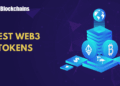

Final week, bulls wanted to carry closes above $85,000 to stave off the bears, and so they managed to do exactly that. Bitcoin worth dropped to help as soon as once more final week, and the bulls defended it effectively, pushing the value again as much as shut the week out at $88,656. The value on the weekly chart has been rejecting from the decrease pattern line of the broadening wedge sample for a number of weeks now, however the pattern line is so low now that the value ought to push above it this week. If it fails to take action this week, search for the value to take the subsequent leg down into the low $70,000 vary.

Key Assist and Resistance Ranges Now

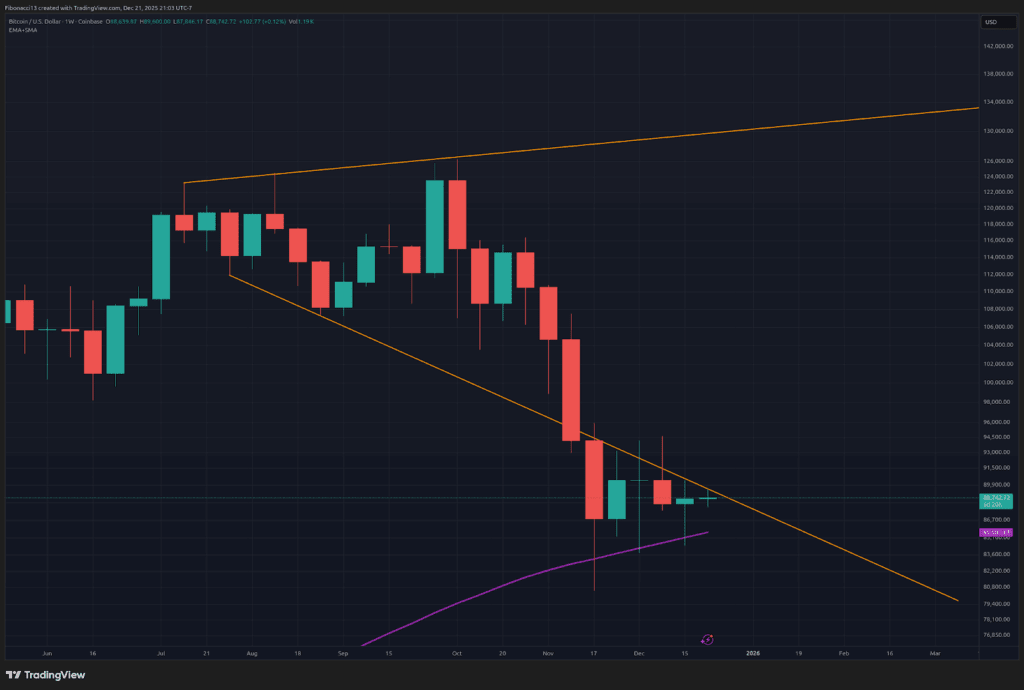

Bulls will wish to proceed the push this week, degree by degree if want be. Preliminary resistance sits at $91,400, with the subsequent degree at $94,000. Above right here, we should always see very sturdy resistance at $98,000. Then we should always see a reasonably sturdy resistance zone from $101,000 all the way in which as much as $108,000. Closing above $108,000 would begin to place extreme doubts on the long-term prime being in place right here.

The $84,000 help degree under is proving to be resilient, holding up once more this previous week. Whether it is misplaced, the anticipated help ranges under haven’t modified. The $72,000 to $68,000 zone needs to be anticipated to help the value on a primary check in any case. Closing under $68,000 doubtless results in a sluggish grind right down to the 0.618 Fibonacci retracement help at $57,000.

Outlook For This Week

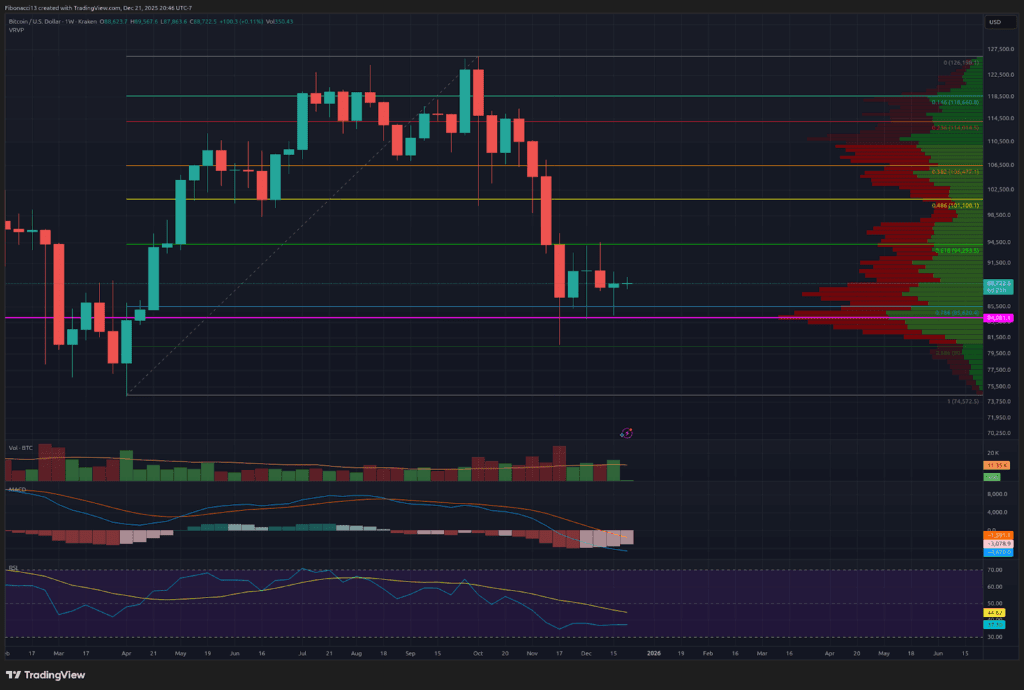

The bears could also be getting a bit flustered with their latest failure to interrupt help. This week, search for the bulls to push again a bit more durable as they acquire some confidence after holding help as soon as once more. Market liquidity needs to be low for Christmas week, so worth motion could also be missing. There are some very massive long-dated bitcoin choices expiring on December twenty sixth, nonetheless, with a max ache worth of $100,000, so search for the value to attempt to push nearer to the $100,000 degree this week.

Market temper: Bearish – Bulls are pushing again a bit right here, however they nonetheless have to show it to the bears with some optimistic worth motion.

The subsequent few weeks

Bulls held again the bears from breaking down main help final week. If the bulls can lastly handle to take out resistance at $94,000 over the subsequent couple of weeks, they are able to maintain some upward momentum into the brand new 12 months as effectively. So if we see a weekly shut above $94,000, search for the value to maneuver in the direction of $101,000. This momentum might proceed to $108,000 with a detailed above $100,000. Resistance turns into extraordinarily thick close to this degree, although, so a powerful rejection close to this degree needs to be anticipated if we will make it there over the approaching weeks.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the value to go greater.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or help degree: A degree at which the value ought to maintain for the asset, not less than initially. The extra touches on help, the weaker it will get and the extra doubtless it’s to fail to carry the value.

Resistance or resistance degree: Reverse of help. The extent that’s more likely to reject the value, not less than initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the value.

Broadening Wedge: A chart sample consisting of an higher pattern line appearing as resistance and a decrease pattern line appearing as help. These pattern traces should diverge away from one another with a view to validate the sample. This sample is a results of increasing worth volatility, usually leading to greater highs and decrease lows.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).