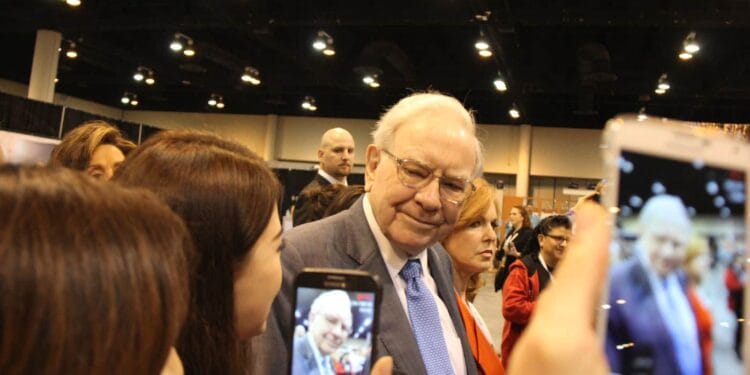

Picture supply: The Motley Idiot

On the latest Berkshire Hathaway (NYSE:BRK.B) annual shareholder assembly, CEO Warren Buffett introduced his retirement. He’ll step down on the finish of the 12 months, by which period he can be 95.

Since that announcement, the share value has fallen practically 5%. I’ve by no means owned any Berkshire shares, however a fast look at a chart reveals I’d have executed very properly shopping for some over any significant interval. They’re up practically 200% in 5 years and 573% in 15 years.

Long run, the returns are legendary. One mind-blowing stat I learn lately was that even when Berkshire Hathaway’s share value was to fall 99% by year-end, Warren Buffett would nonetheless have outperformed the S&P 500 over six many years!

Causes to purchase

Let’s begin with the reason why I’d be enthusiastic about investing in Berkshire.

The primary is that the corporate’s extremely well-diversified. Past a inventory portfolio that features world-class corporations like Coca-Cola, Apple and Visa, it owns total companies throughout insurance coverage, vitality, railroads, manufacturing, and client items.

This vary of corporations and investments would assist me sleep properly at night time as an investor.

One other main attraction right here is the colossal money pile of greater than $300bn. This offers the administration workforce an enormous warfare chest to deploy if the inventory market enters a meltdown. That may’t be dominated out later this 12 months, particularly when the financial injury from tariffs is broadly anticipated to start out exhibiting up.

Associated to this, I’d count on Berkshire’s valuation to carry up higher than most in a bear market. That’s as a result of buyers see it as a protected haven and would assume that money pile can be put to good use.

One motive to be cautious

It may be fascinating to do thought experiments as an investor. Right here’s one: if I needed to choose one inventory to carry for 20 years whereas stranded on a desert island, which might I belief to ship strong returns whereas I’m away?

Beforehand, I’d have plumped for Berkshire inventory. The affected person and clever stewardship of Berkshire below Buffett and his investing lieutenants would have given me nice peace of thoughts (financially) as I foraged about attempting to outlive on my island.

In a altering world that’s typically chaotic, Buffett and Berkshire symbolize cool-headedness and continuity.

However Buffett’s retirement does change this calculation a bit, in my thoughts. Will there be an evolution in type — extra progress shares, for instance?

One factor Buffett stated on the annual assembly struck me: “I’m considerably embarrassed to say that Tim Cook dinner has made Berkshire much more cash than I’ve ever made.“

In fact, Buffett is being modest. It was his determination to start out shopping for Apple inventory in 2016, earlier than making it Berkshire’s largest holding by far. That guess has paid off handsomely.

Nonetheless, was it a tacit admission that Berkshire’s returns might need been even stronger had Buffett embraced tech shares earlier? I don’t know. However a slight change in capital allocation in direction of extra growthier names would possibly improve returns (or threat).

Put money into Berkshire?

Personally, I don’t count on an excessive amount of change transferring ahead. Greg Abel was designated as Buffett’s successor 4 years in the past, in any case.

Nonetheless, I would like to see how Berkshire evolves over the subsequent couple of years earlier than contemplating the inventory once more.

Picture supply: The Motley Idiot

On the latest Berkshire Hathaway (NYSE:BRK.B) annual shareholder assembly, CEO Warren Buffett introduced his retirement. He’ll step down on the finish of the 12 months, by which period he can be 95.

Since that announcement, the share value has fallen practically 5%. I’ve by no means owned any Berkshire shares, however a fast look at a chart reveals I’d have executed very properly shopping for some over any significant interval. They’re up practically 200% in 5 years and 573% in 15 years.

Long run, the returns are legendary. One mind-blowing stat I learn lately was that even when Berkshire Hathaway’s share value was to fall 99% by year-end, Warren Buffett would nonetheless have outperformed the S&P 500 over six many years!

Causes to purchase

Let’s begin with the reason why I’d be enthusiastic about investing in Berkshire.

The primary is that the corporate’s extremely well-diversified. Past a inventory portfolio that features world-class corporations like Coca-Cola, Apple and Visa, it owns total companies throughout insurance coverage, vitality, railroads, manufacturing, and client items.

This vary of corporations and investments would assist me sleep properly at night time as an investor.

One other main attraction right here is the colossal money pile of greater than $300bn. This offers the administration workforce an enormous warfare chest to deploy if the inventory market enters a meltdown. That may’t be dominated out later this 12 months, particularly when the financial injury from tariffs is broadly anticipated to start out exhibiting up.

Associated to this, I’d count on Berkshire’s valuation to carry up higher than most in a bear market. That’s as a result of buyers see it as a protected haven and would assume that money pile can be put to good use.

One motive to be cautious

It may be fascinating to do thought experiments as an investor. Right here’s one: if I needed to choose one inventory to carry for 20 years whereas stranded on a desert island, which might I belief to ship strong returns whereas I’m away?

Beforehand, I’d have plumped for Berkshire inventory. The affected person and clever stewardship of Berkshire below Buffett and his investing lieutenants would have given me nice peace of thoughts (financially) as I foraged about attempting to outlive on my island.

In a altering world that’s typically chaotic, Buffett and Berkshire symbolize cool-headedness and continuity.

However Buffett’s retirement does change this calculation a bit, in my thoughts. Will there be an evolution in type — extra progress shares, for instance?

One factor Buffett stated on the annual assembly struck me: “I’m considerably embarrassed to say that Tim Cook dinner has made Berkshire much more cash than I’ve ever made.“

In fact, Buffett is being modest. It was his determination to start out shopping for Apple inventory in 2016, earlier than making it Berkshire’s largest holding by far. That guess has paid off handsomely.

Nonetheless, was it a tacit admission that Berkshire’s returns might need been even stronger had Buffett embraced tech shares earlier? I don’t know. However a slight change in capital allocation in direction of extra growthier names would possibly improve returns (or threat).

Put money into Berkshire?

Personally, I don’t count on an excessive amount of change transferring ahead. Greg Abel was designated as Buffett’s successor 4 years in the past, in any case.

Nonetheless, I would like to see how Berkshire evolves over the subsequent couple of years earlier than contemplating the inventory once more.