Arizona state Sen. Wendy Rogers has launched a package deal of laws geared toward reshaping how digital belongings are handled below state and native tax regulation, renewing a broader push by some lawmakers to place Arizona as a jurisdiction with clearer and extra favorable guidelines for cryptocurrencies and blockchain infrastructure.

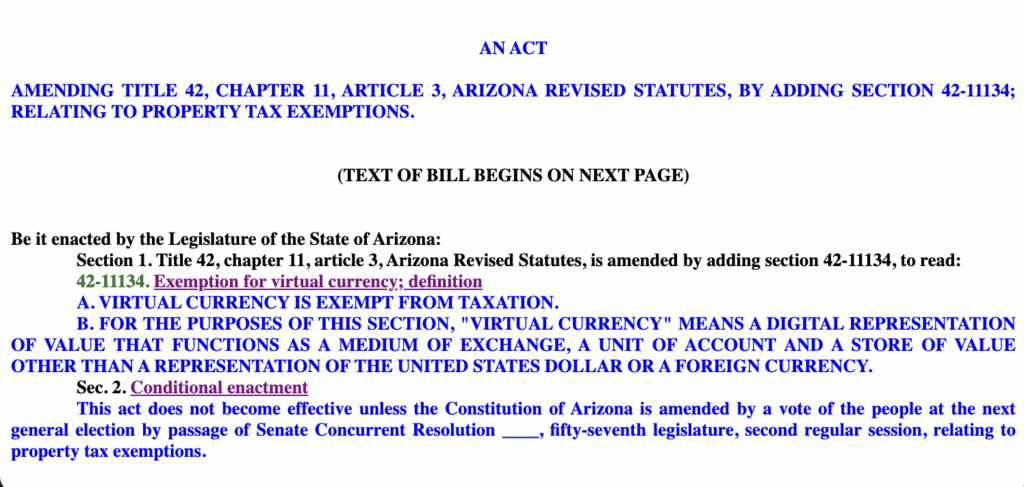

In payments prefiled with the Arizona Senate, Rogers proposed amending state statutes to exempt digital foreign money from taxation (SB 1044), prohibiting counties, cities and cities from taxing or fining entities that function blockchain nodes (SB 1045), and advancing a constitutional modification to make clear how digital belongings match into Arizona’s property tax framework (SCR 1003).

The measures take totally different procedural paths. SB 1045, which focuses on protections for blockchain node operators, may transfer by means of the legislature and grow to be regulation if authorised by lawmakers and signed by the governor.

In contrast, SB 1044 and SCR 1003 are tied collectively and would in the end require voter approval in the course of the subsequent common election in November 2026.

SCR 1003 proposes amending Arizona’s structure to explicitly exclude digital foreign money from property taxation. SB 1044 would mirror that change in state statutes, including language that clarifies digital belongings usually are not topic to property tax. Below Arizona regulation, adjustments to constitutional tax definitions should be authorised by voters, making the poll measure a central hurdle for the broader tax exemption effort.

SB 1045 addresses a narrower, however more and more debated difficulty: the therapy of blockchain nodes on the native stage. The invoice would bar cities, cities and counties from imposing “a tax or price on an individual that runs a node on blockchain expertise,” successfully stopping native governments from singling out node operators by means of taxes or penalties.

Arizona is one among many states embracing bitcoin and crypto

Arizona’s legislative exercise round digital belongings builds on earlier efforts which have already positioned the state amongst a small group with crypto-specific legal guidelines on the books. Arizona is without doubt one of the few U.S. states that permits the federal government to take custody of digital belongings deemed deserted after three years.

That framework emerged from previous makes an attempt by crypto advocates to ascertain a state-level digital asset reserve and has since grow to be a part of a wider debate over how a lot authority states ought to have to carry or spend money on cryptocurrencies corresponding to bitcoin.

Rogers was beforehand a co-sponsor of a bitcoin reserve invoice that was vetoed by Arizona Governor Katie Hobbs in Might. Following the veto, Rogers criticized the choice and mentioned she deliberate to refile related laws in a future session.

Arizona’s proposals arrive as states throughout the nation experiment with totally different approaches to digital asset coverage. New Hampshire and Texas have additionally enacted legal guidelines associated to digital asset reserves, whereas different states have targeted on narrower tax questions.

Ohio lawmakers superior a invoice that might exempt cryptocurrency transactions below $200 from capital features taxes, although it has stalled since June.

In New York, a proposal to impose a 0.2% excise tax on digital asset transactions was referred to committee earlier this 12 months and has not moved ahead.

On the federal stage, Sen. Cynthia Lummis of Wyoming launched draft laws proposing a de minimis exemption for digital asset transactions and capital features of $300 or much less.

Lummis introduced on Friday that she plans to retire from the U.S. Senate in January 2027.

Bitcoin is buying and selling at $87,341, down 3% over the previous 24 hours. Its 24-hour buying and selling quantity is $46 B. The worth is 3% under its 7-day excessive of $90,031 and 1% above its 7-day low of $86,806.

With a circulating provide of 19,966,021 BTC (out of a most 21 million), Bitcoin’s market cap stands at roughly $1.74 T, reflecting a 3% drop within the final 24 hours.

Arizona state Sen. Wendy Rogers has launched a package deal of laws geared toward reshaping how digital belongings are handled below state and native tax regulation, renewing a broader push by some lawmakers to place Arizona as a jurisdiction with clearer and extra favorable guidelines for cryptocurrencies and blockchain infrastructure.

In payments prefiled with the Arizona Senate, Rogers proposed amending state statutes to exempt digital foreign money from taxation (SB 1044), prohibiting counties, cities and cities from taxing or fining entities that function blockchain nodes (SB 1045), and advancing a constitutional modification to make clear how digital belongings match into Arizona’s property tax framework (SCR 1003).

The measures take totally different procedural paths. SB 1045, which focuses on protections for blockchain node operators, may transfer by means of the legislature and grow to be regulation if authorised by lawmakers and signed by the governor.

In contrast, SB 1044 and SCR 1003 are tied collectively and would in the end require voter approval in the course of the subsequent common election in November 2026.

SCR 1003 proposes amending Arizona’s structure to explicitly exclude digital foreign money from property taxation. SB 1044 would mirror that change in state statutes, including language that clarifies digital belongings usually are not topic to property tax. Below Arizona regulation, adjustments to constitutional tax definitions should be authorised by voters, making the poll measure a central hurdle for the broader tax exemption effort.

SB 1045 addresses a narrower, however more and more debated difficulty: the therapy of blockchain nodes on the native stage. The invoice would bar cities, cities and counties from imposing “a tax or price on an individual that runs a node on blockchain expertise,” successfully stopping native governments from singling out node operators by means of taxes or penalties.

Arizona is one among many states embracing bitcoin and crypto

Arizona’s legislative exercise round digital belongings builds on earlier efforts which have already positioned the state amongst a small group with crypto-specific legal guidelines on the books. Arizona is without doubt one of the few U.S. states that permits the federal government to take custody of digital belongings deemed deserted after three years.

That framework emerged from previous makes an attempt by crypto advocates to ascertain a state-level digital asset reserve and has since grow to be a part of a wider debate over how a lot authority states ought to have to carry or spend money on cryptocurrencies corresponding to bitcoin.

Rogers was beforehand a co-sponsor of a bitcoin reserve invoice that was vetoed by Arizona Governor Katie Hobbs in Might. Following the veto, Rogers criticized the choice and mentioned she deliberate to refile related laws in a future session.

Arizona’s proposals arrive as states throughout the nation experiment with totally different approaches to digital asset coverage. New Hampshire and Texas have additionally enacted legal guidelines associated to digital asset reserves, whereas different states have targeted on narrower tax questions.

Ohio lawmakers superior a invoice that might exempt cryptocurrency transactions below $200 from capital features taxes, although it has stalled since June.

In New York, a proposal to impose a 0.2% excise tax on digital asset transactions was referred to committee earlier this 12 months and has not moved ahead.

On the federal stage, Sen. Cynthia Lummis of Wyoming launched draft laws proposing a de minimis exemption for digital asset transactions and capital features of $300 or much less.

Lummis introduced on Friday that she plans to retire from the U.S. Senate in January 2027.

Bitcoin is buying and selling at $87,341, down 3% over the previous 24 hours. Its 24-hour buying and selling quantity is $46 B. The worth is 3% under its 7-day excessive of $90,031 and 1% above its 7-day low of $86,806.

With a circulating provide of 19,966,021 BTC (out of a most 21 million), Bitcoin’s market cap stands at roughly $1.74 T, reflecting a 3% drop within the final 24 hours.