In short

On 4 March 2025, the Australian Competitors and Shopper Fee (ACCC) launched transitional tips (“Tips“) to assist companies navigate the transition to the brand new obligatory and suspensory merger management regime which comes into power on 1 January 2026.

The Tips set out particulars on key dates and processes for a way the ACCC will handle merger clearance critiques throughout the transition interval. The ACCC is encouraging companies to voluntarily notify transactions below the brand new regime from 1 July 2025 to keep away from the potential want for re-notification if the ACCC is unable to finish its overview in time.

Corporations might want to fastidiously consider deal timelines and ACCC engagement in gentle of those transitional preparations as a way to keep away from the chance of getting to restart a merger overview course of with the ensuing delay and extra prices.

For extra data on the brand new merger legal guidelines, together with in relation to the proposed notification thresholds below the brand new regime, please see our earlier consumer alert right here.

- Acquisitions cleared below the casual merger overview course of previous to 1 July 2025 and never implement by 31 December 2025 would require an up to date casual overview from the ACCC earlier than 31 December 2025 to keep away from a possible notification being required below the brand new regime.

- For acquisitions cleared within the casual merger overview course of between 1 July and 31 December 2025, merger events can have 12 months from the date of the ACCC’s clearance letter to place the acquisition into impact, in any other case the merger might should be re-notified below the brand new regime. Equally, there will likely be a 12 month interval to implement merger authorisations granted between 1 July and 31 December 2025.

- Merger events searching for casual merger clearance from the ACCC from 1 July 2025 must fastidiously take into account whether or not the overview might be accomplished in time. The ACCC has indicated that casual merger requests acquired from October to December 2025 are a lot much less more likely to be accomplished in time. If there’s a danger a overview is not going to be full by 31 December 2025, then the events ought to take into account voluntarily notifying the ACCC below the brand new regime.

- Purposes for merger authorisation is not going to be accepted after 30 June 2025.

Casual merger critiques

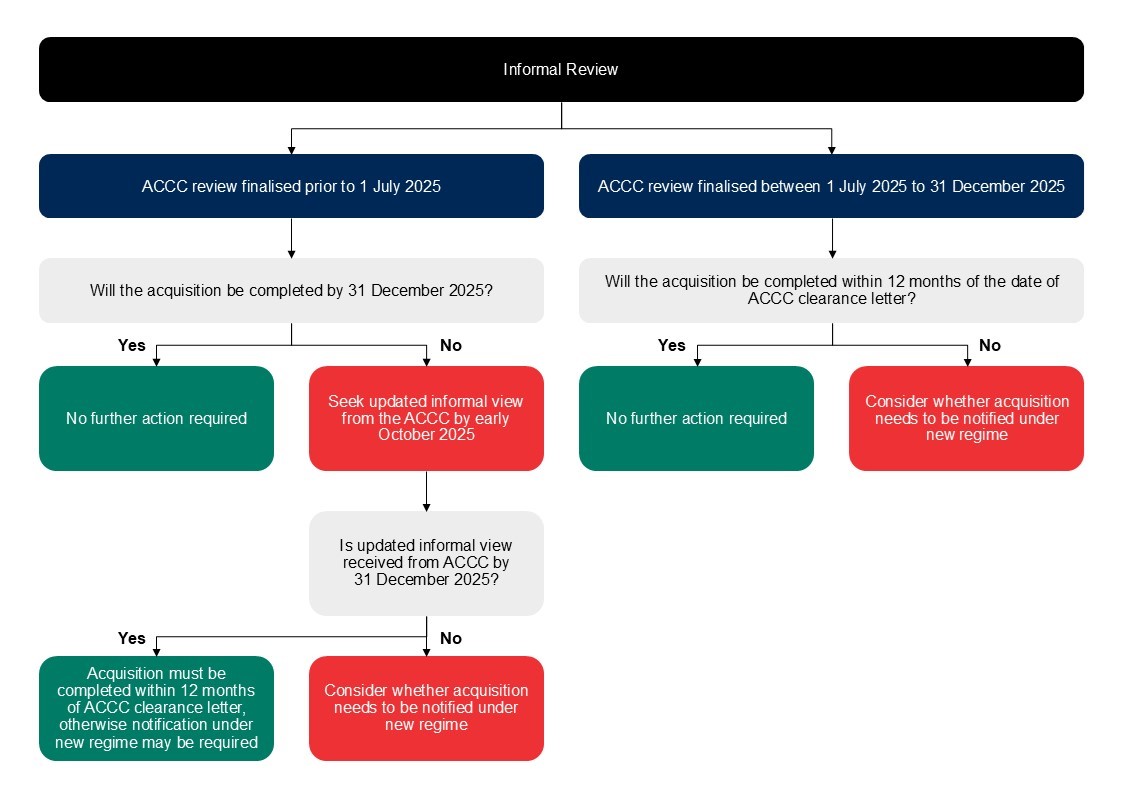

The diagram under units out the ACCC’s transitional preparations for casual merger critiques.

Casual critiques finalised earlier than 1 July 2025

If the ACCC has granted casual merger clearance earlier than 1 July 2025, there is no such thing as a obligation to inform below the brand new regime supplied the merger is implement earlier than 1 January 2026.

Nevertheless, if there’s a danger that the proposed merger is not going to be implement by the top of this yr, the merger events can request an up to date casual view. The merger events will then have 12 months from the date of a letter from the ACCC confirming it maintains its authentic view, to finish the transaction with out the necessity to notify below the brand new regime.

The ACCC strongly recommends that any request for an up to date casual view be made by early October 2025 to make sure that the ACCC has adequate time to finish the overview. A request ought to embody an replace on any adjustments (for instance, adjustments within the related markets and up to date market share). If there are any materials adjustments, the ACCC might conduct a follow-up public overview or pre-assessment.

If the ACCC is unable to finish an up to date casual overview earlier than the top of 2025, and the acquisition is notifiable and meets the merger notification thresholds, it should be re-notified or a notification waiver software made. The ACCC will likely be offering steerage on notification waivers later this yr.

Casual critiques between 1 July to 31 December 2025

If the ACCC grants casual merger clearance between 1 July 2025 and 31 December 2025, then the events can have 12 months from the ACCC’s clearance letter by which to finish their merger. Nevertheless, if an acquisition isn’t implement inside this time, and it’s a notifiable acquisition that meets the merger notification thresholds, it should be re-notified or an software for a notification waiver made.

Whereas the casual merger overview system will stay open till 31 December 2025, merger events are inspired to submit a request for casual overview and interact with the ACCC as quickly as doable to make sure that the overview is accomplished by 31 December 2025. If the ACCC has not accomplished its overview by 31 December 2025, then the overview will stop.

The ACCC has indicated that purposes for casual merger overview acquired between October and December 2025 are a lot much less more likely to be thought of in time, even when there are restricted or no competitors dangers.

Accordingly, if there’s any uncertainty that an off-the-cuff overview is not going to be accomplished by 31 December 2025, then merger events ought to take into account voluntarily notifying the ACCC below the brand new regime from 1 July 2025.

Merger authorisations

Purposes for merger authorisation can’t be made after 30 June 2025.

If the ACCC grants a merger authorisation between 1 July 2025 and 31 December 2025, the events can have 12 months to place the merger into impact. If the merger isn’t implement inside this time, the merger might should be re-notified if the acquisition is notifiable and meets the merger notification thresholds.

For any merger authorisation purposes that haven’t been finalised by 31 December 2025, the ACCC will stop its overview from this date.

Anti-competitive acquisitions

The ACCC has warned that it’s cautious of the chance of anti-competitive acquisitions occurring throughout the transition interval and has mentioned that it’ll take into account “all out there enforcement choices” for anti-competitive acquisitions which have accomplished or deliberate to finish earlier than or after 1 January 2026 with out approval.

This alert was ready with the help of Naasha Loopoo and Alison Chen.

In short

On 4 March 2025, the Australian Competitors and Shopper Fee (ACCC) launched transitional tips (“Tips“) to assist companies navigate the transition to the brand new obligatory and suspensory merger management regime which comes into power on 1 January 2026.

The Tips set out particulars on key dates and processes for a way the ACCC will handle merger clearance critiques throughout the transition interval. The ACCC is encouraging companies to voluntarily notify transactions below the brand new regime from 1 July 2025 to keep away from the potential want for re-notification if the ACCC is unable to finish its overview in time.

Corporations might want to fastidiously consider deal timelines and ACCC engagement in gentle of those transitional preparations as a way to keep away from the chance of getting to restart a merger overview course of with the ensuing delay and extra prices.

For extra data on the brand new merger legal guidelines, together with in relation to the proposed notification thresholds below the brand new regime, please see our earlier consumer alert right here.

- Acquisitions cleared below the casual merger overview course of previous to 1 July 2025 and never implement by 31 December 2025 would require an up to date casual overview from the ACCC earlier than 31 December 2025 to keep away from a possible notification being required below the brand new regime.

- For acquisitions cleared within the casual merger overview course of between 1 July and 31 December 2025, merger events can have 12 months from the date of the ACCC’s clearance letter to place the acquisition into impact, in any other case the merger might should be re-notified below the brand new regime. Equally, there will likely be a 12 month interval to implement merger authorisations granted between 1 July and 31 December 2025.

- Merger events searching for casual merger clearance from the ACCC from 1 July 2025 must fastidiously take into account whether or not the overview might be accomplished in time. The ACCC has indicated that casual merger requests acquired from October to December 2025 are a lot much less more likely to be accomplished in time. If there’s a danger a overview is not going to be full by 31 December 2025, then the events ought to take into account voluntarily notifying the ACCC below the brand new regime.

- Purposes for merger authorisation is not going to be accepted after 30 June 2025.

Casual merger critiques

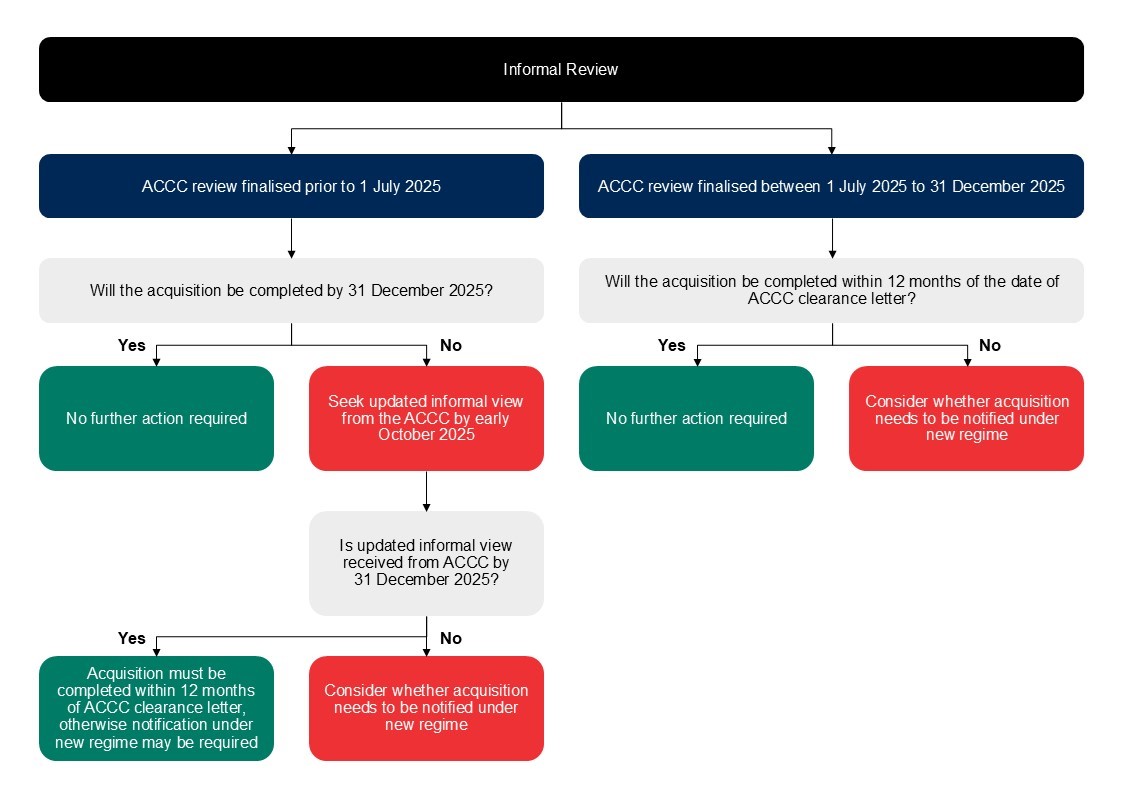

The diagram under units out the ACCC’s transitional preparations for casual merger critiques.

Casual critiques finalised earlier than 1 July 2025

If the ACCC has granted casual merger clearance earlier than 1 July 2025, there is no such thing as a obligation to inform below the brand new regime supplied the merger is implement earlier than 1 January 2026.

Nevertheless, if there’s a danger that the proposed merger is not going to be implement by the top of this yr, the merger events can request an up to date casual view. The merger events will then have 12 months from the date of a letter from the ACCC confirming it maintains its authentic view, to finish the transaction with out the necessity to notify below the brand new regime.

The ACCC strongly recommends that any request for an up to date casual view be made by early October 2025 to make sure that the ACCC has adequate time to finish the overview. A request ought to embody an replace on any adjustments (for instance, adjustments within the related markets and up to date market share). If there are any materials adjustments, the ACCC might conduct a follow-up public overview or pre-assessment.

If the ACCC is unable to finish an up to date casual overview earlier than the top of 2025, and the acquisition is notifiable and meets the merger notification thresholds, it should be re-notified or a notification waiver software made. The ACCC will likely be offering steerage on notification waivers later this yr.

Casual critiques between 1 July to 31 December 2025

If the ACCC grants casual merger clearance between 1 July 2025 and 31 December 2025, then the events can have 12 months from the ACCC’s clearance letter by which to finish their merger. Nevertheless, if an acquisition isn’t implement inside this time, and it’s a notifiable acquisition that meets the merger notification thresholds, it should be re-notified or an software for a notification waiver made.

Whereas the casual merger overview system will stay open till 31 December 2025, merger events are inspired to submit a request for casual overview and interact with the ACCC as quickly as doable to make sure that the overview is accomplished by 31 December 2025. If the ACCC has not accomplished its overview by 31 December 2025, then the overview will stop.

The ACCC has indicated that purposes for casual merger overview acquired between October and December 2025 are a lot much less more likely to be thought of in time, even when there are restricted or no competitors dangers.

Accordingly, if there’s any uncertainty that an off-the-cuff overview is not going to be accomplished by 31 December 2025, then merger events ought to take into account voluntarily notifying the ACCC below the brand new regime from 1 July 2025.

Merger authorisations

Purposes for merger authorisation can’t be made after 30 June 2025.

If the ACCC grants a merger authorisation between 1 July 2025 and 31 December 2025, the events can have 12 months to place the merger into impact. If the merger isn’t implement inside this time, the merger might should be re-notified if the acquisition is notifiable and meets the merger notification thresholds.

For any merger authorisation purposes that haven’t been finalised by 31 December 2025, the ACCC will stop its overview from this date.

Anti-competitive acquisitions

The ACCC has warned that it’s cautious of the chance of anti-competitive acquisitions occurring throughout the transition interval and has mentioned that it’ll take into account “all out there enforcement choices” for anti-competitive acquisitions which have accomplished or deliberate to finish earlier than or after 1 January 2026 with out approval.

This alert was ready with the help of Naasha Loopoo and Alison Chen.