Broadcom, Inc. (NASDAQ: AVGO) has emerged as a key AI infrastructure provider, leveraging its experience in customized AI accelerators, to increase past its legacy smartphone and storage chip companies. Nevertheless, the semiconductor big’s inventory has retreated about 15% after reaching a file excessive earlier this month.

The pullback seems to mirror investor warning over a possible AI bubble, as large quantities are being invested in AI infrastructure with out a clearly outlined roadmap for near-term returns. One other concern is that the corporate’s customized chips carry decrease margins than its conventional standalone chips. Regardless of that, AVGO has been one of many best-performing Wall Avenue shares this 12 months, gaining round 38% prior to now six months and outperforming the S&P 500. Analysts’ consensus estimates recommend the inventory may rise by roughly one-third over the subsequent twelve months.

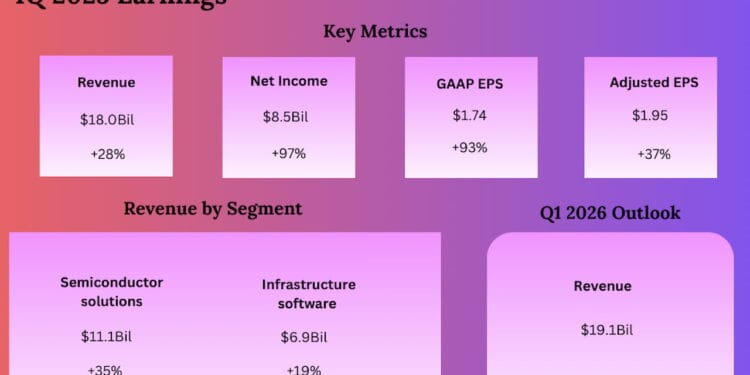

Outlook

In a latest assertion, the Broadcom management stated it expects AI semiconductor income to double YoY to $8.2 billion within the first quarter, pushed by the sturdy demand for customized AI accelerators and Ethernet AI switches. Whole income is predicted to develop by 28% from final 12 months to about $19.1 billion in Q1, which is broadly in step with analysts’ estimates. The bullish outlook displays sturdy orders from hyperscaler prospects akin to Google, Meta Platforms, and TikTok father or mother ByteDance. In the meantime, it expects first-quarter consolidated gross margin to be down round 100 foundation factors sequentially, primarily reflecting a better mixture of AI income.

“We count on renewals to be seasonal in Q1 and forecast infrastructure software program income to be roughly $6.8 billion. We nonetheless count on, nevertheless, that for fiscal 2026, Infrastructure Software program income to develop low double-digit proportion. So, right here’s what we see in 2026. Directionally, we count on AI income to proceed to speed up and drive most of our progress. Non-AI semiconductor income to be secure. Infrastructure software program income will proceed to be pushed by VMware progress at low double digits,” Broadcom’s CEO Hock Tan stated within the This autumn FY25 earnings name.

Report Income

In This autumn FY25, adjusted earnings rose sharply to $1.95 per share from $1.42 per share within the prior-year interval, beating estimates. On an unadjusted foundation, web earnings was $8.52 billion or $1.74 per share in This autumn, vs. $4.32 billion or $0.90 per share within the fourth quarter of 2024. Revenues have been a file $18.0 billion, in comparison with $14.1 billion final 12 months. AI semiconductor income jumped 74% YoY. The highest line beat analysts’ forecasts for the fourth consecutive quarter. Not too long ago, Broadcom’s board accepted a quarterly money dividend of $0.65 per share, payable on December 31.

Regardless of Broadcom’s pivot into a number one provider of customized AI accelerators and a large backlog in AI orders, it’s going through investor scrutiny as revenue margins slim amid a shift towards lower-margin AI-related gross sales. Broadcom’s income stays concentrated amongst a handful of hyperscale cloud prospects, notably Google, which can also be investing in its personal in-house AI chips — underscoring the dangers of buyer dependence. On the identical time, its legacy smartphone and storage chips enterprise is experiencing a slowdown, with business forecasts suggesting a restoration by mid-2026.

On Wednesday, shares of Broadcom opened at $350.68 and principally traded increased in the course of the session. They’ve grown greater than 50% this 12 months, staying sharply above the 12-month common of $272.65.