An analyst has defined how Bitcoin may face important waves of promoting strain from the short-term holders round these worth ranges.

Bitcoin Quick-Time period Holder MVRV Might Flag These Ranges As Essential

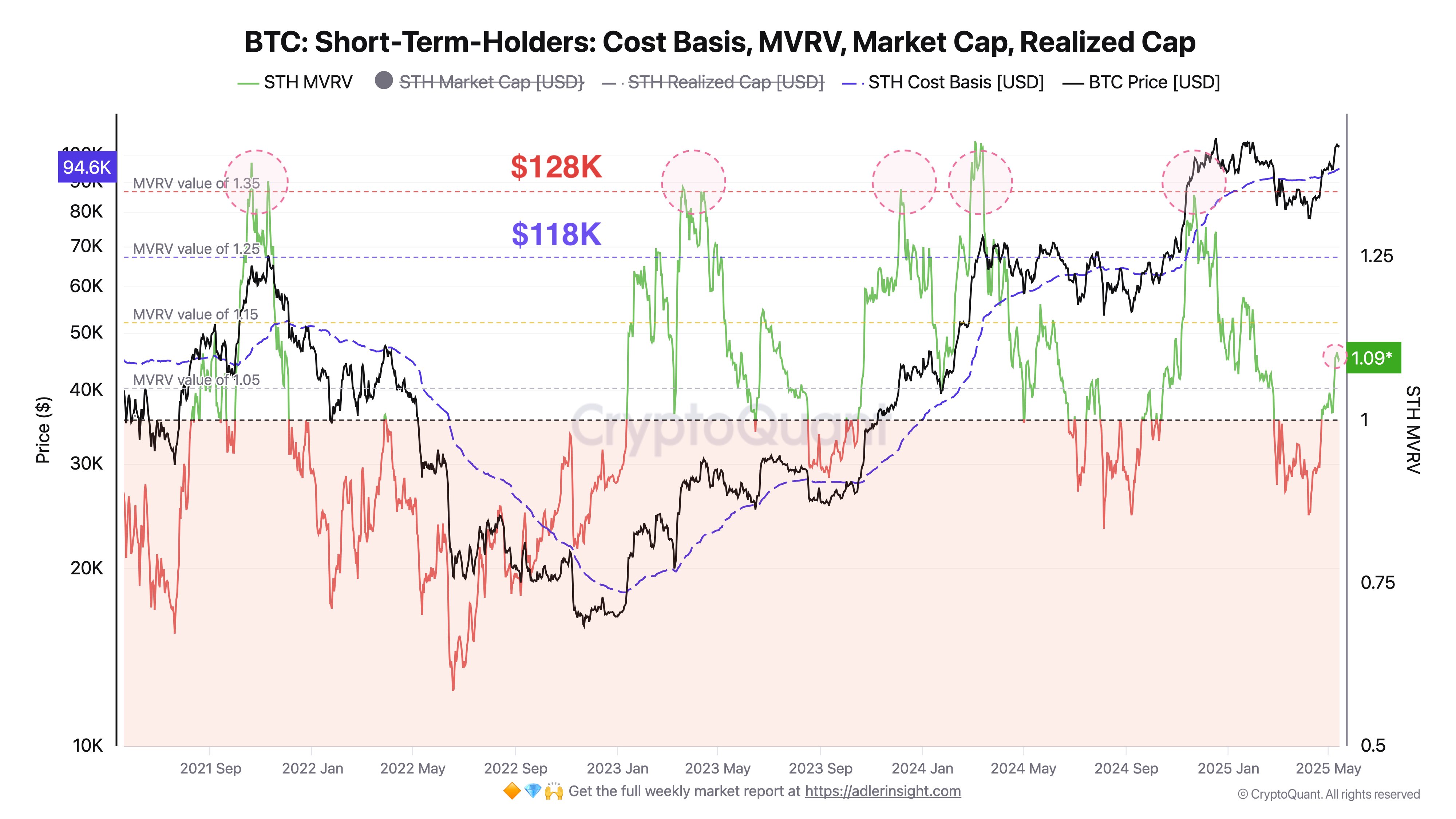

In a brand new submit on X, CryptoQuant writer Axel Adler Jr has talked in regards to the development within the Market Worth to Realized Worth (MVRV) Ratio of the Bitcoin short-term holders.

The MVRV Ratio is an indicator that retains observe of the ratio between the Bitcoin Market Cap and Realized Cap. The previous represents the worth at present held by the traders as a complete, whereas the latter that originally invested by them. As such, this ratio tells us in regards to the profit-loss state of affairs of the community.

When the worth of this metric is bigger than 1, it means the common investor on the chain is holding a internet unrealized revenue. Then again, it being below the brink implies the dominance of loss among the many holders.

Within the context of the present subject, the MVRV Ratio of solely a selected a part of the market is of curiosity: the short-term holders (STHs). The STHs seek advice from the Bitcoin traders who bought their cash throughout the previous 155 days.

The members of this cohort have a tendency to not be too resolute, so that they usually react to market happenings. Specifically, each time the revenue held by them will get too excessive, a mass selloff from them can turn out to be possible, as they appear to comprehend their positive factors.

Now, right here is the chart shared by the analyst that exhibits the development within the Bitcoin STH MVRV Ratio over the previous couple of years:

As is seen within the above graph, the Bitcoin STH MVRV Ratio fell below the 1 mark earlier within the yr because the asset’s worth declined beneath the common price foundation of the group.

With the most recent restoration rally, the cryptocurrency has managed to interrupt again above the road, placing STHs again into positive factors. To date, the MVRV Ratio has solely reached the 1.09 mark, which isn’t too excessive when in comparison with previous rallies. As such, it’s potential that the STHs will not be tempted to comprehend earnings en masse simply but.

Within the chart, Adler Jr has highlighted two ranges the place profitability is excessive sufficient that important promoting strain can certainly turn out to be prone to come up from this cohort: the 1.25 and 1.35 STH MVRV Ratios. At current, the previous is located at $118,000 and the latter at $128,000.

It now stays to be seen whether or not Bitcoin will rally excessive sufficient to retest these ranges—and if it does, whether or not the STH selloff will act as resistance.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $103,200, up over 2% within the final seven days.