The bitcoin value might climb to $143,000 subsequent 12 months as continued adoption by exchange-traded funds and a extra accommodating U.S. regulatory backdrop draw new capital into the market, in line with a brand new forecast from Citi.

Analysts on the Wall Road financial institution set $143,000 as their base-case goal for the bitcoin value over the following 12 months. They outlined a bullish state of affairs that locations the worth above $189,000, whereas their bearish case sees the bitcoin value falling to round $78,500 if macroeconomic circumstances deteriorate, in line with MarketWatch reporting.

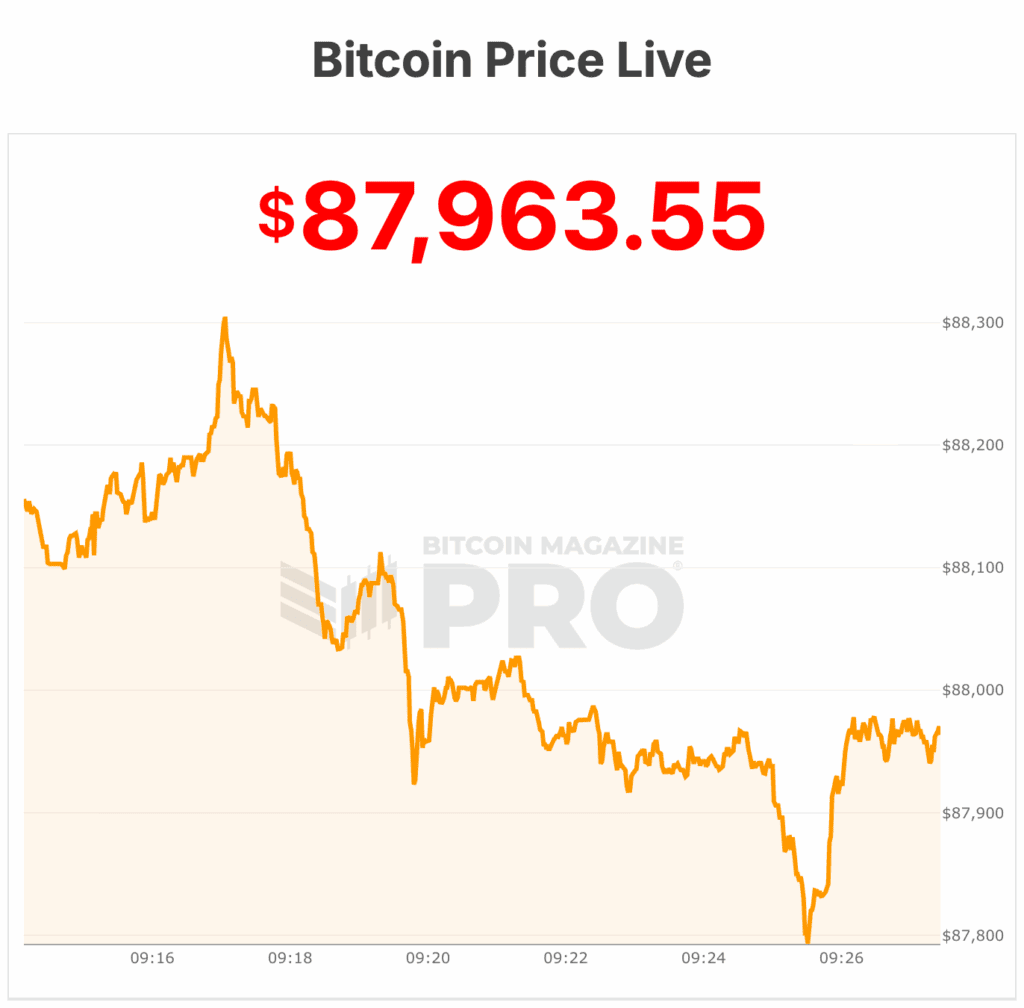

The bitcoin value was buying and selling close to $88,000 on Friday, down roughly 30% from its late-October peak. The pullback adopted a pointy wave of promoting after the rally earlier this 12 months, although Citi famous that outflows from spot bitcoin exchange-traded funds have moderated in current weeks.

“Our forecasts, particularly for bitcoin, relaxation on an assumption that investor adoption continues with flows into ETFs of $15 billion boosting token costs,” the analysts wrote. The notice was led by Alex Saunders, Citi’s head of worldwide quantitative macro technique.

Citi additionally pointed to potential regulatory readability in the US as a key driver of future demand. The U.S. Senate is negotiating its personal model of the Home-passed Readability Act, laws that will place bitcoin below the oversight of the Commodity Futures Buying and selling Fee. The analysts stated clearer guidelines might encourage broader institutional participation.

The financial institution’s bearish state of affairs assumes recessionary pressures and weaker urge for food for danger property. The bitcoin value fell to multi-month lows in November as considerations over excessive know-how valuations and broader macro dangers weighed on markets.

The cryptocurrency shed greater than $18,000 that month, marking its largest greenback decline since Could 2021 amid heavy investor withdrawals.

Banks are embracing bicoin

Two weeks in the past, the Financial institution of America informed its wealth administration purchasers to allocate 1% to 4% of their portfolios to digital property, signaling a significant shift in its strategy to Bitcoin publicity.

The transfer allowed over 15,000 advisers throughout Merrill, Financial institution of America Personal Financial institution, and Merrill Edge to proactively suggest crypto to purchasers.

Final week, PNC Financial institution launched direct spot bitcoin buying and selling for eligible Personal Financial institution purchasers, permitting them to purchase, maintain, and promote bitcoin natively by its personal digital banking platform with out utilizing an exterior change. The transfer was powered by Coinbase’s Crypto-as-a-Service infrastructure.

Bitcoin value evaluation

Bitcoin’s newest sell-off underscores a market caught in consolidation, the place constructive macro catalysts fail to translate into sustained upside.

After briefly testing $89,000 on cooler-than-expected U.S. inflation knowledge, bitcoin slid again towards the $84,000 vary, extending a correction now coming into its second month. The sample has develop into acquainted: sharp, data-driven rallies adopted by fast retracements as sellers defend resistance under $90,000.

Macro indicators supply blended help. November CPI eased to 2.7% 12 months over 12 months, with core inflation at 2.6%, strengthening the case for eventual Federal Reserve fee cuts in 2026. That backdrop helped spark the intraday rally. But rising U.S. unemployment and uneven job progress complicate the outlook, reinforcing expectations that the Fed will transfer cautiously. Markets seem reluctant to cost in aggressive easing.

A key drag stays U.S.-listed spot Bitcoin ETFs, which have shifted from constant inflows to web redemptions. The outflows take away a stabilizing bid that beforehand absorbed promote stress, making breakouts tougher to maintain even on constructive information.

Technically, the bitcoin value is range-bound. Resistance sits slightly below $90,000, whereas help close to $84,000 is weakening. A decisive break decrease might open a transfer towards the $72,000–$68,000 zone, the place analysts count on stronger demand.

Excessive concern readings counsel potential undervaluation, however near-term momentum nonetheless favors sellers.

On the time of writing, the bitcoin value is dancing round the $88,000 stage.