Bitcoin is gearing up for a decisive transfer as worth motion tightens slightly below key resistance ranges. Bulls are working to push BTC greater and make sure the continuation of the bullish section, however the market stays cautious. Whereas technical construction nonetheless favors the upside, rising macroeconomic uncertainty is casting a shadow over sentiment. Inflation pressures, geopolitical tensions, and tightening world liquidity proceed to shake investor confidence throughout threat belongings, and crypto is not any exception.

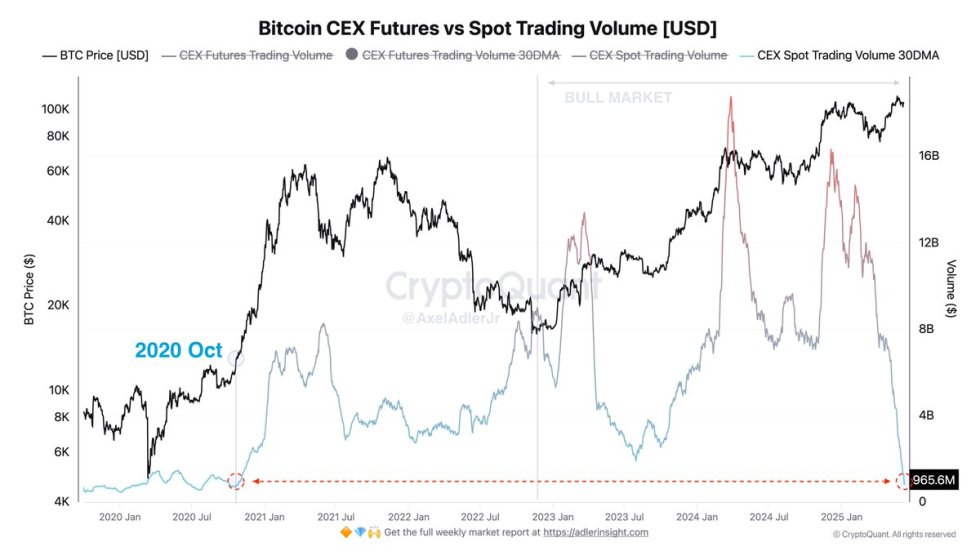

Including to the blended outlook, new information from CryptoQuant reveals that common spot buying and selling quantity on centralized exchanges has dropped to its lowest degree since October 2020. This implies that contributors are sitting on the sidelines, with cash not being actively offered or moved on-chain.

For now, Bitcoin holds above key assist and reveals indicators of energy. However with no surge in quantity or a transparent catalyst, the following transfer could possibly be muted — or explosive. The approaching days could show pivotal in figuring out whether or not BTC breaks out or stalls as soon as once more.

Bitcoin Nears All-Time Excessive As Market Braces for Decisive Transfer

Bitcoin is now simply 6% away from its all-time excessive of $112,000, and all eyes are on whether or not bulls can push by means of this closing barrier. After rallying over 50% from the April lows, BTC has entered a consolidation section slightly below resistance — a setup that usually precedes a breakout or reversal. The approaching transfer is prone to set the tone for the remainder of the market, with momentum both increasing sharply or fading into deeper consolidation.

Whereas the technicals stay sturdy, macroeconomic headwinds proceed to weigh on sentiment. Rising tensions between the US and China, alongside persistently excessive bond yields, have launched systemic threat that might spill over into crypto markets. Buyers stay cautious, with many ready for readability earlier than committing to new positions.

High analyst Axel Adler shared a key perception from CryptoQuant information: common spot buying and selling quantity on centralized exchanges has dropped to its lowest degree since October 2020. In accordance with Adler, this implies that market contributors should not promoting into energy, nor are they aggressively shopping for. Cash are being held tightly, with minimal motion on-chain or in spot markets.

This “HODL mode” factors to rising long-term conviction amongst traders, but in addition displays uncertainty. The dearth of spot exercise makes it tougher for costs to interrupt out decisively with out recent capital getting into the market. Nonetheless, if Bitcoin can flip $112K into assist, it might set off a surge of momentum-driven shopping for.

BTC Approaches Key Resistance

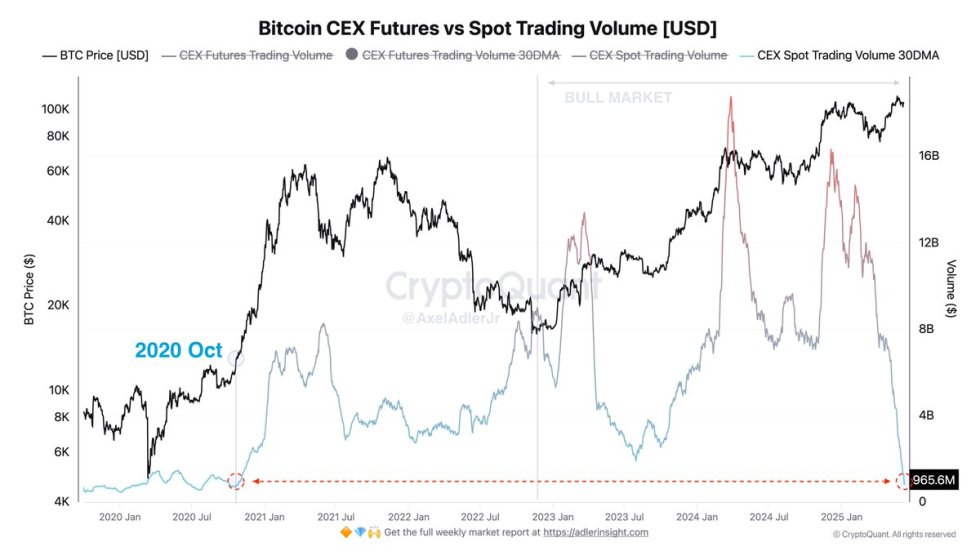

Bitcoin is buying and selling at $107,200 after gaining 1.33% on the day, persevering with its rebound from the $103,600 assist degree. The every day chart reveals BTC climbing steadily, reclaiming the 34-day EMA at $103,683 and holding effectively above the 50-day and 100-day SMAs, at present at $101,906 and $93,053, respectively. This clear reclaim of key shifting averages is a bullish technical sign, exhibiting that momentum is steadily shifting again in favor of the bulls.

Worth is now approaching the $109,300 resistance degree — the ultimate barrier earlier than retesting the all-time excessive close to $112,000. This zone has acted as a ceiling since late Could and is now the important thing degree to observe. A every day shut above $109,300 would doubtless set off a breakout and ship BTC into worth discovery territory.

Quantity stays comparatively low in comparison with earlier surges, suggesting the transfer is pushed extra by regular spot demand than aggressive shopping for. Nonetheless, the construction stays constructive, with greater lows forming for the reason that early June bounce.

So long as Bitcoin holds above $103,600 and continues to push towards resistance, the broader pattern stays intact. A rejection at $109,300, nevertheless, might ship BTC again into consolidation. The subsequent few periods will probably be important.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Bitcoin is gearing up for a decisive transfer as worth motion tightens slightly below key resistance ranges. Bulls are working to push BTC greater and make sure the continuation of the bullish section, however the market stays cautious. Whereas technical construction nonetheless favors the upside, rising macroeconomic uncertainty is casting a shadow over sentiment. Inflation pressures, geopolitical tensions, and tightening world liquidity proceed to shake investor confidence throughout threat belongings, and crypto is not any exception.

Including to the blended outlook, new information from CryptoQuant reveals that common spot buying and selling quantity on centralized exchanges has dropped to its lowest degree since October 2020. This implies that contributors are sitting on the sidelines, with cash not being actively offered or moved on-chain.

For now, Bitcoin holds above key assist and reveals indicators of energy. However with no surge in quantity or a transparent catalyst, the following transfer could possibly be muted — or explosive. The approaching days could show pivotal in figuring out whether or not BTC breaks out or stalls as soon as once more.

Bitcoin Nears All-Time Excessive As Market Braces for Decisive Transfer

Bitcoin is now simply 6% away from its all-time excessive of $112,000, and all eyes are on whether or not bulls can push by means of this closing barrier. After rallying over 50% from the April lows, BTC has entered a consolidation section slightly below resistance — a setup that usually precedes a breakout or reversal. The approaching transfer is prone to set the tone for the remainder of the market, with momentum both increasing sharply or fading into deeper consolidation.

Whereas the technicals stay sturdy, macroeconomic headwinds proceed to weigh on sentiment. Rising tensions between the US and China, alongside persistently excessive bond yields, have launched systemic threat that might spill over into crypto markets. Buyers stay cautious, with many ready for readability earlier than committing to new positions.

High analyst Axel Adler shared a key perception from CryptoQuant information: common spot buying and selling quantity on centralized exchanges has dropped to its lowest degree since October 2020. In accordance with Adler, this implies that market contributors should not promoting into energy, nor are they aggressively shopping for. Cash are being held tightly, with minimal motion on-chain or in spot markets.

This “HODL mode” factors to rising long-term conviction amongst traders, but in addition displays uncertainty. The dearth of spot exercise makes it tougher for costs to interrupt out decisively with out recent capital getting into the market. Nonetheless, if Bitcoin can flip $112K into assist, it might set off a surge of momentum-driven shopping for.

BTC Approaches Key Resistance

Bitcoin is buying and selling at $107,200 after gaining 1.33% on the day, persevering with its rebound from the $103,600 assist degree. The every day chart reveals BTC climbing steadily, reclaiming the 34-day EMA at $103,683 and holding effectively above the 50-day and 100-day SMAs, at present at $101,906 and $93,053, respectively. This clear reclaim of key shifting averages is a bullish technical sign, exhibiting that momentum is steadily shifting again in favor of the bulls.

Worth is now approaching the $109,300 resistance degree — the ultimate barrier earlier than retesting the all-time excessive close to $112,000. This zone has acted as a ceiling since late Could and is now the important thing degree to observe. A every day shut above $109,300 would doubtless set off a breakout and ship BTC into worth discovery territory.

Quantity stays comparatively low in comparison with earlier surges, suggesting the transfer is pushed extra by regular spot demand than aggressive shopping for. Nonetheless, the construction stays constructive, with greater lows forming for the reason that early June bounce.

So long as Bitcoin holds above $103,600 and continues to push towards resistance, the broader pattern stays intact. A rejection at $109,300, nevertheless, might ship BTC again into consolidation. The subsequent few periods will probably be important.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.