- Bitcoin value drives a mid-term sideways development with an increasing channel sample.

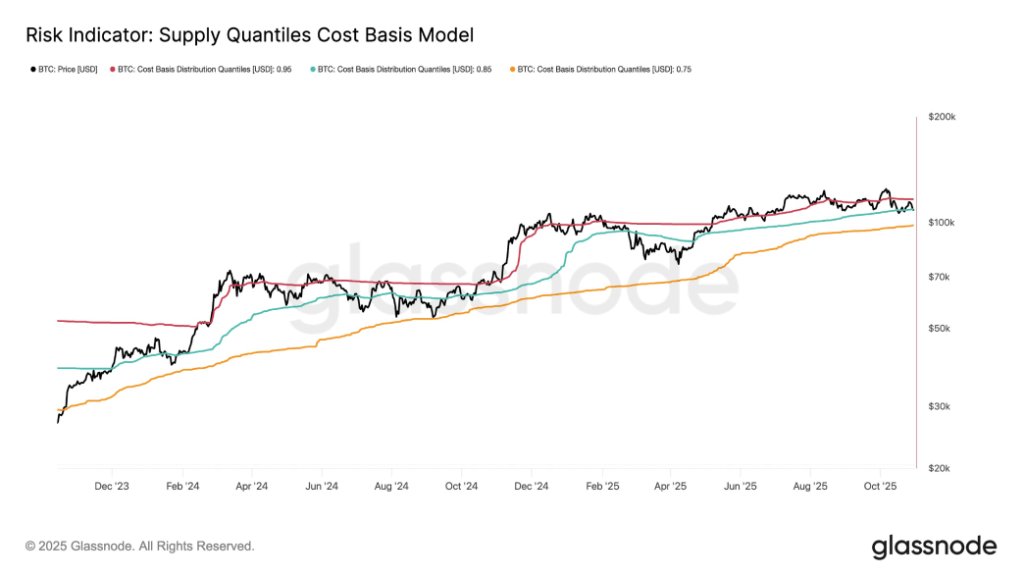

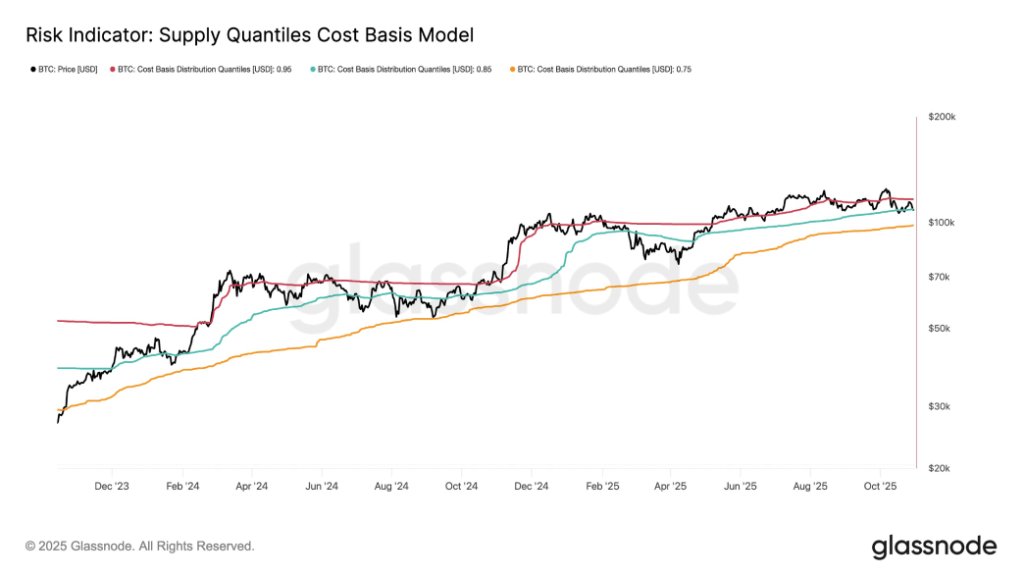

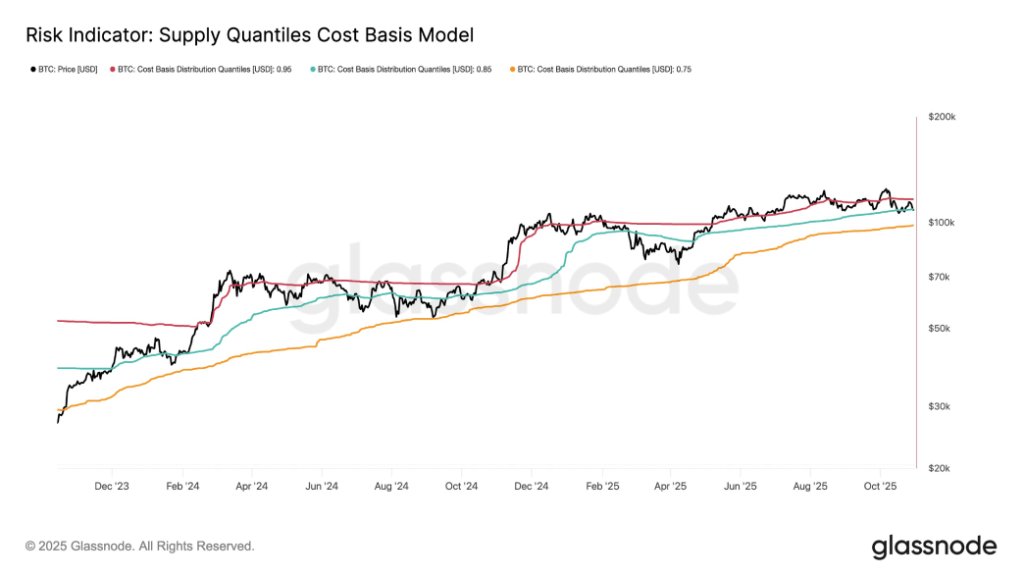

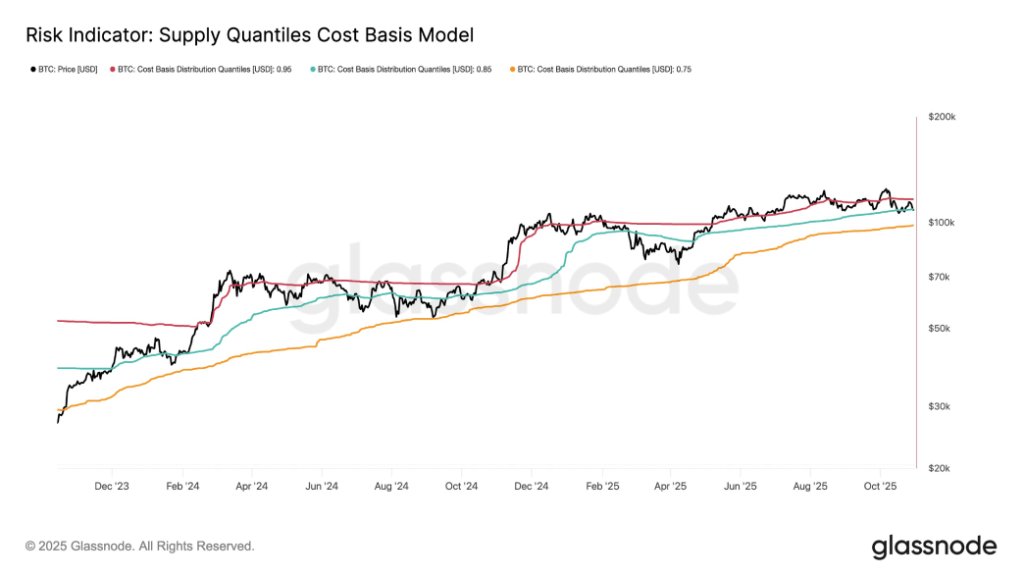

- BTC is again to the 0.85 cost-basis band close to $109K, a area traditionally considered as a important pivot zone.

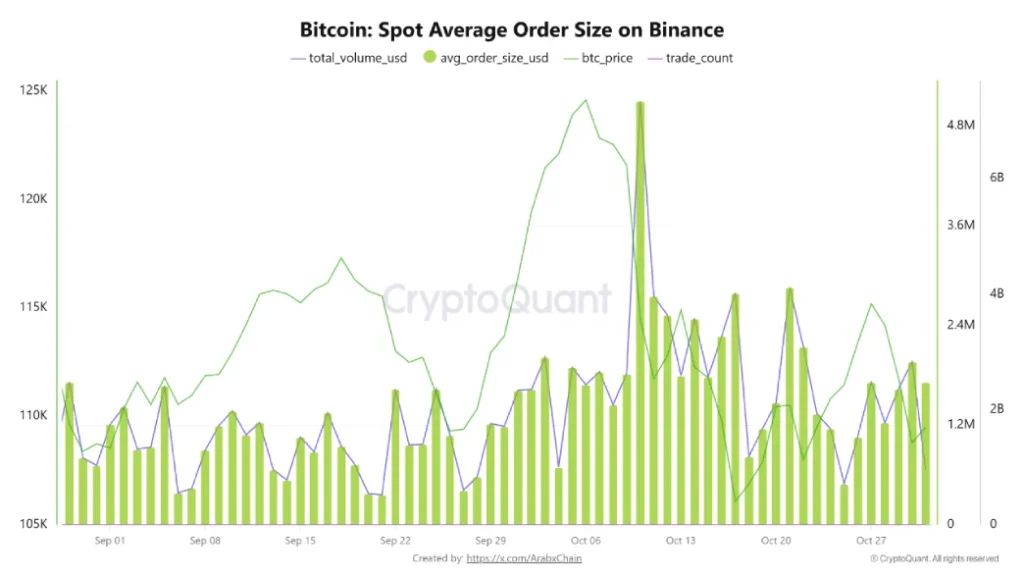

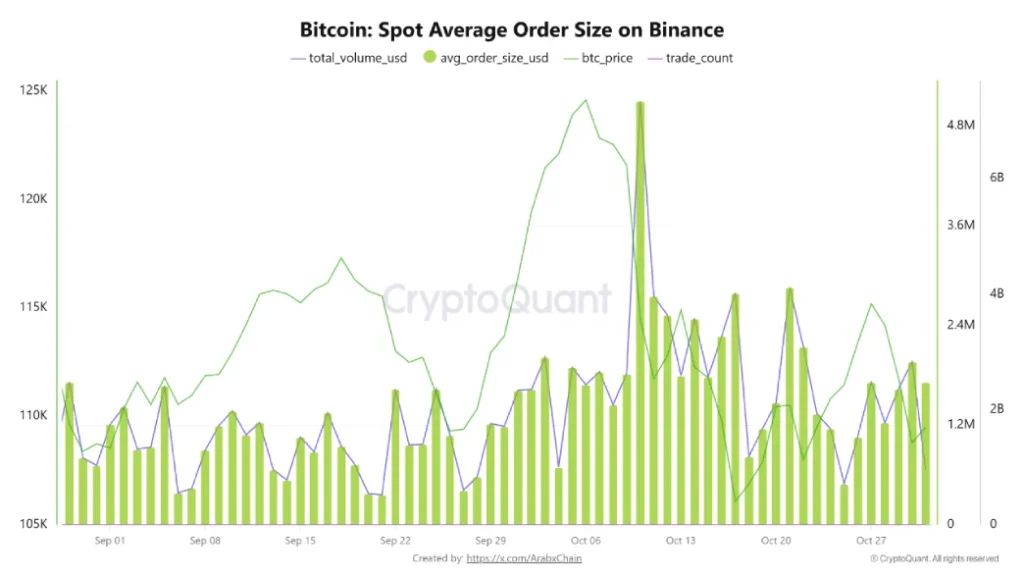

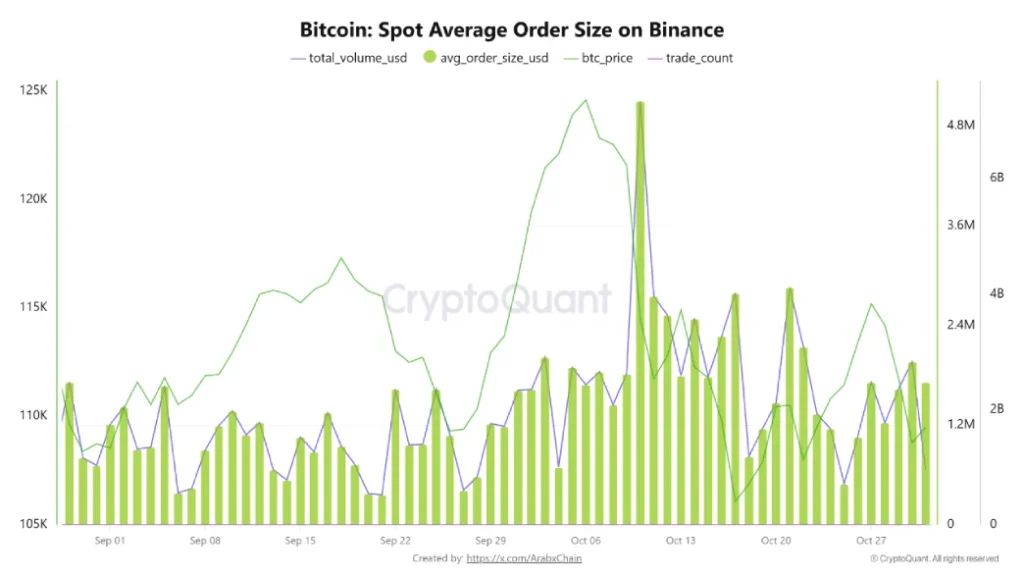

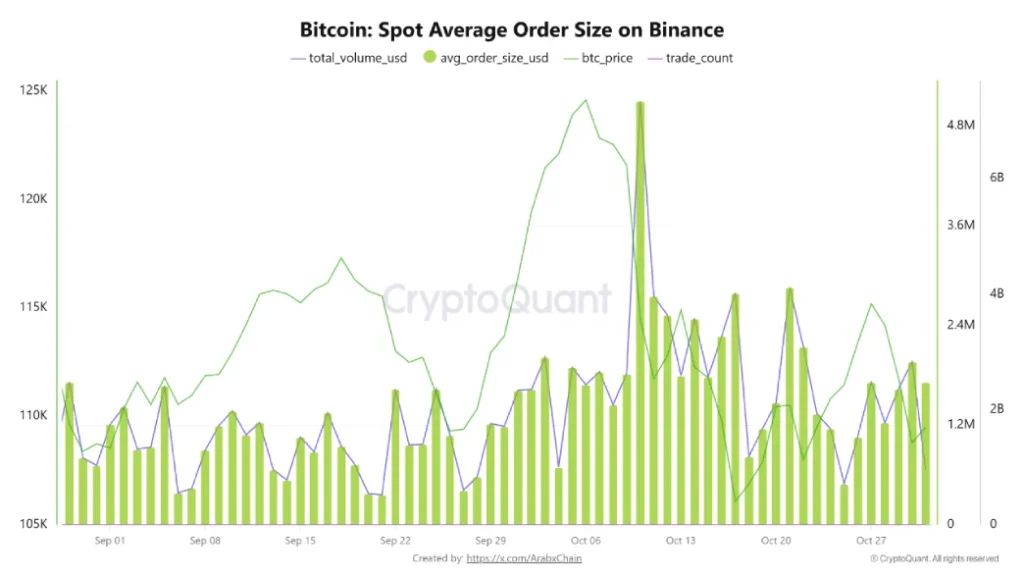

- October recorded one of many highest common order sizes in current months, marking an uptick in whale-driven trades.

The pioneer cryptocurrency, Bitcoin, jumped practically 1.5% on Friday to commerce at $109,870. The shopping for stress probably got here as a reduction rally after a notable sell-off earlier this week. An extended rejection wick connected to the day by day candle alerts an intact overhead provide and a danger of additional correction. Whereas the downward trajectory should create concern amongst retail buyers, the bigger BTC holders are persevering with to build up extra cash, signaling their conviction for a bullish rebound within the close to future.

Whales Step In as Bitcoin Worth Exams $109K Flooring After October Slide

October 2025 proved to be an surprising outlier for buyers, shattering the historic optimism usually tied to this month. The Bitcoin value is on monitor to shut October with a 3.5% loss, as the worth at present trades at $109,476, and the market cap is at $2.18 trillion.

The worth pullback could be attributed to a number of components, together with geopolitical commerce conflict escalation, historic deleveraging of the crypto market on October tenth, technical breakdowns, and the current hawkish flip by the Federal Reserve.

Following this correction, the Bitcoin value retested the 0.85 cost-basis band round $109K, a zone that has repeatedly acted as a make-or-break stage. As shared evaluation from Glassnode information signifies, the coin value may resume a bullish rally if this stage holds. Nonetheless, a bearish breakdown under this ground may bolster an prolonged correction to the 0.75 band round $98,000.

Bitcoin’s current decline has pushed it again right down to a key on-chain value level of round $109,000—an space that has traditionally been the hallmark of main adjustments in its market cycle. Information collected by Glassnode has proven that this stage belongs to the 0.85 cost-basis band, which has traditionally divided intervals of stable recoveries from extra extreme corrections. There’s a lengthy historical past of the inventory falling under the band and persevering with to retrace right down to the .75 stage, which might be round $98,000.

Parallel market costs recommend growing institutional participation all through October. The common spot commerce measurement of Bitcoin within the spot commerce pairs on Binance elevated dramatically to nearly $1.96 million, as measured by a CryptoQuant analyst. This determine is without doubt one of the largest seen in current months and signifies that high-cap buyers have been taking extra direct positions within the spot market.

Binance additionally noticed this institutional bias, with complete Bitcoin spot buying and selling quantity reaching round $2.82 billion. The rise in each commerce measurement and complete stream signifies that bigger entities have been energetic regardless of contained value volatility.

Bitcoin Worth to Prolong Correction Inside Channel Sample

This week, the Bitcoin value exhibits a notable reversal from $116,381 to a present buying and selling value of $109,502, registering a lack of 5.91%. This pullback, backed by growing size of purple candles and rising buying and selling quantity, accentuates the conviction from sellers to drive a chronic correction. Even the inexperienced candle immediately exhibits an 8.86% decline in buying and selling quantity, accentuating the weak palms from consumers.

Presently, the BTC value challenges the assist of the 200-day exponential transferring common, with a possible breakdown looming. If materialized, the promoting stress would speed up and push the worth down by one other 5.3% to check the underside trendline of an increasing channel valued at $102,560.

Theoretically, the chart sample is characterised by two diverging trendlines, which create the next swing in value every cycle, reflecting market uncertainty. A possible breakdown under this stage would additional intensify the bearish correction in value under the $100k stage.

Quite the opposite, if the consumers handle to carry their assist, the Bitcoin value may rebound for a possible renewed restoration.

Additionally Learn: TON Beneficial properties Cross-Chain Connectivity & Actual-Time Information through Chainlink

- Bitcoin value drives a mid-term sideways development with an increasing channel sample.

- BTC is again to the 0.85 cost-basis band close to $109K, a area traditionally considered as a important pivot zone.

- October recorded one of many highest common order sizes in current months, marking an uptick in whale-driven trades.

The pioneer cryptocurrency, Bitcoin, jumped practically 1.5% on Friday to commerce at $109,870. The shopping for stress probably got here as a reduction rally after a notable sell-off earlier this week. An extended rejection wick connected to the day by day candle alerts an intact overhead provide and a danger of additional correction. Whereas the downward trajectory should create concern amongst retail buyers, the bigger BTC holders are persevering with to build up extra cash, signaling their conviction for a bullish rebound within the close to future.

Whales Step In as Bitcoin Worth Exams $109K Flooring After October Slide

October 2025 proved to be an surprising outlier for buyers, shattering the historic optimism usually tied to this month. The Bitcoin value is on monitor to shut October with a 3.5% loss, as the worth at present trades at $109,476, and the market cap is at $2.18 trillion.

The worth pullback could be attributed to a number of components, together with geopolitical commerce conflict escalation, historic deleveraging of the crypto market on October tenth, technical breakdowns, and the current hawkish flip by the Federal Reserve.

Following this correction, the Bitcoin value retested the 0.85 cost-basis band round $109K, a zone that has repeatedly acted as a make-or-break stage. As shared evaluation from Glassnode information signifies, the coin value may resume a bullish rally if this stage holds. Nonetheless, a bearish breakdown under this ground may bolster an prolonged correction to the 0.75 band round $98,000.

Bitcoin’s current decline has pushed it again right down to a key on-chain value level of round $109,000—an space that has traditionally been the hallmark of main adjustments in its market cycle. Information collected by Glassnode has proven that this stage belongs to the 0.85 cost-basis band, which has traditionally divided intervals of stable recoveries from extra extreme corrections. There’s a lengthy historical past of the inventory falling under the band and persevering with to retrace right down to the .75 stage, which might be round $98,000.

Parallel market costs recommend growing institutional participation all through October. The common spot commerce measurement of Bitcoin within the spot commerce pairs on Binance elevated dramatically to nearly $1.96 million, as measured by a CryptoQuant analyst. This determine is without doubt one of the largest seen in current months and signifies that high-cap buyers have been taking extra direct positions within the spot market.

Binance additionally noticed this institutional bias, with complete Bitcoin spot buying and selling quantity reaching round $2.82 billion. The rise in each commerce measurement and complete stream signifies that bigger entities have been energetic regardless of contained value volatility.

Bitcoin Worth to Prolong Correction Inside Channel Sample

This week, the Bitcoin value exhibits a notable reversal from $116,381 to a present buying and selling value of $109,502, registering a lack of 5.91%. This pullback, backed by growing size of purple candles and rising buying and selling quantity, accentuates the conviction from sellers to drive a chronic correction. Even the inexperienced candle immediately exhibits an 8.86% decline in buying and selling quantity, accentuating the weak palms from consumers.

Presently, the BTC value challenges the assist of the 200-day exponential transferring common, with a possible breakdown looming. If materialized, the promoting stress would speed up and push the worth down by one other 5.3% to check the underside trendline of an increasing channel valued at $102,560.

Theoretically, the chart sample is characterised by two diverging trendlines, which create the next swing in value every cycle, reflecting market uncertainty. A possible breakdown under this stage would additional intensify the bearish correction in value under the $100k stage.

Quite the opposite, if the consumers handle to carry their assist, the Bitcoin value may rebound for a possible renewed restoration.

Additionally Learn: TON Beneficial properties Cross-Chain Connectivity & Actual-Time Information through Chainlink