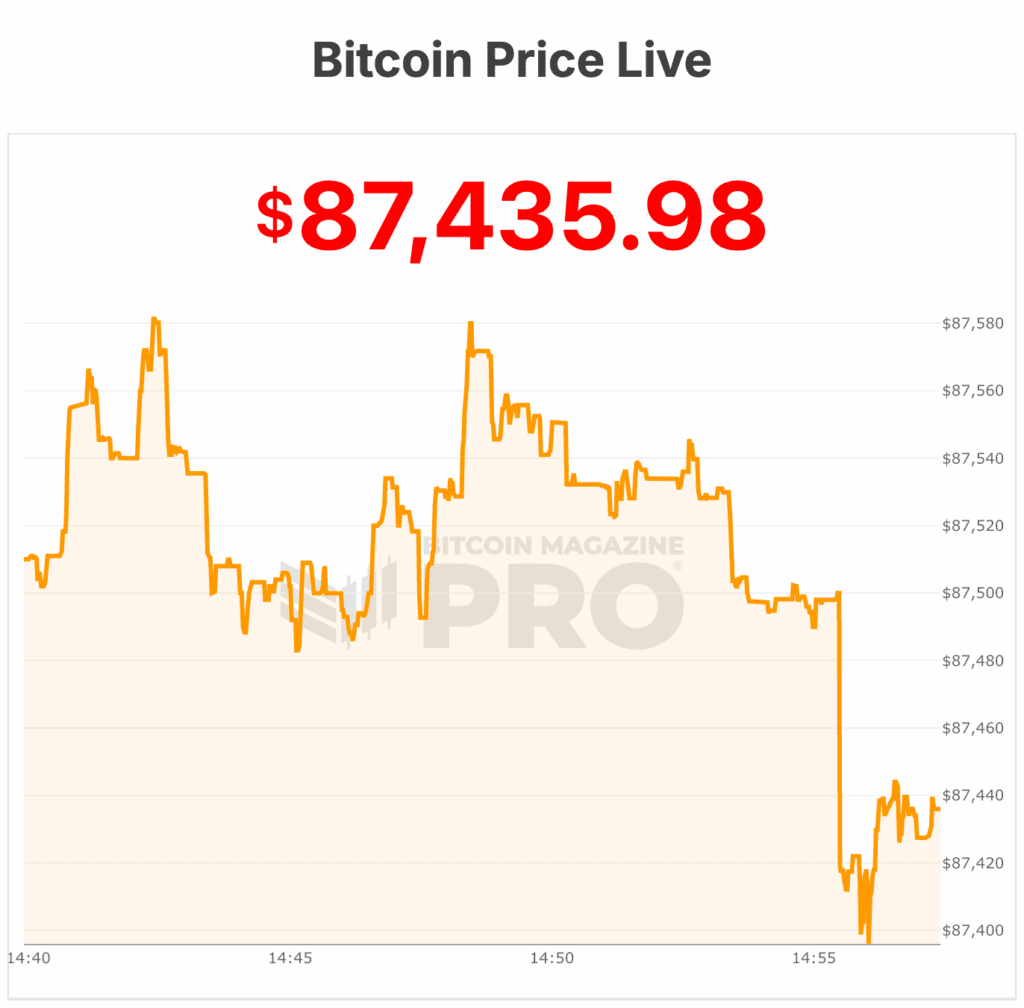

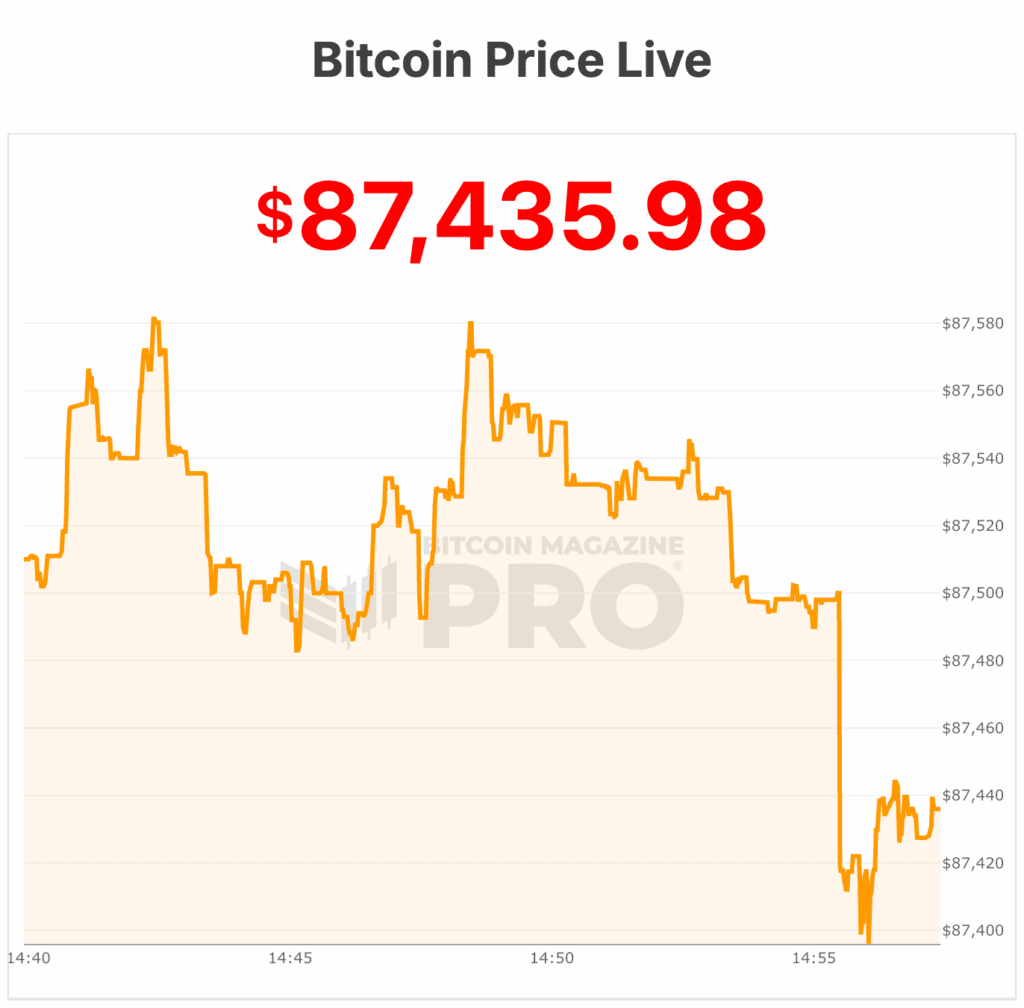

Bitcoin is closing out 2025 close to $87,000, ending the yr in a slender buying and selling vary after months of fading momentum. Skinny vacation liquidity and an absence of contemporary catalysts left the market drifting into the ultimate session of the yr, capping a interval marked much less by explosive good points than by consolidation and unmet expectations.

On the time of writing, bitcoin was buying and selling just under $88,000, roughly flat over the previous week and modestly decrease than the place it started the yr. The worth has spent a lot of December oscillating between the low $80,000s and the excessive $80,000s, with repeated makes an attempt to reclaim $90,000 failing to draw sustained follow-through.

The muted year-end motion stands in distinction to the optimism that outlined the beginning of 2025. Bitcoin entered January buying and selling within the mid-$90,000 vary, buoyed by sturdy inflows into spot bitcoin exchange-traded funds, increasing institutional participation, and expectations that simpler financial coverage would push danger belongings increased.

For a time, these narratives appeared intact.

Bitcoin went on to put up a powerful rally by the primary half of the yr, supported by regular ETF demand and continued accumulation by company treasuries and long-term holders. That advance culminated in October, when bitcoin briefly surged to a brand new all-time excessive above $125,000. The transfer was fueled by enhancing macro sentiment, positioning forward of anticipated price cuts, and renewed speculative curiosity throughout derivatives markets.

The rally, nonetheless, proved unsustainable. Because the fourth quarter unfolded, tighter monetary circumstances, rising bond yields, and a stronger greenback started to weigh on danger urge for food. Bitcoin rolled over alongside equities and different development belongings, giving again a good portion of its good points.

By early December, the value had fallen greater than 30% from its peak, re-entering a spread that had outlined a lot of the yr’s buying and selling.

Bitcoin macro pressures persist

Macro forces performed a central function in shaping bitcoin’s efficiency in 2025. Inflation proved extra persistent than many buyers anticipated, prompting central banks to keep up a restrictive stance longer than anticipated.

That surroundings favored money and yield-bearing belongings over speculative publicity, limiting upside throughout crypto markets. Bitcoin, typically framed as a hedge in opposition to financial debasement, struggled to draw marginal consumers whereas actual yields remained elevated.

Liquidity circumstances additionally deteriorated into year-end. Buying and selling volumes declined sharply in December as market individuals stepped away for the vacations.

With fewer consumers and sellers lively, worth actions grew to become uneven and conviction waned. The dearth of sturdy inflows into spot ETFs in the course of the remaining weeks of the yr strengthened the sense of warning.

On-chain knowledge mirrored the same dynamic. Lengthy-term holders largely remained inactive, whereas short-term merchants dominated flows, contributing to range-bound worth motion. Giant holders decreased aggressive accumulation after the October peak, whereas retail participation ticked increased throughout pullbacks, a sample in step with consolidation quite than development formation.

Nonetheless, 2025 was not with out structural progress for bitcoin. The market continued to mature, with deeper derivatives liquidity, improved custody options, and broader integration into conventional monetary infrastructure.

Spot bitcoin ETFs ended the yr with tens of billions of {dollars} in belongings underneath administration, anchoring a brand new class of long-term demand at the same time as short-term flows fluctuated.

Bitcoin additionally maintained its place because the dominant digital asset by a large margin, outperforming most different cryptocurrencies on a relative foundation.

Whereas it lagged gold’s sturdy efficiency in periods of macro stress, bitcoin remained probably the most liquid and extensively traded belongings globally, reinforcing its function because the benchmark for the broader crypto market.

As bitcoin heads into 2026, the main focus is shifting as to whether the extended consolidation can resolve to the upside. Merchants are watching the $90,000 degree as a key psychological and technical threshold, whereas assist within the low $80,000s has to date held.

A significant change in macro circumstances, renewed ETF inflows, or a resurgence in institutional accumulation might present the catalyst wanted to interrupt the stalemate.

For now, bitcoin enters the brand new yr subdued, buying and selling round $87,000 and looking for path.

Bitcoin is closing out 2025 close to $87,000, ending the yr in a slender buying and selling vary after months of fading momentum. Skinny vacation liquidity and an absence of contemporary catalysts left the market drifting into the ultimate session of the yr, capping a interval marked much less by explosive good points than by consolidation and unmet expectations.

On the time of writing, bitcoin was buying and selling just under $88,000, roughly flat over the previous week and modestly decrease than the place it started the yr. The worth has spent a lot of December oscillating between the low $80,000s and the excessive $80,000s, with repeated makes an attempt to reclaim $90,000 failing to draw sustained follow-through.

The muted year-end motion stands in distinction to the optimism that outlined the beginning of 2025. Bitcoin entered January buying and selling within the mid-$90,000 vary, buoyed by sturdy inflows into spot bitcoin exchange-traded funds, increasing institutional participation, and expectations that simpler financial coverage would push danger belongings increased.

For a time, these narratives appeared intact.

Bitcoin went on to put up a powerful rally by the primary half of the yr, supported by regular ETF demand and continued accumulation by company treasuries and long-term holders. That advance culminated in October, when bitcoin briefly surged to a brand new all-time excessive above $125,000. The transfer was fueled by enhancing macro sentiment, positioning forward of anticipated price cuts, and renewed speculative curiosity throughout derivatives markets.

The rally, nonetheless, proved unsustainable. Because the fourth quarter unfolded, tighter monetary circumstances, rising bond yields, and a stronger greenback started to weigh on danger urge for food. Bitcoin rolled over alongside equities and different development belongings, giving again a good portion of its good points.

By early December, the value had fallen greater than 30% from its peak, re-entering a spread that had outlined a lot of the yr’s buying and selling.

Bitcoin macro pressures persist

Macro forces performed a central function in shaping bitcoin’s efficiency in 2025. Inflation proved extra persistent than many buyers anticipated, prompting central banks to keep up a restrictive stance longer than anticipated.

That surroundings favored money and yield-bearing belongings over speculative publicity, limiting upside throughout crypto markets. Bitcoin, typically framed as a hedge in opposition to financial debasement, struggled to draw marginal consumers whereas actual yields remained elevated.

Liquidity circumstances additionally deteriorated into year-end. Buying and selling volumes declined sharply in December as market individuals stepped away for the vacations.

With fewer consumers and sellers lively, worth actions grew to become uneven and conviction waned. The dearth of sturdy inflows into spot ETFs in the course of the remaining weeks of the yr strengthened the sense of warning.

On-chain knowledge mirrored the same dynamic. Lengthy-term holders largely remained inactive, whereas short-term merchants dominated flows, contributing to range-bound worth motion. Giant holders decreased aggressive accumulation after the October peak, whereas retail participation ticked increased throughout pullbacks, a sample in step with consolidation quite than development formation.

Nonetheless, 2025 was not with out structural progress for bitcoin. The market continued to mature, with deeper derivatives liquidity, improved custody options, and broader integration into conventional monetary infrastructure.

Spot bitcoin ETFs ended the yr with tens of billions of {dollars} in belongings underneath administration, anchoring a brand new class of long-term demand at the same time as short-term flows fluctuated.

Bitcoin additionally maintained its place because the dominant digital asset by a large margin, outperforming most different cryptocurrencies on a relative foundation.

Whereas it lagged gold’s sturdy efficiency in periods of macro stress, bitcoin remained probably the most liquid and extensively traded belongings globally, reinforcing its function because the benchmark for the broader crypto market.

As bitcoin heads into 2026, the main focus is shifting as to whether the extended consolidation can resolve to the upside. Merchants are watching the $90,000 degree as a key psychological and technical threshold, whereas assist within the low $80,000s has to date held.

A significant change in macro circumstances, renewed ETF inflows, or a resurgence in institutional accumulation might present the catalyst wanted to interrupt the stalemate.

For now, bitcoin enters the brand new yr subdued, buying and selling round $87,000 and looking for path.