BTC USD has seen fairly a little bit of volatility recently. Particularly yesterday, for some unusual purpose, when slightly below $1 billion bought liquidated from the crypto market, $830 million of those being longs. Possibly that’s an indication that the sentiment is bullish? Or is it an indication that individuals are having a tough time shifting their bias?

JUST IN:

Financial institution of America formally recommends purchasers put as much as 4% of their portfolio in Bitcoin and crypto. pic.twitter.com/DZoNRFUFbQ

— Watcher.Guru (@WatcherGuru) December 2, 2025

Establishments, then again, are appearing bullish. Take the latest assertion from the Financial institution of America. Is it pleasant recommendation, or an try to save lots of somebody, or stop an extra draw back from occurring? There have been rumours about $MSTR doubtlessly getting in bother if

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.optimistic svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic {

coloration: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.optimistic {

border: 1px stable #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic::earlier than {

border-bottom: 4px stable #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.damaging svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.damaging {

border: 1px stable #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging {

coloration: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging::earlier than {

border-top: 4px stable #A90C0C !necessary;

}

0.34%

Bitcoin

BTC

Value

$90,991.63

0.34% /24h

Quantity in 24h

$51.73B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

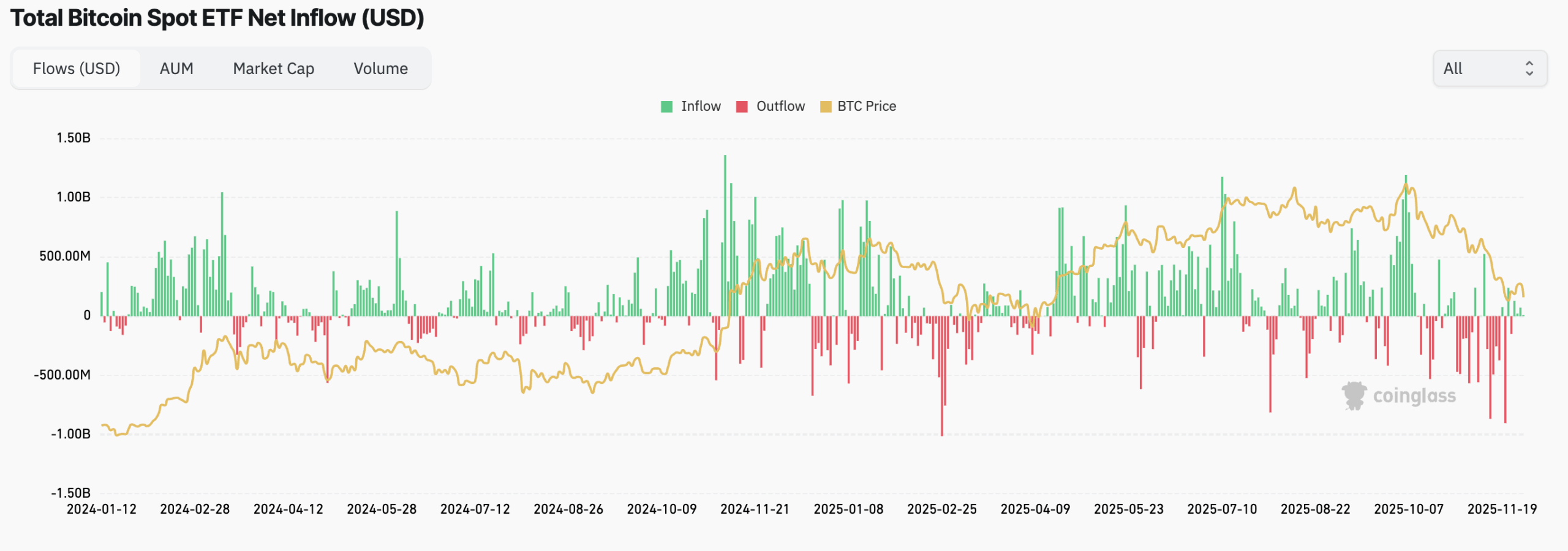

drops right down to $70,000 or decrease. Sayler got here again with a declare about reserves being prepared. What’s transferring the markets then? Over the previous weeks, there was principally promoting within the Bitcoin spot ETF. Though the Influx chart seems near the place it was within the pre-April 2025 pump. Possibly there may be hope.

DISCOVER: Finest Meme Coin ICOs to Spend money on 2025

(Supply – Coinglass)

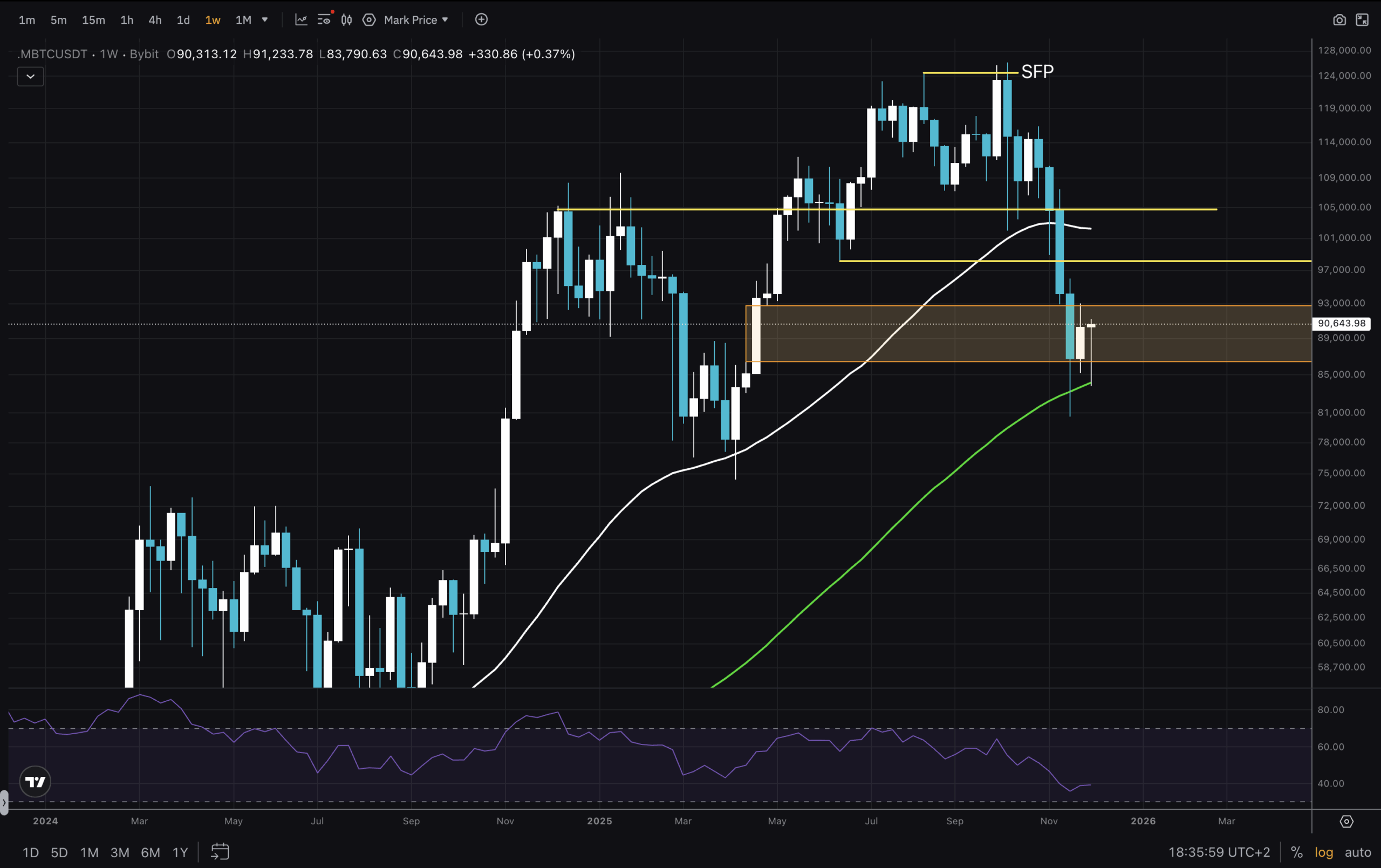

BTC USD Pair Ranges Out: Are We At Help?

(Supply – Tradingview, BTCUSD)

Allow us to start our evaluation with the Weekly chart. A not so arduous to learn type of chart! At the least it matches properly with our drawings from the earlier evaluation. For now, the FVG is holding the value boxed in. We even have confluence with the MA100, as indicated final time, to be a possible assist. It’s nonetheless a better low right here, in relation to the March-April 2025 low. Subsequently, structurally, the uptrend remains to be not damaged.

DISCOVER: High Solana Meme Cash to Purchase in 2025

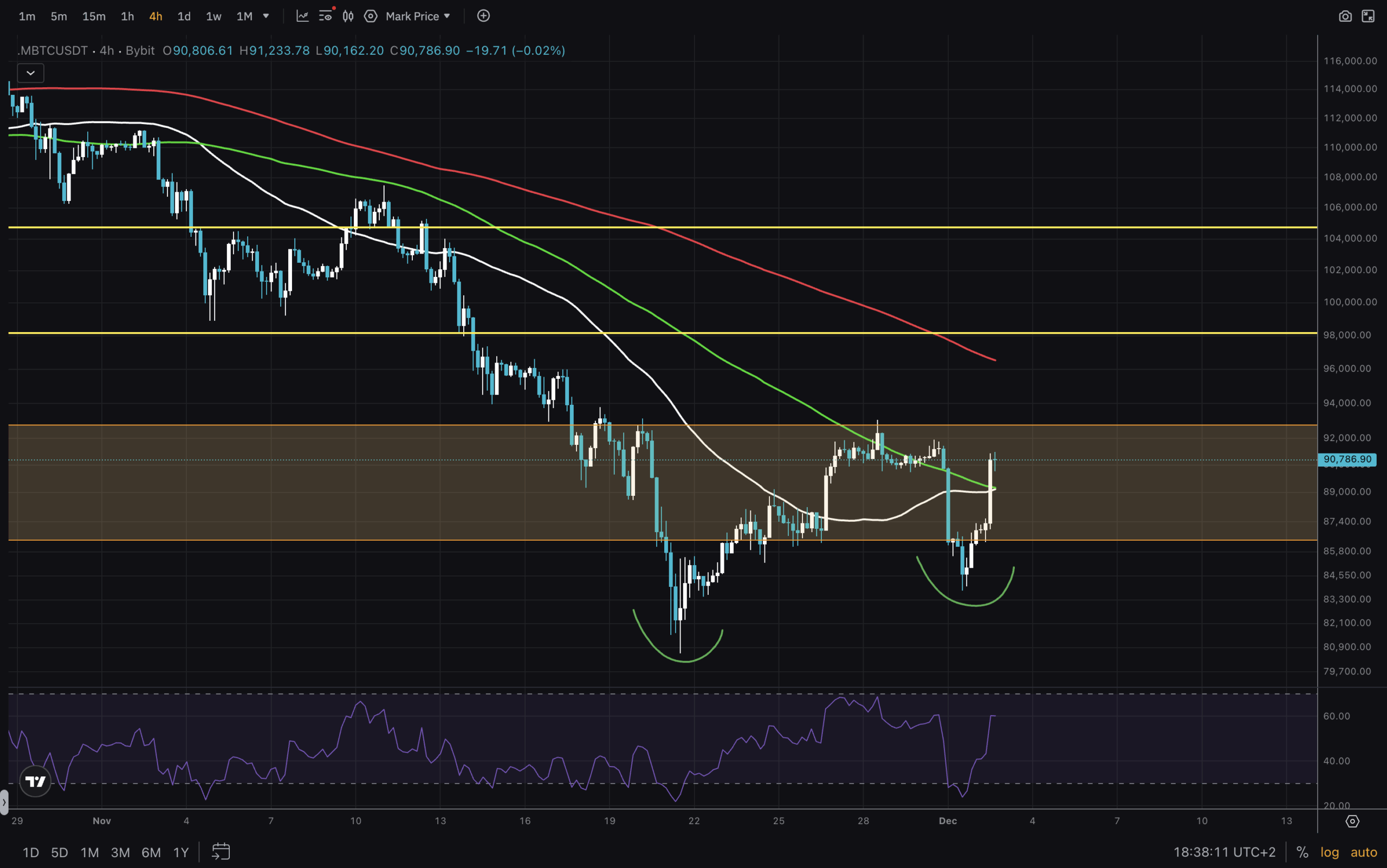

(Supply – Tradingview, BTCUSD)

Shifting on to the Day by day chart, BTC USD is at the moment printing a bullish engulfing candle. And within the meantime, RSI seems prefer it bottomed with its oversold space sweep. Lengthy wicks under the candles ought to sign purchaser curiosity amid vendor strain. Although who has extra ammunition is but to be revealed. The Shifting Averages listed below are all overhead, which isn’t a really fairly sight. And clearly, we’ve been making decrease lows and decrease highs, indicating a pattern shift on this timeframe.

DISCOVER: High 20 Crypto to Purchase in 2025

Concluding Ideas And Key Ranges To Watch

(Supply – Tradingview, BTCUSD)

Lastly, we’ll analyse the 4H timeframe for BTC USD. Right here we’ve a better low shaped, adopted by a robust transfer up, neutralising yesterday’s panic. Value is getting into above MA50 and MA100, with RSI shortly transferring to the robust higher half of its vary. Two key ranges are $98,000 and $105,000. MA200 might present some resistance indicators, however the expectation is that the $7,000 vary between the 2 yellow traces can be examined and doubtlessly type a decrease excessive. An excellent R:R for a protracted place was positively under the final 4H massive and robust candle. Right here, the R:R shouldn’t be too nice. However being again within the $90,000 vary is an efficient begin for bulls.

Keep secure on the market!

DISCOVER: 9+ Finest Memecoin to Purchase in 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

BTC USD Exhibiting Early Indicators Of Restoration: A New Hope?

- RSI on Day by day reveals indicators of backside.

- 4H chart reveals a better low. Possibly a better excessive is subsequent?

- Weekly FVG is crammed and is the present vary.

- $90,000 reclaimed on LTF, however nonetheless early to rejoice for prime timeframes.

- MA100 on weekly, appearing as assist

The publish BTC USD Exhibiting Early Indicators Of Restoration: A New Hope? appeared first on 99Bitcoins.

![[LIVE] Ex-Trump Official Bo Hines Joins Tether: USDT to Resume Bull Run Again Full Gear](https://coininsight.co.uk/wp-content/uploads/2025/08/1f1fa-1f1f8.png)

Financial institution of America formally recommends purchasers put as much as 4% of their portfolio in Bitcoin and crypto.

Financial institution of America formally recommends purchasers put as much as 4% of their portfolio in Bitcoin and crypto.