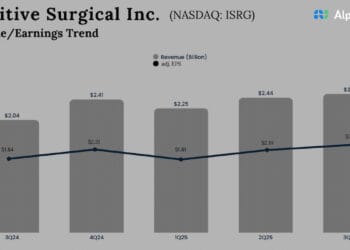

We’re heading right into a holiday-shortened buying and selling week. Do not let that idiot you, although. There’s sufficient on the calendar to fill a full week. Earnings season is ramping up. The Fed’s most popular inflation gauge is due out (albeit a bit stale). And we’re having our first Month-to-month Assembly of the yr. 1. Earnings exterior the portfolio: There will likely be lots of studies to maintain monitor of outdoor the Membership. Trade bellwethers like 3M , Netflix , United Airways , Johnson & Johnson , GE Aerospace , Intel , and SLB are all set to report subsequent week, to call a couple of. Whereas these names aren’t within the Membership, every can present perception into varied sectors of the economic system. For instance, 3M will inform us on industrial exercise and manufacturing demand. GE Aerospace on Thursday can communicate to the implications of President Donald Trump’s requires elevated protection spending and the way a lot business air journey is going down — related for our positions in Boeing and Honeywell. That is additionally the case with United Airways on Wednesday. Plus, United will provide a window into the well being of the patron and their emotions in regards to the U.S. economic system. In the meantime, Intel on Thursday will present perception into semiconductor demand early within the quarter, properly earlier than the info middle juggernauts in our portfolio, Broadcom and Nvidia, report later within the earnings season. Maybe Intel can even give an replace on its customized CPU collaboration with Nvidia, which was introduced to a lot fanfare in September . Within the oil patch, SLB and rival Halliburton — arms sellers for the businesses doing the drilling — will shine a light-weight on power demand and infrastructure dynamics within the wake of the U.S. seize of Venezuelan chief Nicolas Maduro. What these corporations say in regards to the exercise ranges of their prospects might assist us perceive the place power costs are headed in 2026. Chipmaking large Taiwan Semiconductor Manufacturing Co.’s earnings report final week completely illustrated why buyers must comply with shares exterior their portfolio. After TSMC mentioned it was growing its capital funds attributable to robust demand, the entire chip cohort caught a bid — from chip designers resembling Nvidia to supply-chain gamers like Membership title Qnity Electronics . Traders are at all times searching for “readthroughs” that sharpen their understanding of the markets their portfolio corporations function in. This week will present loads of them. 2. Earnings in our portfolio: Each Membership shares reporting this week will achieve this on Thursday. Procter & Gamble is up first earlier than the opening bell, and we can’t be stunned if the headline numbers disappoint. As Jim Cramer famous on Friday’s Morning Assembly, we all know October and November — two-thirds of P & G’s quarter — had been impacted by the federal government shutdown, which led to a delay in SNAP advantages, inflicting weak spot early within the quarter. The problem is, it is not clear to us that Wall Road estimates have absolutely baked this in. The consensus income estimate of $22.31 billion is just one.2% under the place it was on Sept. 30, the day earlier than the shutdown started. Consequently, what P & G has to say about post-shutdown dynamics and the continuing quarter — the third quarter of P & G’s fiscal 2026 — will likely be an important consider figuring out the place the inventory goes from right here. That is the primary P & G quarter with new CEO Shailesh Jejurikar on the helm, and we’re enthusiastic about what he can deliver to the Tide, Crest, and Daybreak father or mother. Later that day, Trump’s strain marketing campaign on the bank card business provides a significant wrinkle to Capital One’s earnings report after the shut. As of now, it is too early to say whether or not Trump’s demand fo r a one-year 10% rate of interest cap will develop into a actuality. Nevertheless it figures to be a giant matter of dialog on the convention name anyway. Most of the large financial institution CEOs who reported final week criticized it. Now, Capital One’s Richard Fairbank, an influential participant within the business, will get his probability to weigh in on what it could imply for the business. Some excellent news for Capital One shareholders, a minimum of, is that Nationwide Financial Council Director Kevin Hassett mentioned Friday on Fox Enterprise that the administration is in contact with the large banks to create a brand new bank card product to appease Trump — an final result that may be a lot narrower than Trump’s preliminary risk, which despatched Capital One shares down 6.4% Monday. As for Capital One’s precise financials, the necessary metrics past headline income and earnings embody delinquency and cost charges as a result of they replicate the well being of the patron. Extra normal commentary about spending habits and debt ranges are key too. With personal consumption accounting for roughly two-thirds of U.S. GDP, figuring out the place the patron stands is totally essential to how one thinks in regards to the market extra broadly. Lastly, administration’s Discovery integration plans for 2026 will likely be of curiosity, as will its commentary on share repurchase exercise. 3. Financial information: The massive financial launch of the week can also be on Thursday. That is after we get the November private spending and earnings report, which incorporates the core PCE worth index, the Fed’s most popular inflation gauge. Whereas the PCE can present hints on the Fed’s future rate of interest strikes, it is necessary to do not forget that this can be a delayed report. For that cause, buyers will likely be higher served focusing extra on what administration groups say throughout earnings convention calls than basing funding selections on a high-level report that’s now practically two months stale. One other launch on our radar is the December pending house gross sales report on Wednesday. A greater-than-expected report on the variety of pending house gross sales ought to bode properly for the economic system. Housing is a type of sectors that punches above its weight, due to all the opposite purchases that include the acquisition of a brand new house, resembling companies, home equipment, furnishings, and so forth. Residence Depot is the inventory in our portfolio most levered to the housing market and mortgage charges. As a reminder, markets had been Monday in honor of Martin Luther King Jr. Day. And on Thursday, we’ll be internet hosting our first Month-to-month Assembly of the yr, so you should definitely ship in all of your questions for Jim and Jeff to handle on the decision. Week forward Monday, Jan.19 U.S. inventory market closed Tuesday, Jan. 20 Earlier than the bell: D.R. Horton, Inc. (DHI), 3M Firm (MMM), Fifth Third Bancorp (FITB), U.S. Bancorp (USB), Fastenal Co. (FAST), Peoples Bancorp Inc (PEBO), KeyCorp (KEY) After the bell: Netflix, Inc. (NFLX), Interactive Brokers Group Inc (IBKR), United Airways (UAL), Progress Software program Corp. (PRGS) Wednesday, Jan. 21 December Pending Residence Gross sales Report at 10 a.m. ET Earlier than the bell: Johnson & Johnson (JNJ), Ally Monetary (ALLY), Halliburton Firm (HAL), Charles Schwab Corp. (SCHW), TE Connectivity Ltd. (TEL), Prologis, Inc. (PLD), Teledyne Applied sciences Inc. (TDY), Vacationers Corporations, Inc. (TRV) After the bell: Kinder Morgan, Inc. (KMI), Banc of California, Inc. (BANC), Banner Company (BANR), CACI Worldwide, Inc. (CACI) Thursday, Jan. 22 PCE Index at 8:30 a.m. ET Kansas Metropolis Fed Manufacturing Index at 11 a.m. ET Earlier than the bell: Procter & Gamble Co. (PG), Freeport-McMoRan Copper & Gold, Inc. (FCX), GE Aerospace (GE), Huntington Bancshares Integrated (HBAN), Texas Capital Bancshares, Inc. (TCBI), Abbott (ABT), McCormick & Firm, Integrated (MKC) After the bell: Capital One Monetary Corp. (COF), Intel Corp. (INTC), Intuitive Surgical, Inc. (ISRG), Alcoa, Inc. (AA), CSX Corp. (CSX) Friday, Jan. 23 College of Michigan’s Client Sentiment Survey (Ultimate) at 10 a.m. ET Earlier than the bell: SLB (SLB), Booz Allen Hamilton Holding Company (BAH), Comerica, Inc. (CMA), Ericsson (ERIC) (Jim Cramer’s Charitable Belief is lengthy NVDA, AVGO, COF and AVGO. See right here for a full checklist of the shares.) As a subscriber to the CNBC Investing Membership with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a inventory in his charitable belief’s portfolio. If Jim has talked a couple of inventory on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.