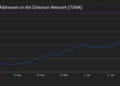

A shock uptick in a key manufacturing unit gauge has merchants rethinking danger, whereas crypto watchers debate whether or not Bitcoin will journey a recent wave increased or keep caught in a drawdown.

The ISM Manufacturing PMI rose into enlargement territory in January, and that single knowledge level has set off a flurry of takes from market strategists and crypto analysts alike.

ISM Manufacturing Alerts Shift

In response to the Institute for Provide Administration, the PMI clocked in at 52.6 for January. That quantity crosses the road that separates contraction from progress.

For traders who watch alerts carefully, a transfer like that may imply cash begins flowing again into belongings seen as increased danger.

“Previous breakouts in 2013, 2016, and 2020 served as key catalysts for Bitcoin’s main bull runs,” Attempt vp of Bitcoin technique, Joe Burnett, stated.

The Fed will discover. A stronger manufacturing print modifications the controversy about inflation and fee coverage. Merchants value within the likelihood of tighter coverage when progress appears stable.

On the similar time, some economists level out manufacturing is just one piece of the puzzle. Providers, employment, and client demand additionally matter. Experiences word the index studying was the very best since August 2022, which makes it notable by itself.

One of many longest ISM Manufacturing PMI contraction intervals in U.S. historical past ended this morning with a breakout to 52.6, up 4.7 factors from December.

Previous breakouts in 2013, 2016, and 2020 served as key catalysts for Bitcoin’s main bull runs.

This ends 26 consecutive months of…

— Joe Burnett, MSBA (@IIICapital) February 2, 2026

Bitcoin Value Motion And Market Temper

Bitcoin’s value has been uneven. After hitting a excessive above $125,000 late final yr, it tumbled after which bounced into the $78,000 space. Experiences say the drop adopted a serious liquidation occasion and a string of macro shocks that pushed traders towards protected belongings.

Some patrons are taking the dip as an entry level. Others stay on the sidelines. Correlations with inventory tech names have been robust, which suggests Bitcoin has behaved extra like a danger asset than a digital gold in latest months.

Supply: ISM

Just a few merchants argue rising PMI readings usually precede “risk-on” intervals, when speculative bets return. Nonetheless, this hyperlink shouldn’t be ironclad. Bitcoin’s strikes are formed by liquidity flows, ETF cash out and in, geopolitical flare-ups, and crypto-specific occasions. The market is being pushed from a number of instructions directly.

Whom To Belief On Forecasts

Institutional voices are splintered. Primarily based on reviews from varied companies, estimates vary from cautious to wildly optimistic. One agency tasks a post-crash rally that would ship costs nicely above present ranges by year-end.

One other analysis home warns of extra retracement earlier than any sustained upswing. A big institutional participant declined to peg a quantity in any respect, calling the atmosphere too chaotic to forecast with confidence.

That sort of vary tells a transparent story: uncertainty guidelines. Analysts who tie Bitcoin to macro cycles are gaining followers, whereas those that deal with it as an unbiased asset argue for a unique playbook.

Why This Issues

Quick-term merchants will watch financial prints and liquidity knowledge carefully. Longer-term holders will weigh Bitcoin’s position relative to gold and equities. Experiences say market construction—who’s shopping for, who’s promoting, and the place ETFs are seeing flows—will possible matter as a lot as any single financial launch.

The ISM rise could be the begin of a more healthy danger tone for international markets, nevertheless it is not going to by itself assure a gentle climb for Bitcoin. Danger is again on the desk, in a way of talking, and the trail ahead will rely upon how coverage makers, massive traders, and retail merchants react within the subsequent a number of weeks.

Featured picture from unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.