Even years after its inception, the XRP Ledger, one of many main networks within the crypto house, continues to draw strong adoption and real-world utilization. With 1000’s of transactions being performed on the main community’s DEX each day, it has now reached a historic degree that marks its rising position in decentralized buying and selling.

Decentralized Buying and selling On XRP Ledger Accelerates

XRP is experiencing heightened curiosity not simply in shopping for exercise from merchants; the XRP Ledger has been seeing important utilization over the previous few weeks. Whereas adoption has elevated towards the community, the Ledger’s Decentralized Trade (DEX) exercise is breaking previous prior highs.

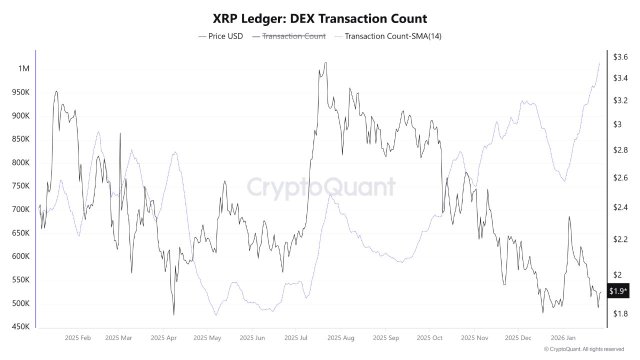

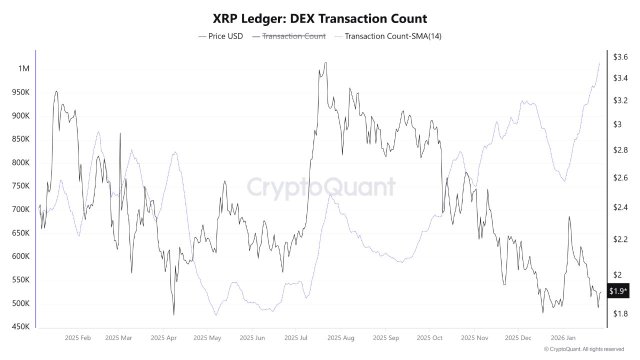

Xaif Crypto, a market skilled and investor on the X platform, reported that the Ledger DEX exercise has surged to new ranges. Particularly, knowledge reveals that the exercise just lately reached a 13-month excessive, signaling a pointy uptick in on-chain buying and selling throughout the community.

As extra liquidity and transactions transfer over XRPL’s native DEX infrastructure, the rise is indicative of accelerating consumer involvement. Sustained development in DEX exercise steadily signifies deeper adoption and increasing use circumstances, in distinction to temporary spikes brought about solely by hypothesis.

In line with the chart shared by the skilled, the variety of transactions on the 14-day MA rose to roughly 1.014 million, breaking the ceiling that held all through all of 2025. With this degree of DEX transactions, the XRP Ledger is turning into a extra energetic middle for decentralized commerce throughout the bigger cryptocurrency ecosystem.

Xaif Crypto said that this large transaction depend isn’t just a mere spike; it alerts sustained momentum for the Ledger. Presently, the community is witnessing a recent wave of liquidity and actual consumer engagement. Consequently, the skilled declares that the Ledger is heating up in 2026.

This milestone comes because the XRP Ledger rolls out a brand new Lending Protocol (XLS-66), which is attracting institutional-grade credit score to the community. With the brand new Lending Protocol, the Ledger is now evolving right into a full monetary layer with Rippled 3.1.0.

The protocol contains the flexibility to create loans on the Ledger, with mortgage brokers with the ability to generate fixed-term and fixed-rate, uncollateralized loans. These loans are predictable for skilled use.

As well as, these loans are held in a Single Asset Vault, permitting risk-isolated liquidity. One other characteristic is the off-chain underwriting for uncollateralized choices. It boasts native effectivity, which presents low-cost lending and not using a intermediary or intermediaries. Within the meantime, Decentralized Finance (DeFi) on the Ledger has simply undergone a lift.

The Lending Protocol Features Institutional Help

Following its historic launch a number of days in the past, the brand new XRP Lending Protocol is now experiencing important assist from institutional-level buyers. One of many earliest corporations to work together with the brand new protocol is Evernorth, a number one public treasury firm.

In accordance to BankXRP, the corporate is backing the native lending protocol to assist transition a $100 billion market cap right into a productive, yield-bearing ecosystem. These sorts of strikes are a sign that the way forward for institutional DeFi is turning into native-driven.

Featured picture from Shutterstock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Even years after its inception, the XRP Ledger, one of many main networks within the crypto house, continues to draw strong adoption and real-world utilization. With 1000’s of transactions being performed on the main community’s DEX each day, it has now reached a historic degree that marks its rising position in decentralized buying and selling.

Decentralized Buying and selling On XRP Ledger Accelerates

XRP is experiencing heightened curiosity not simply in shopping for exercise from merchants; the XRP Ledger has been seeing important utilization over the previous few weeks. Whereas adoption has elevated towards the community, the Ledger’s Decentralized Trade (DEX) exercise is breaking previous prior highs.

Xaif Crypto, a market skilled and investor on the X platform, reported that the Ledger DEX exercise has surged to new ranges. Particularly, knowledge reveals that the exercise just lately reached a 13-month excessive, signaling a pointy uptick in on-chain buying and selling throughout the community.

As extra liquidity and transactions transfer over XRPL’s native DEX infrastructure, the rise is indicative of accelerating consumer involvement. Sustained development in DEX exercise steadily signifies deeper adoption and increasing use circumstances, in distinction to temporary spikes brought about solely by hypothesis.

In line with the chart shared by the skilled, the variety of transactions on the 14-day MA rose to roughly 1.014 million, breaking the ceiling that held all through all of 2025. With this degree of DEX transactions, the XRP Ledger is turning into a extra energetic middle for decentralized commerce throughout the bigger cryptocurrency ecosystem.

Xaif Crypto said that this large transaction depend isn’t just a mere spike; it alerts sustained momentum for the Ledger. Presently, the community is witnessing a recent wave of liquidity and actual consumer engagement. Consequently, the skilled declares that the Ledger is heating up in 2026.

This milestone comes because the XRP Ledger rolls out a brand new Lending Protocol (XLS-66), which is attracting institutional-grade credit score to the community. With the brand new Lending Protocol, the Ledger is now evolving right into a full monetary layer with Rippled 3.1.0.

The protocol contains the flexibility to create loans on the Ledger, with mortgage brokers with the ability to generate fixed-term and fixed-rate, uncollateralized loans. These loans are predictable for skilled use.

As well as, these loans are held in a Single Asset Vault, permitting risk-isolated liquidity. One other characteristic is the off-chain underwriting for uncollateralized choices. It boasts native effectivity, which presents low-cost lending and not using a intermediary or intermediaries. Within the meantime, Decentralized Finance (DeFi) on the Ledger has simply undergone a lift.

The Lending Protocol Features Institutional Help

Following its historic launch a number of days in the past, the brand new XRP Lending Protocol is now experiencing important assist from institutional-level buyers. One of many earliest corporations to work together with the brand new protocol is Evernorth, a number one public treasury firm.

In accordance to BankXRP, the corporate is backing the native lending protocol to assist transition a $100 billion market cap right into a productive, yield-bearing ecosystem. These sorts of strikes are a sign that the way forward for institutional DeFi is turning into native-driven.

Featured picture from Shutterstock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.