- A current tutorial analysis has referenced Morgan Stanley’s assertion on the function of Ripple in lowering the settlement interval in cross-border funds whereas growing transaction pace.

- JPMorgan has additionally highlighted prior to now that Ripple, SWIFT, and the CLS Group are considerably addressing the challenges of cross-border funds.

The function of Ripple (XRP) and its effort in redefining international fee has been acknowledged by funding banking heavyweight Morgan Stanley, describing it as an alternative choice to SWIFT. In keeping with studies, Morgan’s assertion on XRP was made in a doc titled “Blockchain in Banking: Disruptive Risk or Instrument?”.

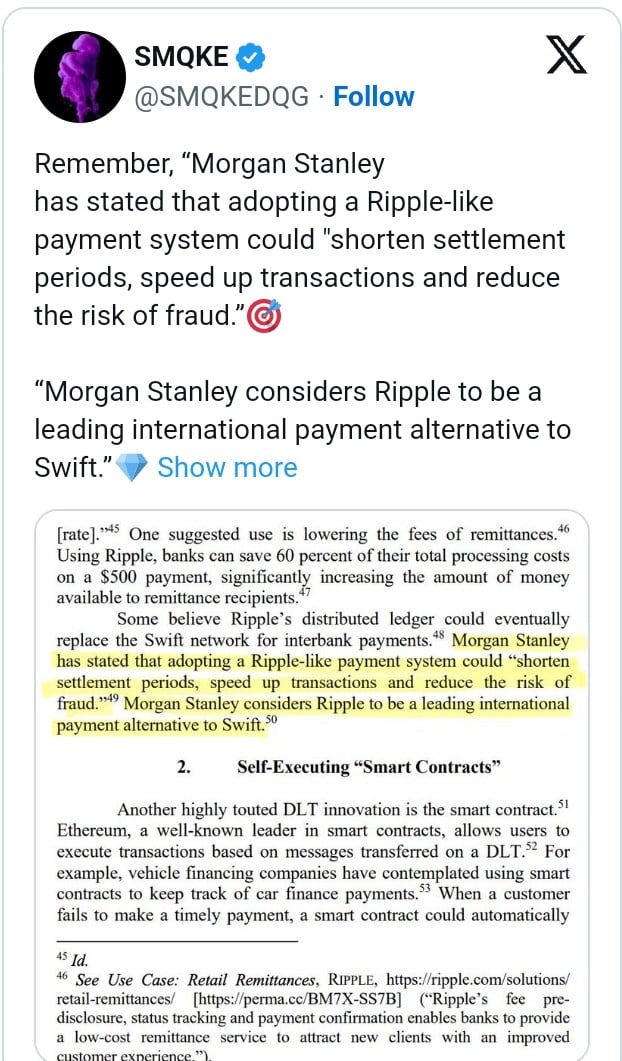

Reviewing a portion of Boston College’s tutorial doc on the Assessment of Banking & Monetary Legislation, shared by a crypto researcher, SMQKE, we discovered that banks that undertake Ripple may save about 60% of their complete processing prices on a $500 fee. The doc additionally cited an announcement from Morgan Stanley, highlighting that “adopting a Ripple-like fee system may considerably cut back settlement occasions, whereas lowering the danger of fraud and dashing up transactions.”

Other than Morgan Stanley, Ripple has additionally earned a notable point out in analysis studies of main establishments, with a current one coming from JPMorgan.

JPMorgan’s Place on Ripple (XRP)

JPMorgan believes that personal entities like Ripple, SWIFT, and the CLS Group have made a number of jaw-dropping initiatives and groundbreaking strikes to deal with the challenges of cross-border funds, particularly, settlement and delays. The financial institution additionally recognized an annual lack of $120 billion from inefficiencies within the cross-border funds. In the meantime, multinational firms are reported to maneuver about $23.5 trillion yearly.

In keeping with JPMorgan, Ripple makes use of a real-time cross-border fee infrastructure that utilises XRP for settlement. In the meantime, it cited the unstable nature of the token as a limitation to banks’ adoption.

Excessive volatility of XRP results in restricted willingness from banks to make use of it to facilitate funds. We’re but to see a scalable and seamless resolution that may work throughout international locations, currencies, and fee programs.

Previous to this report, the US Federal Reserve had additionally disclosed in a doc that it may combine the Ripple community to spice up its FedNow fee system. As detailed in our earlier weblog submit, Ripple was reported to have ties with the Fed alongside 26 different licensed service suppliers.

As additionally highlighted in our earlier dialogue, an analyst recognized as “All Issues XRP” believes that Ripple seeks to solidify its identify by dominating fee, launching its stablecoin rails, and making XRP the default bridge.

Amidst the backdrop of this, XRP is slowly climbing up the worth curve because it presently trades at $2.2 after printing 3% positive factors on the every day chart. Within the final 30 days, the asset has additionally surged by 13%, with the buying and selling quantity rising by a staggering 123% to $4.84 billion. In keeping with our current evaluation, the asset has proven power to stage a bullish reversal to $15.

Really helpful for you: