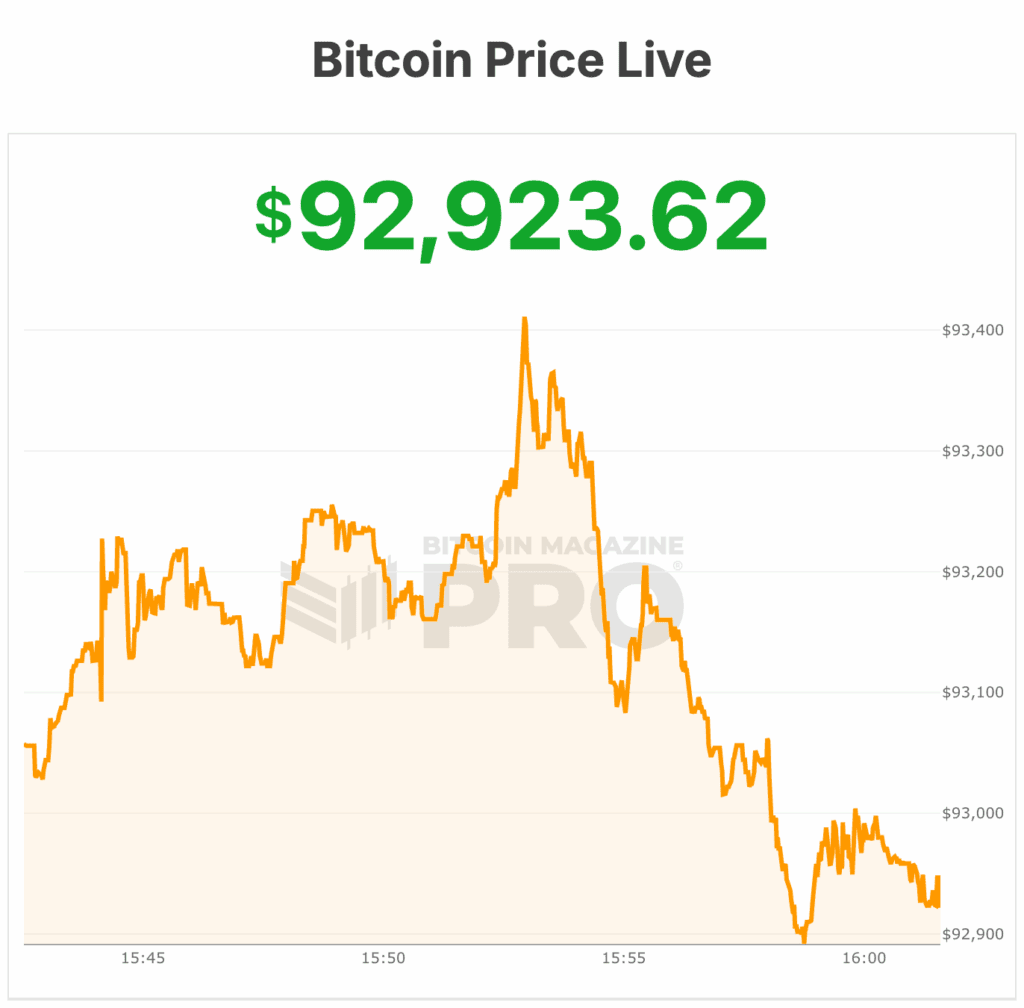

The bitcoin worth is buying and selling close to $93,000, with roughly $81 billion altering palms prior to now 24 hours. The value is up 3% on the day, holding simply 1% beneath immediately’s excessive of $93,929 and about 3% above the weekly low close to $90,837.

Practically 19.96 million BTC are in circulation, inching towards the mounted 21 million cap. The transfer pushed Bitcoin’s international market worth to $1.86 trillion, additionally up 3% over the identical interval.

In response to analysts, the Bitcoin worth briefly dipped beneath its Metcalfe-based honest worth for the primary time since 2023, signaling what analysts say is a traditional late-cycle reset. The transfer got here throughout a pointy 36% drawdown that dragged the Bitcoin worth in direction of $80,000 final week, erased extra leverage and flushed out speculative positions.

In response to community economist Timothy Peterson, durations when bitcoin trades beneath its basic community worth have traditionally produced sturdy ahead returns. Twelve-month positive factors have averaged 132%, with optimistic efficiency occurring 96% of the time, in accordance with CoinDesk reporting.

The community’s inside dynamics have additionally shifted. Lengthy-term holders collected roughly 50,000 BTC over the previous ten days, reversing months of regular distribution.

Cash are maturing from short-term merchants into long-term storage, decreasing promote strain at a second when bitcoin is trying to reclaim larger ranges. Bitcoin recovered again above $90,000 this week and traded at highs of $93,978 on Wednesday.

Bitcoin worth and macro situations

Macro situations are actually converging with on-chain alerts. The Federal Reserve simply ended Quantitative Tightening, with markets pricing a December fee minimize as almost sure.

Traditionally, every QT reversal has coincided with main bitcoin rallies. The sample dates again to 2010 and contains the explosive 2013 cycle and the post-2019 surge that ultimately carried the bitcoin worth to $67,000.

Enterprise-cycle indicators may additionally be turning. The copper-to-gold ratio, a number one gauge for U.S. manufacturing sentiment and future PMI power, seems to be bottoming.

Bitcoin’s latest stagnation regardless of increasing international liquidity suggests buyers have been reacting extra to weakening financial confidence than to crypto-specific elements. A restoration in threat urge for food would possible profit bitcoin after months of consolidation.

The short-term image stays fragile. A bearish November shut confirmed a month-to-month MACD cross, a sign that always precedes multi-month durations of slower momentum.

Key ranges close to $85,000 and $84,000 proceed to behave as assist, whereas analysts warn {that a} breakdown may open the door to a deeper check of $75,000.

Bitcoin worth stays down sharply from its $126,000 report set in October, although volatility has eased as liquidations subside.

Institutional participation continues to develop regardless of turbulence. BlackRock elevated inside publicity to its IBIT ETF, JPMorgan launched a structured observe tied to the product, and Technique Inc. expanded its bitcoin holdings whereas setting apart a $1.4 billion reserve to reassure buyers it won’t be pressured to promote.

Earlier immediately, Charles Schwab mentioned it additionally desires to supply Bitcoin buying and selling in early 2026.

Additionally earlier immediately, BlackRock CEO Larry Fink mentioned he was “fallacious” about Bitcoin, marking a pointy reversal from his previous skepticism.

Talking on the NYT DealBook Summit, Fink known as Bitcoin “an asset of concern,” purchased throughout instances of geopolitical stress, monetary insecurity, or foreign money debasement. He warned it stays risky and by leverage however mentioned it might probably act as significant portfolio insurance coverage.

““Should you’re shopping for it as a hedge towards all of your hope, then it has a significant impression on a portfolio… the opposite large downside of Bitcoin is it’s nonetheless closely influenced by leveraged gamers,” Fink mentioned.

BlackRock now provides main crypto merchandise and is constructing tokenization tech, with Fink seeing a “massive use case” for Bitcoin and digital property.

Additionally through the summit, Brian Armstrong, the CEO of Coinbase, mentioned that there’s “no probability” of the bitcoin worth going to zero.

On the time of publication, the bitcoin worth is $92,923.