The bitcoin value rebounded sharply Friday after a steep sell-off over the earlier 24 hours, climbing briefly climbing above $71,000, a soar of $11,000 from its $60,000 low earlier within the 24-hour session.

The transfer got here after a number of turbulent market classes that noticed the flagship cryptocurrency break key psychological assist ranges in a matter of hours. On Thursday, February 5, the Bitcoin value plunged as international monetary markets deteriorated, with main inventory indices sliding sharply and pushing buyers out of riskier property.

The sudden downturn was linked to broader macroeconomic stress, together with weak earnings reviews and steep declines in know-how shares, which intensified a flight to security amongst merchants.

Knowledge compiled Thursday confirmed Bitcoin’s worth dipping to its lowest since late 2024, signaling rising bearish sentiment amongst market individuals.

The digital asset had retreated greater than 40% from its all-time excessive above $126,000 reached in October 2025, underscoring the severity of the downturn.

Additionally, because the bitcoin value collapsed yesterday, compelled liquidations boomed with over $1 billion in positions worn out over the previous 24 hours, predominantly lengthy bets dealing with computerized close-outs as BTC broke key ranges.

Crypto shares rebound as Bitcoin value recovers

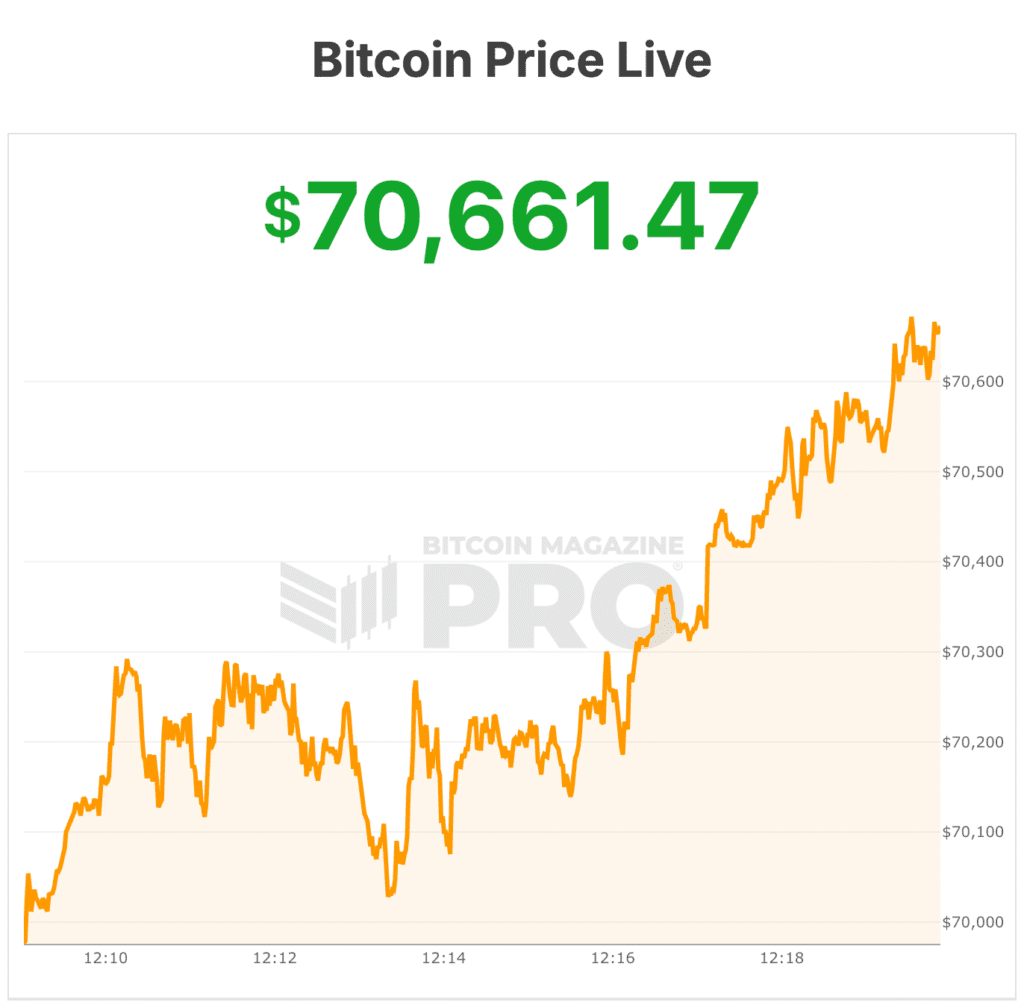

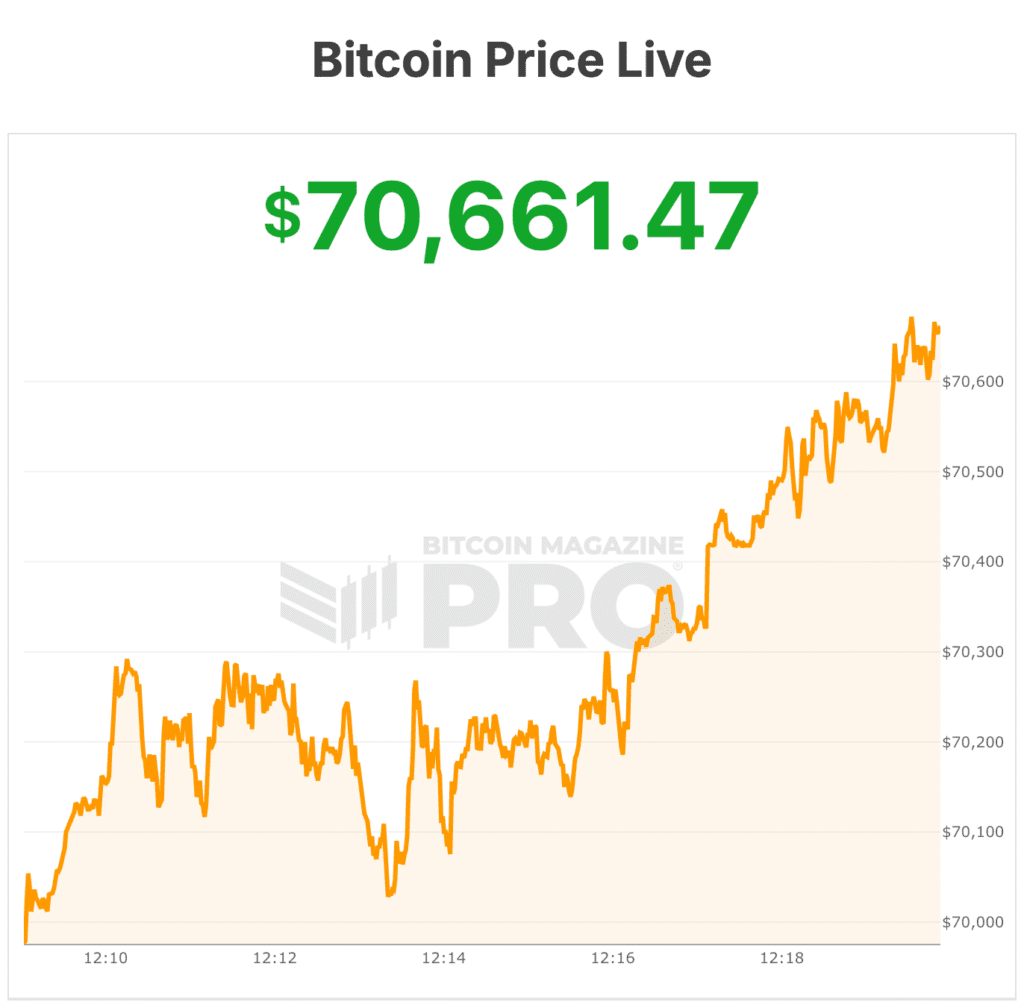

Regardless of Thursday’s losses, Bitcoin value’s rebound Friday noticed costs climb from the $60,000 area again above the $70,000 mark, reflecting an almost 15% restoration from intraday lows.

Crypto-related shares noticed huge features as effectively. Technique ($MSTR) shares have been up 21% on the day, whereas Coinbase ($COIN) and Circle ($CRCL) and Robinhood ($HOOD) shares all jumped 10-15%

Bitcoin-linked equities additionally posted sharp features, led by MARA Holdings (MARA), which climbed 21.03% to $8.14, and TeraWulf (WULF), up 19.55% to $14.25. Riot Platforms (RIOT) rose 16.54% to $14.05, whereas Cipher Mining (CIFR) added 15.47% to $14.66.

Bitmine Immersion Applied sciences (BMNR) elevated 15.43% to $20.08, and Core Scientific (CORZ) gained 10.43% to $16.36. Neptune Digital Property (NDA) additionally superior, rising 11.43% to $0.78

In the course of the drop, the iShares Bitcoin Belief (IBIT), a spot Bitcoin ETF managed by BlackRock that lets buyers achieve publicity to Bitcoin with out holding the crypto instantly, crushed its each day quantity report with about $10 billion price of shares traded — at the same time as its value plunged 13%, marking the second‑worst one‑day drop for the reason that fund’s launch.

At the moment, bitcoin is buying and selling at $70,661.

The bitcoin value rebounded sharply Friday after a steep sell-off over the earlier 24 hours, climbing briefly climbing above $71,000, a soar of $11,000 from its $60,000 low earlier within the 24-hour session.

The transfer got here after a number of turbulent market classes that noticed the flagship cryptocurrency break key psychological assist ranges in a matter of hours. On Thursday, February 5, the Bitcoin value plunged as international monetary markets deteriorated, with main inventory indices sliding sharply and pushing buyers out of riskier property.

The sudden downturn was linked to broader macroeconomic stress, together with weak earnings reviews and steep declines in know-how shares, which intensified a flight to security amongst merchants.

Knowledge compiled Thursday confirmed Bitcoin’s worth dipping to its lowest since late 2024, signaling rising bearish sentiment amongst market individuals.

The digital asset had retreated greater than 40% from its all-time excessive above $126,000 reached in October 2025, underscoring the severity of the downturn.

Additionally, because the bitcoin value collapsed yesterday, compelled liquidations boomed with over $1 billion in positions worn out over the previous 24 hours, predominantly lengthy bets dealing with computerized close-outs as BTC broke key ranges.

Crypto shares rebound as Bitcoin value recovers

Regardless of Thursday’s losses, Bitcoin value’s rebound Friday noticed costs climb from the $60,000 area again above the $70,000 mark, reflecting an almost 15% restoration from intraday lows.

Crypto-related shares noticed huge features as effectively. Technique ($MSTR) shares have been up 21% on the day, whereas Coinbase ($COIN) and Circle ($CRCL) and Robinhood ($HOOD) shares all jumped 10-15%

Bitcoin-linked equities additionally posted sharp features, led by MARA Holdings (MARA), which climbed 21.03% to $8.14, and TeraWulf (WULF), up 19.55% to $14.25. Riot Platforms (RIOT) rose 16.54% to $14.05, whereas Cipher Mining (CIFR) added 15.47% to $14.66.

Bitmine Immersion Applied sciences (BMNR) elevated 15.43% to $20.08, and Core Scientific (CORZ) gained 10.43% to $16.36. Neptune Digital Property (NDA) additionally superior, rising 11.43% to $0.78

In the course of the drop, the iShares Bitcoin Belief (IBIT), a spot Bitcoin ETF managed by BlackRock that lets buyers achieve publicity to Bitcoin with out holding the crypto instantly, crushed its each day quantity report with about $10 billion price of shares traded — at the same time as its value plunged 13%, marking the second‑worst one‑day drop for the reason that fund’s launch.

At the moment, bitcoin is buying and selling at $70,661.