Stablecoin issuance is a profitable enterprise, and in 2025, Hyperliquid, a number one decentralized derivatives buying and selling platform producing not less than $400 billion in buying and selling quantity, is about to launch its platform-specific stablecoin. Whereas Circle’s USDC holds a bigger market share, powering well-liked buying and selling pairs like HYPE USDC, Hyperliquid believes a local stablecoin may funnel earnings to HYPE crypto holders.

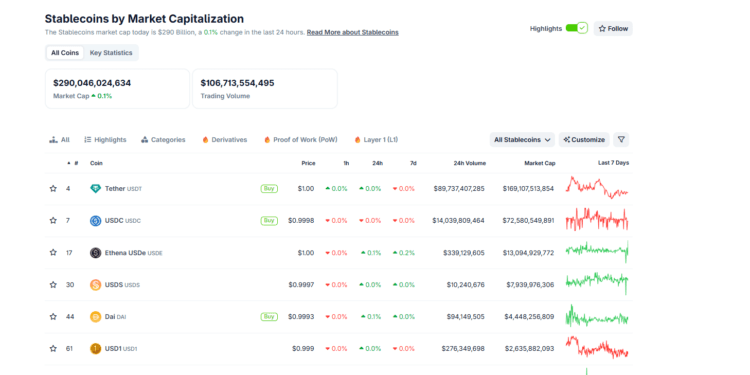

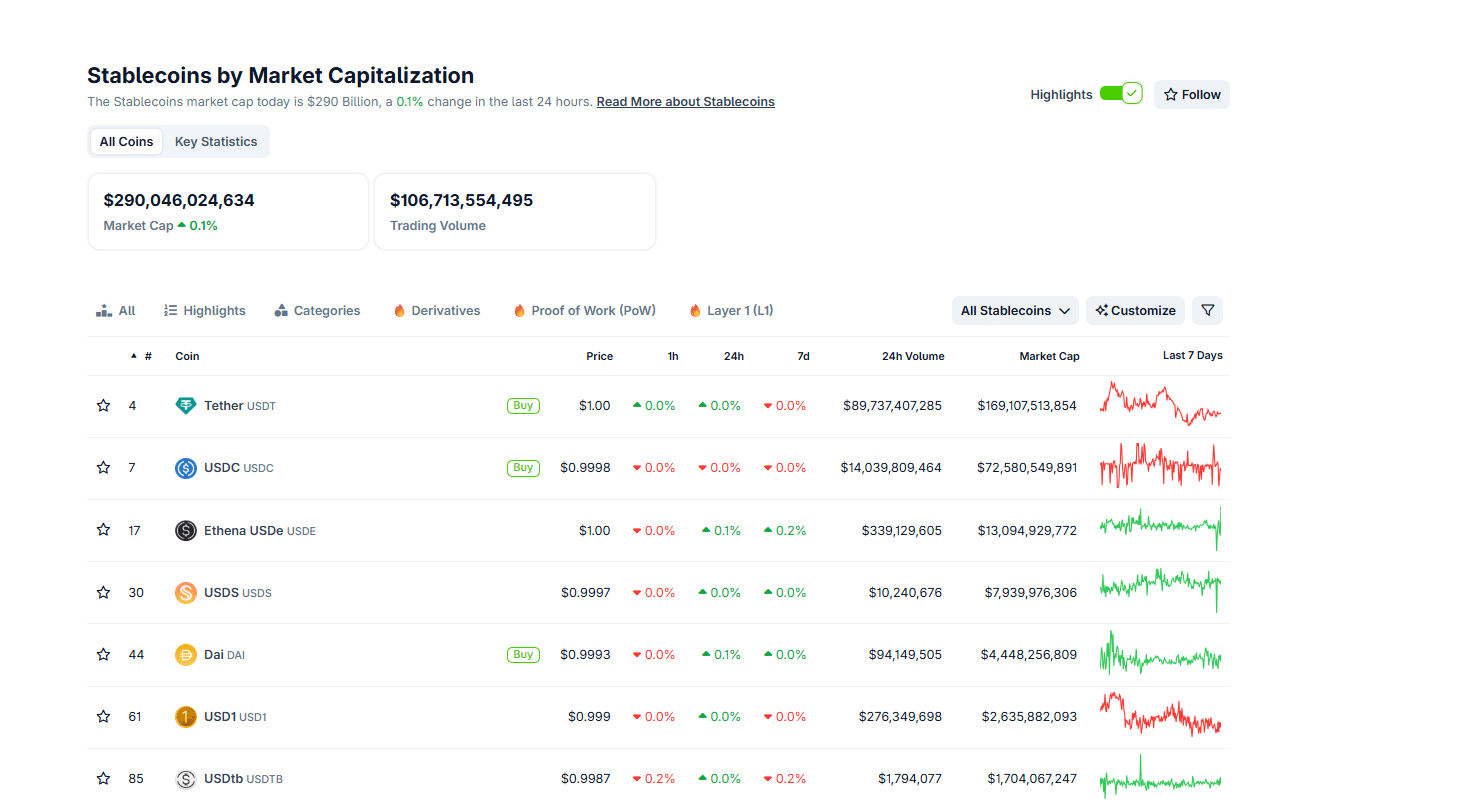

Based on Coingecko, the whole stablecoin market cap exceeds $290 billion. USDT leads, commanding practically 50% of the market with over $169 billion in circulation, totally on Tron and Ethereum. USDC, the second largest, has issued over $72 billion, with a serious presence on Solana and Hyperliquid.

(Supply: Coingecko)

As a consequence of its ease of redemption again to USD, USDC is the go-to stablecoin, powering Hyperliquid’s community-driven liquidity provision, enabling the platform to course of billions in month-to-month buying and selling quantity. Circle points USDC in compliance with U.S. laws, clarified additional by the GENIUS Act, which outlines necessities for stablecoin issuers monitoring the USD on main public chains.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in 2025

Hyperliquid Desires Its Stablecoin, Circle Has Different Plans

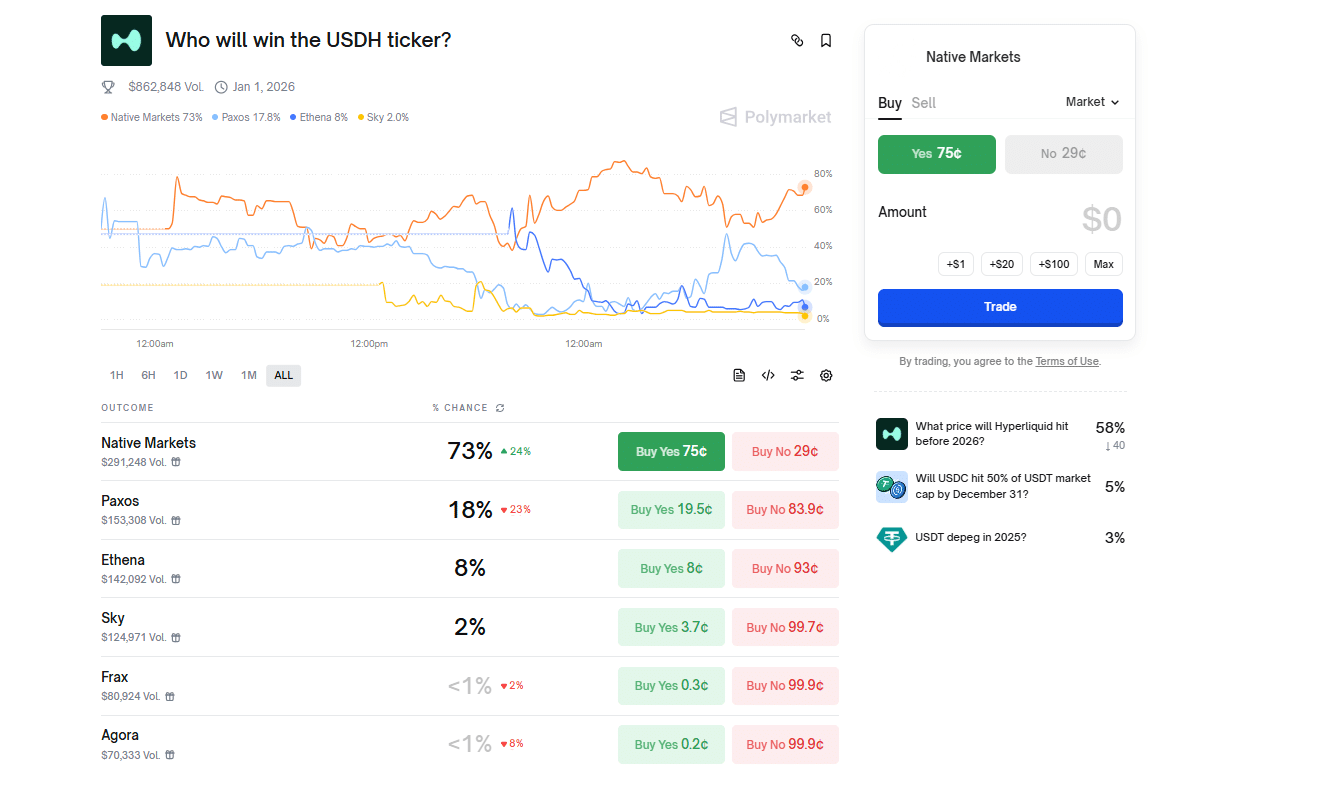

Since Circle, Tether, and different high stablecoin issuers generate billions in earnings, and a few of these tokens gasoline the Hyperliquid ecosystem, the perpetual change goals to redirect earnings to HYPE holders. To attain this, Hyperliquid plans to have a third-party situation for USDH. As of September 10, a number of bidders are competing, with Hyperliquid validators set to decide on the winner by September 14.

events embody Paxos, the group behind BUSD; Ethena, which just lately partnered with Binance for its USDe stablecoin; Sky, a serious participant in decentralized cash markets; Agora; Native Markets; and others. On Polymarket, punters assume Native Markets will situation USDH.

(Supply: Polymarket)

Circle, which dominates USDC buying and selling on Hyperliquid, shouldn’t be excited about issuing USDH however as an alternative plans to proceed with USDC. USDC powers 95% of Hyperliquid’s buying and selling pairs, enabling clean buying and selling of belongings like PUMP and HYPE. In a put up on X, Circle’s CEO, Jeremy Allaire, said they’ll interact the “HYPE ecosystem in an enormous manner” and “intend to be a serious participant and contributor to the ecosystem.”

Don’t Imagine the Hype

We’re coming to the HYPE ecosystem in an enormous manner. We intend to be a serious participant and contributor to the ecosystem.

Pleased to see others buy new USD tickers and compete

Hyper quick native USDC with deep and practically instantaneous cross chain…

— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) September 7, 2025

Agora, Paxos, Ethena, Sky, and Frax are all vying to situation USDH, providing to share reserve yields with the group to speed up HYPE buybacks or fund group growth.

Circle, nevertheless, goals to combine USDC natively into Hyperliquid’s layer-1, eliminating bridging prices from Arbitrum, whereas refusing to share earnings. Any try and divert income to Hyperliquid shall be consequential, immediately harming CIRCL shareholders.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Circle Fall? CIRCL Inventory Already Promoting Off

As such, how Circle will navigate the stablecoin scene in Hyperliquid stays unclear, particularly as validators put together to vote for a USDH issuer prepared to channel an enormous chunk of income again to HYPE holders.

If merchants instantly shift to USDH and purchase in anticipation of positive factors, Circle’s profitability may shrink quickly. This example may worsen, because the U.S. Federal Reserve is prone to reduce charges in September, lowering yields on Treasuries and bonds.

Regardless of Circle’s liquidity, regulatory compliance, and market cap benefits, USDC’s dominance on Hyperliquid may diminish, impacting CIRCL inventory.

(Supply: CIRCL, TradingView)

As of September 10, CIRCL inventory is down 60% from July highs, and with turbulence in Hyperliquid, the probability of CIRCL inventory falling under $100 has elevated.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

Hyperliquid USDH vs. Circle USDC: Will CIRCL Inventory Crash?

- Hyperliquid is organising for a local stablecoin, USDH

- Native Markets prone to be the following issuer

- Circle sticking to USDC

- Will CIRCL inventory crash under $100?

The put up Will Hyperliquid USDH Finish Circle and USDC? CIRCL Inventory Plummets appeared first on 99Bitcoins.