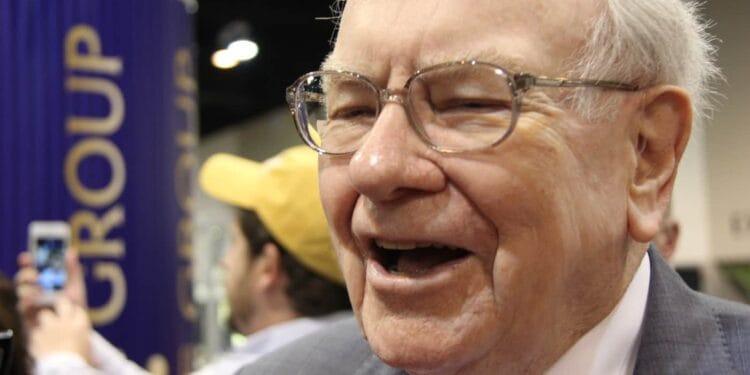

Picture supply: The Motley Idiot

In line with Warren Buffett, the primary rule of investing is to not lose cash. However his funding automobile, Berkshire Hathaway (NYSE:BRK.B), simply recorded a $3.8bn write-down within the worth of one in all its investments.

It’s truthful to say the corporate’s funding in Kraft Heinz hasn’t been one in all its most profitable ventures. However – as typical – Buffett’s one step forward.

Kraft Heinz

In its Q2 earnings replace, Berkshire registered that $3.8bn write-down in worth and, because of this, the agency reported a decline in internet earnings in comparison with the earlier 12 months.

The write-down displays a mix of the change within the Kraft Heinz share worth and the agency’s monetary outlook. However except one thing occurs sooner or later, the impairment’s everlasting. Kraft Heinz is present process a strategic evaluate, which could contain separating its condiment unit from its grocery division. That is not often an indication of a enterprise that’s firing on all cylinders.

Berkshire has additionally relinquished its seats on the corporate’s board, which additionally isn’t an excellent signal. However regardless of all of this, Buffett’s funding hasn’t precisely been a catastrophe.

Funding construction

His funding within the enterprise isn’t the sort of deal odd retail traders can do. As a part of its preliminary funding, Berkshire obtained $4.25bn in most well-liked shares with a 9% dividend yield. These returned $1.3bn in money earlier than being redeemed (for $4.25bn) in 2015. Which means Berkshire acquired over half of its preliminary funding again from this alone.

As well as, the frequent shares Buffett’s firm acquired have distributed $6.3bn in dividends and the remaining stake has a market worth of $8.8bn. That means a complete acquire of over 100%.

The general return is first rate, however the secret’s the construction of the deal. Getting over half of the preliminary stake again by way of most well-liked shares and dividends significantly reduces the possibilities of dropping cash.

Berkshire Hathaway

Berkshire Hathaway’s enormous money reserves generally is a drag on development when issues are going effectively. However it places the agency ready to take benefit when unusually good alternatives come up.

The possibility ot make an funding like Buffett’s one in Kraft Heinz isn’t one thing that comes round fairly often. And it additionally isn’t out there to most traders.

It’s solely attainable for corporations with uncommon monetary power – akin to Berkshire Hathaway. And as I see it, that’s an enormous a part of what investing’s about.

After I make investments, I search for companies which have alternatives to generate higher returns than I can handle on my own. That’s why Berkshire Hathaway’s my largest inventory funding.

A shopping for alternative?

Since Buffett introduced his retirement, Berkshire Hathaway shares have fallen round 10%. And that is sensible – the agency’s dropping an uncommonly expert CEO.

I believe nevertheless, that one in all Berkshire’s different key belongings – its steadiness sheet – continues to be firmly intact. So I count on it to be in a powerful place to benefit from alternatives for a while.

I’m seeking to purchase the shares at a price-to-book (P/B) ratio of round 1.5. The inventory’s a little bit above that in the meanwhile, however I’m preparing because it will get nearer to that degree.

Picture supply: The Motley Idiot

In line with Warren Buffett, the primary rule of investing is to not lose cash. However his funding automobile, Berkshire Hathaway (NYSE:BRK.B), simply recorded a $3.8bn write-down within the worth of one in all its investments.

It’s truthful to say the corporate’s funding in Kraft Heinz hasn’t been one in all its most profitable ventures. However – as typical – Buffett’s one step forward.

Kraft Heinz

In its Q2 earnings replace, Berkshire registered that $3.8bn write-down in worth and, because of this, the agency reported a decline in internet earnings in comparison with the earlier 12 months.

The write-down displays a mix of the change within the Kraft Heinz share worth and the agency’s monetary outlook. However except one thing occurs sooner or later, the impairment’s everlasting. Kraft Heinz is present process a strategic evaluate, which could contain separating its condiment unit from its grocery division. That is not often an indication of a enterprise that’s firing on all cylinders.

Berkshire has additionally relinquished its seats on the corporate’s board, which additionally isn’t an excellent signal. However regardless of all of this, Buffett’s funding hasn’t precisely been a catastrophe.

Funding construction

His funding within the enterprise isn’t the sort of deal odd retail traders can do. As a part of its preliminary funding, Berkshire obtained $4.25bn in most well-liked shares with a 9% dividend yield. These returned $1.3bn in money earlier than being redeemed (for $4.25bn) in 2015. Which means Berkshire acquired over half of its preliminary funding again from this alone.

As well as, the frequent shares Buffett’s firm acquired have distributed $6.3bn in dividends and the remaining stake has a market worth of $8.8bn. That means a complete acquire of over 100%.

The general return is first rate, however the secret’s the construction of the deal. Getting over half of the preliminary stake again by way of most well-liked shares and dividends significantly reduces the possibilities of dropping cash.

Berkshire Hathaway

Berkshire Hathaway’s enormous money reserves generally is a drag on development when issues are going effectively. However it places the agency ready to take benefit when unusually good alternatives come up.

The possibility ot make an funding like Buffett’s one in Kraft Heinz isn’t one thing that comes round fairly often. And it additionally isn’t out there to most traders.

It’s solely attainable for corporations with uncommon monetary power – akin to Berkshire Hathaway. And as I see it, that’s an enormous a part of what investing’s about.

After I make investments, I search for companies which have alternatives to generate higher returns than I can handle on my own. That’s why Berkshire Hathaway’s my largest inventory funding.

A shopping for alternative?

Since Buffett introduced his retirement, Berkshire Hathaway shares have fallen round 10%. And that is sensible – the agency’s dropping an uncommonly expert CEO.

I believe nevertheless, that one in all Berkshire’s different key belongings – its steadiness sheet – continues to be firmly intact. So I count on it to be in a powerful place to benefit from alternatives for a while.

I’m seeking to purchase the shares at a price-to-book (P/B) ratio of round 1.5. The inventory’s a little bit above that in the meanwhile, however I’m preparing because it will get nearer to that degree.