Bitcoin’s newest pullback is doing extra than simply shaking value ranges – it’s actively flushing out market positioning.

In accordance to information highlighted by crypto analyst Joao Wedson, a major share of lengthy positions opened over the previous month has already been liquidated, underscoring how crowded the bullish commerce had turn out to be.

Key Takeaways

- A big portion of current Bitcoin lengthy positions has been liquidated, highlighting crowded bullish positioning.

- The lack of the 89.2k degree and a rising Threat Index are reinforcing near-term bearish sentiment.

- The 84.5k zone is now essential – holding it may stabilize value, whereas a breakdown could open the door to a deeper transfer towards the mid-70k space.

This wave of liquidations suggests that almost all merchants had been leaning closely towards additional upside. As value slipped, that imbalance created superb situations for exchanges and bigger gamers to hunt liquidity, pushing Bitcoin decrease to pressure weak fingers out of their positions.

Liquidation strain reshapes market construction

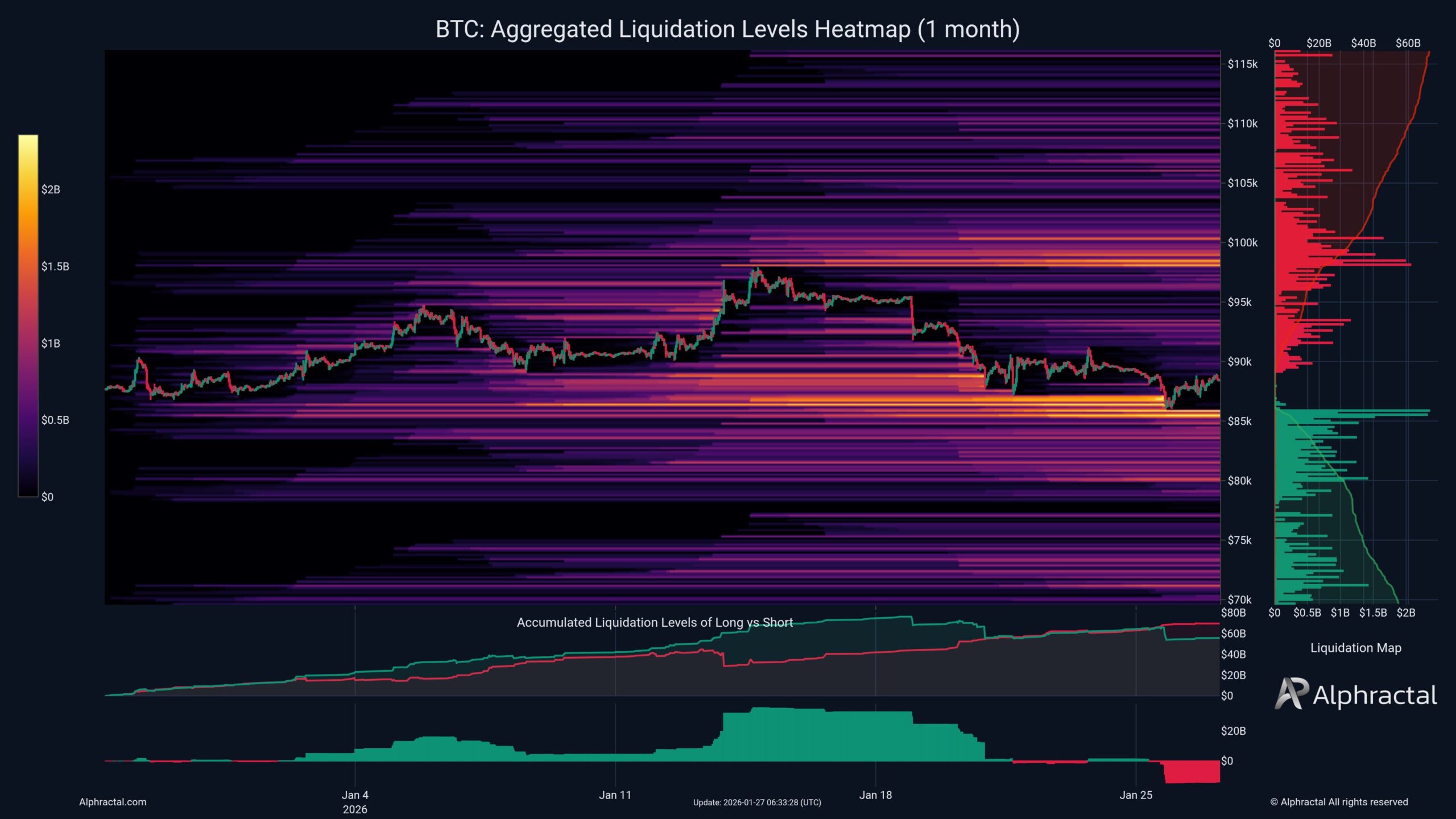

Heatmap information monitoring aggregated liquidation ranges over the previous 30 days reveals dense clusters of lengthy publicity being cleared as Bitcoin drifted decrease. Reasonably than a single capitulation occasion, the transfer resembles a gradual bleed, with leverage steadily unwinding as value fails to reclaim prior highs.

This habits suits a well-known sample in crypto markets. When consensus turns into too one-sided, value typically strikes in the wrong way, concentrating on areas the place cease losses and liquidation ranges are stacked. The result’s a market that appears technically weak, even when broader conviction stays intact.

Threat Index climbs as key assist breaks

Latest value motion has strengthened a bearish short-term outlook. Bitcoin misplaced the 89.2k assist zone, a degree that had acted as a pivot all through January. On the similar time, the Bitcoin Threat Index continued to rise, signaling a higher-risk setting and worsening sentiment.

Traditionally, elevated readings within the Threat Index have coincided with intervals of volatility and draw back strain. Whereas not a timing software by itself, the mix of rising threat and falling value suggests merchants stay cautious and defensive.

84.5k turns into the market’s battleground

Regardless of the bearish momentum, bulls are nonetheless defending a vital space close to 84.5k. This zone now represents the instant draw back goal and the final significant assist earlier than a deeper correction comes into play.

If value dips into this area and rapidly recovers, particularly alongside cooling threat metrics, it may open the door for higher-conviction lengthy entries. A short liquidity sweep under assist wouldn’t be uncommon in that state of affairs.

Alternatively, a clear break and sustained consolidation under 84.5k would doubtless shift the broader construction decrease. In that case, consideration would flip to ranges under the November vary, with the mid-70k space rising as a major draw back goal.

Momentum indicators ship blended alerts

Brief-term technicals replicate the market’s indecision. On the 4-hour chart, momentum has weakened following the current sell-off, whereas RSI stays subdued and under impartial ranges. MACD readings present restricted upside momentum, suggesting consumers have but to regain management.

On the similar time, promoting strain seems extra managed than throughout sharp capitulation phases, pointing to a market that’s correcting moderately than collapsing.

The knowledge supplied on this article is for academic functions solely and doesn’t represent monetary, funding, or buying and selling recommendation. Coindoo.com doesn’t endorse or advocate any particular funding technique or cryptocurrency. At all times conduct your individual analysis and seek the advice of with a licensed monetary advisor earlier than making any funding selections.