Bitcoin regained value ranges above $90,000 after buying and selling beneath this key zone for almost all of the previous two weeks. Inside this era, the premier cryptocurrency noticed a decline to as little as $80,600, marking a greater than 10% deviation from the aforementioned help.

As the worth stands pretty over $90,000, there appears to be a restoration underway. Nonetheless, a more in-depth monitoring of on-chain exercise has revealed that the truth is diametrically reverse to widespread expectation.

LTH-STH SOPR Ratio Spikes To 2.63 — What This Means

In a latest QuickTake submit on CryptoQuant, the on-chain analytics platform Arab Chain reveals a shift throughout the inner buildings of the Bitcoin market. This report revolves round readings obtained from the Binance: BTC SOPR Ratio (LTH – STH) metric, which assesses and compares the profit-taking conduct of Bitcoin’s long-term holders (LTH) to that of its short-term holders (STH).

Arab Chain highlights that the LTH-STH ratio lately noticed a spike to 2.63, a studying which marks the very best stage put in since August. Notably, this spike within the SOPR index comes amid Bitcoin’s rise to round $90,000, signaling an underlying spike in LTH sell-off regardless of this modest rebound.

This notion is confirmed by the Lengthy-Time period Holder SOPR itself, which reportedly to 2.58, indicating that members of Bitcoin’s most influential pattern setters are at the moment exiting the market in deep earnings. Usually, the sharp transfer within the LTH–STH ratio, particularly one which causes the institution of a multi-month excessive, often represents a interval of promoting strain that sometimes precedes value corrections. Nonetheless, the present scenario steers barely away from this customary.

‘Revenue-Taking Section Might Go On For A number of Weeks’ — Analyst

Because the LTH SOPR reads 2.58, the STH SOPR stands at ranges across the 0.98 mark, suggesting that the flagship cryptocurrency’s short-term holders are promoting off their holdings both at break-even and even with some losses incurred.

The market imbalance, subsequently, reveals itself in that “long-term traders are capturing substantial earnings and capitalizing on earlier rallies to dump, whereas short-term traders are unable to realize clear good points.” Arab Chain explains that if the Bitcoin value decline ought to intensify, there might be further acceleration devoted to its fall down south.

Traditionally, widening gaps between LTH and STH SOPR have typically preceded outlined actions in BTC’s market cycle. This conduct, in line with Arab Chain, reveals that the market is probably going coming into a typical “cash-for-profit” part, the place its main holders dump their holdings. Seeing as a surge of an virtually comparable magnitude final passed off in August, the agency conjectures that the market may see a serious value reset, versus the minor value fluctuation traders could also be anticipating.

As of this writing, Bitcoin is value about $90,652, recording no vital motion over the previous day.

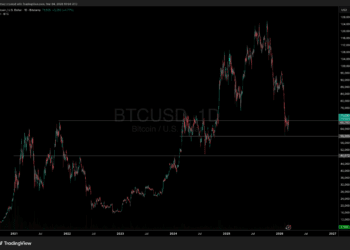

Featured picture from Shutterstock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Bitcoin regained value ranges above $90,000 after buying and selling beneath this key zone for almost all of the previous two weeks. Inside this era, the premier cryptocurrency noticed a decline to as little as $80,600, marking a greater than 10% deviation from the aforementioned help.

As the worth stands pretty over $90,000, there appears to be a restoration underway. Nonetheless, a more in-depth monitoring of on-chain exercise has revealed that the truth is diametrically reverse to widespread expectation.

LTH-STH SOPR Ratio Spikes To 2.63 — What This Means

In a latest QuickTake submit on CryptoQuant, the on-chain analytics platform Arab Chain reveals a shift throughout the inner buildings of the Bitcoin market. This report revolves round readings obtained from the Binance: BTC SOPR Ratio (LTH – STH) metric, which assesses and compares the profit-taking conduct of Bitcoin’s long-term holders (LTH) to that of its short-term holders (STH).

Arab Chain highlights that the LTH-STH ratio lately noticed a spike to 2.63, a studying which marks the very best stage put in since August. Notably, this spike within the SOPR index comes amid Bitcoin’s rise to round $90,000, signaling an underlying spike in LTH sell-off regardless of this modest rebound.

This notion is confirmed by the Lengthy-Time period Holder SOPR itself, which reportedly to 2.58, indicating that members of Bitcoin’s most influential pattern setters are at the moment exiting the market in deep earnings. Usually, the sharp transfer within the LTH–STH ratio, particularly one which causes the institution of a multi-month excessive, often represents a interval of promoting strain that sometimes precedes value corrections. Nonetheless, the present scenario steers barely away from this customary.

‘Revenue-Taking Section Might Go On For A number of Weeks’ — Analyst

Because the LTH SOPR reads 2.58, the STH SOPR stands at ranges across the 0.98 mark, suggesting that the flagship cryptocurrency’s short-term holders are promoting off their holdings both at break-even and even with some losses incurred.

The market imbalance, subsequently, reveals itself in that “long-term traders are capturing substantial earnings and capitalizing on earlier rallies to dump, whereas short-term traders are unable to realize clear good points.” Arab Chain explains that if the Bitcoin value decline ought to intensify, there might be further acceleration devoted to its fall down south.

Traditionally, widening gaps between LTH and STH SOPR have typically preceded outlined actions in BTC’s market cycle. This conduct, in line with Arab Chain, reveals that the market is probably going coming into a typical “cash-for-profit” part, the place its main holders dump their holdings. Seeing as a surge of an virtually comparable magnitude final passed off in August, the agency conjectures that the market may see a serious value reset, versus the minor value fluctuation traders could also be anticipating.

As of this writing, Bitcoin is value about $90,652, recording no vital motion over the previous day.

Featured picture from Shutterstock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.