Key Highlights

- On November 17, the NYSE authorized the itemizing and registration of the Canary Marinade Solana ETF, clearing the street earlier than its launch

- This ETF nonetheless requires ultimate approval from the SEC, after which it might start buying and selling on the Cboe alternate within the upcoming weeks

- This new pattern of Solana ETFs comes after latest regulatory statements on staking tokens

As per the most recent replace, the New York Inventory Change (NYSE) has authorized the itemizing and registration of the Canary Marinade Solana ETF. With this approval, this new SOL ETF is one inch away from going dwell for buying and selling.

“We additional certify that the safety described above has been authorized by the Change for itemizing and registration upon official discover of issuance. We perceive that the Registrant is searching for effectiveness underneath the Kind 8-A 12(b), and we hereby take part such request,” acknowledged within the official doc.

Canary Marinade Solana ETF Prepares to Go Dwell

With the approval from the NYSE, a brand new SOL ETF is predicted to go for market debut in the USA. The approval comes with a fast-track course of after the Securities and Change Fee (SEC) authorized up to date generic itemizing requirements, which permit merchandise just like the Canary Marinade Solana ETF to proceed.

This new ETF might turn into a sizzling favourite for these buyers who need to reap the benefits of staking tokens, because it passes by 100% of the staking rewards to buyers.

The ETF now requires ultimate approval from the SEC and will start buying and selling on the Cboe alternate within the upcoming weeks.

Nonetheless, the continued downward pattern within the cryptocurrency market has additionally affected SOL. On the time of writing, SOL is buying and selling at round $131.25 after a 21.67% drop in every week, based on CoinMarketCap.

Solana ETFs Debut Amid Market Volatility

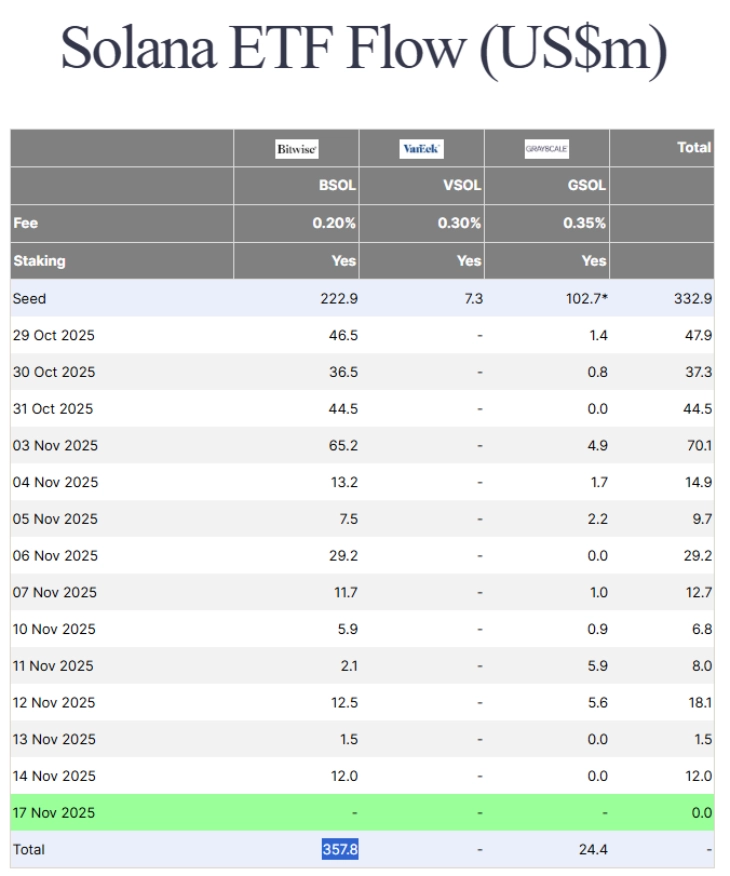

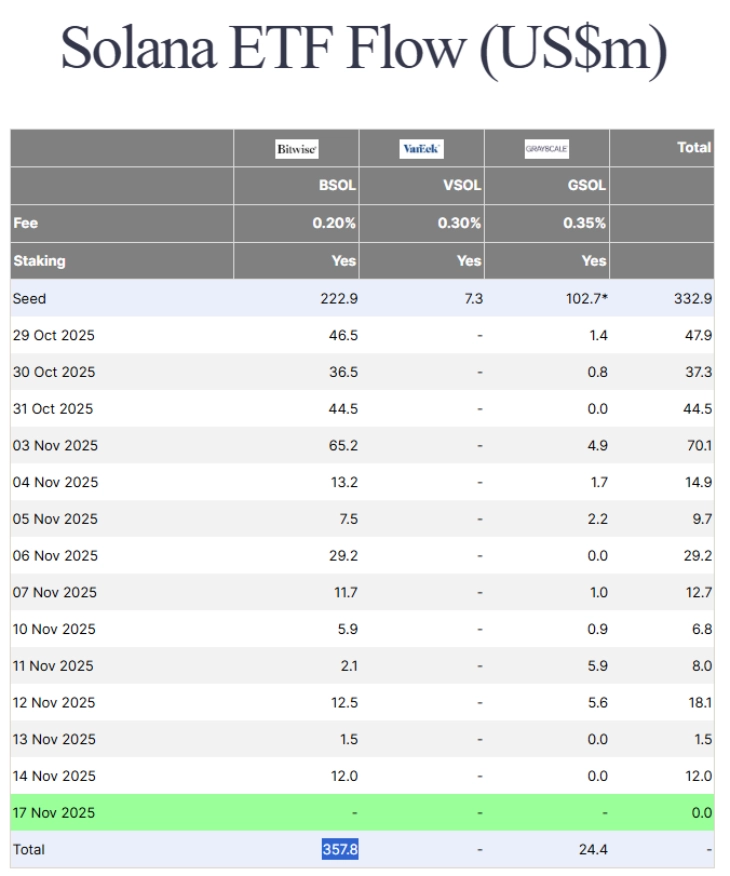

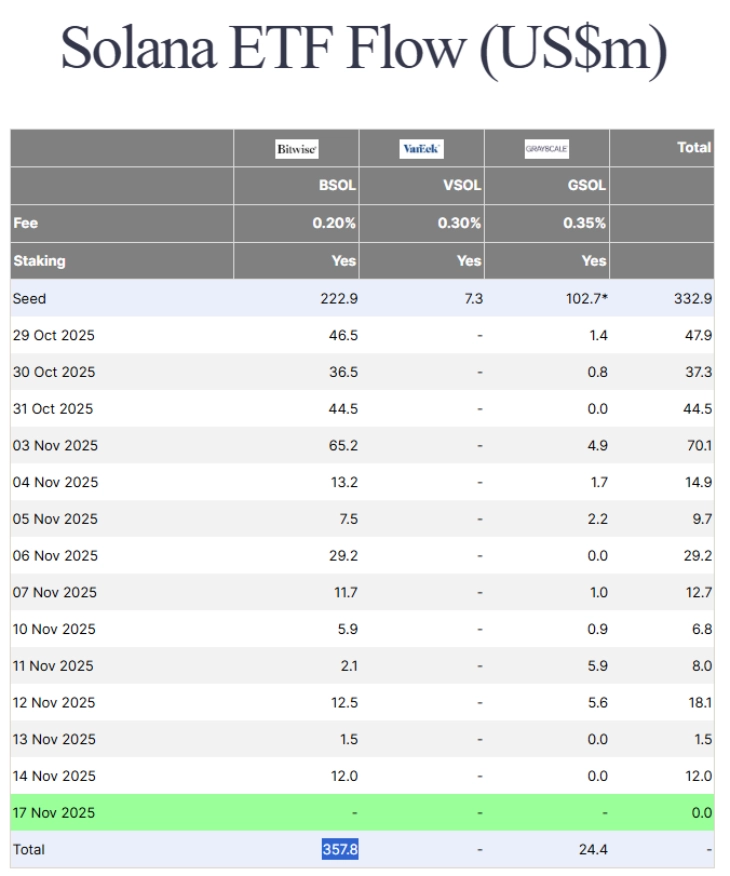

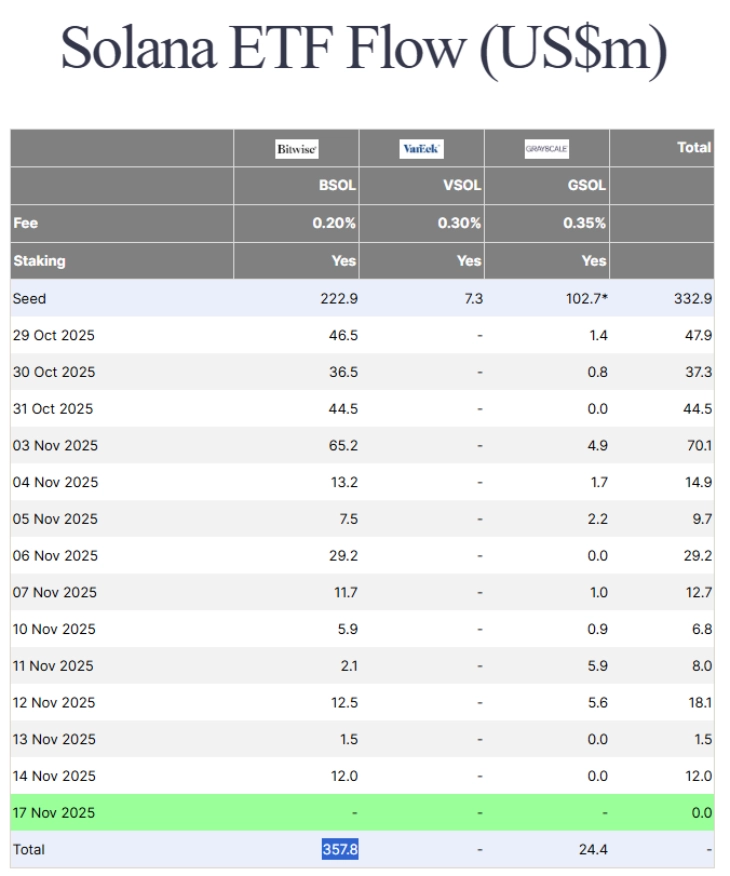

The USA has witnessed one other main pattern in late October with the launch of the primary Spot Solana ETF. The Bitwise Solana Staking ETF started buying and selling on the NYSE Arca on October 28. On its first day, BSOL attracted an influx of 46.5 million, based on Farside. For the reason that launch, the Solana ETF has maintained a optimistic streak of inflows. The whole quantity invested in BSOL because the ETF launched revolves round $357.8 million, making it the largest Solana ETF.

(Supply: Farside)

BSOL can also be designed to supply direct publicity to SOL. Additionally, it partnered with Helius to stake 100% of its holdings to permit the fund to supply buyers with over 7% in annual staking yields.

The launch of BSOL additionally inspired different ETF issuers to hitch the occasion and launch their very own merchandise. The day after Bitwise’s launch, Grayscale additionally launched its Solana Belief ETF on the NYSE Arca. This ETF transformed Grayscale’s present closed-end fund into a brand new spot ETF product that comes with staking rewards. Up to now, GSOL has witnessed a complete influx of $24.4 million. Whereas this funding is fixed, it’s nonetheless small in comparison with Bitcoin ETFs.

The competitors available in the market intensified in mid-November when VanEck entered the market with its VanEck Solana ETF, which started buying and selling on the Cboe BZX alternate. Because the second U.S. spot Solana product to incorporate staking, VanEck adopted a powerful technique to entice buyers by waiving all administration charges for the primary $1 billion in property or till February 17, 2026, whichever comes first, based on the press launch.

One of many main causes behind the increase in Solana ETFs is the most recent regulatory pointers from authorities that opened doorways for staking-based ETFs. In August, the SEC’s Division of Company Finance launched a press release, wherein they clarified that sure liquid staking tokens are usually not securities.

“It’s the Division’s view that “Liquid Staking Actions” (as outlined under) in reference to Protocol Staking don’t contain the provide and sale of securities throughout the which means of Part 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Part 3(a)(10) of the Securities Change Act of 1934 (the “Change Act”). Accordingly, it’s the Division’s view that contributors in Liquid Staking Actions don’t must register with the Fee transactions underneath the Securities Act, or fall inside one of many Securities Act’s exemptions from registration in reference to these Liquid Staking Actions,” acknowledged within the official assertion.

Key Highlights

- On November 17, the NYSE authorized the itemizing and registration of the Canary Marinade Solana ETF, clearing the street earlier than its launch

- This ETF nonetheless requires ultimate approval from the SEC, after which it might start buying and selling on the Cboe alternate within the upcoming weeks

- This new pattern of Solana ETFs comes after latest regulatory statements on staking tokens

As per the most recent replace, the New York Inventory Change (NYSE) has authorized the itemizing and registration of the Canary Marinade Solana ETF. With this approval, this new SOL ETF is one inch away from going dwell for buying and selling.

“We additional certify that the safety described above has been authorized by the Change for itemizing and registration upon official discover of issuance. We perceive that the Registrant is searching for effectiveness underneath the Kind 8-A 12(b), and we hereby take part such request,” acknowledged within the official doc.

Canary Marinade Solana ETF Prepares to Go Dwell

With the approval from the NYSE, a brand new SOL ETF is predicted to go for market debut in the USA. The approval comes with a fast-track course of after the Securities and Change Fee (SEC) authorized up to date generic itemizing requirements, which permit merchandise just like the Canary Marinade Solana ETF to proceed.

This new ETF might turn into a sizzling favourite for these buyers who need to reap the benefits of staking tokens, because it passes by 100% of the staking rewards to buyers.

The ETF now requires ultimate approval from the SEC and will start buying and selling on the Cboe alternate within the upcoming weeks.

Nonetheless, the continued downward pattern within the cryptocurrency market has additionally affected SOL. On the time of writing, SOL is buying and selling at round $131.25 after a 21.67% drop in every week, based on CoinMarketCap.

Solana ETFs Debut Amid Market Volatility

The USA has witnessed one other main pattern in late October with the launch of the primary Spot Solana ETF. The Bitwise Solana Staking ETF started buying and selling on the NYSE Arca on October 28. On its first day, BSOL attracted an influx of 46.5 million, based on Farside. For the reason that launch, the Solana ETF has maintained a optimistic streak of inflows. The whole quantity invested in BSOL because the ETF launched revolves round $357.8 million, making it the largest Solana ETF.

(Supply: Farside)

BSOL can also be designed to supply direct publicity to SOL. Additionally, it partnered with Helius to stake 100% of its holdings to permit the fund to supply buyers with over 7% in annual staking yields.

The launch of BSOL additionally inspired different ETF issuers to hitch the occasion and launch their very own merchandise. The day after Bitwise’s launch, Grayscale additionally launched its Solana Belief ETF on the NYSE Arca. This ETF transformed Grayscale’s present closed-end fund into a brand new spot ETF product that comes with staking rewards. Up to now, GSOL has witnessed a complete influx of $24.4 million. Whereas this funding is fixed, it’s nonetheless small in comparison with Bitcoin ETFs.

The competitors available in the market intensified in mid-November when VanEck entered the market with its VanEck Solana ETF, which started buying and selling on the Cboe BZX alternate. Because the second U.S. spot Solana product to incorporate staking, VanEck adopted a powerful technique to entice buyers by waiving all administration charges for the primary $1 billion in property or till February 17, 2026, whichever comes first, based on the press launch.

One of many main causes behind the increase in Solana ETFs is the most recent regulatory pointers from authorities that opened doorways for staking-based ETFs. In August, the SEC’s Division of Company Finance launched a press release, wherein they clarified that sure liquid staking tokens are usually not securities.

“It’s the Division’s view that “Liquid Staking Actions” (as outlined under) in reference to Protocol Staking don’t contain the provide and sale of securities throughout the which means of Part 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Part 3(a)(10) of the Securities Change Act of 1934 (the “Change Act”). Accordingly, it’s the Division’s view that contributors in Liquid Staking Actions don’t must register with the Fee transactions underneath the Securities Act, or fall inside one of many Securities Act’s exemptions from registration in reference to these Liquid Staking Actions,” acknowledged within the official assertion.