Fastenal Firm (NASDAQ: FAST) is gearing as much as publish its fourth-quarter 2025 monetary outcomes, after successfully navigating an evolving market setting. The report is anticipated to make clear the corporate’s long-term methods and the way the enterprise is adapting to challenges and alternatives. Whereas the fastener distributor continues to learn from contract wins from massive prospects and selective worth will increase in sure classes, demand developments stay fluid amid trade-related uncertainties and cautious buyer spending.

Estimates

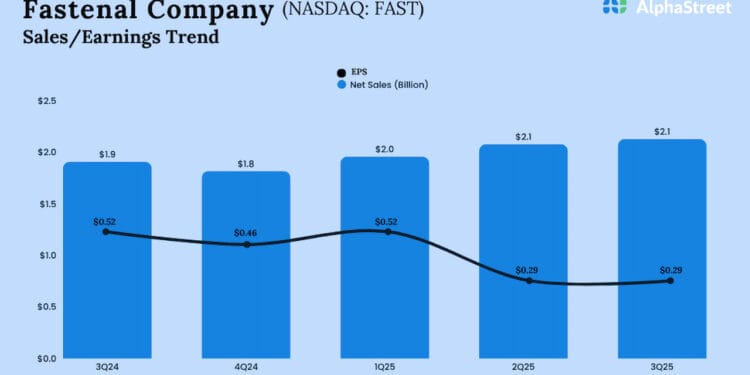

Fastenal’s fourth-quarter 2025 report is anticipated to be printed on Tuesday, January 20, at 6:50 am ET. Analysts’ consensus gross sales and earnings estimates for the quarter are $2.04 billion and $0.26 per share, respectively. Within the year-ago quarter, the corporate earned $0.23 per share on revenues of $1.82 billion.

In 2025, the inventory delivered constant positive aspects and reached an all-time excessive in August. After this peak, the development reversed, with shares declining steadily by means of the remainder of the yr. The typical worth of FAST for the previous 12 months is $42.05. Regardless of the latest pullback, the valuation seems to be on the upper facet because of the firm’s moderating development prospects and persevering with margin strain. Fastenal cut up its inventory 2:1 in early 2025, marking the ninth cut up since going public practically 4 a long time in the past.

Q3 Consequence

For the third quarter, Fastenal reported web earnings of $335.5 million, or $0.29 per share, in comparison with $298.1 million, or $0.26 per share, within the prior-year quarter. Third-quarter web gross sales elevated 11.7% year-over-year to $2.13 billion, primarily reflecting improved buyer contract signings. Throughout the quarter, it signed 7,050 FASTB and FASTVend gadgets, leading to 19,925 new FASTB and FASTVend signings within the first 9 months of FY25. The highest line was in keeping with estimates, whereas earnings missed expectations after beating within the prior quarter.

Commenting on Fastenal’s pricing technique, CEO Daniel Florness mentioned within the Q3 earnings name, “{The marketplace} is pushing by means of worth. We truly favor to not push by means of worth. We favor to push by means of development. We favor to have conversations about know-how we will deploy to your level of use. That lowers your consumption. Increasing the universe of what we’re promoting, the value dialog is just about prices are going up in your provide chain. And worth is how a buyer realizes that. And so we’ve all the time been reticent. On the flip facet, we’ve nice line of sight to our wants, and we’ve open candid discussions with our prospects about what’s taking place of their provide chain.“

Highway Forward

Whereas Fastenal maintains secure gross sales and money move development, macroeconomic uncertainties and industrial sector weak spot stay challenges. The corporate’s reliance on a comparatively small variety of massive prospects for income poses a possible threat, significantly as enterprises face value strain from tariffs and evolving authorities commerce insurance policies. The administration expects that the margin squeeze skilled final quarter may prolong into the fourth quarter.

Fastenal’s shares have declined greater than 2% previously six months. On Friday, the inventory opened at $41.79 and made modest positive aspects in early buying and selling.