Be part of Our Telegram channel to remain updated on breaking information protection

The US Commodity Futures Buying and selling Fee (CFTC) has opened a path for some offshore crypto exchanges to re-enter the American market underneath its Overseas Board of Commerce (FBOT) framework, clearing the best way for corporations together with Binance and ByBit to service native buyers.

Performing CFTC Chair Caroline Pham stated in an Aug. 28 assertion that the transfer “gives the regulatory readability wanted to legally onshore buying and selling exercise” after what she known as an period of “unprecedented regulation by enforcement.”

She added that US merchants will as soon as once more have “alternative and entry to the deepest and most liquid world markets” in digital property.

Pham additionally welcomed again American firms that have been compelled to arrange store abroad.

“Beginning now, the CFTC welcomes again People that wish to commerce effectively and safely underneath CFTC rules, and opens up US markets to the remainder of the world,” she stated. “It’s simply one other instance of how the CFTC will proceed to ship wins for President Trump as a part of our crypto dash.”

New CFTC Pathway May Lead To Buying and selling Quantity Increase For Binance And Different Exchanges

Over the previous few years, offshore exchanges have been “pushed out of america,” Pham stated. This has compelled change platforms, corresponding to Binance, to discover different avenues to achieve entry to the US market.

The change ended up servicing US merchants by way of a separate entity known as Binance.US, a platform that’s nonetheless not accessible in all states.

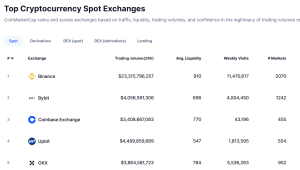

Whatever the restrictions, Binance stays the biggest crypto change platform on the planet when it comes to buying and selling quantity. Information from CoinMarketCap reveals the change’s 24-hour volumes are at present above $23 billion.

High crypto exchanges by buying and selling quantity (Supply: CoinMarketCap)

The subsequent greatest crypto change by buying and selling quantity is ByBit, one other off-shore platform with greater than $4 billion in 24-hour buying and selling quantity.

ByBit was blocked from working within the US again in 2021 on account of regulatory points that included inadequate KYC procedures.

The CFTC’s new pathway will handle the restrictions that these platforms and others have needed to cope with over the previous few years. This might probably result in elevated volumes on fashionable exchanges which can be headquartered outdoors of the US, particularly because the Donald Trump Administration forges forward with its pro-crypto coverage.

CFTC Performing On Professional-Crypto Steering From The White Home

Throughout his election marketing campaign final yr, Trump made a sequence of guarantees to the crypto group, which was dealing with a regulatory onslaught from rhe US Securities and Trade Fee (SEC) and its former Chair, Gary Gensler.

Since taking the White Home in January, Trump has began delivering on a number of of his guarantees. In the identical month as his inauguration, the US President signed an govt order endorsing the “accountable progress and use of digital property, blockchain know-how, and associated applied sciences.”

Congress additionally handed the GENIUS Stablecoin Act, a key invoice that establishes the rules for stablecoin issuers within the US. Many have seen the transfer as a step in the proper course in direction of giving the Web3 business the regulatory readability it has been asking for through the years.

The Trump Administration additionally dismantled a crypto enforcement unit inside the US Justice Division, in addition to eased enforcement and appointed extra crypto-friendly management throughout quite a few regulatory companies, together with the SEC.

The SEC’s Crypto Activity Pressure is hitting the street and internet hosting a sequence of roundtables throughout the nation to supply alternatives for extra stakeholders to supply suggestions and to listen to from representatives of crypto-related initiatives.

Particulars 👉https://t.co/AIj4oFvUQV pic.twitter.com/hbB9T9EDyH

— U.S. Securities and Trade Fee (@SECGov) August 22, 2025

In July, the President’s crypto working group additionally launched a report laying out a roadmap for Trump’s mission to make the US the “crypto capital of the world.”

A complete of 18 suggestions have been made to the CFTC, two of that are involved with the company instantly. The remaining suggestions regarding the CFTC concerned different companies such because the SEC and US Treasury.

That led to the CFTC launching an aggressive “Crypto Dash” initiative in the beginning of the month, which acts on the steering acquired from the White Home.

The initiative has two phases and is designed to quickly roll out guidelines for cryptos and different digital property. As a part of the initiative, the CFTC moved ahead to permit spot buying and selling of digital property on registered futures exchanges, and lately began “stakeholder engagement” on all the suggestions made within the White Home’s report.

“The Trump Administration has ushered in a brand new daybreak for crypto, and it’s as much as market members to grab this chance to be part of the Golden Age of innovation,” Pham stated in an Aug. 21 assertion.

“Underneath President Trump’s robust management and imaginative and prescient, the CFTC is full pace forward on enabling quick buying and selling of digital property on the Federal degree in coordination with the SEC’s Mission Crypto,” Pham added.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection