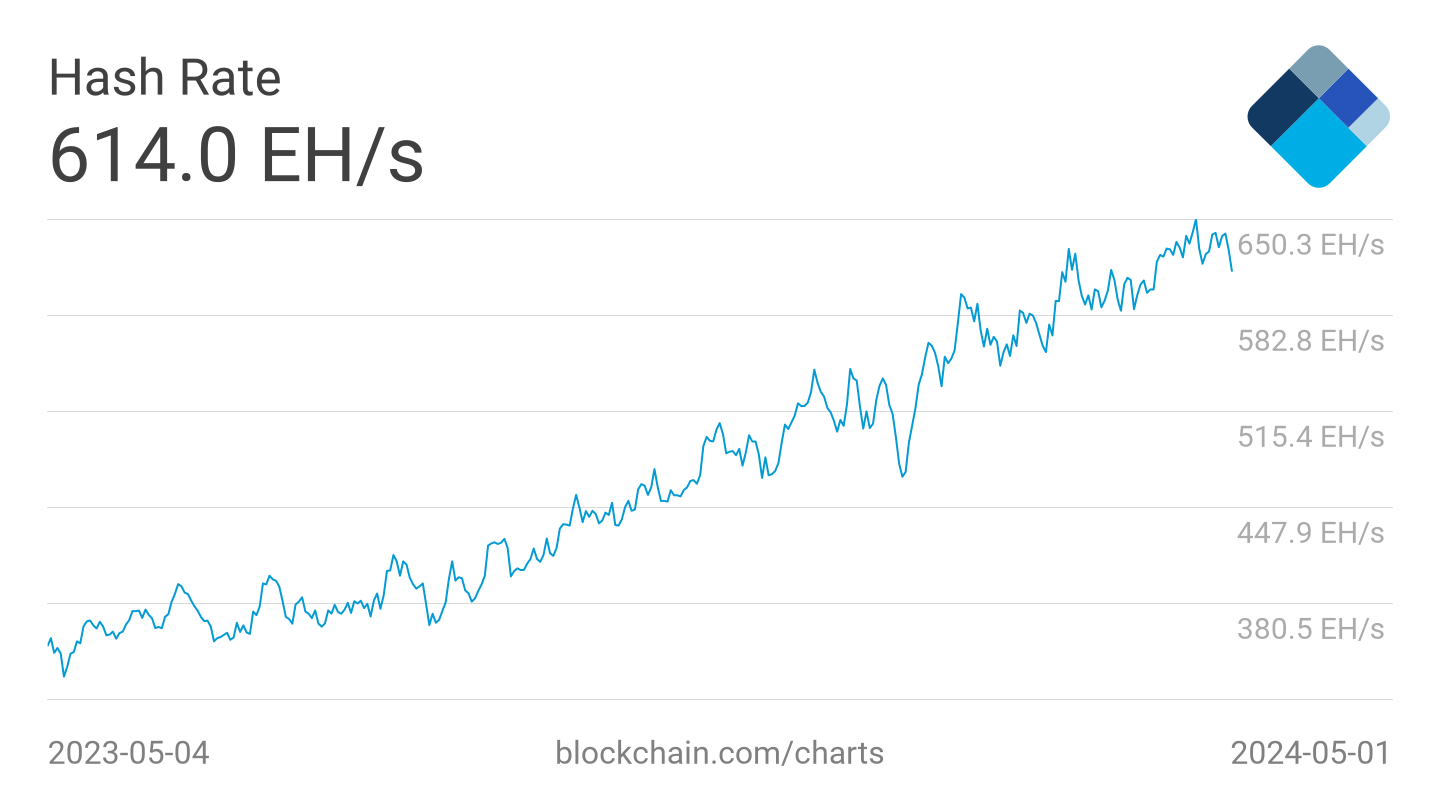

On Sep. 23, Bitcoin’s hashrate set a brand new all-time excessive of 1,073 EH/s. During the last month, uncooked compute rose about 21%.

During the last quarter, roughly 70%. During the last yr, the curve went vertical, up round 675%.

Hashrate was a chart for miners and protocol nerds. Now it reads like a capital expenditure scoreboard for an trade you may commerce.

Let’s reply the fundamental query rapidly: What’s hashrate, and why ought to anybody outdoors a mining warehouse care?

Hashrate is the entire computational effort pointed at Bitcoin’s proof-of-work: i.e., how onerous it will be to outvote the community and rewrite the ledger. Extra hashrate makes an assault costlier and fewer sensible. However the extra fascinating angle isn’t simply “security”; it’s what this says in regards to the scale of the trade behind it.

You don’t get a zetahash with out years of establishing amenities, putting in transformers, hauling in container a great deal of machines, and locking in power contracts large enough to energy whole cities. Each uptick on this line is cash and engineering displaying up in the actual world.

Mechanically, the protocol retains block cadence regular by elevating or reducing issue each 2016 blocks, like a treadmill that accelerates when the runners get stronger. When hashrate jumps prefer it did into September, the treadmill kicks sooner on the subsequent epoch or two, and margin will get tighter.

That suggestions loop drives the enterprise: machines come on-line, blocks arrive too rapidly, issue adjusts, and unit economics compress till solely essentially the most environment friendly operators preserve their edge. The protocol is agnostic; it doesn’t negotiate. Miners both hit their energy worth and fleet-efficiency targets or they get pushed to the again of the road.

The newest each day print set a contemporary excessive round 1,073 EH/s. The previous 30 days added roughly 184 EH/s on the peak of the run-up, an absolute soar large enough to have counted as the complete community not way back.

Yr so far, hashrate is up about 36%. The sequence crossed every psychological marker on a predictable cadence: 1 EH/s in early 2016, 10 EH/s by late 2017, 100 EH/s by late 2019, 500 EH/s in late 2023, and now four-comma territory. These thresholds marked step-ups in industrial scale: new-gen ASIC waves, denser racks, higher firmware, and cheaper electrical energy.

That is the place “why hashrate issues past mining” turns into the incorrect lens to take a look at it. It issues quite a bit for mining as a result of public miners now sit on the heart of this trade. MARA, RIOT, CLSK, CORZ, IREN, CIFR, and friends aren’t simply buying and selling proxies for Bitcoin; they’re working corporations tied to this treadmill.

When hashrate accelerates sooner than worth, issue chases it, and hashprice compresses. You’ll be able to see that shake out on earnings calls: fleet age and watts per terahash abruptly matter greater than intelligent treasury strains.

Operators with sub-$0.04-$0.05/kWh energy, environment friendly immersion or high-utilization air-cooled websites, and firmed energy hedges journey the adjustment with out coughing up margin. Everybody else watches their breakeven rise.

The fairness market facet of that is easy to relate and onerous to run.

Scale is now an actual infrastructure drawback: substation lead instances, transmission constraints, interconnect queues, and localized politics about the place you may place load. That’s why the hashrate chart reads like a map of who really executed.

A community that simply cleared one zetahash is an trade with onerous belongings all internationally, grouped in areas with low-cost energy and a supporting native authorities. The inventory tape displays that sorting.

Firms with contemporary fleets and available megawatts seize share into an upswing; the remainder get diluted, consolidated, or quietly sidelined when the subsequent issue ratchet arrives.

The trade is all the time tempted to show hashrate spikes into worth calls.

Nonetheless, the higher story right here is that worth displays temper whereas hashrate displays dedication. Rigs don’t magically seem as a result of social sentiment turned inexperienced. The transfer we simply logged implies months of capex already spent and months extra queued up for supply.

If spot stalls, issue will nonetheless do its job and power the trade to get leaner. If worth runs with it, you’ll see the general public names dash as operational leverage flips optimistic.

The previous month’s +20% and the quarter’s +70% aren’t simply large; they’re quick. The only largest 30-day absolute acquire on this run hit in mid-September, a reminder that the cadence of deployments is now lumpy as containers land in bursts, energy comes on-line in chunks, and grid seasons matter.

That rhythm is what’s going to resolve the leaderboard over the subsequent few epochs.

You’ll be able to faux a story. You’ll be able to’t faux delivered energy.