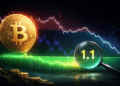

Bitcoin is nearing a degree on the MVRV ratio that traditionally strains up with market “undervaluation,” in keeping with CryptoQuant contributor Crypto Dan, as merchants search for indicators {that a} four-month drawdown from October 2025’s all-time excessive is shifting from distribution into accumulation.

Is Bitcoin Undervalued?

In a put up on X, Korean Dan mentioned Bitcoin is “approaching the undervalued zone,” arguing that the market is getting near a threshold that has usually marked compelling risk-reward for longer-horizon patrons.

Associated Studying

“After reaching its all-time excessive in October 2025, Bitcoin has been declining for roughly 4 months and is now approaching the undervalued zone,” he wrote. “Typically talking, when the MVRV ratio falls under 1, Bitcoin is taken into account to be undervalued. The present worth is round 1.1, which may be seen as being near the undervalued zone.”

The MVRV framing issues as a result of the metric has tended to compress towards 1 round prior cycle lows. The chart shared alongside the put up exhibits the ratio at roughly 1.10, with earlier sub-1.0 dips highlighted round previous bottoming home windows.

Crypto Dan cautioned that merchants shouldn’t assume the present setup will rhyme completely with prior drawdowns, particularly as a result of the previous advance appeared totally different on valuation measures. “

Nonetheless, in contrast to earlier cycles, it’s obligatory to acknowledge that on this cycle, Bitcoin didn’t sharply rise all the way in which into the overvalued zone throughout the uptrend,” he wrote. “Accordingly, the sample of the decline may seem in another way from the earlier backside zones, so it appears prudent to arrange for that risk in our response.”

That caveat turned the point of interest of a brief back-and-forth in replies. One consumer, onlyus8x, urged that if Bitcoin reached this cycle’s prior all-time excessive greater than 3 times quicker than earlier than, the downturn may additionally resolve quicker—“would possibly the winter additionally move 3 instances quicker?”

Associated Studying

Crypto Dan pushed again on a easy pace analogy, replying: “As a result of there are variations out of your previous, I personally set the standards in another way from previous decline cycles by comprehensively judging these items as nicely.”

Mayer A number of And The 200-Week MA

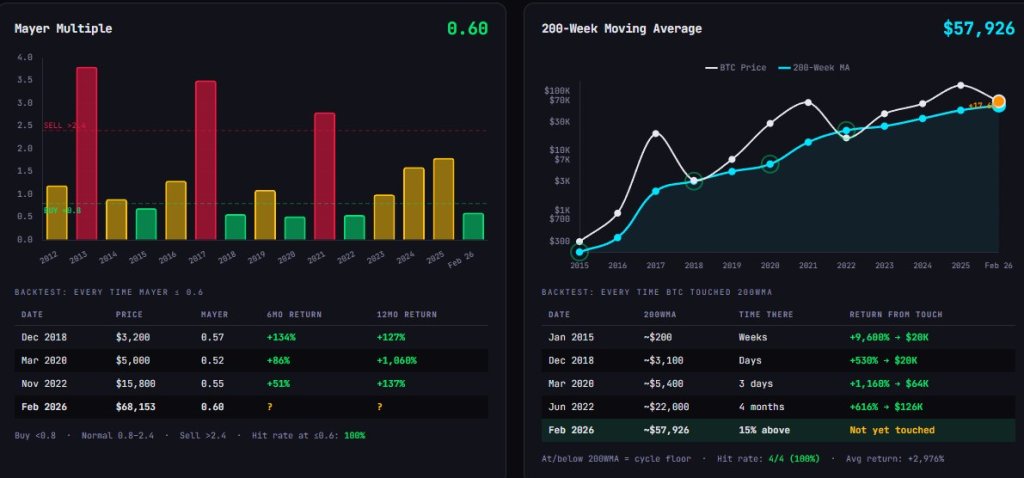

A separate put up from analyst Will Clemente pointed to 2 long-watched, price-based benchmarks which can be additionally urgent into traditionally constructive ranges. “All through Bitcoin’s life span we’ve seen two indicators proceed to be one of the best international market backside indicators: The Mayer a number of (distance from 200 day transferring common) and the 200 week transferring common,” Clemente wrote. “Each of those are clearly in long run accumulation territory.”

The charts he shared present a Mayer A number of round 0.60, alongside a backtest desk that flags prior cases when the indicator fell to roughly that degree. The identical picture positioned Bitcoin’s 200-week transferring common close to $57,926, with Bitcoin proven about 15% above it and a notice that it has “not but touched” that line within the present drawdown.

At press time, BTC traded at $67,277.

Featured picture created with DALL.E, chart from TradingView.com