Picture supply: Getty Photos

There are solely a handful of shares within the FTSE 100 that gives a dividend yield north of 8% and Phoenix Group (LSE: PHNX) is one among them. However precisely how a lot might an investor flip a £10,000 funding in to?

Compounding returns

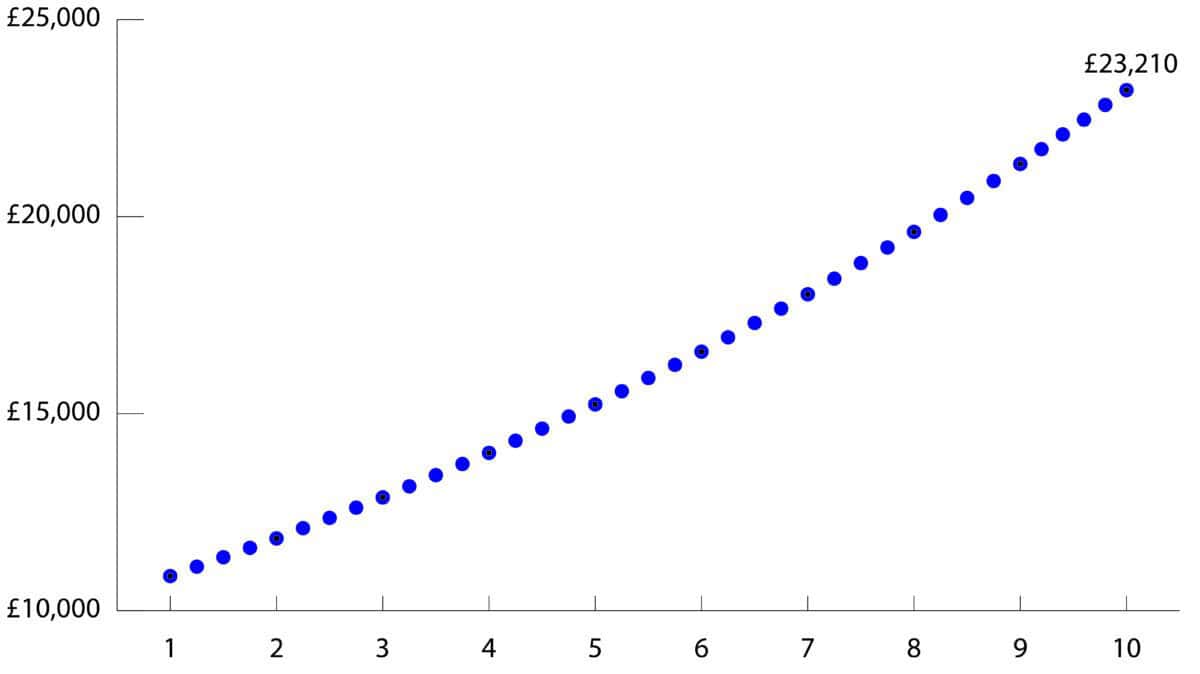

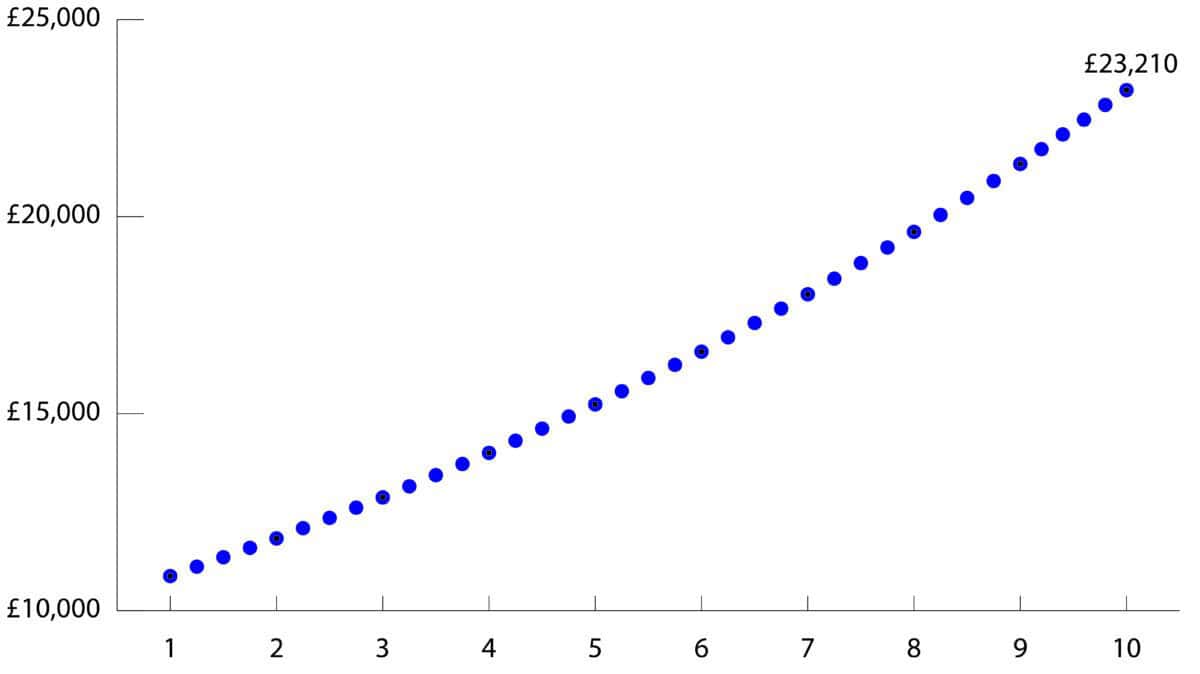

Compounding one’s returns is the key sauce that may supercharge a portfolio’s returns. Because the chart beneath highlights, reinvesting dividends alongside the best way would greater than double one’s cash in 10 years. That is considerably greater than the £18,600 ‘flat’ return with out compounding.

Chart generated by writer

However even this calculation isn’t strictly proper because it assumes there isn’t a share worth motion or change in dividend. As regards to the latter, during the last 10 years, the life insurer has raised its dividend from 40.8p per share to 54p, a rise of 32%.

Future dividends

The enterprise makes use of three monetary metrics as a foundation for figuring out future dividend will increase. These are working money technology (OCG), shareholder capital protection ratio, and the mum or dad firm distributable reserves. My favoured metric is to give attention to money technology, as it’s simpler to grasp.

On 8 September, at H1 outcomes, it reported a rise of 9% in OCG to £705m. This quantity greater than coated the dividend fee and different recurring makes use of (e.g., curiosity expense and working prices). At full-year outcomes, it’s guiding for complete extra money to be roughly £300m.

Accounting mismatch

One concern that spooked traders throughout its H1 outcomes (inflicting a 5% drop on the day) was a decline in statutory accounting (often called IFRS) shareholders’ fairness. On the floor, this might probably counsel issues sustaining the dividend.

Phoenix defined the decline because of an “accounting mismatch” between the stability sheets based mostly on IFRS and its most popular reporting technique, Solvency II.

One main distinction between the accounting requirements is the best way they deal with an funding contract, like an annuity. Beneath IFRS, such contracts are valued utilizing locked-in financial assumptions fastened at a particular time. Beneath Solvency II, nevertheless, they’re handled extra like capital, and consequently revalued at every stability sheet date.

Though fairly technical, such variations are extraordinarily essential. When adjusted for such variances, shareholders’ fairness got here in at £3.5bn, considerably greater than the £768m reported below IFRS.

Progress drivers

Personally, I’m sceptical when a enterprise deploys inventive accounting options to clarify away discrepancies within the stability sheet. Clearly, if IFRS shareholders’ fairness doesn’t develop within the medium time period, as administration expects, then the inventory might come below stress.

Placing this concern apart, the enterprise does have important development alternatives within the years forward. A shift from outlined profit (DB) to outlined contribution (DC) office pensions is one mega development.

A DC pension places the onus on an worker to each decide their very own funds and to make sure that they’ve an ample pension pot at retirement. Right this moment, it’s estimated that one in seven may have a shortfall at retirement. And with so few individuals presently taking monetary recommendation at retirement, Phoenix seems to be effectively positioned to capitalise.

I’m sorely tempted to purchase Phoenix for the dividend yield alone. Nonetheless, given I’m already closely invested in one other high-yielding rival, I don’t need my portfolio to be over uncovered to only one sector.

Picture supply: Getty Photos

There are solely a handful of shares within the FTSE 100 that gives a dividend yield north of 8% and Phoenix Group (LSE: PHNX) is one among them. However precisely how a lot might an investor flip a £10,000 funding in to?

Compounding returns

Compounding one’s returns is the key sauce that may supercharge a portfolio’s returns. Because the chart beneath highlights, reinvesting dividends alongside the best way would greater than double one’s cash in 10 years. That is considerably greater than the £18,600 ‘flat’ return with out compounding.

Chart generated by writer

However even this calculation isn’t strictly proper because it assumes there isn’t a share worth motion or change in dividend. As regards to the latter, during the last 10 years, the life insurer has raised its dividend from 40.8p per share to 54p, a rise of 32%.

Future dividends

The enterprise makes use of three monetary metrics as a foundation for figuring out future dividend will increase. These are working money technology (OCG), shareholder capital protection ratio, and the mum or dad firm distributable reserves. My favoured metric is to give attention to money technology, as it’s simpler to grasp.

On 8 September, at H1 outcomes, it reported a rise of 9% in OCG to £705m. This quantity greater than coated the dividend fee and different recurring makes use of (e.g., curiosity expense and working prices). At full-year outcomes, it’s guiding for complete extra money to be roughly £300m.

Accounting mismatch

One concern that spooked traders throughout its H1 outcomes (inflicting a 5% drop on the day) was a decline in statutory accounting (often called IFRS) shareholders’ fairness. On the floor, this might probably counsel issues sustaining the dividend.

Phoenix defined the decline because of an “accounting mismatch” between the stability sheets based mostly on IFRS and its most popular reporting technique, Solvency II.

One main distinction between the accounting requirements is the best way they deal with an funding contract, like an annuity. Beneath IFRS, such contracts are valued utilizing locked-in financial assumptions fastened at a particular time. Beneath Solvency II, nevertheless, they’re handled extra like capital, and consequently revalued at every stability sheet date.

Though fairly technical, such variations are extraordinarily essential. When adjusted for such variances, shareholders’ fairness got here in at £3.5bn, considerably greater than the £768m reported below IFRS.

Progress drivers

Personally, I’m sceptical when a enterprise deploys inventive accounting options to clarify away discrepancies within the stability sheet. Clearly, if IFRS shareholders’ fairness doesn’t develop within the medium time period, as administration expects, then the inventory might come below stress.

Placing this concern apart, the enterprise does have important development alternatives within the years forward. A shift from outlined profit (DB) to outlined contribution (DC) office pensions is one mega development.

A DC pension places the onus on an worker to each decide their very own funds and to make sure that they’ve an ample pension pot at retirement. Right this moment, it’s estimated that one in seven may have a shortfall at retirement. And with so few individuals presently taking monetary recommendation at retirement, Phoenix seems to be effectively positioned to capitalise.

I’m sorely tempted to purchase Phoenix for the dividend yield alone. Nonetheless, given I’m already closely invested in one other high-yielding rival, I don’t need my portfolio to be over uncovered to only one sector.