The dialog round cryptocurrency in the USA seems to be getting into a brand new part as key laws positive aspects traction in Congress. In response to Bitwise Chief Funding Officer Matt Hougan, the passage of a number of pro-crypto payments beneath dialogue in Washington may have lasting implications for the market.

In a observe to shoppers, Hougan emphasised the long-term structural shift underway, stating that when these payments cross, “you possibly can’t put the genie again within the bottle.”

The legislative push, dubbed “Crypto Week” by Hougan, follows a declaration by the US Home of Representatives to advance three main items of digital currency-focused laws.

These embody the GENIUS Act, which goals to ascertain a regulatory framework for stablecoins; the CLARITY Act, designed to control broader digital forex belongings; and the Anti-CBDC Surveillance State Act, which might prohibit the introduction of a US central financial institution digital forex (CBDC). The GENIUS Act has already cleared the Senate, putting it a step nearer to changing into regulation.

Legislative Readability May Cut back Structural Danger in Crypto

Hougan argues that regulatory readability may play a pivotal function in decreasing systemic threat throughout the digital asset trade. He famous that most of the high-profile failures within the digital forex house, together with FTX, Terra (Luna), Celsius, and Mt. Gox, had been enabled by a lack of oversight.

Within the absence of outlined guidelines, offshore platforms with insufficient inner controls and auditing had been in a position to thrive, leading to vital losses for customers.

He contends that correct laws may have prevented such failures. “If clear rules had allowed safer variations of those providers to exist within the US, most of the historic blow-ups won’t have occurred,” Hougan said.

Regulatory pointers, in accordance with the observe, may additionally facilitate entry for conventional monetary establishments, permitting for crypto custody and providers via acquainted, regulated channels. That shift may enhance investor confidence and probably restrict the frequency and severity of market drawdowns.

Hougan additionally believes that the passage of those payments may diminish the chance of future excessive value crashes. Whereas Bitcoin stays one of many best-performing belongings over the past 15 years, its historical past contains a number of drawdowns exceeding 70%. Hougan argues that enhanced regulation may restrict the affect of unpredictable occasions that set off such volatility.

Bipartisan Help and Institutional Purchase-In Sign Lasting Momentum

Whereas some could query whether or not future administrations may reverse pro-crypto momentum, Hougan stays unconcerned. He identified that help for laws just like the GENIUS Act has been bipartisan, passing the Senate 68-30 with vital backing from each Democrats and Republicans.

He attributes this cross-party alignment not solely to generational voter pursuits but in addition to Wall Avenue’s rising involvement in crypto.

In response to Hougan, as monetary establishments like BlackRock, JPMorgan, and Morgan Stanley increase their crypto operations, the chance of political reversal diminishes. “As a broader array of buyers and corporations turns into concerned in crypto, will probably be more and more troublesome for politicians to align in opposition to it,” he stated.

Ought to these legislative efforts succeed, Hougan concludes that crypto is positioned to transition additional into the mainstream. With clearer guidelines, diminished threat, and rising institutional help, the digital asset market could also be getting into a brand new period of progress and maturity.

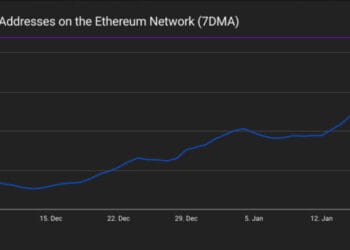

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

The dialog round cryptocurrency in the USA seems to be getting into a brand new part as key laws positive aspects traction in Congress. In response to Bitwise Chief Funding Officer Matt Hougan, the passage of a number of pro-crypto payments beneath dialogue in Washington may have lasting implications for the market.

In a observe to shoppers, Hougan emphasised the long-term structural shift underway, stating that when these payments cross, “you possibly can’t put the genie again within the bottle.”

The legislative push, dubbed “Crypto Week” by Hougan, follows a declaration by the US Home of Representatives to advance three main items of digital currency-focused laws.

These embody the GENIUS Act, which goals to ascertain a regulatory framework for stablecoins; the CLARITY Act, designed to control broader digital forex belongings; and the Anti-CBDC Surveillance State Act, which might prohibit the introduction of a US central financial institution digital forex (CBDC). The GENIUS Act has already cleared the Senate, putting it a step nearer to changing into regulation.

Legislative Readability May Cut back Structural Danger in Crypto

Hougan argues that regulatory readability may play a pivotal function in decreasing systemic threat throughout the digital asset trade. He famous that most of the high-profile failures within the digital forex house, together with FTX, Terra (Luna), Celsius, and Mt. Gox, had been enabled by a lack of oversight.

Within the absence of outlined guidelines, offshore platforms with insufficient inner controls and auditing had been in a position to thrive, leading to vital losses for customers.

He contends that correct laws may have prevented such failures. “If clear rules had allowed safer variations of those providers to exist within the US, most of the historic blow-ups won’t have occurred,” Hougan said.

Regulatory pointers, in accordance with the observe, may additionally facilitate entry for conventional monetary establishments, permitting for crypto custody and providers via acquainted, regulated channels. That shift may enhance investor confidence and probably restrict the frequency and severity of market drawdowns.

Hougan additionally believes that the passage of those payments may diminish the chance of future excessive value crashes. Whereas Bitcoin stays one of many best-performing belongings over the past 15 years, its historical past contains a number of drawdowns exceeding 70%. Hougan argues that enhanced regulation may restrict the affect of unpredictable occasions that set off such volatility.

Bipartisan Help and Institutional Purchase-In Sign Lasting Momentum

Whereas some could query whether or not future administrations may reverse pro-crypto momentum, Hougan stays unconcerned. He identified that help for laws just like the GENIUS Act has been bipartisan, passing the Senate 68-30 with vital backing from each Democrats and Republicans.

He attributes this cross-party alignment not solely to generational voter pursuits but in addition to Wall Avenue’s rising involvement in crypto.

In response to Hougan, as monetary establishments like BlackRock, JPMorgan, and Morgan Stanley increase their crypto operations, the chance of political reversal diminishes. “As a broader array of buyers and corporations turns into concerned in crypto, will probably be more and more troublesome for politicians to align in opposition to it,” he stated.

Ought to these legislative efforts succeed, Hougan concludes that crypto is positioned to transition additional into the mainstream. With clearer guidelines, diminished threat, and rising institutional help, the digital asset market could also be getting into a brand new period of progress and maturity.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.