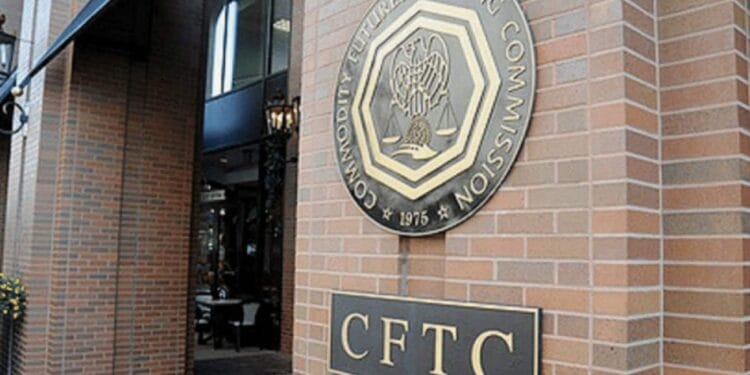

The SEC and CFTC have relaunched Venture Crypto to offer clear, coordinated regulation for the rising U.S. digital asset business.

The U.S. Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) have relaunched Venture Crypto in a coordinated effort to offer regulatory readability for the digital asset business.

The initiative is a part of a technique to align the 2 companies’ approaches to crypto markets and guarantee U.S. monetary management retains tempo with technological innovation.

Venture Crypto Targets Clearer Crypto Guidelines

In a January 29 joint assertion, SEC Chair Paul Atkins and CFTC Chair Heath Tarbert emphasised that “America’s monetary markets are the strongest and most trusted on this planet as a result of they had been constructed upon the premises of clear guidelines and honest enforcement.”

Nevertheless, in recent times, below the Biden administration, enforcement actions and laws had been usually unclear, creating uncertainty for market members. Beneath President Trump’s management, the 2 teams have shared plans to return to core rules that emphasize transparency, predictability, and equity. This effort shall be superior by way of Venture Crypto, a joint initiative geared toward harmonizing digital asset regulation.

Venture Crypto is designed to prepared U.S. markets for a future through which buying and selling, clearing, settlement, and custody more and more happen on-chain.

The plan comes as Congress advances bipartisan laws to determine a federal framework for digital belongings. Regardless of this, the companies consider that these guidelines alone are inadequate, noting that efficient oversight requires “disciplined execution grounded in advantage neutrality and free market rules.”

In keeping with the press launch, the initiative will give attention to creating clear pathways for firms that adjust to the necessities. This may contain updating the surveillance instruments to replicate trendy buying and selling practices and implementing guidelines in a deliberate step-by-step method.

You may additionally like:

Regulators additionally warned that failing to modernize might push innovation and funding to different nations with extra accommodating markets.

Harmonization and Clear Oversight

A fundamental goal of Venture Crypto is to convey the SEC and CFTC into nearer alignment, addressing fragmented guidelines and overlapping jurisdictions which have lengthy made it tough for companies to function effectively.

The programme seeks to deal with these points by aligning definitions, coordinating supervision, and sharing knowledge securely between them. The 2 regulators additionally wish to scale back duplication, present clear steering for traders and companies, and assist a market that’s each revolutionary and well-regulated.

The relaunch builds on earlier efforts, together with the SEC’s Venture Crypto and the CFTC’s Crypto Dash, and represents a contemporary method to inter-agency coordination. By working collectively, the duo hopes to supply readability for market members, encourage innovation on U.S. soil, and be certain that the way forward for finance develops below oversight that protects traders whereas supporting progress.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this hyperlink to register and unlock $1,500 in unique BingX Trade rewards (restricted time provide).