Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value rose a fraction of a p.c prior to now 24 hours to commerce at $2.79 as of 1:17 a.m. EST whilst buying and selling quantity plunged 58% to $2.8 billion.

This comes as six purposes for spot XRP exchange-traded funds (ETFs) are nearing resolution deadlines.

The US Securities and Trade Fee (SEC) is anticipated to rule on them between October 18 and October 25, which is able to decide whether or not XRP turns into the third cryptocurrency after Bitcoin and Ethereum to achieve entry to US-listed spot ETFs.

🔥 XRP ETFs may convey large institutional inflows and push $XRP to new ATH $8-$10!

13 Issuers 💵

19 Merchandise 🎁 (9 Spot / 9 Futures)

10 Dwell 🟢 | 9 Pending 🔴 pic.twitter.com/GiFEr1IpFr— XRP_Cro 🔥 AI / Gaming / DePIN (@stedas) September 27, 2025

Grayscale’s XRP ETF is scheduled for assessment on October 18, 21Shares Core XRP Belief ETF on October 19, Bitwise’s XRP ETF on October 22, Canary Capital and CoinShares on October 23, and WisdomTree’s XRP ETF submitting on October 24.

Nate Geraci, the president of NovaDius Wealth Administration, says ”prepare for October” after constructive regulatory developments within the final two weeks that included a sequence of firsts that he detailed within the following publish:

Final 2 weeks…

First ETF providing spot xrp publicity

First ETF providing spot doge publicity

SEC approves generic itemizing requirements

First index-based spot crypto ETF

First eth staking ETF

First hype ETF submitting

Vanguard capitulates on spot crypto ETFs

Prepare for October.

— Nate Geraci (@NateGeraci) September 27, 2025

XRP At A Crossroads: Can Bulls Defend The Key Help Zone?

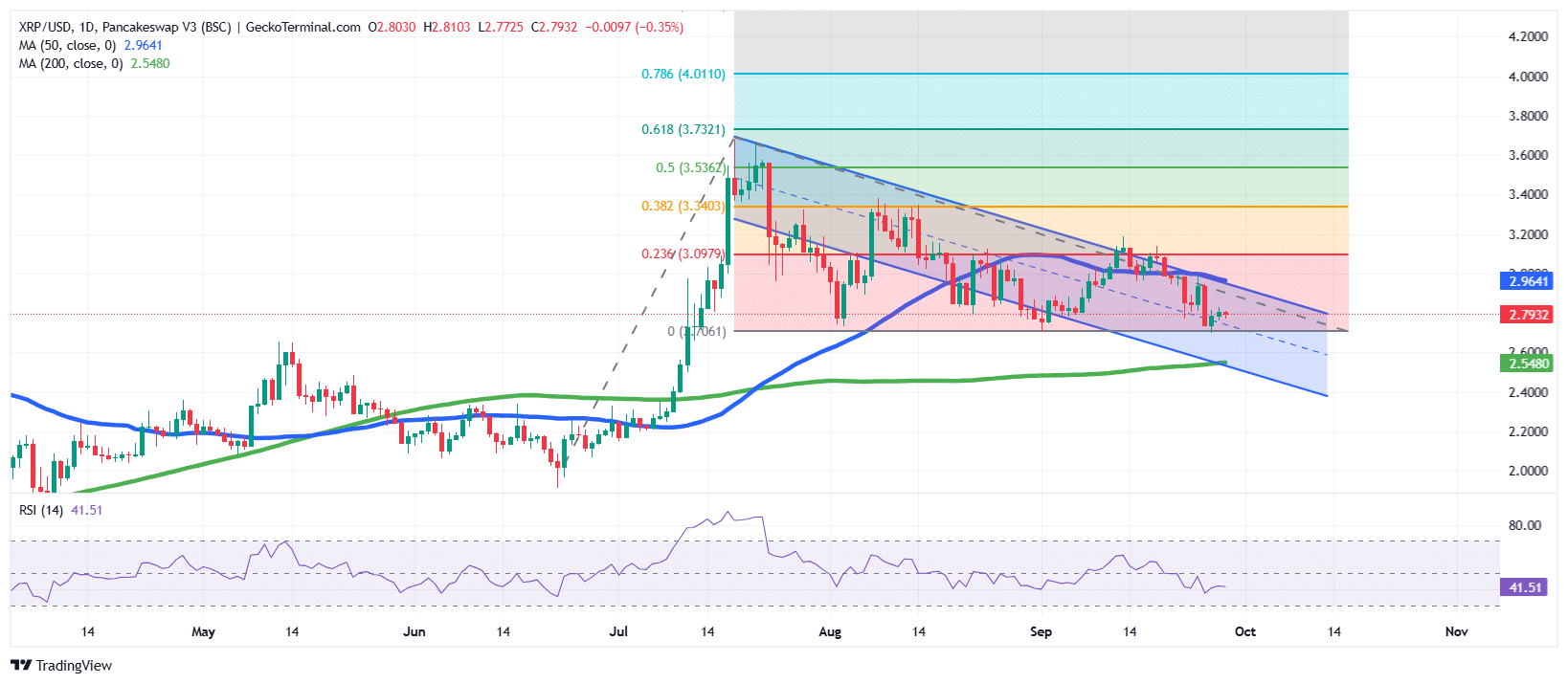

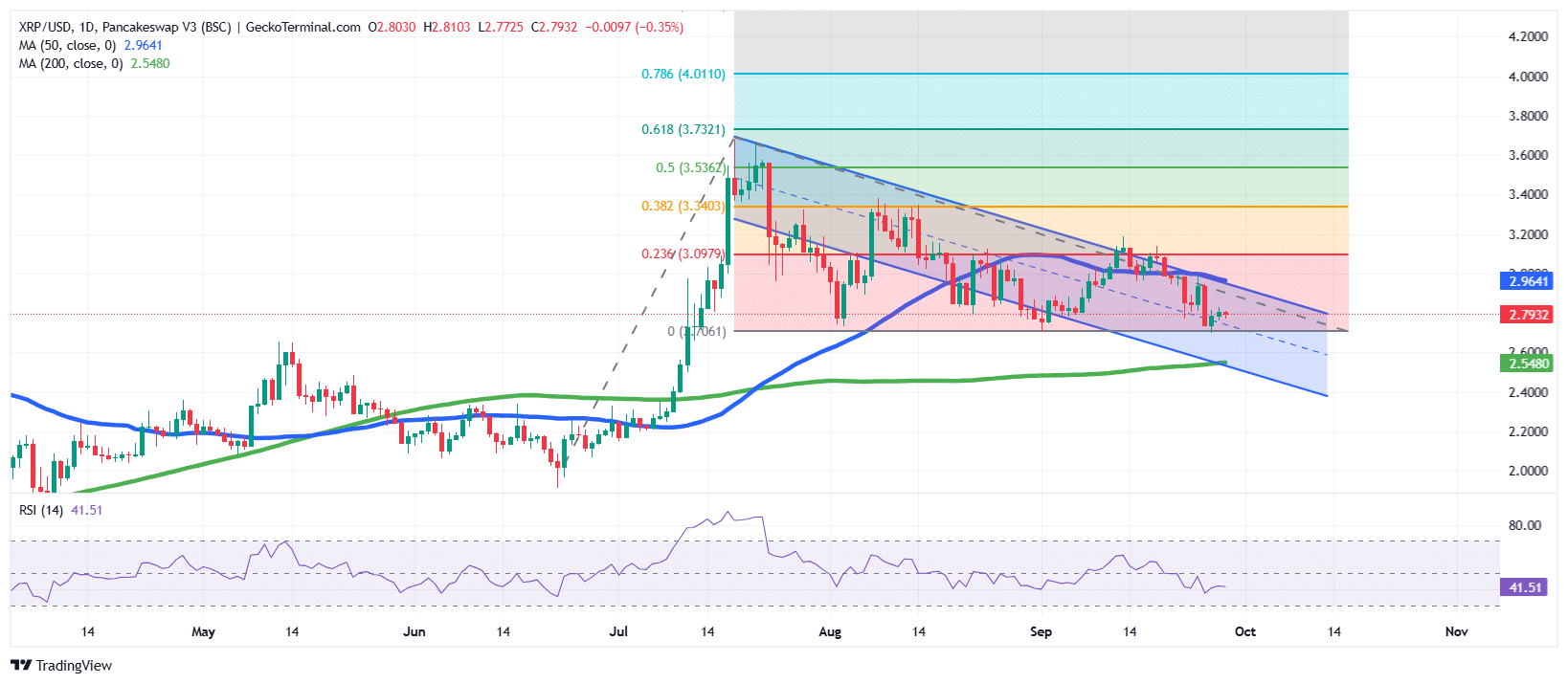

The XRP value on the each day chart exhibits a market below strain, buying and selling close to $2.79 after a gradual decline from its mid-July highs.

The Ripple token value motion has fashioned a descending channel sample, reflecting a transparent bearish development in current weeks.

Every rally try has been met with promoting strain, conserving XRP locked under the channel’s higher resistance. XRP is hovering simply beneath the 50-day Easy Transferring Common (SMA) (at $2.96), whereas the 200-day SMA (at $2.54) stays a vital long-term assist stage.

The Fibonacci retracement from the July rally highlights resistance at $3.09 (23.6%), $3.34 (38.2%), and $3.53 (50%). These ranges stay essential hurdles if XRP makes an attempt a restoration.

In the meantime, the Relative Power Index (RSI) at present sits at 41.5, inserting it in bearish territory however not but oversold. This means there may nonetheless be room for additional draw back earlier than sturdy accumulation seems.

In the meantime, the 50-day SMA has crossed above the XRP value, performing as dynamic resistance, whereas the 200-day SMA stays supportive, making a battle between short-term bearishness and long-term development stability.

Trying forward, XRP’s value motion will probably hinge on whether or not it could possibly maintain above the $2.55 assist zone, which aligns with the 200-day SMA.

A breakdown under this stage may set off a deeper retracement towards $2.40.

On the upside, reclaiming $3.00 could be the primary sign of energy, with a possible breakout above $3.34 opening the trail towards $3.53 and past. For now, XRP stays at a crossroads, with the market awaiting affirmation of its subsequent main transfer.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection