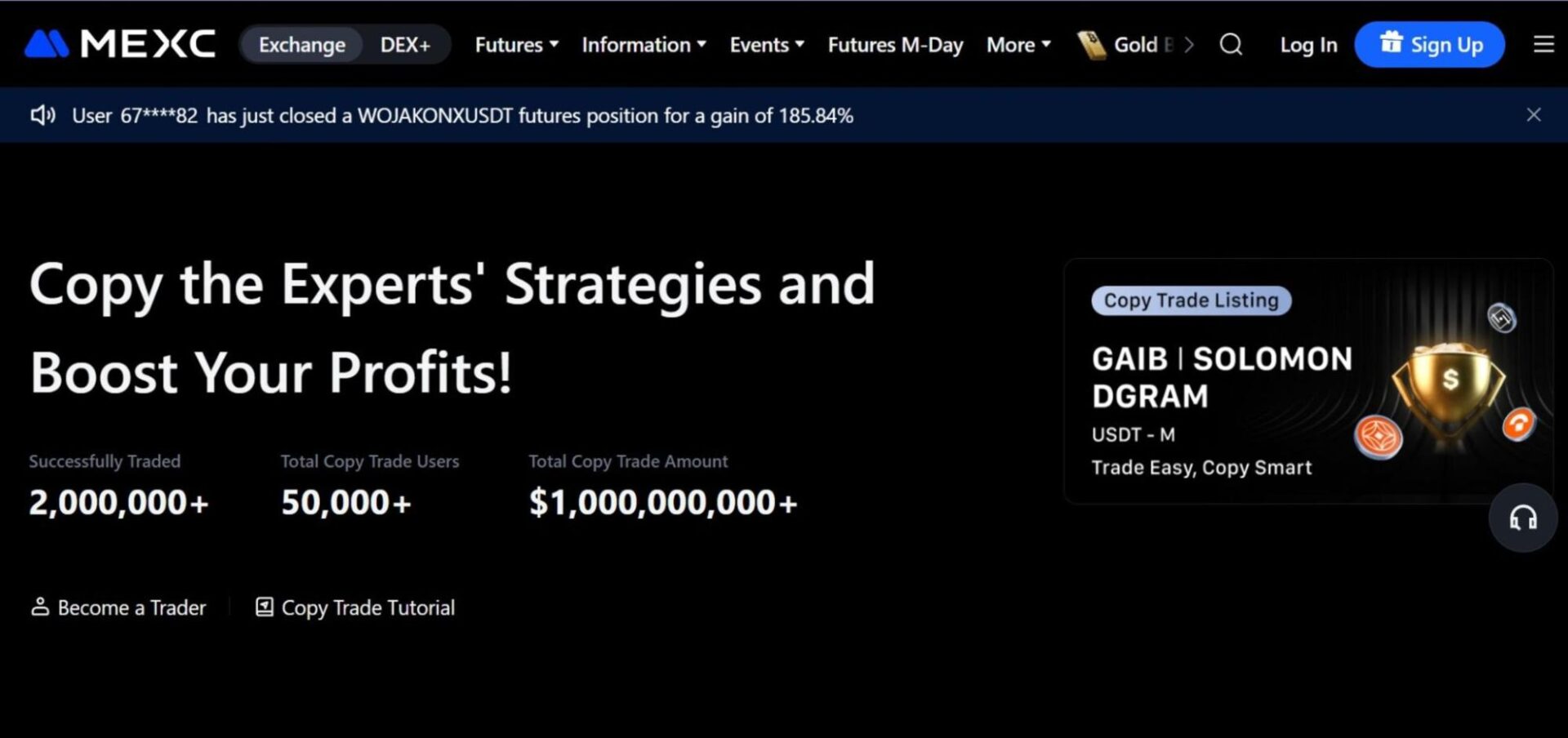

MEXC Copy Buying and selling is without doubt one of the most used options on this trade. It’s created to assist novices comply with the actions of lead merchants and routinely repeat every place opened by the chosen professional. Now, new customers can select a dealer, overview their previous efficiency, set most popular parameters, and add funds earlier than the system begins mirroring every transfer.

This characteristic is designed to make it simpler for folks to take part within the futures market whereas studying from skilled merchants. Whereas MEXC copy buying and selling will be worthwhile, outcomes range relying on which professional you comply with.

Additionally, each commerce you copy continues to be influenced by the crypto market’s unpredictable nature. Due to this fact, whereas copy buying and selling generally is a useful instrument, it additionally carries dangers since crypto costs can change all of the sudden and with out warning.

Introduction to MEXC Change

MEXC Change is a world platform launched in 2018 and acknowledged for its robust futures market, aggressive charges, and broad collection of digital property. The platform presents customers entry to identify markets, futures pairs/contracts, and an intensive record of rising tokens, making it interesting to each novices and skilled merchants.

MEXC trade is constructed to assist lively buying and selling, with instruments that assist customers discover totally different markets and handle positions with ease. The platform additionally presents a duplicate buying and selling characteristic that permits novices to comply with the trades of skilled merchants and mirror every place the chosen professional takes.

This offers new customers a easy entry level into the futures market and a clearer view of how professionals strategy the market. If you wish to be taught extra about MEXC Change earlier than exploring the copy buying and selling market, you possibly can take a look at our full MEXC overview right here.

What Is MEXC Copy Buying and selling?

MEXC copy buying and selling is a characteristic that permits customers to comply with the actions of skilled merchants, generally known as grasp merchants, and routinely open the identical futures positions as the chosen professional.

The system is constructed to allow novices a neater entry into futures buying and selling by displaying them how expert merchants deal with totally different market situations. So, customers can select a grasp dealer, overview their previous outcomes, set a duplicate ratio, and add funds earlier than the system begins mirroring the professional’s strikes.

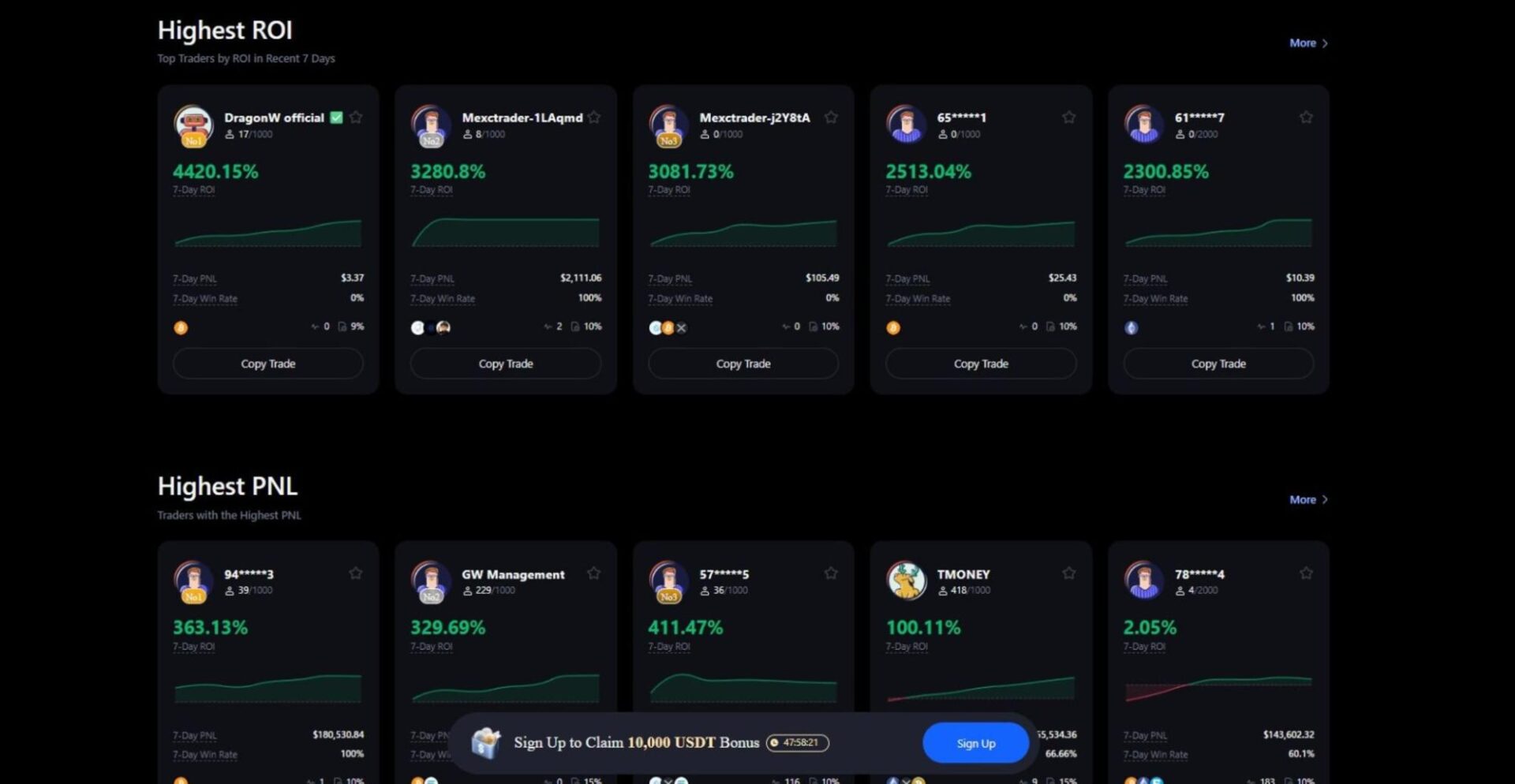

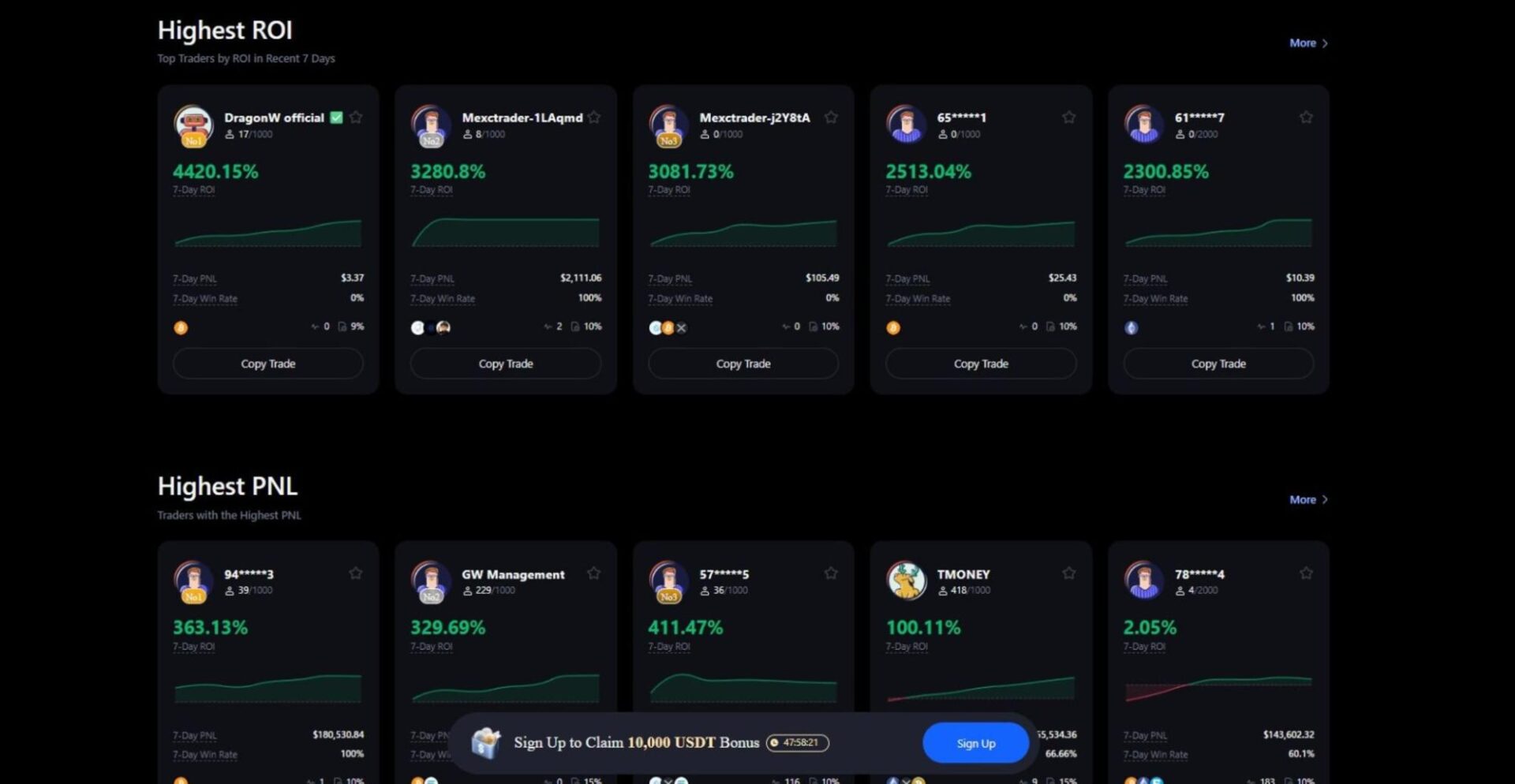

To assist customers make knowledgeable selections, MEXC shows key metrics, together with return on funding (ROI), revenue and loss (PnL), win price, and drawdown. These indicators present how constant a dealer has been, how a lot threat is concerned, and the way efficiency has modified over time.

By reviewing these numbers, novices can choose a grasp dealer whose model aligns with private objectives. Please notice that replicate buying and selling can provide steerage, however outcomes nonetheless rely on market motion, so cautious analysis is essential.

How Does MEXC Copy Buying and selling Work

MEXC copy buying and selling works by permitting customers to routinely replicate the trades of skilled merchants within the futures market. As soon as you choose a grasp dealer, each place they open or shut will be copied to the your account in accordance with your settings.

The system executes trades routinely, so customers don’t have to handle every commerce manually. This makes it simpler for novices to take part out there whereas observing how expert merchants deal with positions and threat.

Begin Copy Buying and selling: Step-by-Step Setup Information

- Join: Create a MEXC account utilizing your e mail and a password. Then, proceed to finish id verification for full entry to the platform’s merchandise and better withdrawal limits.

- Deposit: Click on the “Deposit” possibility in your account homepage and add funds utilizing a supported fee technique.

- Navigate to the Copy Buying and selling Interface: Go to the Copy Buying and selling part on the platform and browse out there high merchants. Assessment their efficiency metrics, together with ROI, profitable trades, and drawdown, to assist resolve which lead dealer’s methods align along with your wants.

- Set Parameters: Modify the copy ratio, threat limits, and different preferences to align with private objectives.

- Begin Copy Buying and selling: Verify settings and let the system routinely mirror every commerce executed by the chosen dealer.

How Trades Are Executed Routinely

MEXC copy buying and selling is designed to make following grasp merchants easy and accessible for novices. When a specific dealer opens or closes a place, the system mirrors the commerce routinely within the follower’s account primarily based on the chosen copy ratio and threat settings.

Trades are executed instantly to match the grasp dealer as carefully as potential, though small variations, known as slippage, can happen as a result of market motion.

Followers even have management over their copy buying and selling accounts and open positions, regardless that they’re following skilled buyers. A method this management is enhanced is thru the guide override choices.

These choices enable customers to pause, cease, or alter trades at any time, guaranteeing they’ll handle threat, exit positions, or modify settings with out disrupting the automated course of.

Vital Metrics to Analyze Earlier than Copying a Lead Dealer

Selecting the best dealer to comply with is without doubt one of the most essential steps in MEXC copy buying and selling. Additionally, understanding key efficiency metrics may also help novices make knowledgeable selections and keep away from pointless threat.

While you overview these parameters, you’ll achieve perception into how a dealer operates and whether or not their technique aligns along with your private objectives.

- Return on Funding (ROI): The full ROI reveals the general revenue generated by the dealer over time, serving to customers gauge consistency.

- Revenue and Loss (PnL): The full PnL breaks down good points and losses per commerce, revealing how positions carry out throughout varied market situations.

- Belongings underneath administration (AUM): AUM reveals the full capital others are copying from this dealer, and the professional follower depend reveals their neighborhood recognition and belief degree.

- Danger Stage: It highlights how aggressive or conservative the dealer’s strategy is.

Observe: When you think about all these metrics collectively, you possibly can evaluate merchants extra successfully and select a method that matches your consolation degree and targets.

What Are the Professionals and Cons of MEXC Copy Buying and selling

The professionals and cons of MEXC copy buying and selling are highlighted beneath:

| Professionals | Cons |

| Straightforward for novices to begin buying and selling futures pairs | Market volatility can have an effect on outcomes |

| Trades are executed routinely | Efficiency depends upon the grasp dealer |

| Saves time in comparison with guide buying and selling | No assured income |

| Entry to skilled and verified merchants. Customers can even comply with multiple dealer. | Potential for losses exists |

| Permits portfolio diversification |

Who Ought to Use MEXC Copy Buying and selling (and Who Ought to Keep away from It)

Splendid customers of MEXC Copy Buying and selling are those that want a hands-off strategy, need to be taught from skilled merchants, and worth constant, disciplined methods with out continually monitoring the market. It fits novices who lack superior buying and selling abilities or confidence, in addition to reasonable merchants searching for to diversify their portfolios safely.

In the meantime, non-ideal customers embody high-risk merchants who crave full management over their trades, need to execute daring methods, or want flexibility in timing and margin settings. Those that dislike following others’ selections or anticipate assured income also needs to keep away from copy buying and selling.

MEXC Copy Commerce Mode – Splendid Customers

MEXC Crypto Buying and selling is usually appropriate for:

- Learners: Copy buying and selling is ideal for these new to futures buying and selling as a result of it permits participation with out requiring deep information of methods or market evaluation. By following expert merchants, novices can observe how positions are opened and closed, serving to them be taught market conduct in actual time.

This reduces the chance of pricey errors whereas regularly constructing confidence and expertise. Learners achieve each steerage and a sensible studying alternative by means of the hands-on replication of trades.

- Passive Merchants: This group advantages from automation as a result of trades are executed routinely, eradicating the necessity to monitor the markets continually. Passive merchants can stay invested with out dedicating hours to monitoring value actions or making real-time selections.

- Busy Buyers: Copy buying and selling saves time for buyers who can not deal with buying and selling full-time. Automated execution ensures alternatives usually are not missed whereas managing different commitments. Busy buyers can keep lively out there with out continually analyzing charts or monitoring trades. This strategy permits them to take part successfully with minimal effort.

MEXC Copy Commerce Mode – Not Splendid For

MEXC crypto buying and selling just isn’t appropriate for everybody. Whereas it may possibly make buying and selling simpler for some, others may discover it limiting or demanding.

- Excessive-Danger Merchants: Excessive-risk merchants typically discover copy buying and selling restrictive as a result of it requires following another person’s selections, limiting the power to execute daring, aggressive positions or experiment with methods in a private approach.

Since copy buying and selling removes the power to regulate leverage, place sizes, or timing freely, it may possibly battle with the necessity for speedy, unconventional strikes in unstable markets. This lack of direct management additionally exposes the dealer to the copied dealer’s threat administration selections and any sudden modifications in technique.

- Customers Who Need Full Management: Merchants preferring to manage each facet of their trades might discover copy buying and selling limiting. Following different merchants means selections are shared slightly than made independently, which might battle with private buying and selling plans. For customers who worth independence and exact decision-making, this lack of autonomy will be irritating.

- Customers With Low Danger-Tolerance: Even when following skilled merchants, losses are potential as a result of market volatility. Merchants who’re uncomfortable with the potential of swings in portfolio worth might discover copy buying and selling demanding. The reliance on one other dealer’s technique can amplify uncertainty for cautious customers. These with low threat tolerance might want self-managed methods with slower, extra managed publicity to the market.

Suggestions for Selecting the Proper Dealer on MEXC

Listed below are some ideas that can assist you select the precise high dealer on MEXC.

- Assessment Previous Efficiency: MEXC gives clear efficiency information that covers each quick and prolonged timeframes, together with seven-day and one-hundred-and-eighty-day outcomes for Revenue and Loss (PNL), Return on Funding (ROI), and win charges.

These metrics make it simpler to evaluate whether or not a dealer has maintained regular progress or skilled uneven outcomes. With this data, you possibly can select somebody whose efficiency file aligns along with your funding objectives.

- Analyze Buying and selling Type: Understanding a dealer’s model is important as a result of each dealer approaches the market in another way. On the Dealer Particulars web page, you possibly can examine patterns akin to Buying and selling Frequency and the Revenue and Loss Ratio (PNL Ratio) to see whether or not the individual’s rhythm matches your individual consolation degree.

- Assessment Rankings and Metrics: MEXC types merchants by a number of metrics akin to Return on Funding (ROI), win charges, Revenue and Loss (PNL), and follower depend. These rankings make it simpler to identify merchants who’ve earned belief by means of constant outcomes. A big follower base is usually an encouraging signal, because it suggests the neighborhood has confidence in that dealer’s strategy.

The right way to Consider Futures Buying and selling Type and Margin Settings

Evaluating a dealer’s model begins with understanding the kind of technique they like, as a result of this units the tempo and threat degree of your copied trades. Some merchants depend on frequent, short-term strikes, whereas others deal with calmer, long-term positions, so it helps to decide on the rhythm that matches your consolation degree.

It’s also helpful to verify how a lot leverage the dealer makes use of and whether or not that degree feels secure to your funding strategy, particularly throughout quick market swings. By taking a look at consistency, previous drawdowns, and the way the dealer behaves underneath strain, you get a clearer image of whether or not their model aligns with what you need from copy buying and selling.

Danger Administration and Extra Settings for Copy Dealer

Managing threat in copy buying and selling begins with setting a cease loss, as a result of it creates a transparent boundary that protects your capital when the market strikes towards the copied technique. As soon as that safety is in place, resolve how a lot to allocate. It’s advisable to maintain the quantity small to keep away from exposing your whole stability. From there, spreading your funds throughout a number of merchants provides an additional layer of security, since totally different methods can stability each other throughout unpredictable market situations.

Conclusion – Getting Began with MEXC Copy Buying and selling

MEXC copy buying and selling presents a easy path for anybody who desires to enter the market by mirroring the actions of expert merchants by means of automated execution. While you perceive the dangers concerned, how the system works, together with the professionals and cons, it makes it simpler to strategy copy buying and selling with confidence and sensible expectations.

Whereas this buying and selling technique holds a lot promise, it is very important examine every grasp dealer fastidiously and train warning when investing. If you’re prepared to start, you possibly can enroll on MEXC and get bonuses and price reductions to spice up your preliminary funding. You possibly can activate your copy buying and selling account with this MEXC referral Code.