Bitcoin drifted underneath $83,000 on Thursday as market focus shifted towards how liquidity is stacked on exchanges. Reviews say a mixture of large orders and tight ranges has left merchants feeling boxed in.

Some analysts warn {that a} break underneath a key degree might spark sharper promoting, whereas others level to concentrated purchase orders which may cushion a drop.

Associated Studying

Order-Ebook Stress And Liquidity

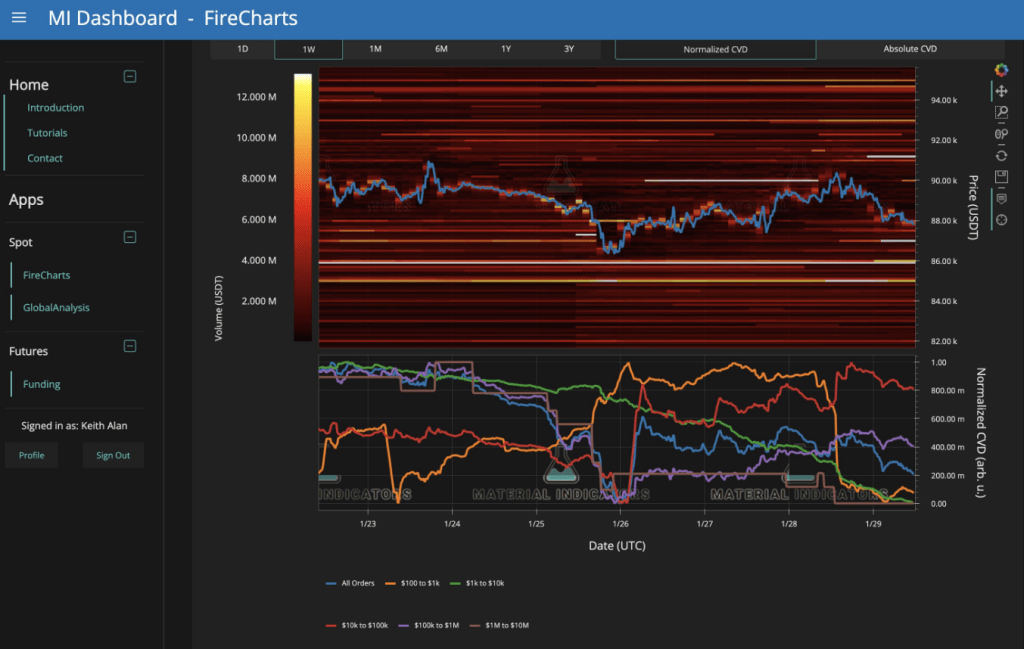

In keeping with trading-room information, one group or a cluster of enormous accounts seems to be shaping short-term strikes by putting large bids and provides within the order ebook.

This may maintain worth caught in a slim band. Materials Indicators’ analysis flagged a sample the place bids are clustering round $85,000 to $87,500 — a zone that would act like a flooring for now.

The thought is straightforward: by piling up liquidity at sure costs, giant gamers can get fills on their orders or discourage fast recoveries earlier than choices expiry.

Market individuals say this type of habits can entice less-experienced merchants who react to sudden strikes. At instances, the strain appears deliberate; at different instances, it might be a byproduct of many merchants aiming for a similar ranges. Both approach, the outcome has been uneven worth motion and rising rigidity within the ebook.

FireCharts reveals $BTC worth is being suppressed by one entity utilizing a liquidity herding technique to push worth decrease, doubtlessly to get their very own bids stuffed, or attainable to maintain worth pinned within the decrease finish of this vary earlier than Friday’s choices expiry.

A major quantity of… pic.twitter.com/c63miAxBkh

— Materials Indicators (@MI_Algos) January 29, 2026

Whales, Wyckoff And The Spring Concept

Reviews observe {that a} group of merchants utilizing Wyckoff-style pondering expects a “spring” — a drop beneath current lows that then results in a robust bounce as heavy palms purchase at decrease costs.

Pseudonymous analysts have pointed to $86,000 as a robust purchase wall offered by giant orders. One commentator shared charts exhibiting how a fast dip underneath $80,000 might function the spring earlier than a rebound.

Some merchants view this sample as a part of accumulation. Others see it as a dangerous setup that would widen losses if assist fails. The reality could sit between these views: each accumulation and the chance of a flush are attainable in a tense market.

Bitcoin Value Motion

Bitcoin has been transferring in a good vary after failing to carry above $90,000. Value slid close to $82,300 as contemporary worries about financial coverage and world occasions hit danger property.

Volatility has been low at instances after which spikes shortly, which makes buying and selling tough. Patrons have stepped in at sure ranges, however they haven’t but compelled a transparent break greater.

Geopolitics And Fed Strikes

Reviews say rising tensions in elements of the Center East and speak about a brand new Federal Reserve chair decide have added to uncertainty.

Some buyers concern tighter coverage would drain liquidity from markets and weigh on crypto. Market chatter has even talked about US President Donald Trump in relation to political shifts that would affect financial coverage.

Secure-haven flows into different property have been seen when headlines worsen, and people strikes have pulled cash away from riskier holdings.

Associated Studying

Key Ranges To Watch

Merchants ought to watch the $83,000–$85,000 zone intently. A every day shut beneath $86,000 can be learn by many as a damaging signal and will open the door to deeper promoting. On the flip facet, sustained shopping for at these ranges might arrange a rally if large liquidity holders determine to carry provides.

For most individuals, endurance and clear cease guidelines matter proper now, as a result of the market is being pushed by each order-book techniques and out of doors information, and both issue can shift worth quick.

Featured picture from Unsplash, chart from TradingView