm pale as uncertainty surrounding President Donald Trump’s tariff agenda rattled international markets.

Bitcoin worth battling with leveraged merchants

Whereas U.S. equities have largely rebounded from these shocks, Bitcoin has struggled to regain momentum. The October downturn was compounded by a wave of liquidations after leveraged positions reached document ranges. On Oct. 10, a pointy sell-off flushed out lengthy publicity and reset market positioning.

Demand for spot Bitcoin exchange-traded funds has additionally weakened. In response to information by Bloomberg, ETF outflows have reached roughly $6 billion within the fourth quarter, including regular strain as Bitcoin did not reclaim the $90,000 threshold.

Vacation buying and selling situations have additional distorted worth motion. Earlier this week, the bitcoin worth swung sharply round $90,000 throughout low-liquidity periods, posting quick beneficial properties and losses that lacked follow-through.

Costs briefly rose about 2.6% throughout skinny buying and selling and held above $86,000 over the week, however once more did not maintain ranges above $90,000 throughout Asian hours.

QCP Capital stated latest strikes mirror a market brief on participation. In a notice, the agency pointed to a steep decline in derivatives exercise following final Friday’s document choices expiry. Open curiosity dropped by practically 50%, signaling that many merchants moved to the sidelines.

That choices expiry additionally altered short-term market dynamics. In response to QCP, sellers who had been lengthy gamma forward of the occasion are actually brief gamma on the upside. In such situations, rising costs can pressure hedging exercise that amplifies short-term strikes, significantly when liquidity is skinny.

An analogous setup emerged earlier this month when the bitcoin worth briefly approached $90,000. Funding charges climbed rapidly as merchants crowded into bullish positions, creating short-lived upward strain.

Deribit’s perpetual funding charge surged above 30% following the newest expiry, up from near-flat ranges beforehand. Elevated funding charges usually point out overheated positioning and lift the price of sustaining lengthy publicity.

From a technical perspective, Bitcoin Journal analysts stated the market continues to reject decrease ranges inside a broadening wedge sample, suggesting draw back momentum is weakening. Key resistance sits at $91,400 and $94,000. A weekly shut above $94,000 might open a path towards $101,000 and $108,000, although resistance stays heavy.

On the draw back, $84,000 stays crucial help. A break under that degree might ship the bitcoin worth towards the $72,000 to $68,000 vary.

The bitcoin worth hovered under $90,000 close to $80,000 at the moment as merchants made one other late push to get better year-end losses throughout skinny vacation buying and selling, however the market once more lacked the conviction wanted for a sustained breakout.

The bitcoin worth stood at $88,063 on the time of writing, up about 1% over the previous 24 hours, in keeping with market information. Buying and selling quantity totaled roughly $40 billion, reflecting muted participation as December attracts to a detailed.

Bitcoin is now about 1% under its seven-day excessive of $89,201 and roughly 1% above its seven-day low of $86,855.

The world’s largest cryptocurrency has a circulating provide of 19,969,296 BTC, with a tough cap of 21 million cash. Bitcoin’s whole market capitalization is roughly $1.76 trillion, up 1% from a day earlier.

Bitcoin pushed towards the $90,000 degree yesterday for a second straight session earlier than the rally stalled as soon as once more. Value motion stays confined to a broad vary between roughly $85,000 and $95,000, a construction that has outlined the market since a sharp October sell-off.

That drawdown adopted Bitcoin’s all-time excessive in early October, when costs had been up practically 30% on the 12 months.

Since then, sentiment has shifted. The bitcoin worth is now down about 5% from final December, placing it on monitor for its first annual loss in three years.

“I’d proceed to count on exaggerated strikes on gentle circulate by way of New 12 months’s,” Jasper De Maere, desk strategist at Wintermute, stated in a notice to Bloomberg.. He cautioned merchants towards relying too closely on short-term alerts till liquidity returns to regular ranges.

The latest worth stagnation contrasts with the broader restoration in conventional threat property. Bitcoin started the 12 months with a robust rally fueled by optimism round crypto-friendly insurance policies underneath the second Trump administration.

That enthusiasm pale as uncertainty surrounding President Donald Trump’s tariff agenda rattled international markets.

Bitcoin worth battling with leveraged merchants

Whereas U.S. equities have largely rebounded from these shocks, Bitcoin has struggled to regain momentum. The October downturn was compounded by a wave of liquidations after leveraged positions reached document ranges. On Oct. 10, a pointy sell-off flushed out lengthy publicity and reset market positioning.

Demand for spot Bitcoin exchange-traded funds has additionally weakened. In response to information by Bloomberg, ETF outflows have reached roughly $6 billion within the fourth quarter, including regular strain as Bitcoin did not reclaim the $90,000 threshold.

Vacation buying and selling situations have additional distorted worth motion. Earlier this week, the bitcoin worth swung sharply round $90,000 throughout low-liquidity periods, posting quick beneficial properties and losses that lacked follow-through.

Costs briefly rose about 2.6% throughout skinny buying and selling and held above $86,000 over the week, however once more did not maintain ranges above $90,000 throughout Asian hours.

QCP Capital stated latest strikes mirror a market brief on participation. In a notice, the agency pointed to a steep decline in derivatives exercise following final Friday’s document choices expiry. Open curiosity dropped by practically 50%, signaling that many merchants moved to the sidelines.

That choices expiry additionally altered short-term market dynamics. In response to QCP, sellers who had been lengthy gamma forward of the occasion are actually brief gamma on the upside. In such situations, rising costs can pressure hedging exercise that amplifies short-term strikes, significantly when liquidity is skinny.

An analogous setup emerged earlier this month when the bitcoin worth briefly approached $90,000. Funding charges climbed rapidly as merchants crowded into bullish positions, creating short-lived upward strain.

Deribit’s perpetual funding charge surged above 30% following the newest expiry, up from near-flat ranges beforehand. Elevated funding charges usually point out overheated positioning and lift the price of sustaining lengthy publicity.

From a technical perspective, Bitcoin Journal analysts stated the market continues to reject decrease ranges inside a broadening wedge sample, suggesting draw back momentum is weakening. Key resistance sits at $91,400 and $94,000. A weekly shut above $94,000 might open a path towards $101,000 and $108,000, although resistance stays heavy.

On the draw back, $84,000 stays crucial help. A break under that degree might ship the bitcoin worth towards the $72,000 to $68,000 vary.