The bitcoin worth continued to swing across the $90,000 stage throughout skinny vacation buying and selling, rising and falling in sharp strikes that lacked any quantity wanted for a sustained breakout.

The world’s largest cryptocurrency rose about 2.6% throughout low-liquidity classes and held above $86,000 over the week, however was unable to maintain its $90,000 stage in Monday’s Asian buying and selling hours, in line with market knowledge.

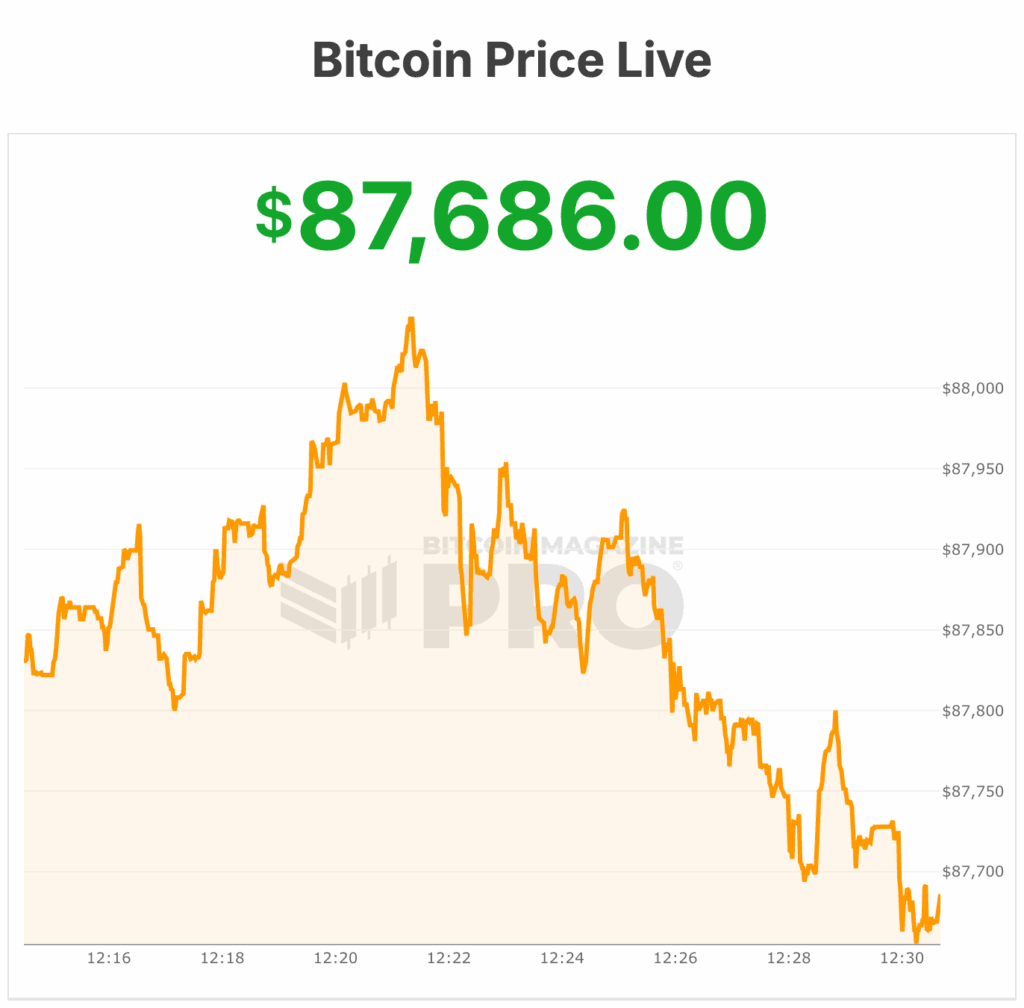

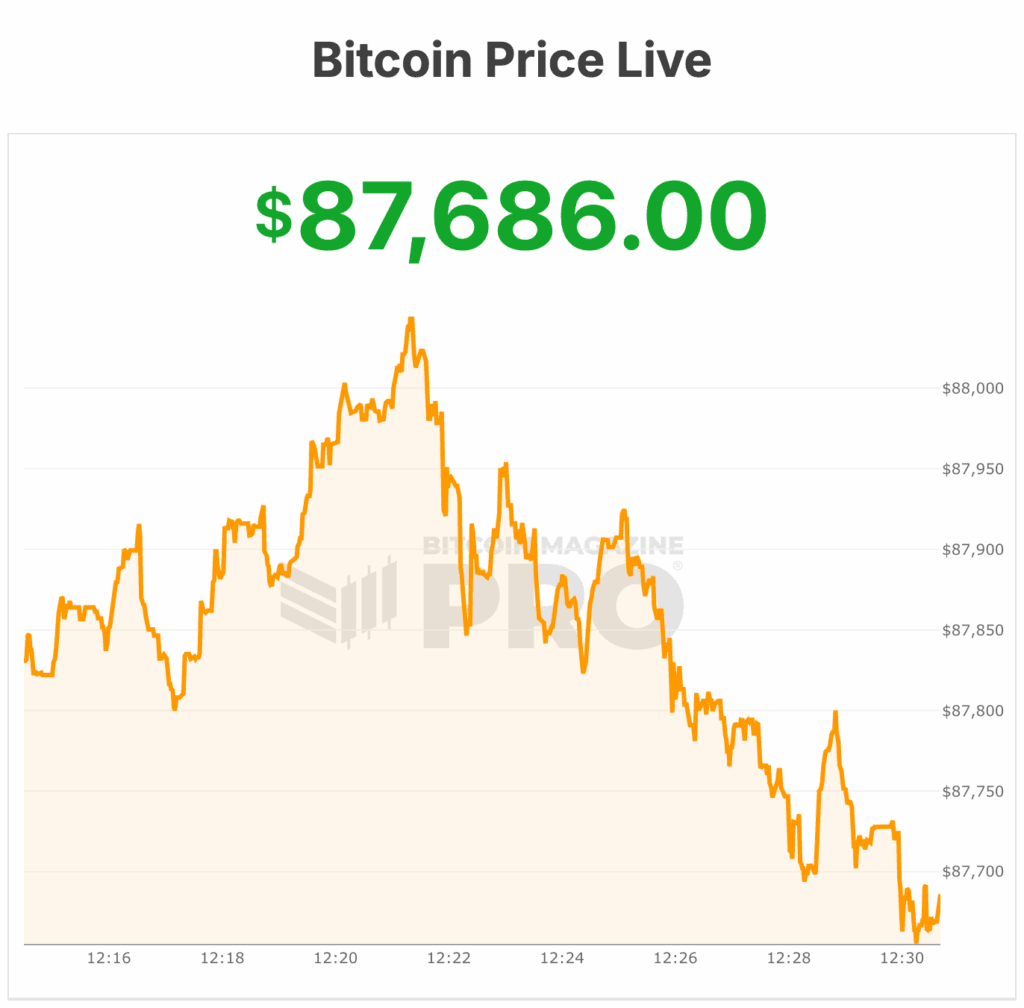

At time of writing, the bitcoin worth was buying and selling at $87,465 on Tuesday, with a 24-hour quantity of about $52 billion and little change over the previous day.

The cryptocurrency sits roughly 3% beneath its current day excessive of $90,230, with a market capitalization of about $1.75 trillion based mostly on a circulating provide of practically 20 million BTC, in line with Bitcoin Journal Professional knowledge.

QCP Capital mentioned the transfer lacks the participation required to push costs decisively increased. In a word, the agency pointed to a pointy drop in open curiosity following final Friday’s file choices expiry. Open curiosity fell by practically 50%, signaling that many merchants stepped to the sidelines.

Choices are affecting market positioning

The file choices expiry marked a turning level in market construction. Sellers who had been lengthy gamma forward of the occasion at the moment are brief gamma to the upside, QCP mentioned. On this setup, rising costs pressure sellers to hedge by shopping for spot bitcoin or short-dated name choices.

That dynamic can amplify worth strikes and create a suggestions loop throughout bitcoin worth rallies.

QCP mentioned the same sample emerged earlier this month when the bitcoin worth briefly traded close to $90,000. Funding charges rose rapidly as sellers adjusted positions, contributing to short-term upward strain.

Deribit’s perpetual funding price climbed to greater than 30% following the expiry, up from close to flat ranges earlier. Elevated funding charges improve the price of sustaining lengthy positions and infrequently replicate crowded bullish trades.

Heavy exercise was seen within the BTC-2JAN26-94K name choice throughout the newest rally try. QCP mentioned a transfer above $94,000 might lengthen the gamma-driven shopping for, however careworn {that a} breakout would require sustained spot demand.

The agency mentioned that with none actual quantity, upside strikes danger fading.

The macro backdrop is including market volatility

Bitcoin’s current push towards $90,000 earlier coincided with rising oil costs after renewed assaults on vitality infrastructure in Russia and Ukraine dampened hopes for a near-term peace deal. Greater vitality costs added to inflation issues throughout international markets.

The bitcoin worth traded increased in Asian hours as geopolitical uncertainty grew however gave again all positive factors in early U.S. hours.

Long term, supporters proceed to border bitcoin as a hedge in opposition to fiscal imbalances. U.S. nationwide debt has climbed to about $37.65 trillion, in line with official knowledge.

Bitcoin worth has crucial help at $84,000

In response to Bitcoin Journal analysts, the broader bitcoin market continues to reject decrease ranges inside a broadening wedge sample, suggesting draw back momentum is weakening. Bulls now must construct on this protection by breaking resistance at $91,400 and, extra importantly, $94,000 to regain management.

A weekly shut above $94,000 might open the door to a transfer towards $101,000 and doubtlessly $108,000, although heavy resistance is anticipated alongside the way in which.

On the draw back, $84,000 stays crucial help. A breakdown there would possible ship the bitcoin worth towards the $72,000–$68,000 vary, with deeper losses potential beneath $68,000.

Quick-term liquidity could stay skinny throughout the present vacation interval, however giant choices expiries close to $100,000 might affect worth motion.

General sentiment stays cautious, per the analysts, with bulls exhibiting resilience however nonetheless needing affirmation.

On the time of writing, the bitcoin worth is close to $87,000. Over the Christmas vacation classes, bitcoin bounced between $86,000 and $90,000.

The bitcoin worth continued to swing across the $90,000 stage throughout skinny vacation buying and selling, rising and falling in sharp strikes that lacked any quantity wanted for a sustained breakout.

The world’s largest cryptocurrency rose about 2.6% throughout low-liquidity classes and held above $86,000 over the week, however was unable to maintain its $90,000 stage in Monday’s Asian buying and selling hours, in line with market knowledge.

At time of writing, the bitcoin worth was buying and selling at $87,465 on Tuesday, with a 24-hour quantity of about $52 billion and little change over the previous day.

The cryptocurrency sits roughly 3% beneath its current day excessive of $90,230, with a market capitalization of about $1.75 trillion based mostly on a circulating provide of practically 20 million BTC, in line with Bitcoin Journal Professional knowledge.

QCP Capital mentioned the transfer lacks the participation required to push costs decisively increased. In a word, the agency pointed to a pointy drop in open curiosity following final Friday’s file choices expiry. Open curiosity fell by practically 50%, signaling that many merchants stepped to the sidelines.

Choices are affecting market positioning

The file choices expiry marked a turning level in market construction. Sellers who had been lengthy gamma forward of the occasion at the moment are brief gamma to the upside, QCP mentioned. On this setup, rising costs pressure sellers to hedge by shopping for spot bitcoin or short-dated name choices.

That dynamic can amplify worth strikes and create a suggestions loop throughout bitcoin worth rallies.

QCP mentioned the same sample emerged earlier this month when the bitcoin worth briefly traded close to $90,000. Funding charges rose rapidly as sellers adjusted positions, contributing to short-term upward strain.

Deribit’s perpetual funding price climbed to greater than 30% following the expiry, up from close to flat ranges earlier. Elevated funding charges improve the price of sustaining lengthy positions and infrequently replicate crowded bullish trades.

Heavy exercise was seen within the BTC-2JAN26-94K name choice throughout the newest rally try. QCP mentioned a transfer above $94,000 might lengthen the gamma-driven shopping for, however careworn {that a} breakout would require sustained spot demand.

The agency mentioned that with none actual quantity, upside strikes danger fading.

The macro backdrop is including market volatility

Bitcoin’s current push towards $90,000 earlier coincided with rising oil costs after renewed assaults on vitality infrastructure in Russia and Ukraine dampened hopes for a near-term peace deal. Greater vitality costs added to inflation issues throughout international markets.

The bitcoin worth traded increased in Asian hours as geopolitical uncertainty grew however gave again all positive factors in early U.S. hours.

Long term, supporters proceed to border bitcoin as a hedge in opposition to fiscal imbalances. U.S. nationwide debt has climbed to about $37.65 trillion, in line with official knowledge.

Bitcoin worth has crucial help at $84,000

In response to Bitcoin Journal analysts, the broader bitcoin market continues to reject decrease ranges inside a broadening wedge sample, suggesting draw back momentum is weakening. Bulls now must construct on this protection by breaking resistance at $91,400 and, extra importantly, $94,000 to regain management.

A weekly shut above $94,000 might open the door to a transfer towards $101,000 and doubtlessly $108,000, although heavy resistance is anticipated alongside the way in which.

On the draw back, $84,000 stays crucial help. A breakdown there would possible ship the bitcoin worth towards the $72,000–$68,000 vary, with deeper losses potential beneath $68,000.

Quick-term liquidity could stay skinny throughout the present vacation interval, however giant choices expiries close to $100,000 might affect worth motion.

General sentiment stays cautious, per the analysts, with bulls exhibiting resilience however nonetheless needing affirmation.

On the time of writing, the bitcoin worth is close to $87,000. Over the Christmas vacation classes, bitcoin bounced between $86,000 and $90,000.