It appears some time in the past already that Tesla (NASDAQ: TSLA) was a darling progress inventory, with a market capitalisation properly north of a trillion {dollars}. Tesla inventory has now misplaced over half its worth from the excessive level it hit over the previous 12 months. It has crashed 42% because the starting of the 12 months.

Nevertheless, that also places it 37% greater than only one 12 months in the past – and 729% up over a five-year interval.

Again in 2020, Tesla was buying and selling under $100 a share.

Might it get down there once more – and in that case, ought I to purchase some for my portfolio?

Tesla’s progress has been phenomenal – however it might be over

A big a part of what has spurred the Tesla inventory worth has been its excellent progress story.

This has not merely been a prospect dangled in entrance of traders – it has been a large-scale enterprise actuality.

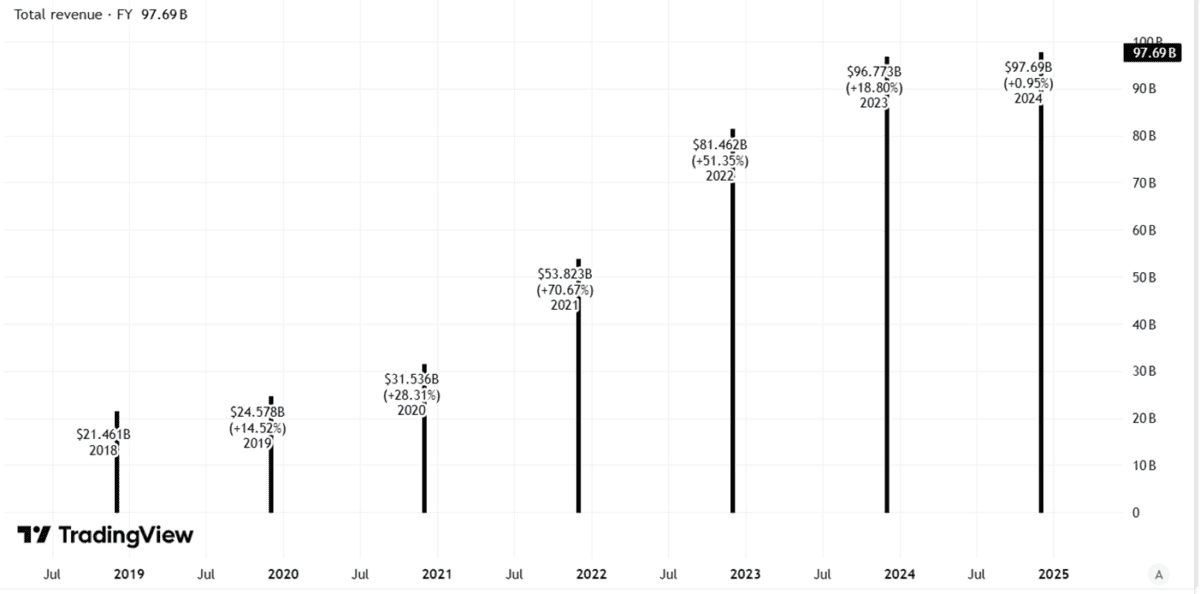

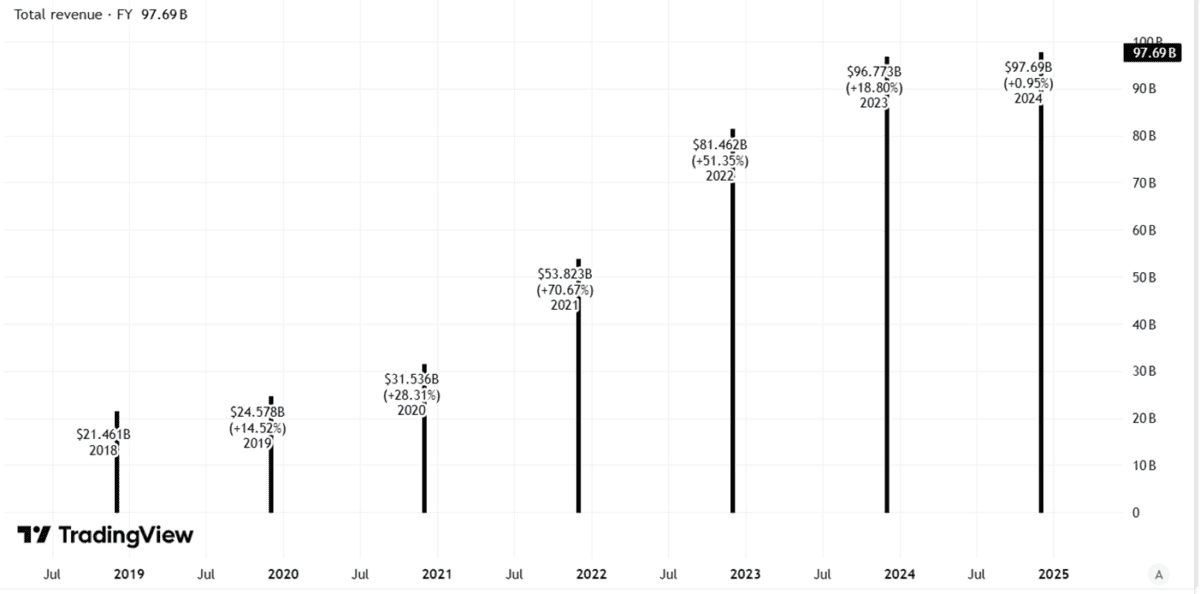

Take a look at the corporate’s revenues, for instance.

Created utilizing TradingView

It has near quadrupled since 2020, from a excessive base.

However final 12 months’s progress of barely 1% was a step change in comparison with the prior years. It was additionally the primary 12 months when deliveries of Tesla automobiles declined quite than grew.

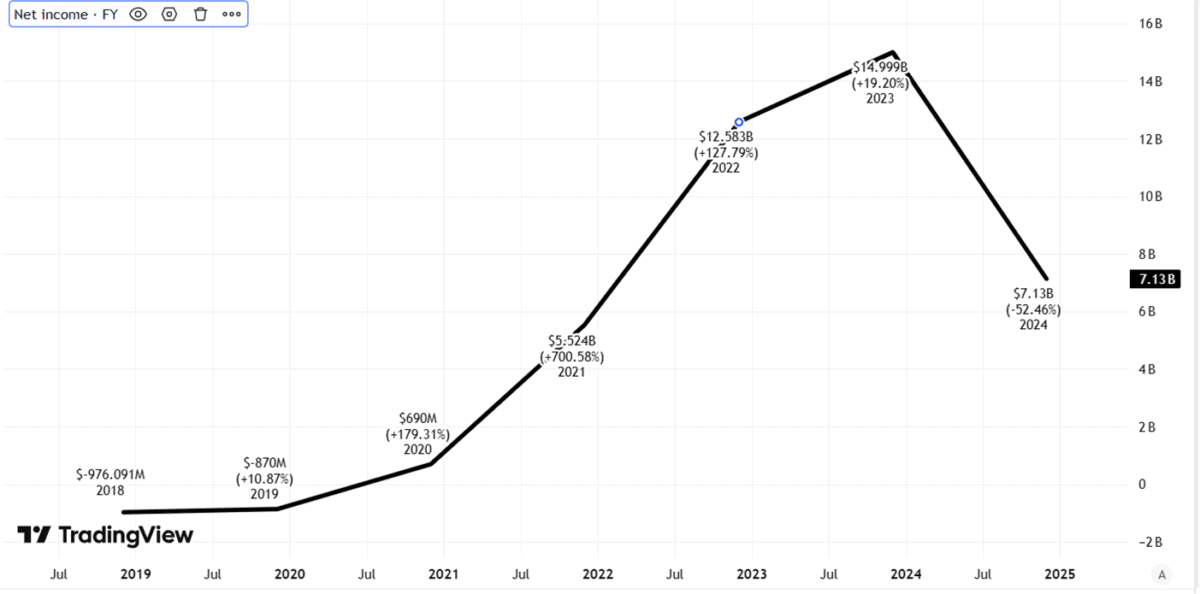

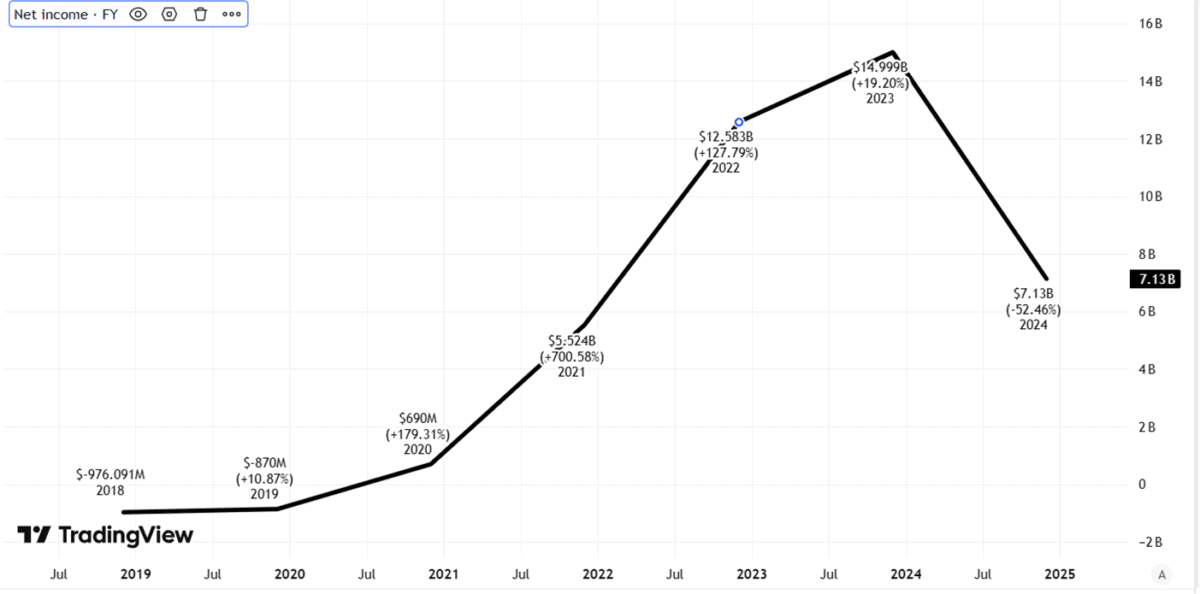

What about revenue?

Final 12 months web earnings was a beefy $7bn. However not solely was that lower than half the earlier 12 months’s quantity, it additionally represented an inflection level, because the chart turned from a few years of progress to contraction.

Created utilizing TradingView

There might be worse to come back. An more and more aggressive electrical automobile market might damage each gross sales volumes and revenue margins. Add to that the potential affect of Tesla boss Elon Musk’s high-profile political actions and I see a threat that Tesla will report falling gross sales revenues and weaker income this 12 months.

That doesn’t imply it isn’t nonetheless a strong enterprise. However Tesla inventory soared as a result of traders beloved the expansion story. If that progress story is over, it might be unhealthy information for the share worth.

Tesla appears to be like badly overvalued to me

For the time being, the corporate trades on a price-to-earnings (P/E) ratio of 116. That appears very costly to me.

If it was to fall according to the S&P 500 common P/E ratio of 28 (nonetheless hardly a discount, in my opinion), that will imply Tesla inventory dropping simply over 75% of its present worth. That will take it right down to round $57 apiece.

That’s if – and I see it as a giant if for the explanations I defined above – Tesla may even keep earnings finally 12 months’s degree.

I’d like to take a position, on the proper worth

Nonetheless, Tesla has confounded critics for years and will maintain doing so.

The agency has a big following amongst traders, has constructed an unimaginable enterprise at pace and will proceed rising. It has a robust model, giant person base, and financially engaging vertically built-in manufacturing and gross sales mannequin.

On prime of that, its energy technology enterprise appears to be like set to continue to grow at tempo.

I see a case for the worth crashing properly under $100. For now, I believe Tesla inventory nonetheless appears to be like badly overvalued. But when it acquired low cost sufficient, I might fortunately begin shopping for.

It appears some time in the past already that Tesla (NASDAQ: TSLA) was a darling progress inventory, with a market capitalisation properly north of a trillion {dollars}. Tesla inventory has now misplaced over half its worth from the excessive level it hit over the previous 12 months. It has crashed 42% because the starting of the 12 months.

Nevertheless, that also places it 37% greater than only one 12 months in the past – and 729% up over a five-year interval.

Again in 2020, Tesla was buying and selling under $100 a share.

Might it get down there once more – and in that case, ought I to purchase some for my portfolio?

Tesla’s progress has been phenomenal – however it might be over

A big a part of what has spurred the Tesla inventory worth has been its excellent progress story.

This has not merely been a prospect dangled in entrance of traders – it has been a large-scale enterprise actuality.

Take a look at the corporate’s revenues, for instance.

Created utilizing TradingView

It has near quadrupled since 2020, from a excessive base.

However final 12 months’s progress of barely 1% was a step change in comparison with the prior years. It was additionally the primary 12 months when deliveries of Tesla automobiles declined quite than grew.

What about revenue?

Final 12 months web earnings was a beefy $7bn. However not solely was that lower than half the earlier 12 months’s quantity, it additionally represented an inflection level, because the chart turned from a few years of progress to contraction.

Created utilizing TradingView

There might be worse to come back. An more and more aggressive electrical automobile market might damage each gross sales volumes and revenue margins. Add to that the potential affect of Tesla boss Elon Musk’s high-profile political actions and I see a threat that Tesla will report falling gross sales revenues and weaker income this 12 months.

That doesn’t imply it isn’t nonetheless a strong enterprise. However Tesla inventory soared as a result of traders beloved the expansion story. If that progress story is over, it might be unhealthy information for the share worth.

Tesla appears to be like badly overvalued to me

For the time being, the corporate trades on a price-to-earnings (P/E) ratio of 116. That appears very costly to me.

If it was to fall according to the S&P 500 common P/E ratio of 28 (nonetheless hardly a discount, in my opinion), that will imply Tesla inventory dropping simply over 75% of its present worth. That will take it right down to round $57 apiece.

That’s if – and I see it as a giant if for the explanations I defined above – Tesla may even keep earnings finally 12 months’s degree.

I’d like to take a position, on the proper worth

Nonetheless, Tesla has confounded critics for years and will maintain doing so.

The agency has a big following amongst traders, has constructed an unimaginable enterprise at pace and will proceed rising. It has a robust model, giant person base, and financially engaging vertically built-in manufacturing and gross sales mannequin.

On prime of that, its energy technology enterprise appears to be like set to continue to grow at tempo.

I see a case for the worth crashing properly under $100. For now, I believe Tesla inventory nonetheless appears to be like badly overvalued. But when it acquired low cost sufficient, I might fortunately begin shopping for.