Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value has plunged 15% up to now week and 1.1% within the final 24 hours to commerce at $2.12 as of three.45 a.m. EST on a 29% bounce in buying and selling quantity to $6.05 billion.

This comes because the long-awaited launch of the Bitwise XRP ETF begins buying and selling at the moment on the New York Inventory Change below the ticker “XRP”.

Large information: The Bitwise XRP ETF is ready to start buying and selling on NYSE tomorrow with the ticker $XRP.

It has a administration charge of 0.34%, which is waived for the primary month on the primary $500M in belongings. This product brings traders spot publicity to XRP, the crypto asset that goals to… pic.twitter.com/0GLR37NnuI

— Bitwise (@BitwiseInvest) November 19, 2025

The ETF is anticipated to deliver new liquidity from institutional consumers, however uncertainty nonetheless shadows the Ripple token after a tough November.

Bitwise’s transfer is large information for the XRP neighborhood. The fund has a 0.34% administration charge (waived for the primary month), and it’s custodied by Coinbase.

Bitwise’s XRP ETF is designed as a spot product, promising direct publicity to XRP’s value, not like earlier crypto ETFs centered on futures.

With Grayscale and Franklin Templeton additionally set to launch XRP funds within the coming week, might these funds assist stabilise the XRP value?

XRP Value Beneath Strain As Sellers Dominate

Value motion for XRP has been below sustained downward strain. Knowledge from Glassnode exhibits that over 41% of the XRP provide is now sitting at a loss, and solely 58.5% of XRP holders are nonetheless in revenue—the bottom degree since late 2024, when XRP was buying and selling close to $0.53.

On-chain analytics reveal whales have been promoting for the reason that summer time, sparking a shift in sentiment to “nervousness.” Retail traders are additionally dashing for the exits, particularly these with lower than 100 XRP tokens.

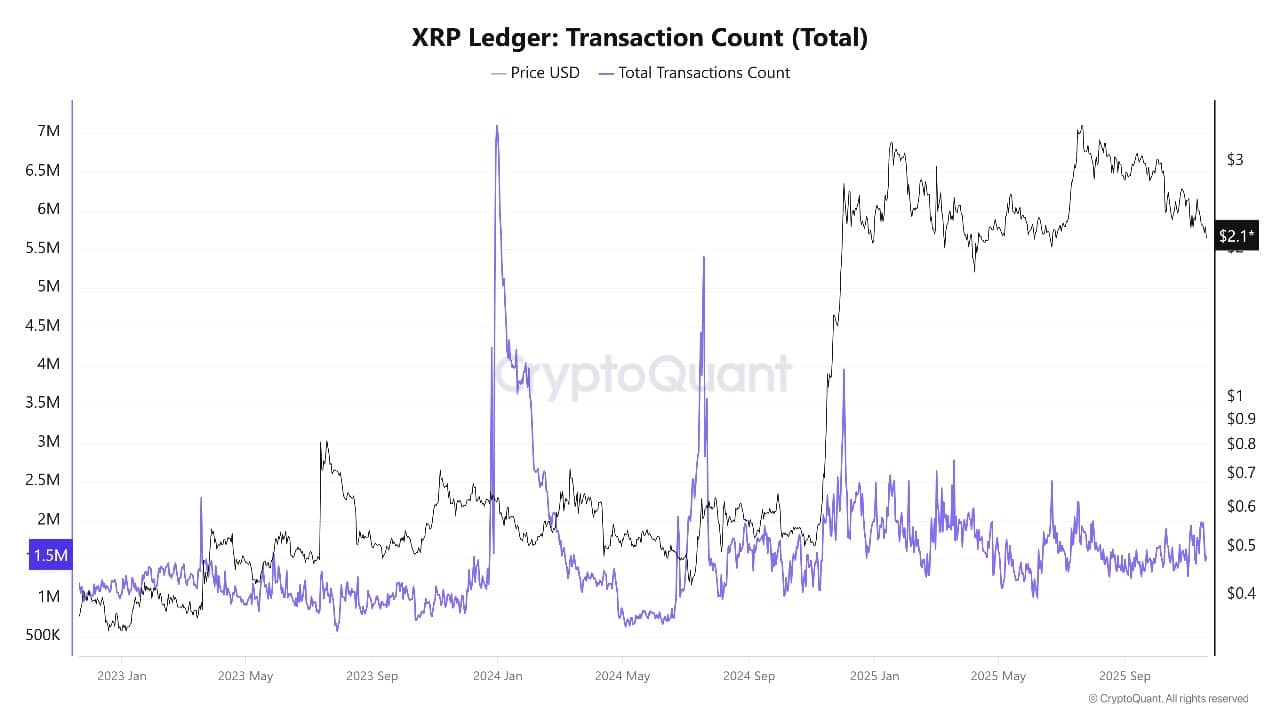

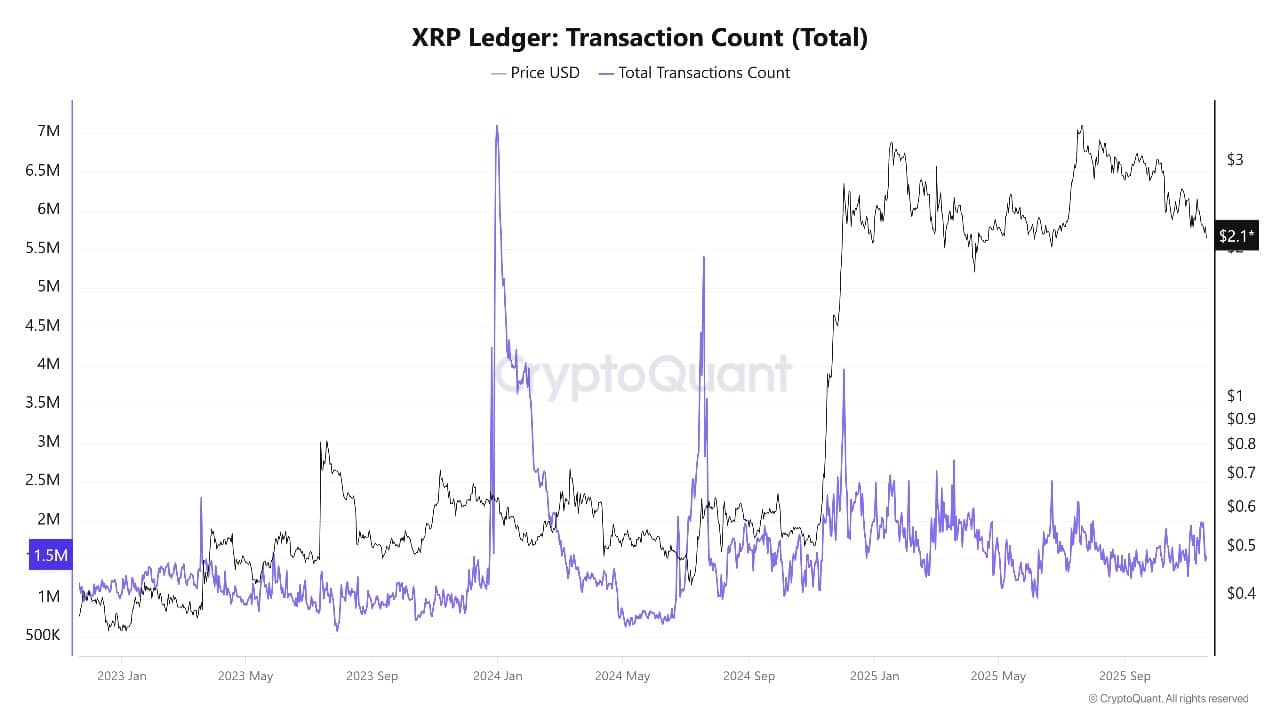

Nonetheless, the usage of the XRP Ledger stays sturdy regardless of the worth droop. XRPScan studies that transaction volumes are excessive, with a number of every day spikes not associated to speculative buying and selling, however to will increase in utility.

Not too long ago, over two billion XRP have been moved on the community in someday, displaying that fee and settlement use circumstances are nonetheless energetic. The ledger continues to file between 1.5 and a pair of million profitable transactions per day, outperforming many different blockchains, even because the coin’s value drops.

XRP Ledger Transaction Rely supply: CryptoQuant

XRP Value Bulls Might Regain Management

The XRP value is now buying and selling at $2.12, under the 50-week easy shifting common (SMA) at $2.53 and approaching key assist ranges proven by the current multi-month buying and selling vary.

Bears are in management, because the coin struggles to carry above the essential $2.10-$2.00 assist zone. The 50-week SMA at $2.53 has turn out to be sturdy resistance after the current breakdown. The 200-week SMA sits far under at $1.05, suggesting main long-term assist stays distant.

XRPUSDT Chart Evaluation Supply: Tradingview

The Relative Energy Index (RSI) is at 41, displaying that XRP shouldn’t be but “oversold,” however the pattern is bearish and momentum is missing. The MACD indicator is destructive, with the principle line under the sign and histogram bars in purple. This indicators that sellers are nonetheless in cost.

XRP’s value is at present caught between $2.00 and $2.50, with the $2.00 space now performing as key assist. If bears break this degree, value might drop rapidly to $1.80 and even $1.60, near the 61.8% Fibonacci retracement (at $1.60) from the earlier large rally.

Beneath that, the 200-week SMA at $1.05 is the final “line within the sand” for long-term bulls. Nevertheless, for any rebound, XRP value should reclaim $2.20–$2.25 first, then attempt to flip the 50-week SMA at $2.53 again into assist. Solely above $2.53 does the outlook begin to enhance, with upside targets close to $2.72 (23.6% Fib) and $3.10 (earlier native highs).

Will ETF Launches Stabilise XRP?

The brand new Bitwise XRP ETF launch at the moment is drawing big consideration from each institutional and retail traders. Whereas it’s anticipated so as to add new liquidity and should entice contemporary waves of shopping for, the broader destructive sentiment and on-chain proof of heavy promoting make a fast turnaround unsure.

If at the moment’s ETF launch sparks demand, XRP might discover assist and get well to greater ranges. But when consumers don’t step in strongly, value dangers will drift towards decrease helps within the coming weeks.

The subsequent few days of buying and selling will likely be essential for deciding whether or not XRP value can lastly stabilise, or whether or not the downtrend continues regardless of Wall Road’s newest crypto product launches.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection