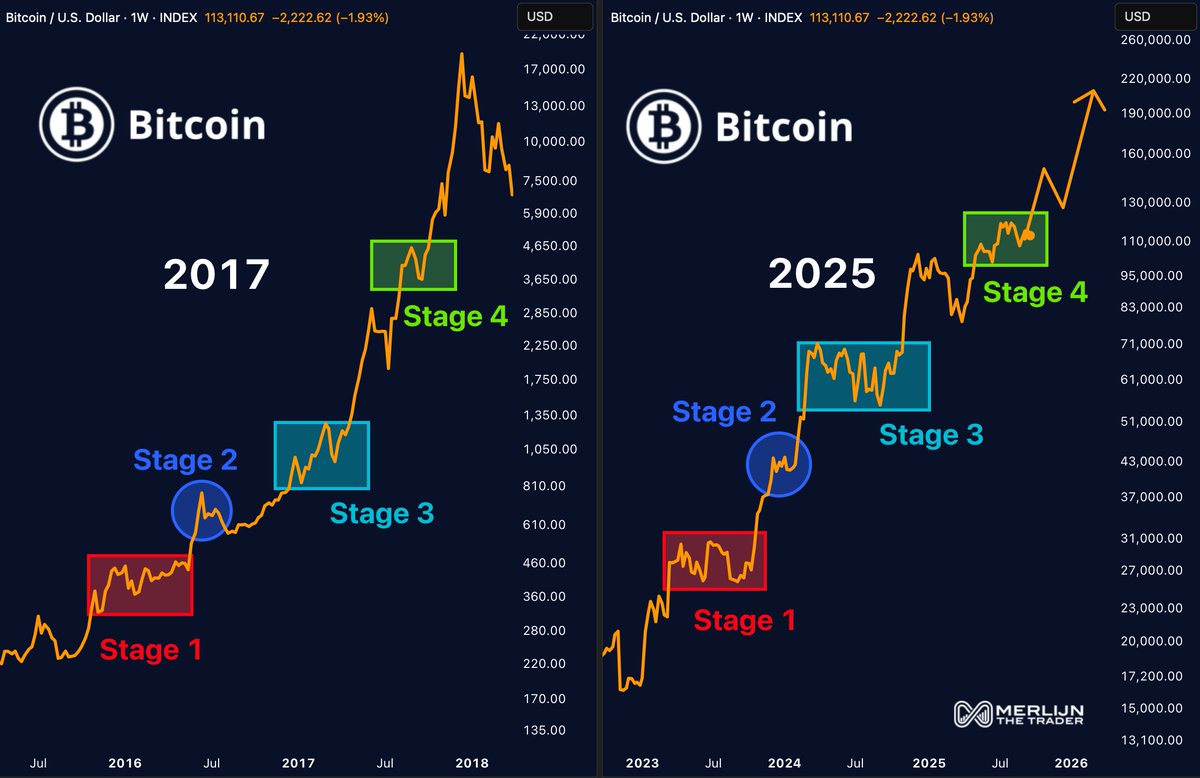

Bitcoin seems to be repeating the 2017 cycle, doubtlessly driving its worth as much as $220K quickly.

That is what Merlijn The Dealer believes based mostly on the four-stage bull fractal, which brought about $BTC to soar by 528% in 2017, from round $3,500 to over $21,000. The identical sample is occurring in 2025, this time pointing towards a $220K goal.

Primarily based on latest developments, together with the final FOMC assembly the place the Fed reduce rates of interest by 25 foundation factors and the GENIUS Act finalizing its first implementation part in October, Bitcoin guarantees an explosive finish to 2025.

The identical seems true for Bitcoin’s upcoming Layer 2 improve, Bitcoin Hyper ($HYPER), presently in an $18M presale.

With sturdy potential for sooner and cheaper transactions on the Bitcoin community, Hyper’s rampant presale demonstrates spectacular investor help more likely to proceed into 2026.

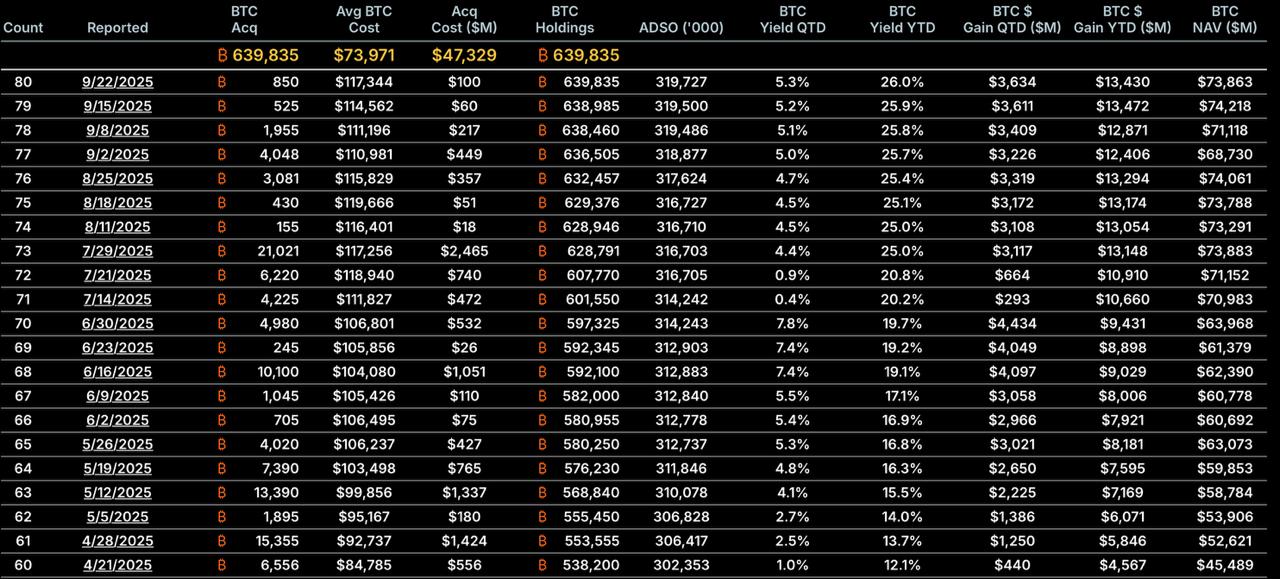

Michael Saylor Doubles Down on His Assist for Bitcoin

Michael Saylor referred to Bitcoin as cash in an X submit, stating that all the pieces else is credit score.

The remark may be very acceptable on condition that Technique purchased $11,044 $BTC over $8B between August and September alone.

This shopping for technique enabled the corporate to ascertain a $74 billion Bitcoin reserve with no clear finish in sight.

The final buy of 850 Bitcoins on September twenty second occurred as Technique exploited the dip that adopted the newest FOMC assembly, which brought about Bitcoin to drop by 4.8% between the nineteenth and immediately, leading to a $7K loss.

Saylor’s belief in Bitcoin as a sport changer isn’t based on blind religion.

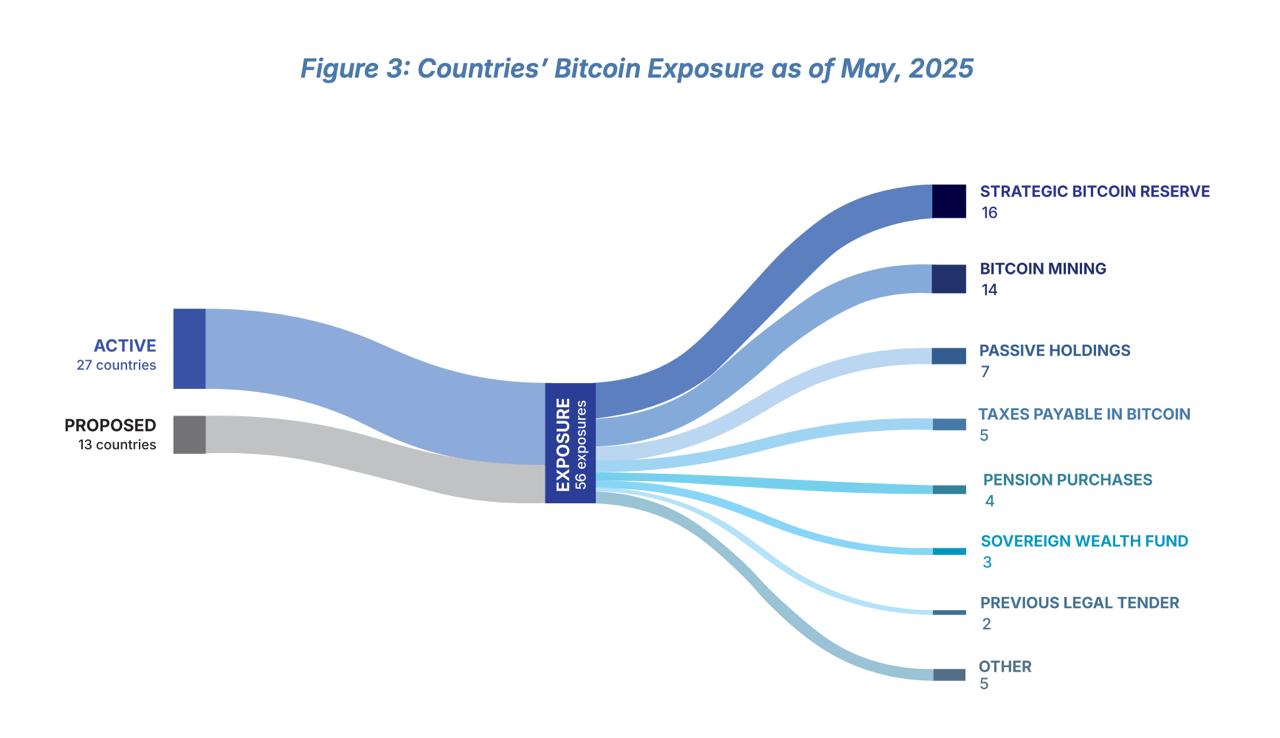

Bitcoin is already reaching groundbreaking milestones worldwide, based on a latest report from Bitcoin Coverage Institute, which highlighted a widespread world adoption development.

Because the report exhibits, 27 international locations had publicity to Bitcoin, whereas 13 extra have been actively pursuing it legally by the top of Could 2025.

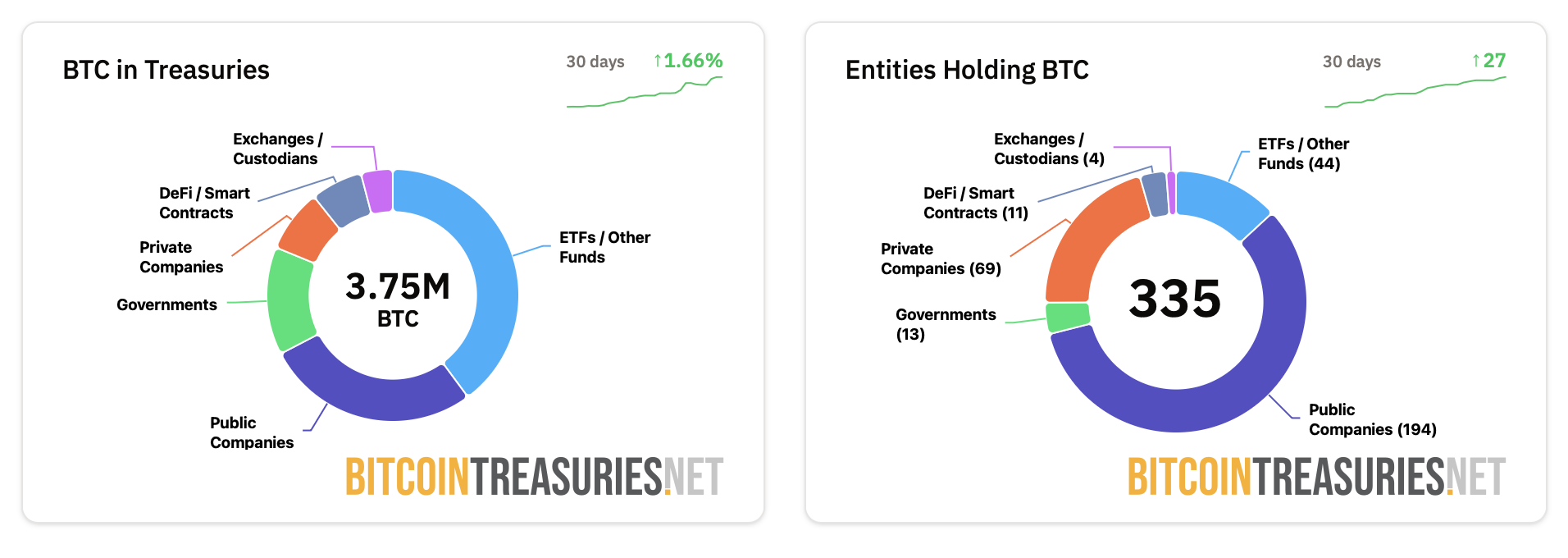

The scenario is analogous within the public sector, as Bitcoin Treasuries exhibits. The info signifies that $3.76 million $BTC is locked in treasuries throughout varied sectors, together with authorities, public establishments, non-public firms, and ETF funds.

Furthermore, the buildup development is up 1.79%, regardless of Bitcoin’s poor latest efficiency.

Other than Bitcoin’s worth as a decentralized asset, its traditionally low volatility, and its spectacular 10-year ROI of 38,906.1%, yet one more issue might increase Bitcoin’s efficiency in 2025: Bitcoin Hyper ($HYPER).

How Bitcoin Hyper Turns Bitcoin Into an Institutional-Grade Asset

Bitcoin Hyper ($HYPER) transforms Bitcoin into an institutional-grade asset by addressing the community’s major downside: its efficiency limitation.

The Bitcoin community is inherently restricted to 7 transactions per second (TPS), rating it twenty second amongst the quickest blockchains by TPS. Solana ranks second on that listing with a TPS of 796 on the time of writing.

The issue is clear, and Hyper plans to eradicate it.

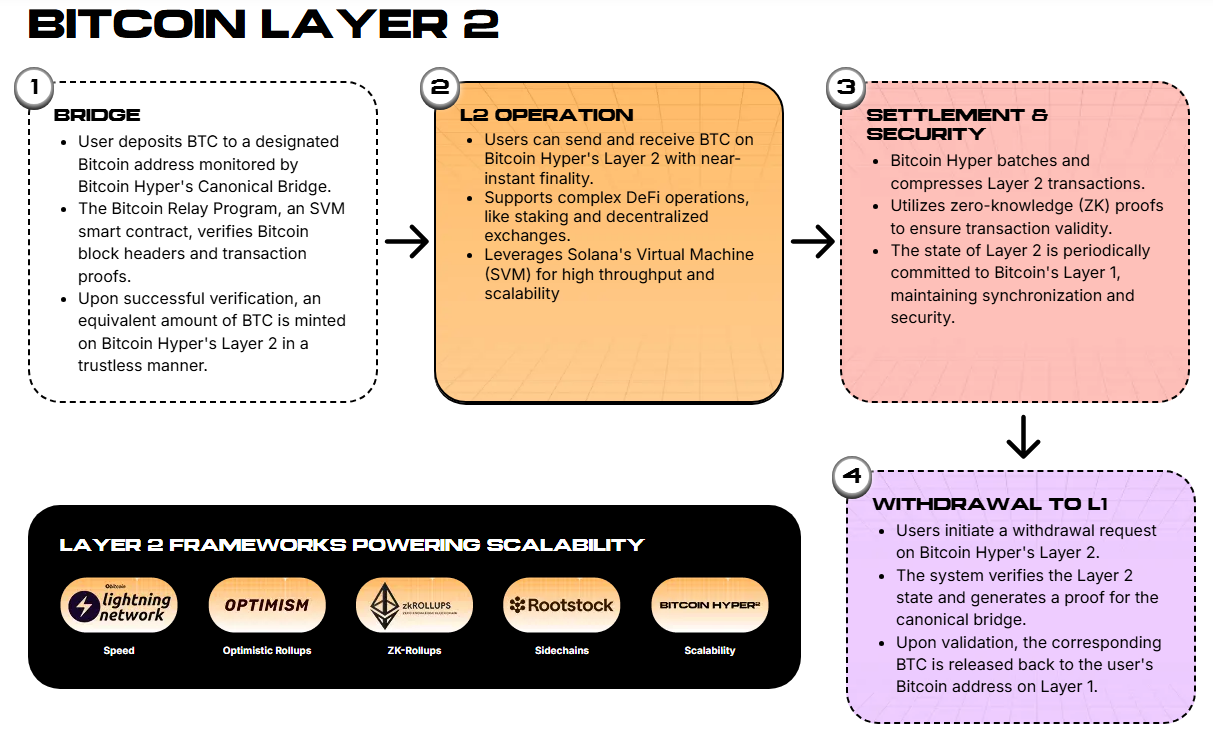

The challenge is dependent upon a number of instruments, with Solana Digital Machine (SVM) and the Canonical Bridge being essentially the most impactful.

Whereas SVM accelerates the execution of good contracts and DeFi apps for a major efficiency increase, the Canonical Bridge tackles community congestion and the extraordinarily lengthy affirmation instances.

The Bridge is dependent upon the Bitcoin Relay Program to confirm and make sure transactions, after which it mints the customers’ tokens into the Hyper layer. Merchants can use their wrapped Bitcoin throughout the Hyper ecosystem or withdraw it to the native Bitcoin layer at their discretion.

These instruments considerably increase Hyper’s efficiency, eradicate community congestion, and take away Bitcoin’s fee-based precedence system, which favors massive, fee-heavy transactions over smaller, cheaper ones.

The result’s a faster and extra responsive Bitcoin community with affirmation instances of seconds and considerably higher scalability.

This guarantees to make the Bitcoin ecosystem a extra engaging choice for institutional traders, who deal with hundreds of transactions per second. This price is incompatible with the Bitcoin community’s present capability.

The presale simply broke $18M with $HYPER valued at $0.012965.

This publication is sponsored. Coindoo doesn’t endorse or assume accountability for the content material, accuracy, high quality, promoting, merchandise, or some other supplies on this web page. Readers are inspired to conduct their very own analysis earlier than participating in any cryptocurrency-related actions. Coindoo won’t be liable, straight or not directly, for any damages or losses ensuing from the usage of or reliance on any content material, items, or companies talked about. At all times do your personal analysis.