Chainlink’s partnership with Japanese SBI is all around the headlines At this time. Buyers are majorly excited as these two begin working collectively, particularly as this collaboration not solely feeds into Chainlink’s use case but additionally spreads crypto consciousness amongst non-crypto natives, opening up recent liquidity. The LINK value chart can be trying excellent from a technical evaluation viewpoint.

BREAKING

Strategic partnership between Chainlink and SBI Group one in every of Japan’s largest monetary conglomerates with the USD equal of over $200 billion in complete belongings. pic.twitter.com/H8MpF3eX2C

— Quinten | 048.eth (@QuintenFrancois) August 25, 2025

200 Billion USD! What does that imply? Is SBI shopping for 200 billion price of LINK?

That is an institutional partnership. SBI Group is one in every of Japan’s most vital monetary conglomerates and has been a dominant supplier of internet-based monetary providers for the reason that late Nineties.

Now, in gentle of current successes surrounding the expansion of company crypto reserves, it needs to develop its digital foreign money portfolio. To do this, it would use Chainlink’s know-how.

What does the Chainlink know-how do? It facilitates cross-chain tokenization of belongings, cross-border funds, and compliance-focused transactions, decreasing prices. It offers on-chain internet asset worth information to enhance automation and effectivity. This ensures transparency and belief for regulated stablecoins in an institutional setting.

DISCOVER: Greatest Meme Coin ICOs to Put money into 2025

I do know it is a lot of data all of sudden. However I hope it provides a transparent image of how a lot Chainlink is definitely doing and the sturdy fundamentals they’ve constructed to change into the spine of institutional adoption.

ChainLink Value Evaluation: What Does the LINK Value Chart Say?

(LINKUSD)

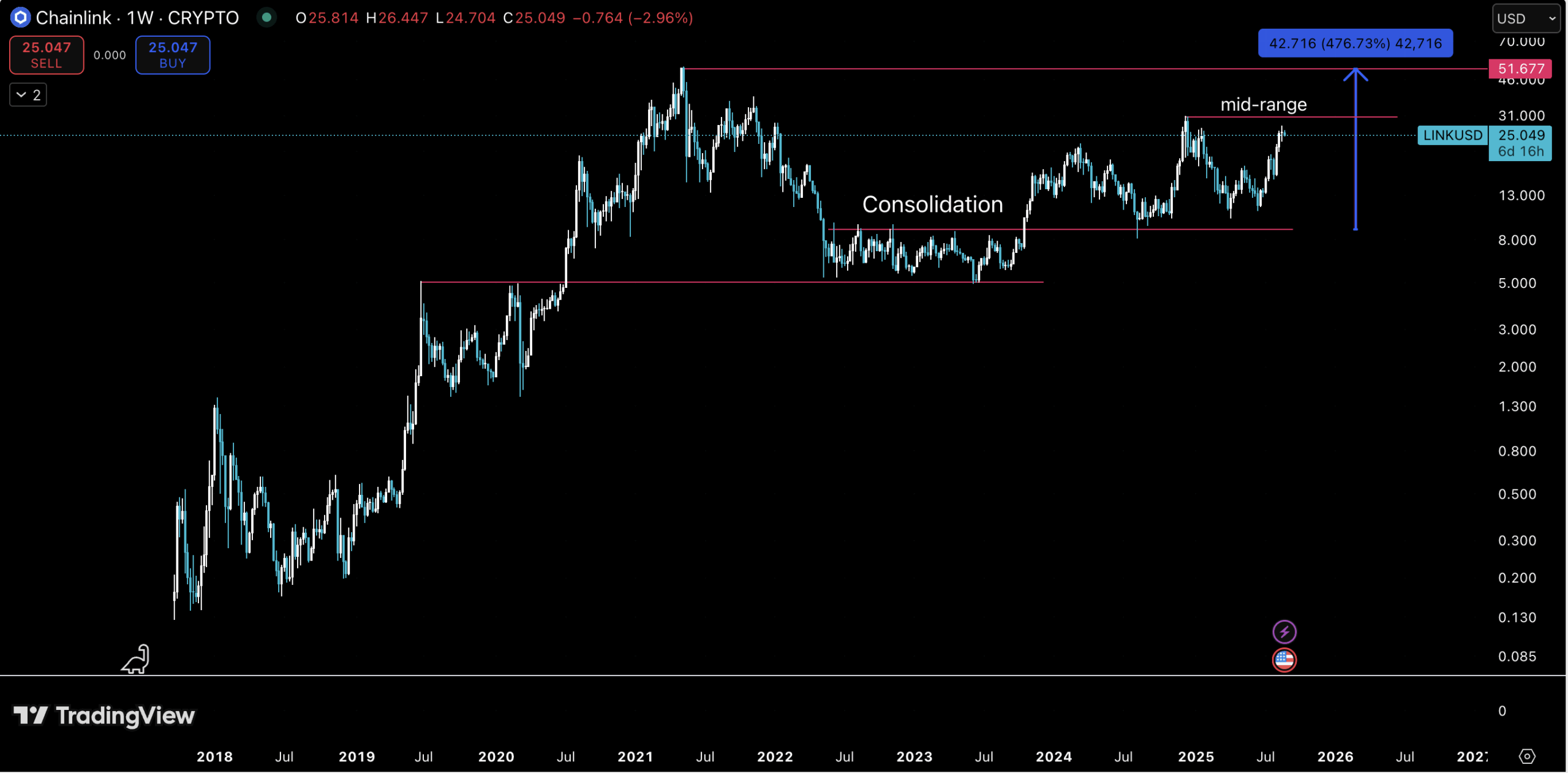

Allow us to start with a better timeframe, such because the 1W chart. Right here we see the value historical past from the undertaking’s inception. We see a transparent consolidation from Could 2022 till October 2023 that examined 2019’s highs.

Then, in late 2023, Chainlink’s value broke above the consolidation vary into one other one, under mid-range. The subsequent break above ought to lead us to the earlier ATH and shortly after, above it.

DISCOVER: High Solana Meme Cash to Purchase in 2025

(LINKUSD)

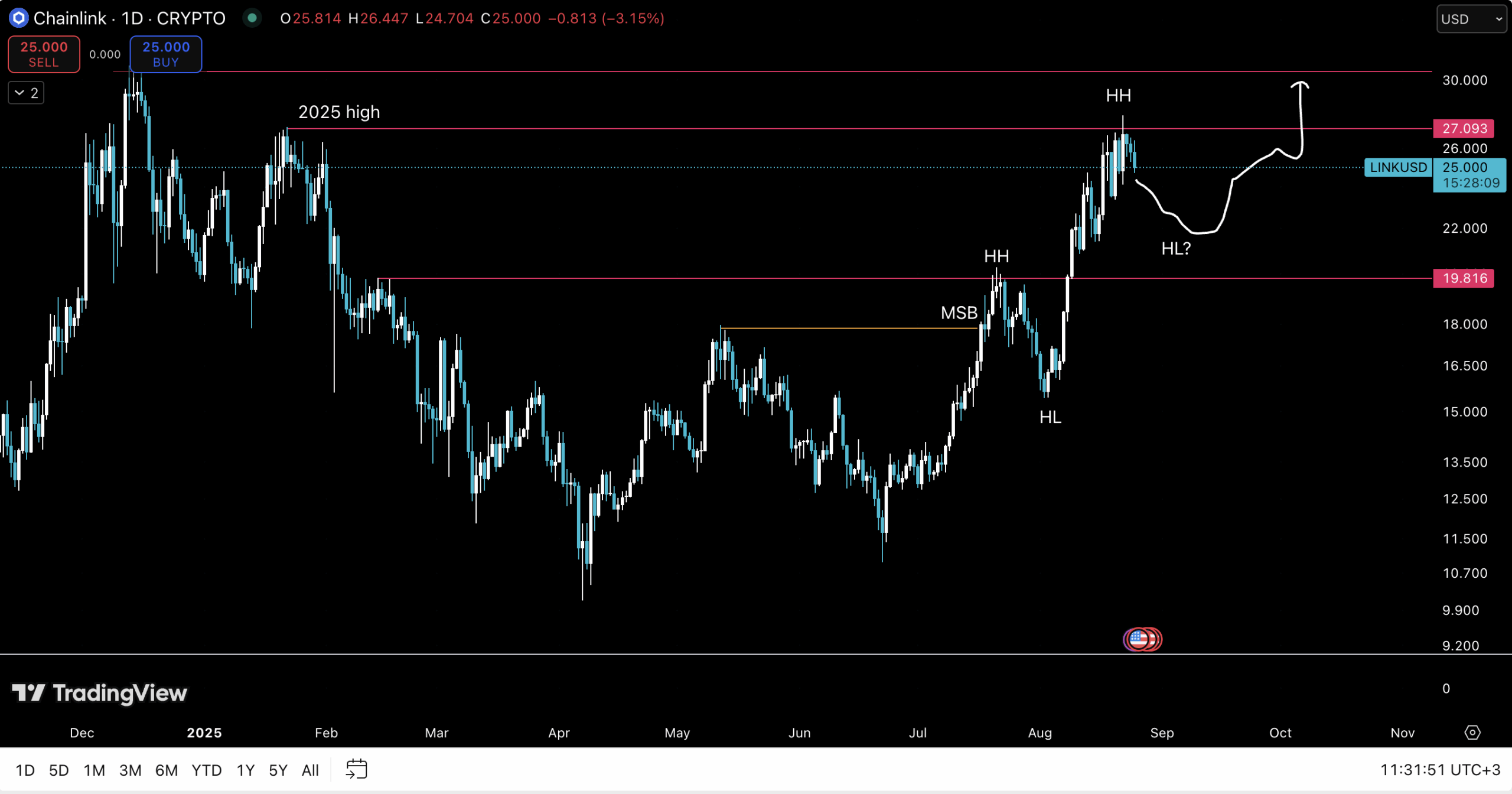

The subsequent and remaining chart would be the 1D chart. It’s not good to get chopped up on decrease timeframes throughout unstable intervals. Yesterday was an important instance of why it’s price ready and never going all in when the LINK value is between key ranges.

From this chart, we see that our subsequent stage to beat is the 2025 excessive. Final week, there was a transparent rejection. There’s a lovely bullish development that began in July. For lengthy entries, I’d wait to see a better low shaped.

DISCOVER: High 20 Crypto to Purchase in 2025

Cancel out the noise and hype vibes. Defend your capital always. That’s the one technique to keep and commerce profitably in the long term.

Completely satisfied buying and selling!

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Replace

ChainLink Value Run Quickly: Main Partnership With SBI Group

- Weekly chart exhibits gradual and regular advance in direction of ATH

- Good consolidation intervals – clearly outlined

- 1D chart exhibits anticipated rejection at 2025 excessive, searching for decrease excessive to kind

- Sturdy fundamentals of the undertaking total and institutional partnerships

The publish ChainLink Value Run Quickly: Main Partnership With SBI Group Units Stage appeared first on 99Bitcoins.

BREAKING

BREAKING