Key Takeaways

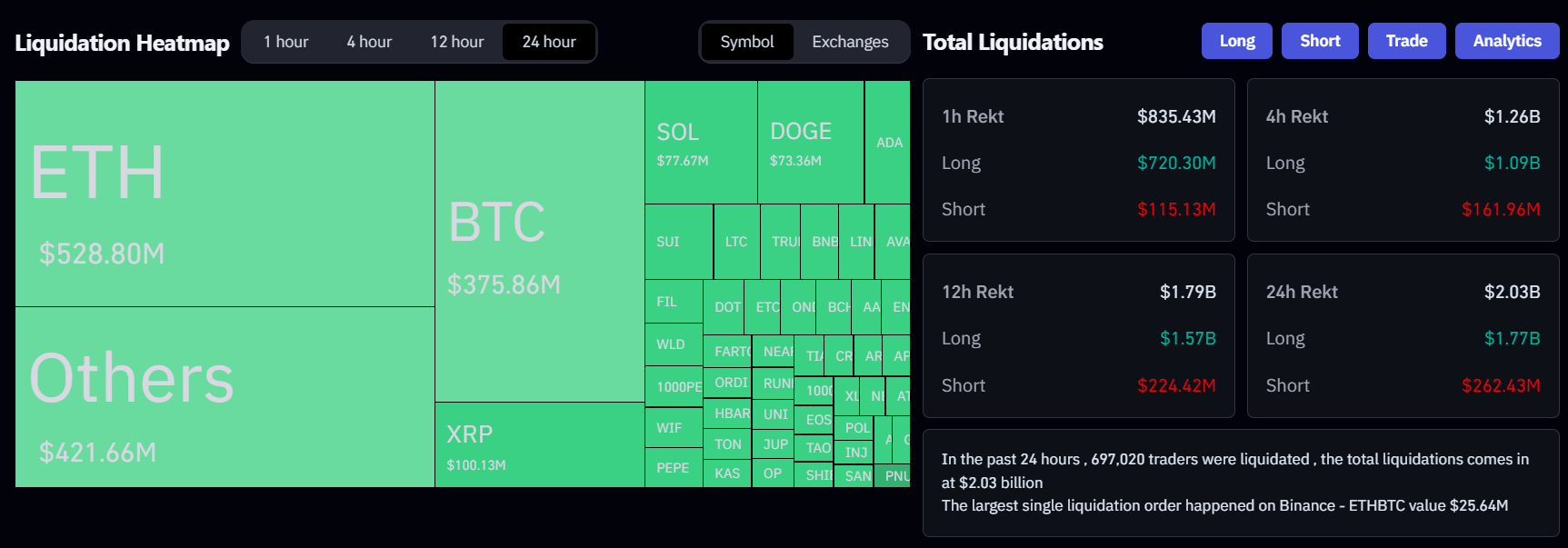

- Crypto crash worn out $2 billion in leverage liquidations within the final 24 hours.

- Regardless of the current decline, analysts recommend {that a} weaker greenback and decrease US charges may create favorable circumstances for Bitcoin adoption.

Crypto market liquidations surged to $2 billion as Bitcoin dropped to its lowest degree since early January, following President Trump’s announcement of recent tariffs that sparked inflation issues, in response to Coinglass knowledge.

Trump on Saturday introduced plans to impose a 25% tariff on imports from Canada and Mexico, together with a ten% tariff on Chinese language items. The measures, focusing on America’s three largest buying and selling companions, will take impact on Tuesday.

The President framed the tariffs as a part of a broader technique to deal with border safety and fight the opioid disaster, notably fentanyl trafficking.

Economists warn Trump’s new tariffs may enhance shopper prices as companies move on further bills.

Whereas the White Home maintains these measures will strengthen American manufacturing, specialists warning they might worsen inflation and doubtlessly set off a commerce battle affecting all nations concerned, resulting in job losses and provide chain disruptions.

The announcement of those tariffs has triggered volatility within the crypto market as buyers reacted to fears of mounting inflationary pressures.

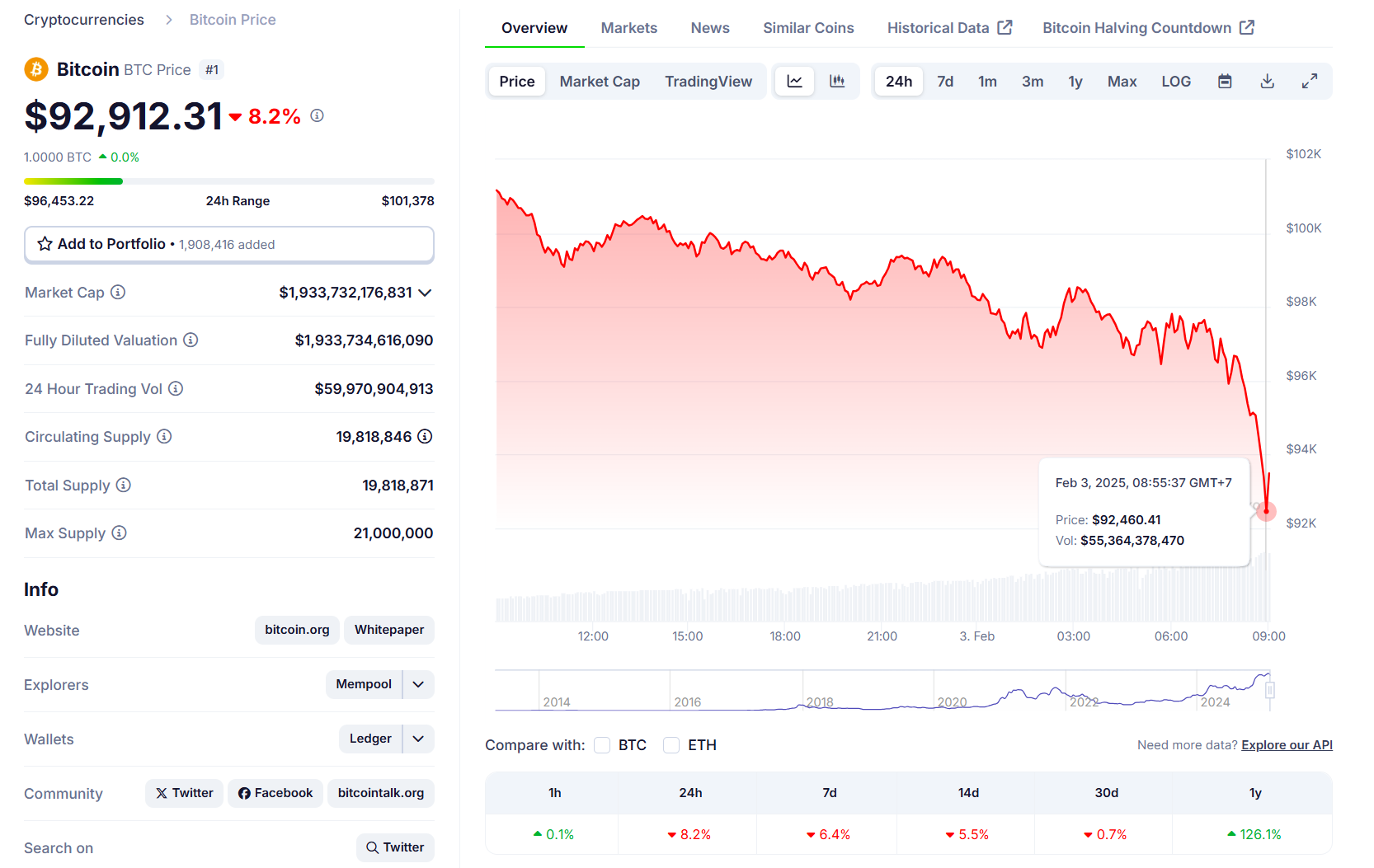

Bitcoin fell under $100,000 on Saturday and continued its decline to $92,000, whereas Ethereum dropped 24% to $2,300, in response to CoinGecko knowledge.

The market turbulence led to $1.7 billion in lengthy place liquidations over 24 hours, with Ethereum merchants experiencing $528 million in losses and Bitcoin merchants dealing with $421 million in liquidations, Coinglass knowledge reveals.

The general crypto market capitalization shrank by roughly 8%, with most crypto belongings recording double-digit losses inside a day. XRP and DOGE fell 30%, ADA declined 35%, whereas SOL and BNB every dropped 15%.

Trump’s tariffs will ship Bitcoin costs larger, quicker

Analysts imagine that Trump’s new tariffs may result in elevated demand for Bitcoin as a hedge towards inflation. But, many warning that ongoing market volatility might proceed to strain costs downward within the quick time period.

In line with Jeff Park, head of alpha methods at Bitwise Asset Administration, Trump’s tariff insurance policies may inadvertently set the stage for a Bitcoin increase.

That is the one factor you have to examine tariffs to perceive Bitcoin for 2025. That is undoubtedly my highest conviction macro commerce for the yr: Plaza Accord 2.0 is coming.

Bookmark this and revisit because the monetary struggle unravels sending Bitcoin violently larger. pic.twitter.com/WxMB36Yv8o

— Jeff Park (@dgt10011) February 2, 2025

The implementation of recent tariffs may weaken the greenback and create circumstances favorable for Bitcoin’s development, Park suggests. This comes because the US grapples with the Triffin Dilemma, the place its position as the worldwide reserve foreign money requires sustaining commerce deficits to supply worldwide liquidity.

The tariffs are considered as a strategic transfer to quickly weaken the greenback, doubtlessly resulting in a multilateral settlement just like “Plaza Accord 2.0” that would scale back greenback dominance and encourage international locations to diversify their reserves past US Treasuries.

The analyst signifies that the mix of a weaker greenback and decrease US charges may create favorable circumstances for Bitcoin adoption. As tariffs push inflation larger, affecting each home customers and worldwide commerce companions, international nations might face foreign money debasement, doubtlessly driving their residents towards Bitcoin instead retailer of worth.

Either side of the commerce imbalance will search refuge in Bitcoin, driving its worth “violently larger,” Park stated.